FBI analysts name major flaw in mass proliferation of cryptocurrencies

The FBI’s Miami office has issued a warning about the most popular fraud schemes, which include cryptocurrencies. Particular attention was paid to incidents in which the perpetrator pretends to be a longtime friend or potential partner of the victim, gains their trust, and then asks for money under the pretext of volunteering help. The transfer itself must be made by the victim through a crypto machine. Here’s a closer look at the situation.

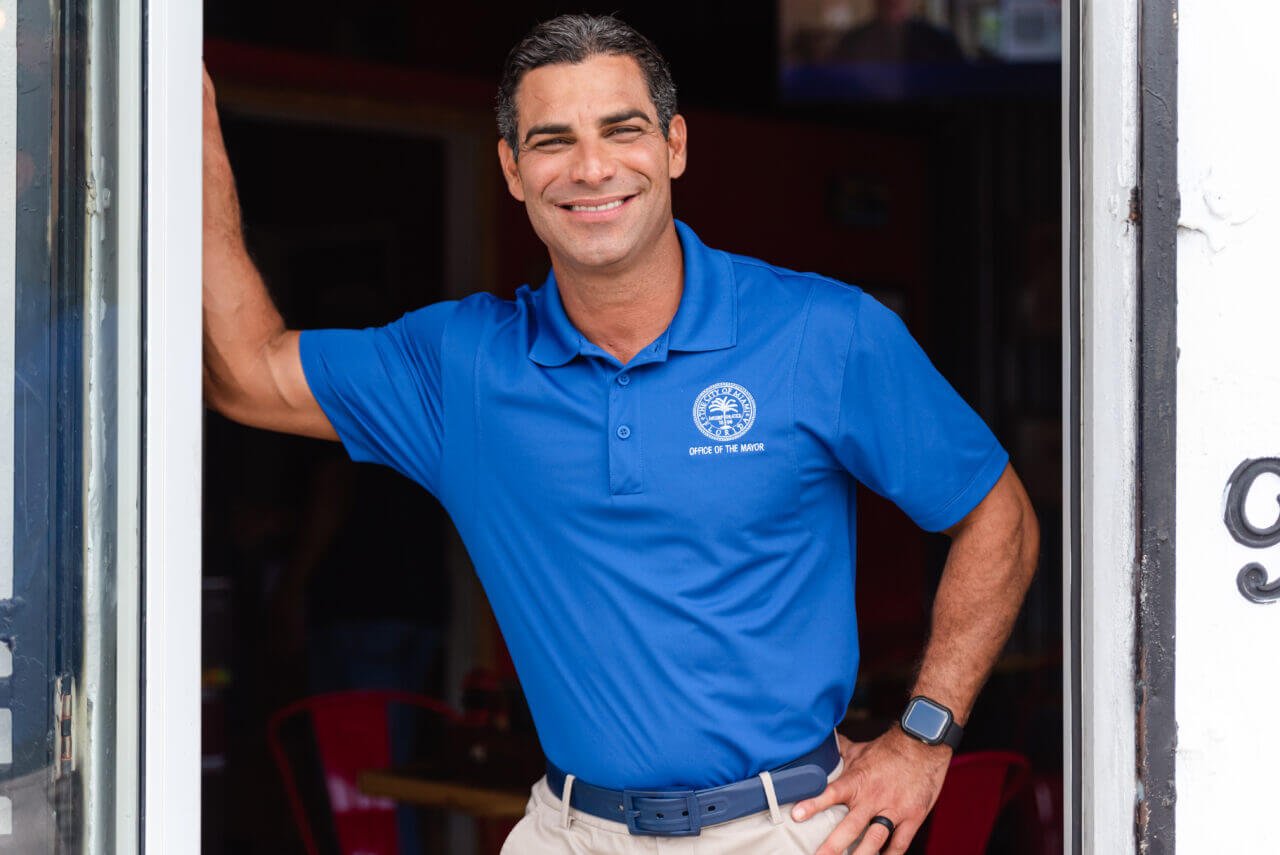

It should be noted that Miami is quite a popular location among cryptocurrency enthusiasts around the world. The fact is that mayor Francis Suarez is an active fan of digital assets and even talked about his desire to invest in Bitcoin, Etherium and DOGE. It has eventually come to the point where Suarez has stated his willingness to receive a pension in BTC. Read more about this in a separate piece.

Miami Mayor Francis Suarez

The promotion of digital assets in the city has gone so far as to say that authorities this summer announced the launch of Miami’s official NFT collection, which is being developed in collaboration with TIME and Mastercard. In other words, quite a few people in the city know about crypto, so this kind of attention to coins by the security services is justified.

How are cryptocurrencies stolen?

For a long enough time, online fraudsters have relied on wire transfers and prepaid gift cards to run their own schemes. They can be used to transfer money in a way that makes it difficult for law enforcement agencies to trace the recipient of the transaction. Cryptocurrencies have now been added to this list of tools. Here’s a quote from an FBI publication on the subject.

Many victims report being asked to make wire transfers to overseas accounts or to purchase prepaid cards for large amounts. The use of cryptocurrencies and cryptomats is also a new way of carrying out transactions. Individual losses from such fraudulent schemes range from tens of thousands to millions of dollars.

In this case, the victim uses fiat to acquire digital assets, but provides a specific fraudster's address for depositing coins. This makes it difficult to trace the author of the scheme - especially if he uses different platforms to cover his tracks like cryptocurrency mixers.

Note that cryptomats themselves are popular among newcomers to the world of digital assets. Although many of them allow to purchase coins without identity confirmation, such devices usually feature unprofitable exchange rates, which means it is much more profitable to purchase crypto on regular exchanges. In fact, this feature is an in-built commission that the operators of these devices live on.

According to Cointelegraph’s sources, fraudsters “play up the drama” in front of the victim more often than not because of a single transfer. They constantly ask for money under different pretexts, which means the process can take a long time and result in large financial losses for the victim.

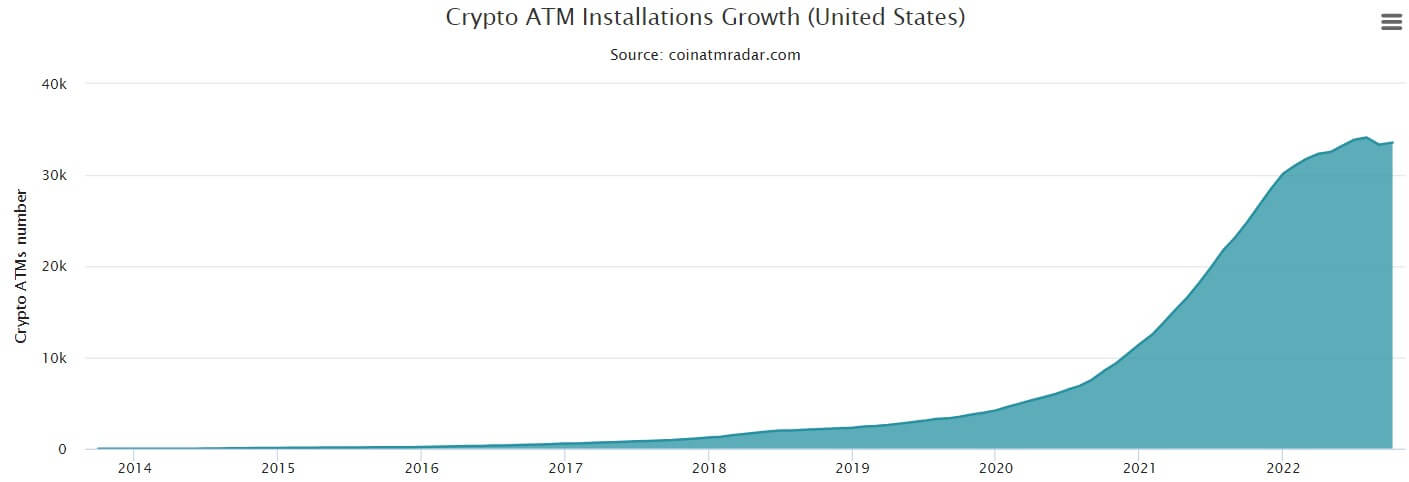

The FBI study was conducted in the USA, which has the largest number of cryptomats compared to any other country in the world. In total, more than 33,000 devices can be found here, meaning that the proliferation of cryptomats has become so massive that it is easy for a victim to find them in almost any city that is more or less large.

The rise of cryptomats in the US

It’s also a “headache” for law enforcement agencies – they advise people to double-check the authenticity of their interlocutors’ intentions, not to click on suspicious links or download suspicious files to avoid leaking important information.

😈 MORE INTERESTING THINGS TO COME FROM US AT YANDEX.ZEN!

Another study on cryptocurrency fraud activity was conducted by analytics platform Elliptic: in its latest publication, the analysts explored the “new frontier of crypto money laundering”. The platform’s report summarises that the free movement of capital between different areas of the crypto market has become more seamless thanks to the emergence of new technologies like blockchain bridges and decentralised exchanges.

Note that bridges link different blockchains and allow the transfer of different crypto-assets between them. At the same time, the decentralised exchanges we are already familiar with are places to exchange cryptocurrencies and tokens without the involvement of a centralised body.

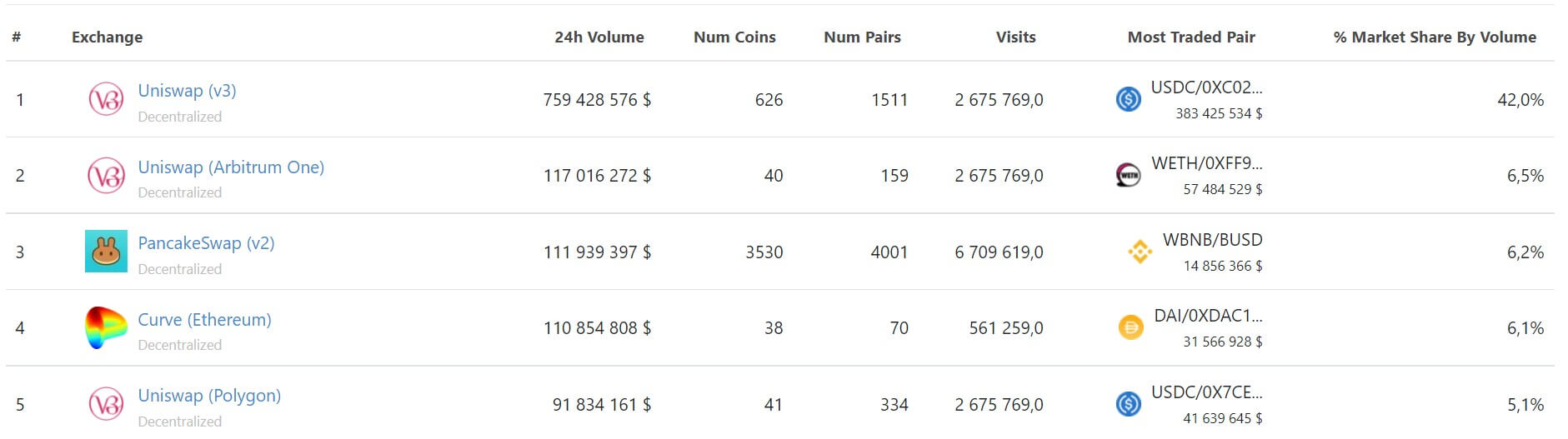

They have also become convenient tools for hiding at least $4 billion in illicit proceeds since the beginning of 2020. About a third of all stolen cryptocurrencies, worth an estimated $1.2 billion, were transferred through decentralised exchanges to obfuscate transaction traces. Analysts also noted that at least half of the illegally obtained funds were exchanged directly through two decentralised exchanges, Curve and Uniswap. Another protocol called 1inch ranks third in this ranking.

Top 5 decentralised crypto exchanges by trading volume

A similar amount of around $1.2 billion has been laundered through token exchange services, which allow users to exchange assets within and across different networks without the need to confirm their identity. Here is the relevant quote.

Many of these are advertised on Russian cybercrime forums and are aimed almost exclusively at criminal audiences.

In addition, sanctioned organisations are increasingly turning to decentralised tools to move funds and conduct cyberattacks. Experts continue.

Wallets associated with various groups that eventually came under US sanctions have laundered more than $1.8 billion using such tools.

Crypto-trading

We believe that such news is unlikely to benefit the reputation of the cryptocurrency industry. However, the chance of finding criminals thanks to blockchain transparency is still there, which means it is unlikely to be a popular scheme for long. In addition, experienced crypto enthusiasts usually avoid cryptocurrencies because of their strange exchange rates.