The cryptocurrency market has once again surpassed the trillion-dollar mark. Why have coins risen?

This week, the cryptocurrency market is finally on the move. On Tuesday, Bitcoin and Etherium started to rise noticeably, with many altcoins also performing well, with the entire industry capitalisation again crossing the trillion-dollar mark. What was the main reason for the local surge? Arthur Hayes, former CEO of BitMEX, shared his opinion on the matter. Here’s his viewpoint.

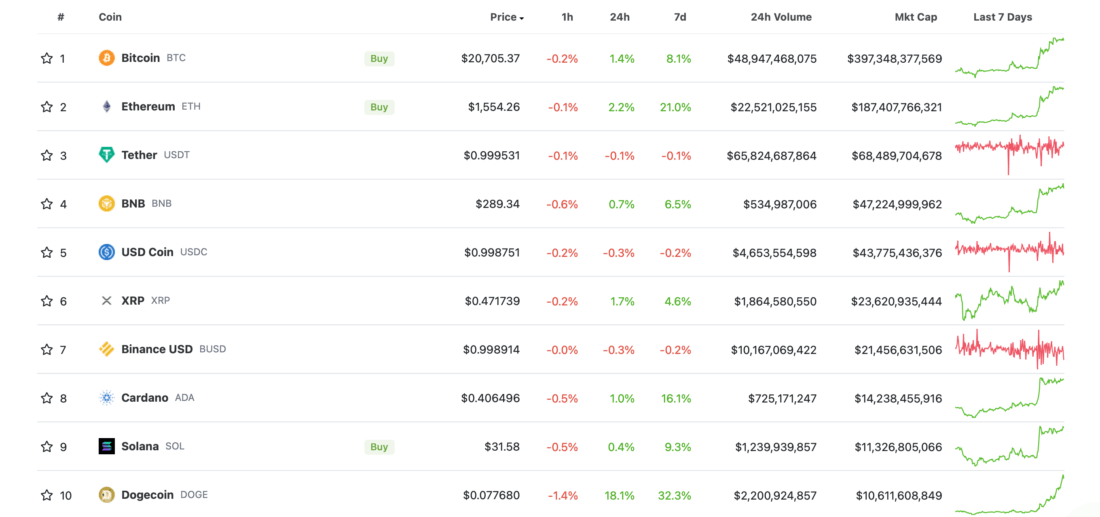

Today’s cryptocurrency market started the day positively. Bitcoin is still near the $21,000 mark, while other coins have produced good gains on the week’s scale.

Situation in the cryptocurrency market today

Dogecoin DOGE turned out to be the growth leader for the week among the top cryptocurrencies in terms of market capitalization. The coin gained 32 per cent in seven days, and the news of Twitter’s acquisition by Ilon Musk must have contributed to this. Still, he had previously suggested that DOGE could be integrated into the platform.

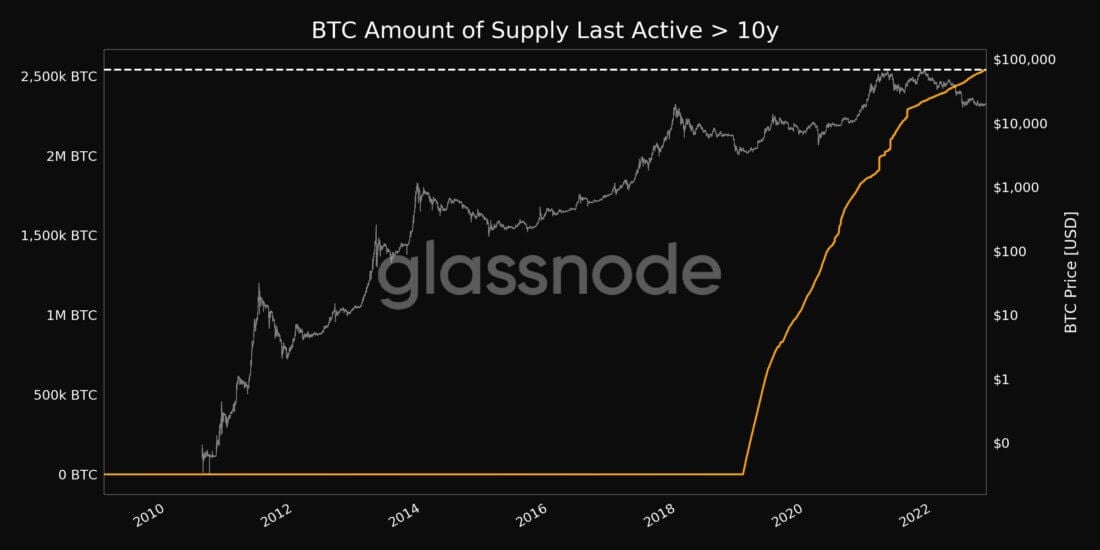

At the same time, the Bitcoin network has set a record for the volume of coins that have not moved for at least a decade. There are now 2.53 million BTCs, and quite a few of them are probably in addresses that have lost access.

The amount of bitcoins that haven’t moved in a decade

Why Bitcoin rose

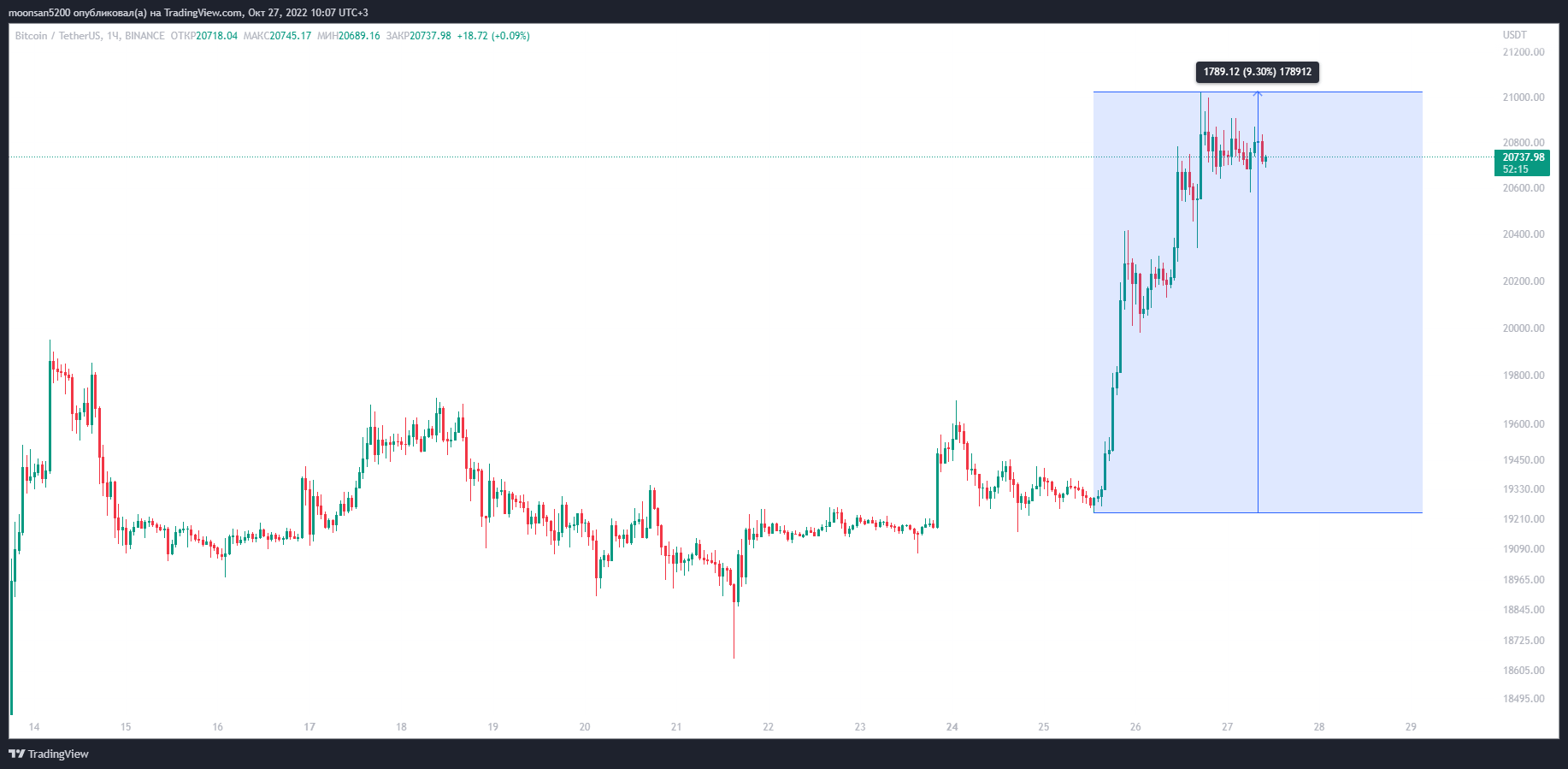

Since October 25, BTC has managed to set a local high of $21,023, meaning the cryptocurrency has risen almost 10 percent in those couple of days.

Bitcoin’s local rise in a few days

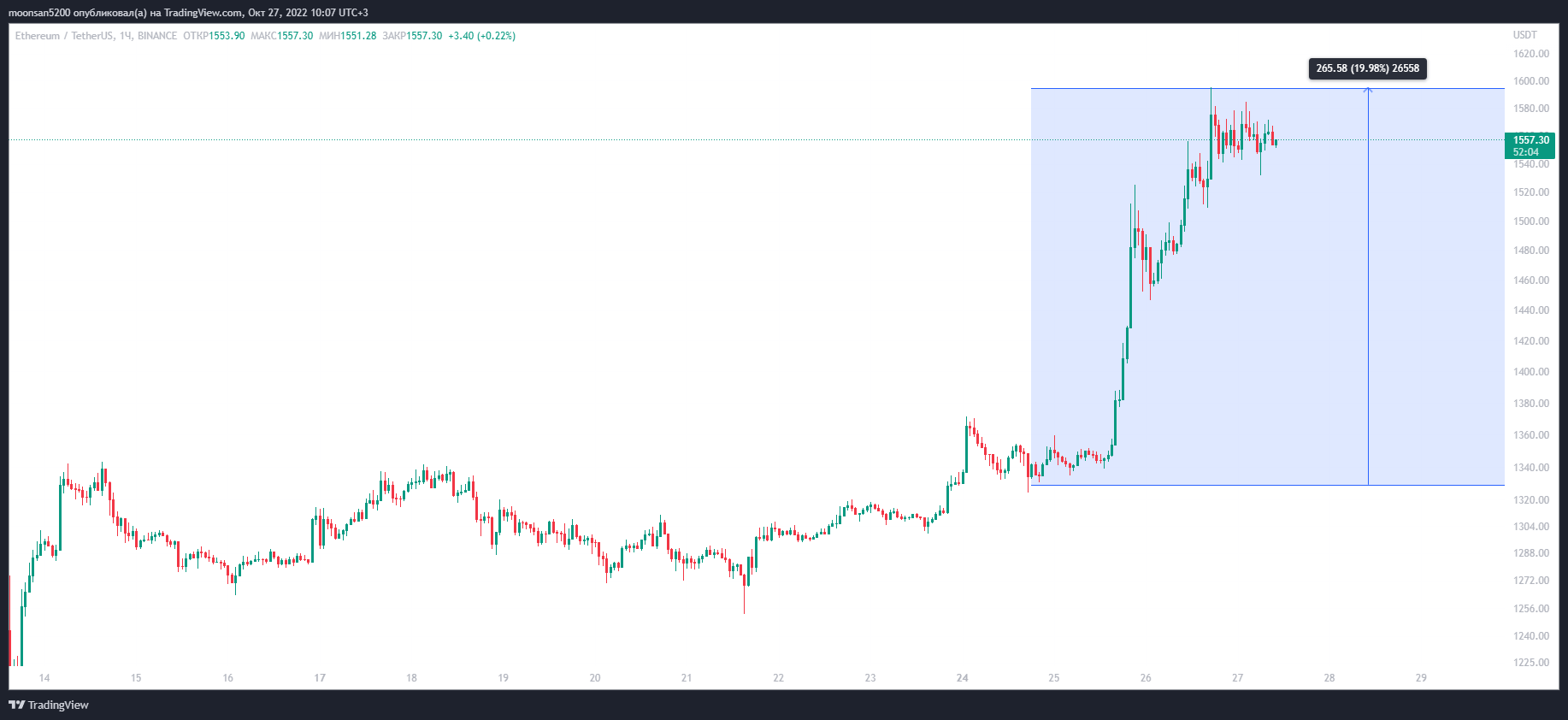

Etherium’s rise to a new local high was more impressive, with the altcoin rising nearly 20 percent over the same time frame to reach $1,595 at its local peak.

Etherium’s local rise

Over a couple of days of Bitcoin’s rise, more than $800 million in volume of short positions of traders who had hoped to play on the industry’s further decline were liquidated in trading in the main cryptocurrency. On his Twitter account, Arthur Hayes named the main culprit for the rise – it turns out to be the US Treasury Department. Here’s his rejoinder, cited by CryptoPotato.

The US Treasury is thinking about supplying the market with more short-term Treasury bills to reduce their deficits. Money market funds like short-term bills, but there are not enough of them, so they put their money in reverse repos by the Fed. This brings similar returns.

Arthur Hayes’ tweet on the rise of cryptocurrencies

The point is that reverse repo deals don’t make a profit, but liquidity in Treasury bills can be used to grow risky assets. According to Hayes, the volume of reverse repo transactions is currently expected to decline significantly – meaning the cryptocurrency market could be preparing for a continued local bull run.

😈 YOU CAN FIND MORE INTERESTING NEWS ON OUR YANDEX.ZEN!

More positive news for crypto: this week the head of the US Commodity Futures Trading Commission (CFTC), Rostin Behnam, stated that Bitcoin and Etherium should be considered commodities. And this is the exact opposite of the view that major cryptocurrencies should supposedly be considered analogous to stocks – and regulated accordingly.

I consider ETH a commodity, but the head of the US Securities and Exchange Commission, Gensler, thinks differently.

In this quote, voiced at a recent conference in Manhattan, Behnam referred to SEC Chairman Gary Gensler. To recap, Gensler has previously hinted on more than one occasion that the move to the new Proof-of-Stake consensus algorithm would allow the regulator to consider the altcoin to be analogous to a security. In such a case, officials could allegedly cause problems for the crypto because it was launched and exists outside of the outdated regulations used for equities.

CFTC chief executive Rostin Behnam

This is an important point, as recognising a cryptocurrency as a security automatically leads to it being regulated under the relevant legislation. Behnam, on the other hand, does not think this scenario is acceptable. And that’s good for the crypto industry as a whole – it just doesn’t make sense to control it by enforcing laws that were created for equities back in the last century.

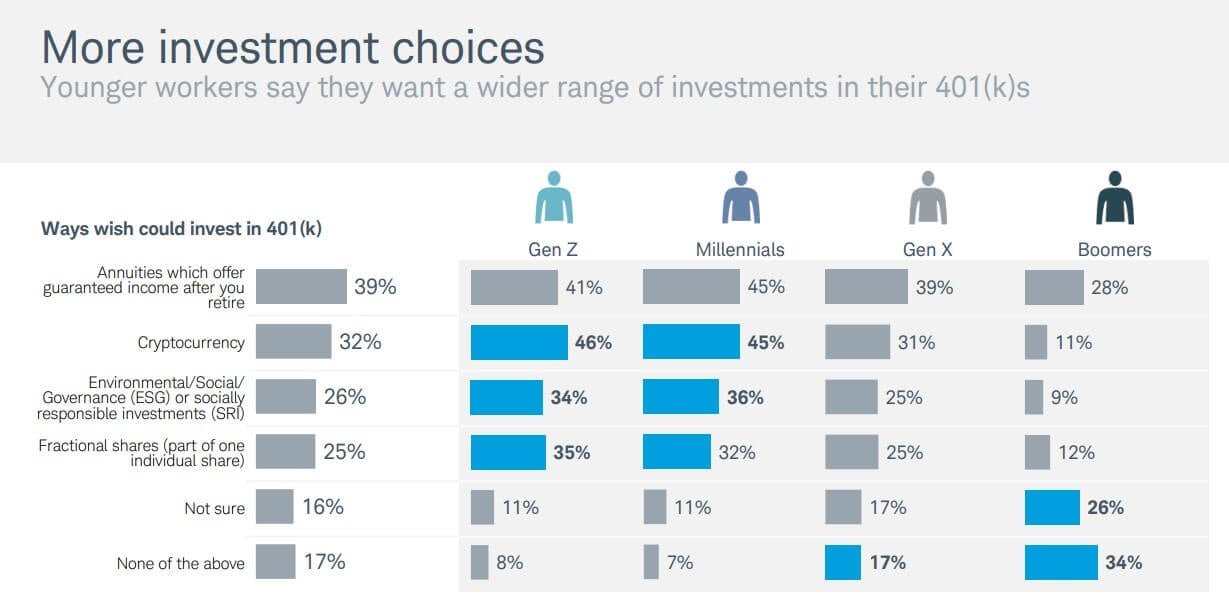

Still, cryptocurrencies should be regulated at least to protect individual investors, experts say. Nearly half of millennials and zoomers would like to see digital assets in their 401(k) retirement plans. That's the data shared this week by analysts at Charles Schwab, Cointelegraph reports. The firm surveyed 1,100 401(k) retirement plan participants aged 21 to 70 between April 4 and April 19, 2022.

According to the survey, 46 per cent of zoomers and 45 per cent of millennials said they ‘would like’ to invest in cryptocurrencies as part of their retirement planning. 43 percent of zoomers and 47 percent of millennials invest in cryptocurrencies outside of their 401(k) plans, which may indicate a strong affinity for this group for this asset class.

Share of interest in crypto and other investments by different age categories

Cryptocurrencies are already an important part of many young investors’ lives. In 10-20 years’ time, they will be the dominant age group in all markets, so the acceptance of Bitcoin and altcoins will also increase significantly. In such a situation, crypto really needs proper regulation that would not hinder the progress of the industry.

We believe that the current growth has turned out to be a fairly logical development of the market situation. After all, cryptocurrencies have been stable for a long time, and as a result, Bitcoin's volatility has even fallen below certain indices like the S&P500, and it can't stay that way forever. Time will tell what will happen next, with every event like this one adding to the certainty that the bottom of the digital asset market could indeed be reached in June 2022, with BTC dipping into the $17,000 zone.

What do you think about it? Share your opinion in our millionaires cryptochat. Talk about other interesting topics around the digital asset industry there as well.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THERE’S EVEN MORE INTERESTING NEWS HERE.