Bitcoin’s yield has fallen to its lowest in four years. What does this mean for investors?

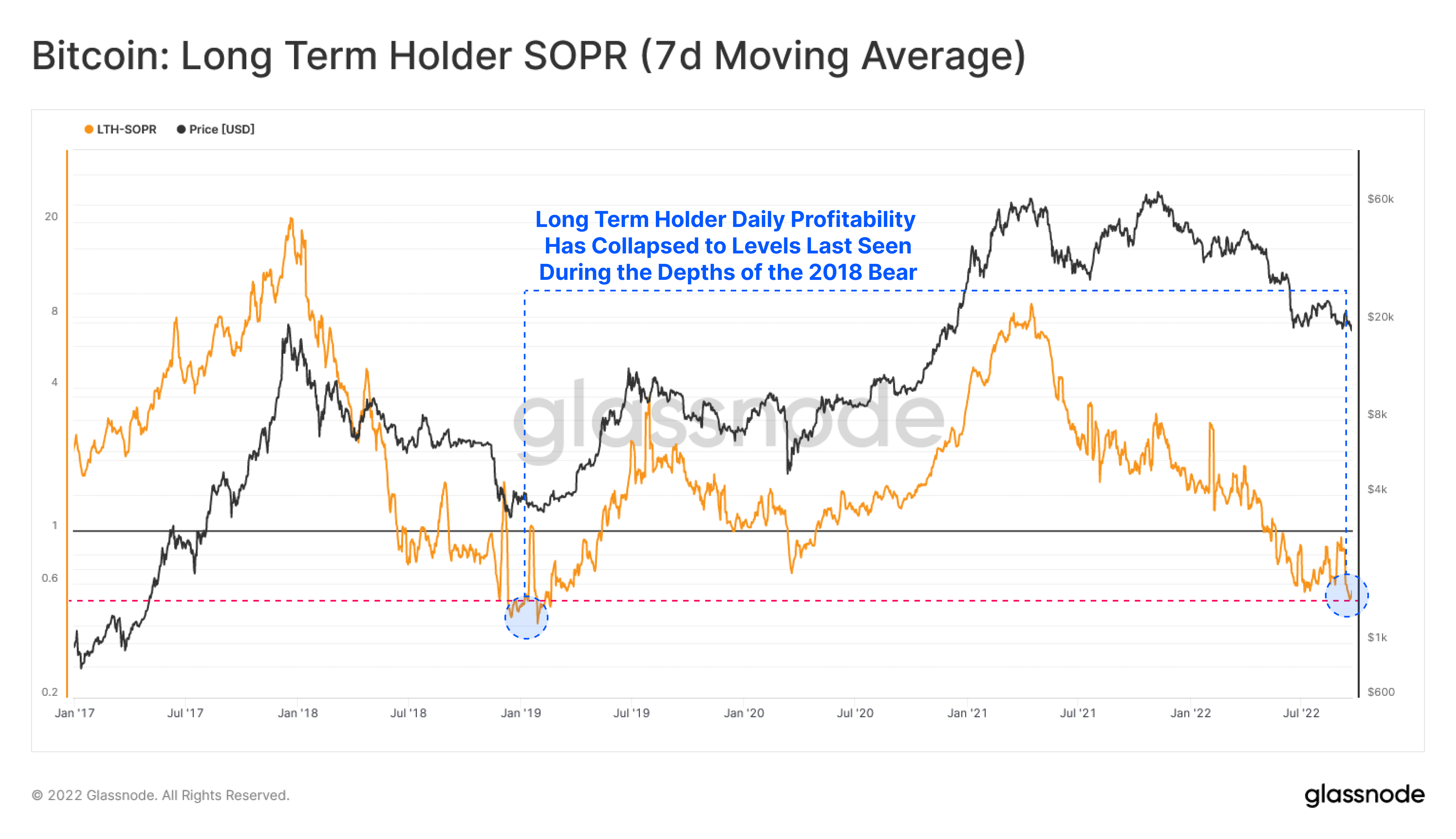

The profitability of Bitcoin investments for long-term holders of the cryptocurrency has approached a critical point. Analysts say they are now selling coins at an average loss of 42 per cent. The last time the situation was this sad was in 2018 during the final stage of a bearish trend bottom formation. Details of the latest market research were shared by analysts at the Glassnode platform. We tell you the details of the current market situation.

Despite the downturn in the coin market, cryptocurrencies had a reason to grow in the long term the day before. We are talking about the decision of the Bank of England management to move to the so-called quantitative easing policy, which involves printing new money. That will certainly accelerate inflation in the future and have an effect on ordinary citizens’ confidence in financial institutions. Read more about what is happening in a separate article.

How much is Bitcoin bringing in

According to Glassnode, published by Cointelegraph news portal, the average purchase price of BTC for long-term holders is above $30,000. That is, it can be assumed that a significant portion of market players have purchased the coins in 2021, as Bitcoin has been trading above the marked mark for most of the year.

Falling yields for long-term Bitcoin holders

Right now, what’s happening in trading is much worse: in recent weeks, the cryptocurrency has been at $18,000 to $20,000 and shows no serious willingness to turn things around. In addition, the situation with the global economy is also not particularly conducive to the beginning of a new bull run, i.e. the transition of the coin industry to growth.

The fall of Bitcoin and other cryptocurrencies

The bearish trend can be attributed to several macroeconomic factors. BTC continues to correlate strongly with the stock market – and especially with tech stocks, which are currently experiencing an even bigger decline than cryptocurrencies. Rising inflation, combined with the inability of central banks to control it, is also exacerbating the situation for investors. With much less money on hand to invest, traders and long-term holders have switched to less risky assets.

😈 YOU CAN FIND MORE INTERESTING THINGS ON OUR YANDEX.ZEN!

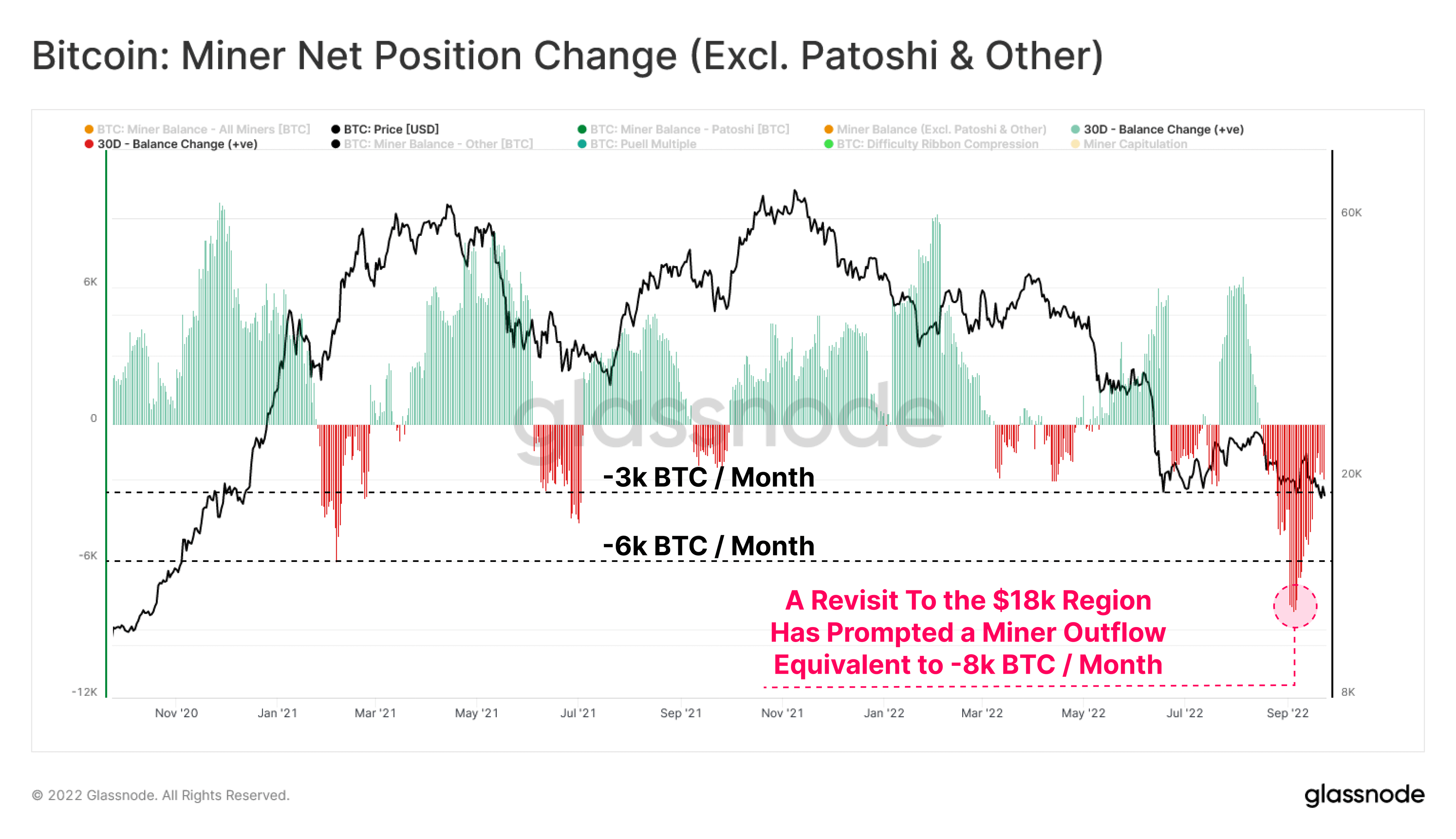

This can also be seen in the bitcoin sales by miners. Historically, many miners have been long-term holders of crypto in anticipation of higher profits. However, rising energy prices, combined with the increasing difficulty of mining coins and the declining BTC exchange rate, have severely undermined the profitability of the business. As a result, there is now a large outflow of funds from miners’ wallets: according to Glassnode, it reaches 8,000 BTC per month.

It's important to understand that more often than not, miners are forced to get rid of some of their own savings and the coins they receive. In this case, the money is used to pay rent for the space where the computing devices are located, to pay for the electricity consumed and additional expenses like repairing the miners. Consequently, when the cryptocurrency rate slumps, more coins need to be sold to maintain the same costs.

BTC outflows from miners’ cryptocurrency wallets

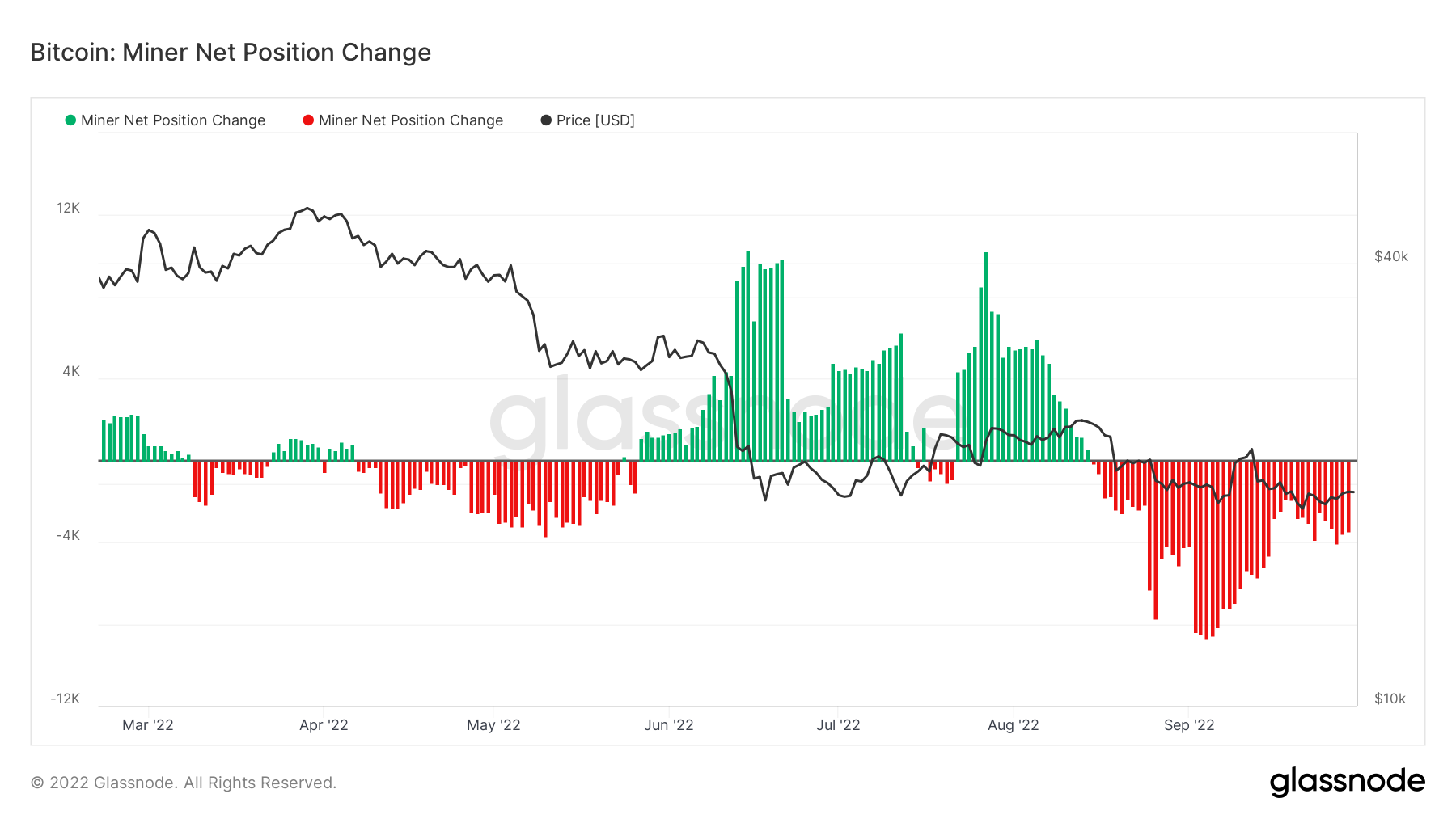

Another graph is the same BTC sales by miners, only on a more detailed scale. Notice how in late August, after Bitcoin’s price failed to break above $24,500, miners started liquidating their cryptocurrency holdings, trying to get rid of some of the stock at a higher price.

BTC outflows from miners’ cryptocurrency wallets

It looks like miners will now have to optimise their costs to stay in business. Another collapse of Bitcoin’s price to new lows could result in a significant drop in the network’s hash rate, as a significant portion of miners will be forced to shut down their crypto farms due to lack of profit.

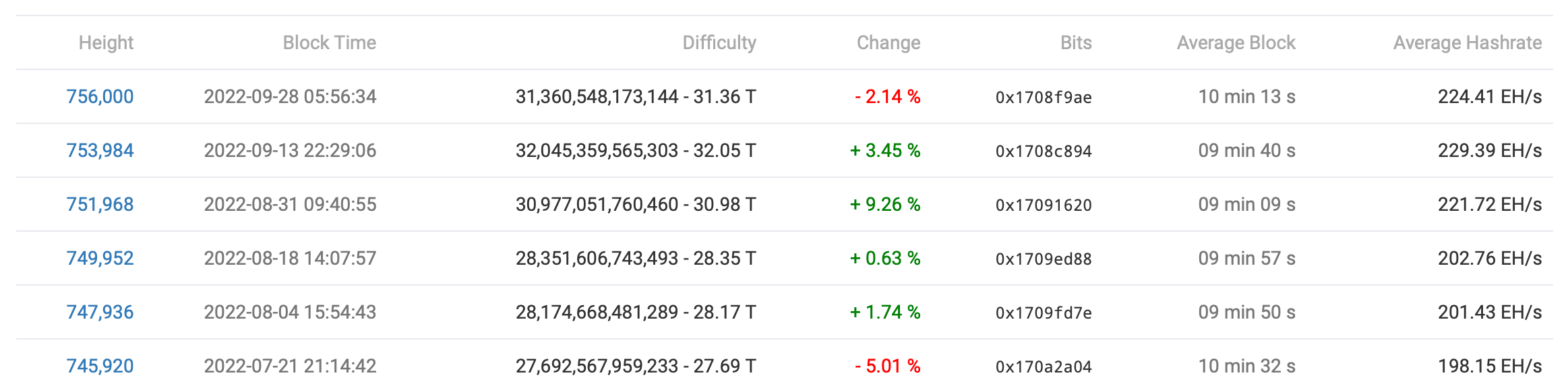

By the way, Bitcoin’s mining difficulty slipped by 2.14 per cent this week, with the drop in this figure occurring for the first time in two months. Prior to that, BTC had become more difficult to mine four times in a row. This situation reflected the increasing popularity of Bitcoin mining, as evidenced, among other things, by the network’s average hash rate during these periods. It is shown on the right.

Changes in Bitcoin mining complexity

We believe that the decline in returns on investments in Bitcoin and other cryptocurrencies is quite logical given the current market conditions. However, there are questions about the willingness of long-term investors to get rid of a cryptocurrency at a loss after months of hiking. Obviously, such an event could also mean a market bottom, with most crypto holders simply giving up and exiting the game.