Vitalik Buterin, the creator of Etherium, has identified the main disadvantages of gold compared to cryptocurrencies. What are they?

Gold can hardly be considered a good decentralised alternative to money – a statement made the day before by Etherium co-founder Vitalik Buterin. In his tweet, he noted that gold is an “overly inconvenient” investment instrument, which is hard to use, and especially in transfers to others. That said, cryptocurrencies have all the features needed to be a better substitute for gold. We tell you more about what’s going on.

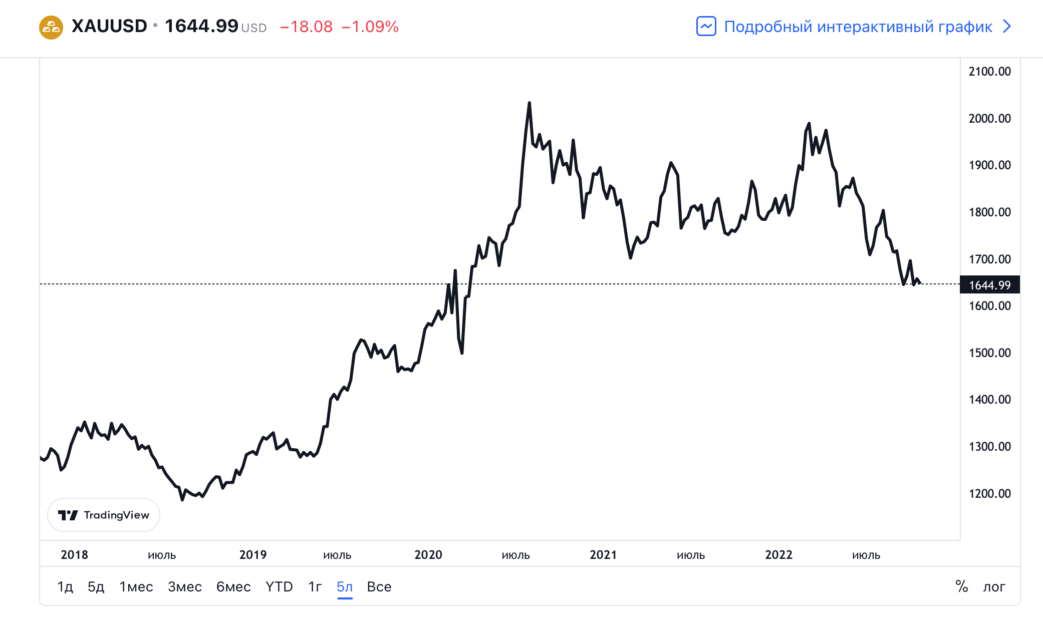

Gold is a popular investment instrument that has been on the market much longer than Bitcoin and other cryptocurrencies. The precious metal is relatively stable. For example, in the five-year chart below, the price of gold has fluctuated from $1184 to a peak of $2031. Accordingly, the percentage change in price here is much smaller than that of BTC.

Graph of the gold price over the past five years

In general, the advantages of digital assets compared to gold are rather obvious. First of all, they are decentralized, which means that the cryptocurrency network is not subject to outside control. Also, coins can be easily sent to a person anywhere in the world, and BTCs and other crypto are also divisible down to the smallest of values.

Most importantly: the total supply of gold is unknown, while it is easy to check the number of bitcoins, ethers or other popular coins in circulation.

Why cryptocurrencies are better than gold

Vitalik posted his thoughts on gold in response to the following tweet by artist Zack Weinersmith.

The only argument with meaning within cryptocurrency supporters’ own views that makes sense is that they don’t want centralised power over money. Why not just use gold in that case?

In other words, Zack has somehow decided that gold can supposedly replace digital assets, which are not controlled by authorities, judges and other representatives of such positions. Apparently, the artist is not particularly familiar with the peculiarities of crypto, if he thinks such an argument is logical.

According to Decrypt’s sources, Vitalik’s response was as follows.

Gold is incredibly uncomfortable. It’s difficult to use, especially for transactions with untrustworthy parties. It does not support secure storage options such as multi-signature. At the moment, gold is less popular than cryptocurrencies, so crypto is a better tool.

As a reminder, multi-signature involves the need to sign a transaction with multiple private keys in order to conduct it. In other words, if the required number of signatures is missing, no transaction can be made with the money. At the same time anyone can own gold, and due to the lack of blockchain transparency, this will include a stolen asset.

Vitalik Buterin

Gold is really inconvenient to transport and store, and both processes are strictly regulated in different parts of the world. Compared to cryptocurrencies, the precious metal has only one advantage – thousands of years of history and, as a result, enormous credit to the asset from all mankind. But Vitalik also stated the growing popularity of crypto – it is far more common among young investors than gold.

In addition to Vitalik, Hayden Adams, creator of the decentralised exchange Uniswap, also joined the discussion. He noted that in the future the price of gold could fall substantially if humanity introduces the necessary technology to mine the metal on asteroids. To be fair, it is worth noting that even on the horizon in the next few years market collapse of gold for such a reason does not threaten – until a full-fledged extraction of resources in space is still far away.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

The cryptocurrency market has shown the first signs of recovery this week, with its capitalisation rising above the trillion dollar mark and Bitcoin breaking through the $20,000 resistance line. However, October saw record low average daily trading volumes across all digital assets in the context of institutional, i.e. professional investor, trading instruments.

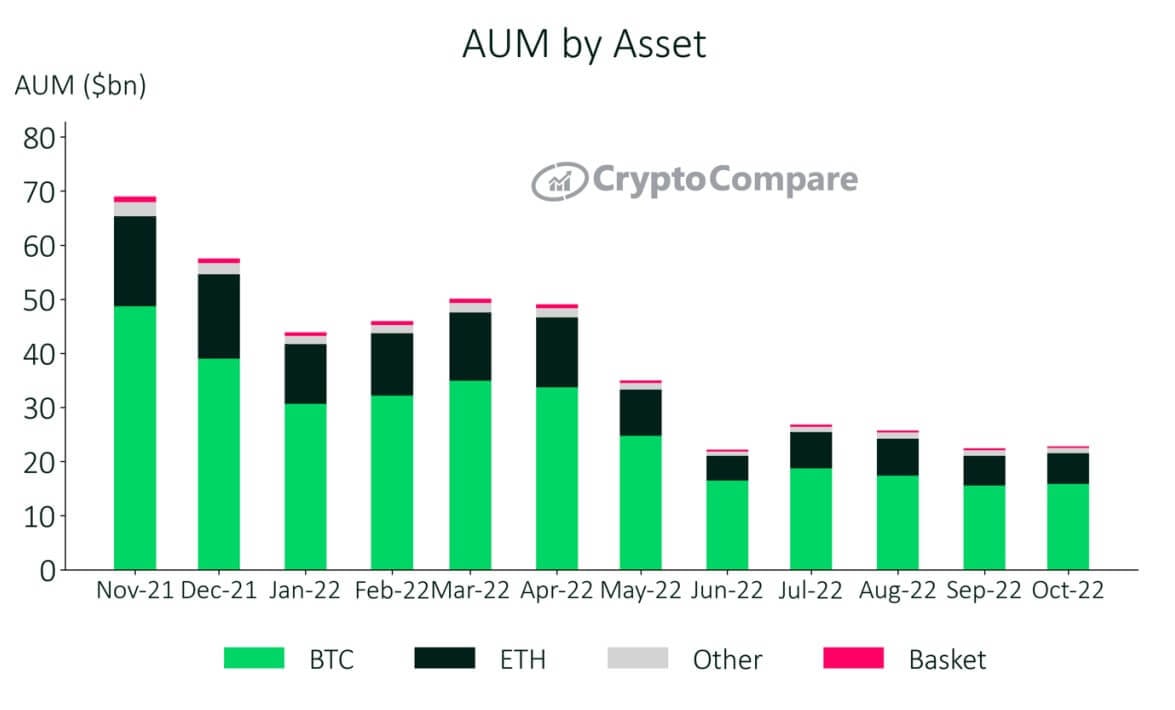

Assets under institutional management

This was mentioned in a recent report by analysts at the CryptoCompare platform. The average daily trading volume of institutional trading instruments fell 34.1 percent to $61.3 million in October, Cointelegraph reported. Almost all instruments included in the report showed a drop in daily volumes ranging from 24.3 percent to 77.5 percent.

The downward trend in trading volumes has been in place since November 2021, with a small exception of May 2022. October was the second month since September 2020 when average daily volumes have fallen below 100 million dollars. However, the report does show some upbeat developments in other market indicators. Total assets under management across all investment products rose 1.76 per cent to $22.9 billion compared to September.

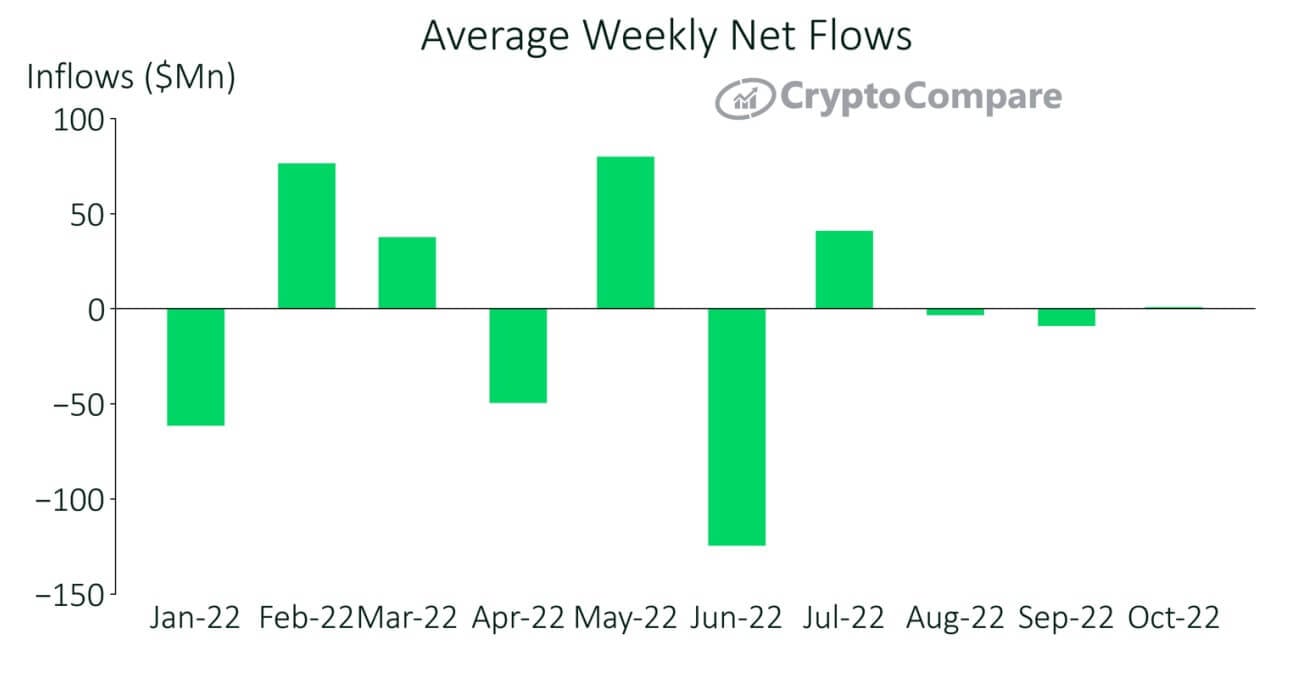

Institutional inflows/outflows

It should be remembered that these are only institutional trading instruments – e.g. the Bitcoin ETF. The drop in volumes is an expected development against the background of very low volatility of the main cryptocurrency this month. However, this is likely to change quickly in November if Bitcoin continues to rise.

We think we can only agree with Vitalik Buterin in this situation. Still, gold is not as popular among the younger generation today - and there is a logical explanation for that. The precious metal is more limited in its functionality compared to cryptocurrencies, on top of which it is much more difficult to make transactions with, let alone send it to another country or something like that. Obviously, as time goes on, more and more investors will become familiar with the benefits of coins and opt for them over more traditional investment vehicles.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will discuss other important developments in the world of blockchain and decentralisation.