Elon Musk suggests how long the US recession and general market collapse could last

Billionaire and Tesla CEO Elon Musk is predicting a prolonged recession in the US economy: according to his recent tweet, the recession period could last until spring 2024. This is disappointing news for crypto investors, as Bitcoin is still highly correlated with traditional markets. Accordingly, they could react to the recession with another collapse.

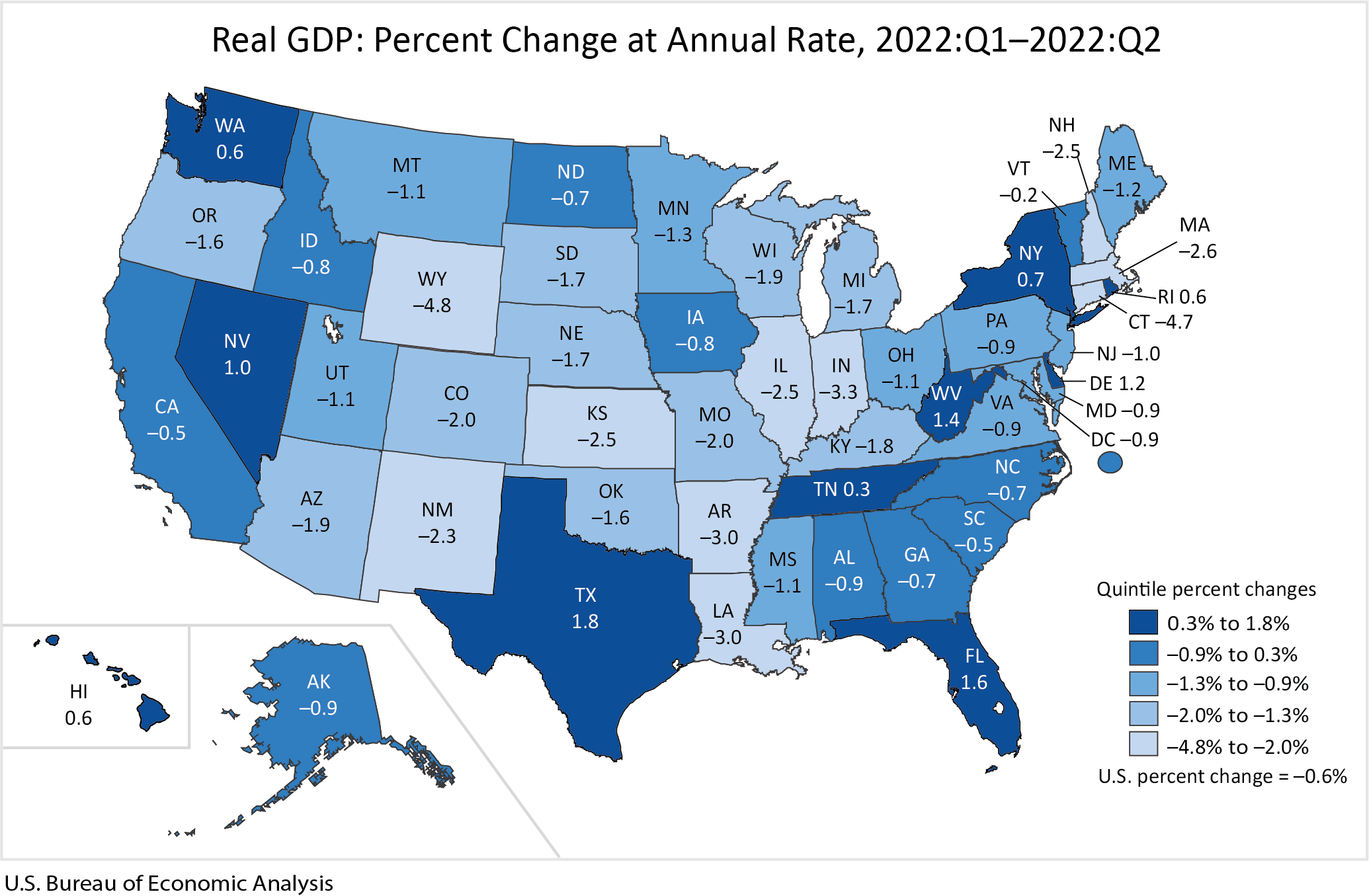

Traditionally, let’s start with an explanation. According to the classical definition, recession or prolonged fall of the economy occurs when the GDP figure shows a slump for two quarters in a row. This has already happened in the case of the USA over the summer, but the event did not crash the markets. Moreover, Bitcoin, along with cryptocurrencies among others, showed growth after the release of the relevant data.

After that, government officials tried to challenge the above definition and claimed that there was no recession yet. As a result, the global economic situation leaves much to be desired, but the US authorities were in no hurry to admit recession after the release of the GDP data.

What will happen to Bitcoin during the recession?

Data on the US GDP forecast for the third quarter of this year does not inspire optimism – the question of whether there will be a recession is no longer on the table. Now a “hard landing” in the US economy after the unprecedented policy of the US Federal Reserve is inevitable, which means that only the duration of the recession remains to be predicted.

US GDP in the first and second quarter of 2022 by state

According to Musk, markets will be hard pressed until spring 2024. However, if another global upheaval such as another pandemic or military conflict does not happen in the world during this time.

Tweet by Ilon Musk with recession prediction

Incidentally, Tesla remains the world's third largest public company in terms of crypto reserves. At the end of the third quarter of 2022, it has 10,055 BTC on its balance sheet. And while Tesla already sold bitcoins earlier this year, getting rid of 75 per cent of its own reserves, no further BTC sales have followed - at least for now.

Bitcoin exchange rate over the past year

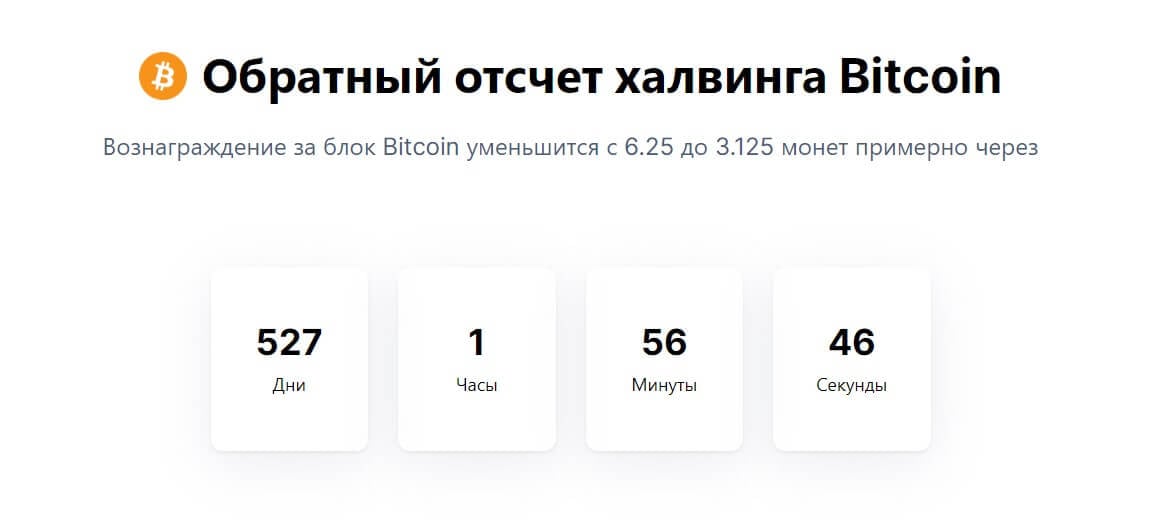

Given the billionaire’s prediction, we can assume that the next global bull run of BTC will indeed start around the time of the upcoming halving, that is, the cryptocurrency’s reward per block on the network will be halved. As a reminder, the next halving of miners’ yields will take place in the spring of 2024, and it is now about a year and a half away.

Countdown to the next halving

Until that point in time, local uptrends cannot be ruled out, but experts admit that crypto investors should hardly expect a notable rise or even a new historical high in the price of BTC. For now, Bitcoin continues to trade around $19,000 – the cryptocurrency fell even below that mark this week, but quickly bounced back to its previous price channel.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.DEN!

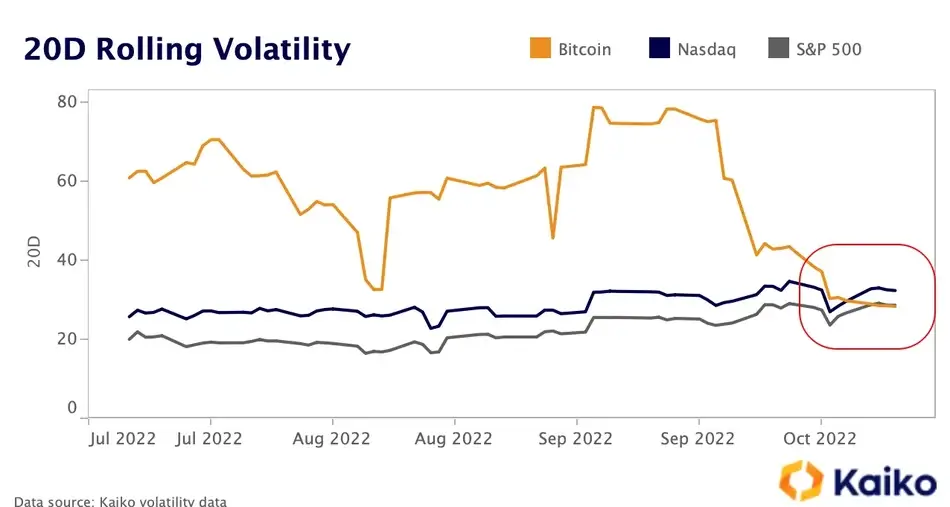

According to Decrypt’s sources, Bitcoin’s price is now remaining remarkably stable. The cryptocurrency’s 20-day average volatility has fallen below that of the Nasdaq and S&P 500 stock indices for the first time in two years. At the same time, the gap between the 30- and 90-day volatility readings for Bitcoin and equities has been narrowing since the second half of September. Both the Nasdaq 100 and the S&P 500 have fallen about 10 per cent since the start of last month.

For the first time since October 2020, Bitcoin was less volatile than the Nasdaq. It was also the first time since August 2020 that the world’s largest cryptocurrency was more stable than the S&P 500. Against the backdrop of the current bear cycle, the digital asset has gone from being a risky investment to a real haven for capital – at least so far, investments in BTC are making fewer losses than investments in the stock market. And that’s a rather funny situation, because various bankers and officials most often criticise digital assets for their volatility, i.e. sharp changes in value.

Bitcoin’s volatility compared to stock indices

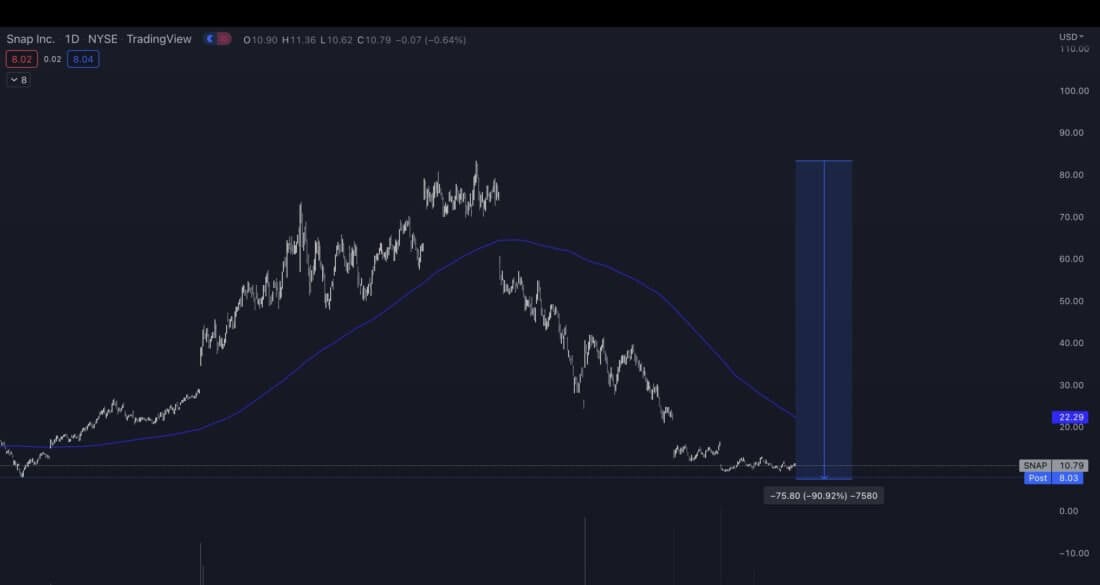

However, some stocks have performed far worse than many cryptocurrencies. For example, Snap Inc., which runs the social media platform Snapchat and cameras, lost 90 percent of the value of its own shares from their price highs. Against such results, the same BTC appears to be more stable.

The situation with shares of Snap Inc.

The increased volatility in stock trading is a direct consequence of various fundamental factors – the US Federal Reserve’s economic policy, the strengthening dollar, and the energy and geopolitical crisis in Europe, according to Clara Medali, head of research at the Kaiko platform. Here’s her cue.

The divergence in market activity between the two asset classes suggests that cryptocurrencies are more resilient to recent macro events causing volatility.

We believe that expecting a collapse period to end by a certain date is an ungodly thing to do. This is especially true for digital assets, where anything can happen. However, the main takeaway from these expert remarks is that a bull market will come sooner or later. The same goes for inflation, which will also be beaten.

Apart from the current stability, crypto has another important advantage – much higher potential returns during a new bull run. So it’s time to get interested in digital assets and at the same time subscribe to our millionaires’ cryptochat.