Could cryptocurrencies start rising as early as 2023? Morgan Creek Capital Management managing director’s answer

An anonymous Bitcoin creator under the alias Satoshi Nakamoto implemented a so-called halving mechanism in the cryptocurrency’s protocol, which means reducing the block reward to miners by half every 210,000 blocks, or about once every four years. Because of this, the supply of new BTCs in the market decreases over time, and halving is traditionally seen as an important trigger for a market bull run. The next such event will take place in the spring of 2024, so experts already have certain expectations because of this.

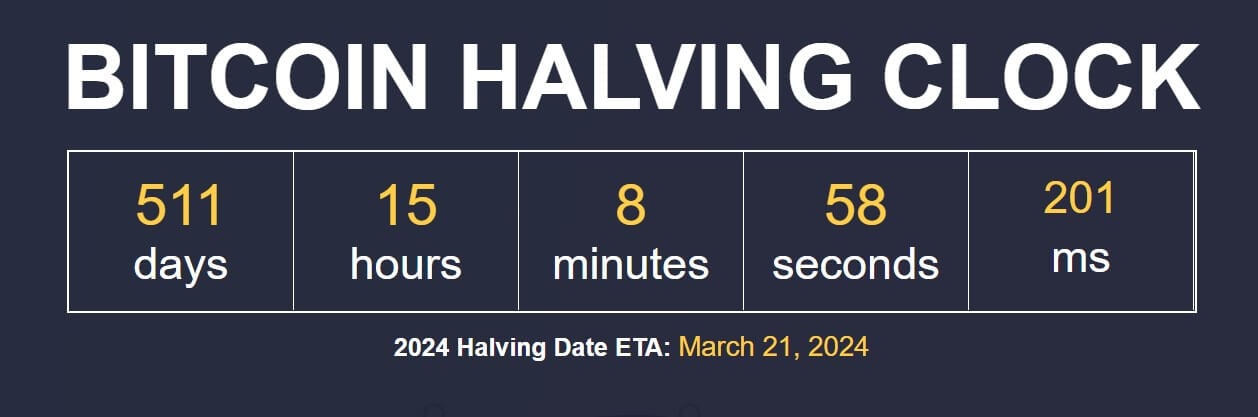

According to BuyBitcoinWorldwide, the next halving is just over 511 days away and the event itself will take place on 21 March 2024. During this procedure, the reward per block for miners will be reduced from the current 6.25 BTC to 3.125 BTC.

Countdown to the next halving

It is important to understand that the final date is likely to change. Still, this number is based on an ideal Bitcoin blockchain situation – that is, a stable hash rate and mining difficulty, as well as mining blocks every ten minutes. In practice, this is not the case, and the complexity changes regularly, causing blocks to be created faster or slower.

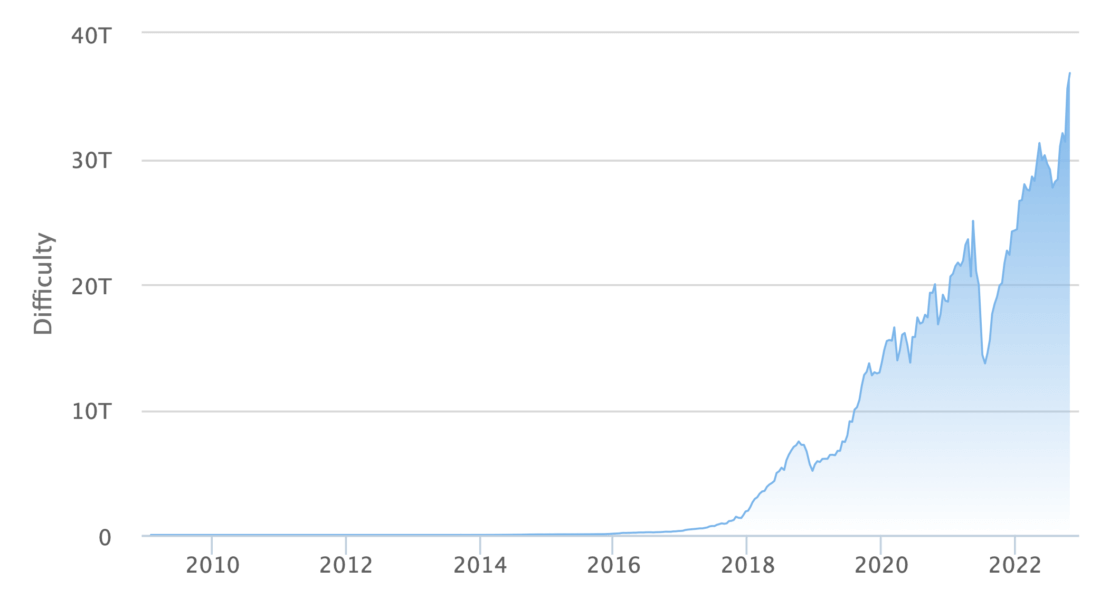

Proof of this was the 3.44 per cent jump in the index on Monday. As a result, the difficulty of mining BTC is at 36.84 T – which is an all-time record for the index.

Bitcoin mining difficulty graph

Accordingly, cryptocurrency enthusiasts should expect BTC halving in spring 2024, but probably not on March 21.

What happens to Bitcoin next

The wait for the bullrun may be shorter than it looks. That’s the view expressed by Morgan Creek Capital Management managing director Mark Yusko in his latest interview with news outlet Cointelegraph. He predicts the beginning of a new market growth cycle as early as the second quarter of 2023, which is the first half of next year.

Here’s a quote from Yusko on his expectations.

Normally, the market will start taking an event as early as nine months in advance.

Why the expert takes this particular timeframe is unknown. It is worth noting that the previous halving took place on 11 May 2020, i.e. even before the so-called DeFi-let. At the same time, BTC did recover in 2019, although in March 2020 a market collapse due to a pandemic and widespread uncertainty awaited us.

Morgan Creek Capital Management managing director Mark Yusco

In such an environment, the major cryptocurrency may well rise in price as high as $100,000, the expert believes. In this case, the new bullrun will not prevent even a difficult macroeconomic environment due to the ever-increasing credit rate of the US Federal Reserve and the energy crisis. Yusco continues.

Traditional assets are determined by economic growth, Fed policy and inflation. Cryptocurrencies are determined by the technology itself, the adoption of millennials.

Overall, after the halving, Yusco expects the BTC price to double further – under such conditions, miners will be able to continue their business and remain profitable. This is a rather optimistic forecast, because crypto is still strongly correlated with major stock indices.

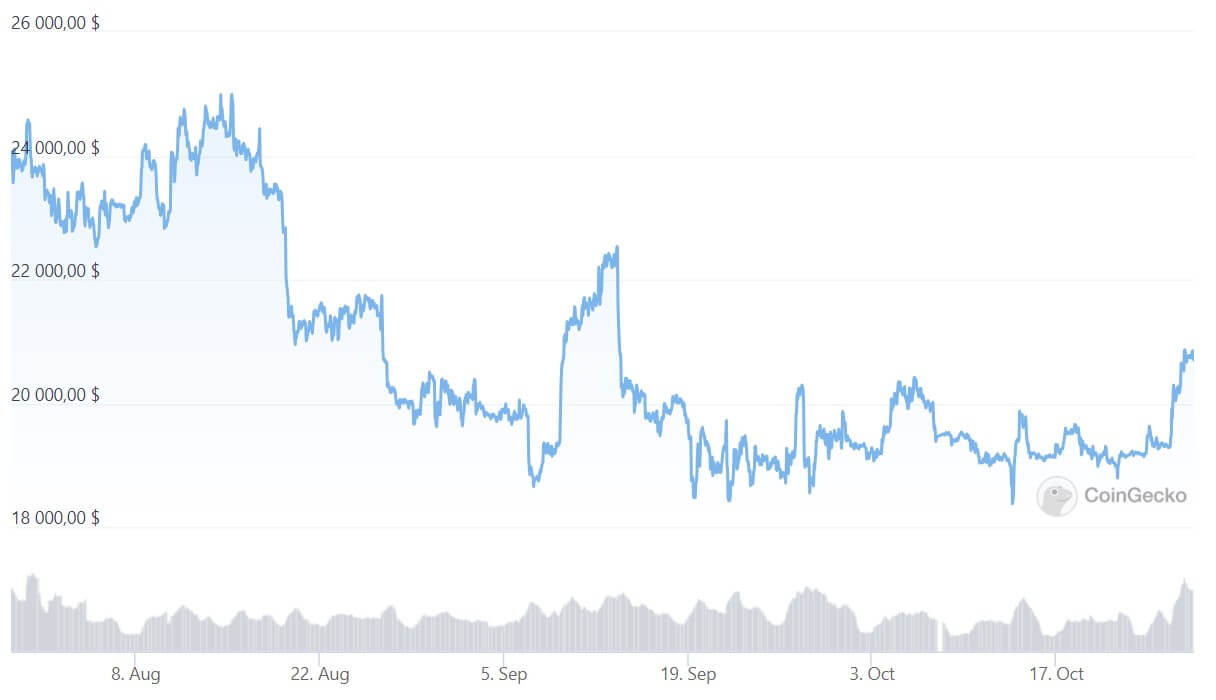

Bitcoin exchange rate over the past 90 days

All in all, this does not mean that the bearish trend will only be marked by a lack of volatility and a steady decline in cryptocurrencies. Just this week, Bitcoin’s price broke above the $20,000 level for the first time in quite a long time, which may indicate the start of a local rise in the cryptocurrency. Such short-term rallies are sure to continue, but they probably won’t lead to a new historical high for the next few months.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.DEN!

Even with all the complexities of a bearish trend, major venture capital fund Andreessen Horowitz (a16z) is not about to give up on its digital asset strategies. As a reminder, the a16z cryptocurrency fund was launched in 2019 and already lost around 40 per cent of its value in the first half of 2022. However, the setbacks aren’t stopping the head of the unit, Chris Dixon – here’s a quote from his recent interview quoted by Decrypt.

I don’t look at prices. I look at business and developer activity. That’s the most important metric.

A16z crypto fund portfolio

During the “crypto-zima” there has been little company activity. Of the recent changes in a16z’s cryptocurrency portfolio, investments in crypto project Aptos and the postponement of former WeWork CEO Adam Neumann’s Flowcarbon token launch are worth highlighting. Despite the volatile period, a16z management has made several other bets on crypto projects. In particular, the crypto fund recently participated in a $165 million Series B funding round for decentralised cryptocurrency exchange Uniswap.

a16z has also suffered setbacks with shares of Coinbase and MicroStrategy, both securities showing serious declines since the beginning of this year. In total, the fund lost more than $2.9 billion on Coinbase shares.

We believe it is impossible to predict the exact start of the cryptocurrency market's rise, as it is driven by hundreds of factors - including those from outside the industry. However, it is important to understand that sooner or later, the market trend will change, and the current collapse will only be part of the memory. Yet despite the downturn, the underlying technology is getting better over time, which is attracting new investor interest and capital.