Analysts believe that the cryptocurrency market has almost bottomed out. How can we be sure of that?

Cryptocurrency participants have not yet fully capitulated, although we are supposedly nearing the end of a bearish trend. This is the data shared by analysts at Glassnode the day before. They believe that on a large scale, the formation of a global bottom for Bitcoin is still in process, but local collapses to new price lows are possible in the short term. We tell you more about the experts’ views.

What’s next for Bitcoin

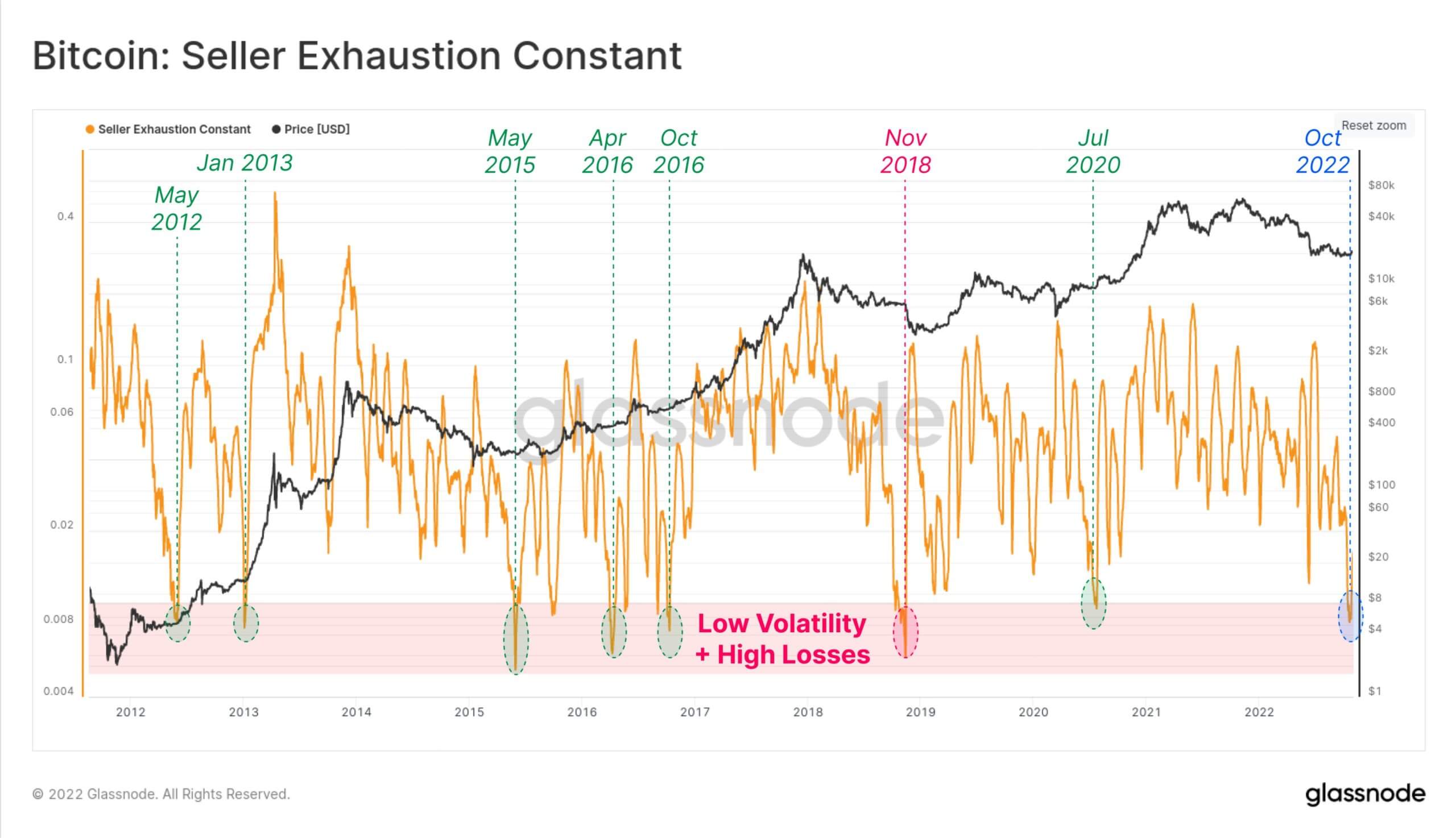

At the moment, the market is in a so-called “perfect storm” – that is, low volatility and high losses for Bitcoin investors. The current situation is clearly shown by the Seller Exhaustion Constant indicator, which is calculated on the basis of one-month volatility and profitability of trades in the network. The principle of calculation of the constant was explained in more detail in the article by Yassin Elmanjra, an analyst of ARK Invest. Here is a quote from it, cited by Cointelegraph.

The seller depletion constant is the percentage of the total circulating supply of BTC in profit multiplied by its volatility over the past thirty days.

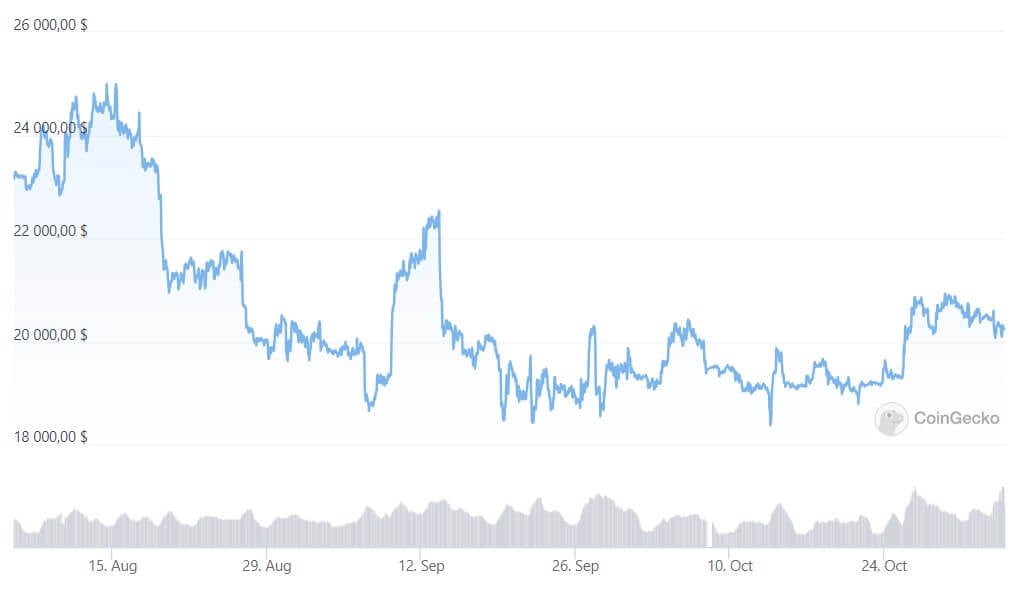

Bitcoin exchange rate over the last 90 days

This figure is now at its lowest since November 2018, and it’s been fairly infrequent in cryptocurrency history. Here’s a quote from Glassnode’s official Twitter account about it.

This indicator reaches lows with low volatility and high losses in the blockchain. In six out of seven cases, the situation led to a surge in volatility and growth in the cryptocurrency.

In other words, experts are making it clear that Bitcoin and many other cryptocurrency sellers are running out of steam right now, which means there should not be many willing to get rid of digital assets anytime soon. Well, the lack of sellers traditionally leads to upside opportunities, which is where the above-mentioned surge comes from.

Seller Exhaustion Constant indicator

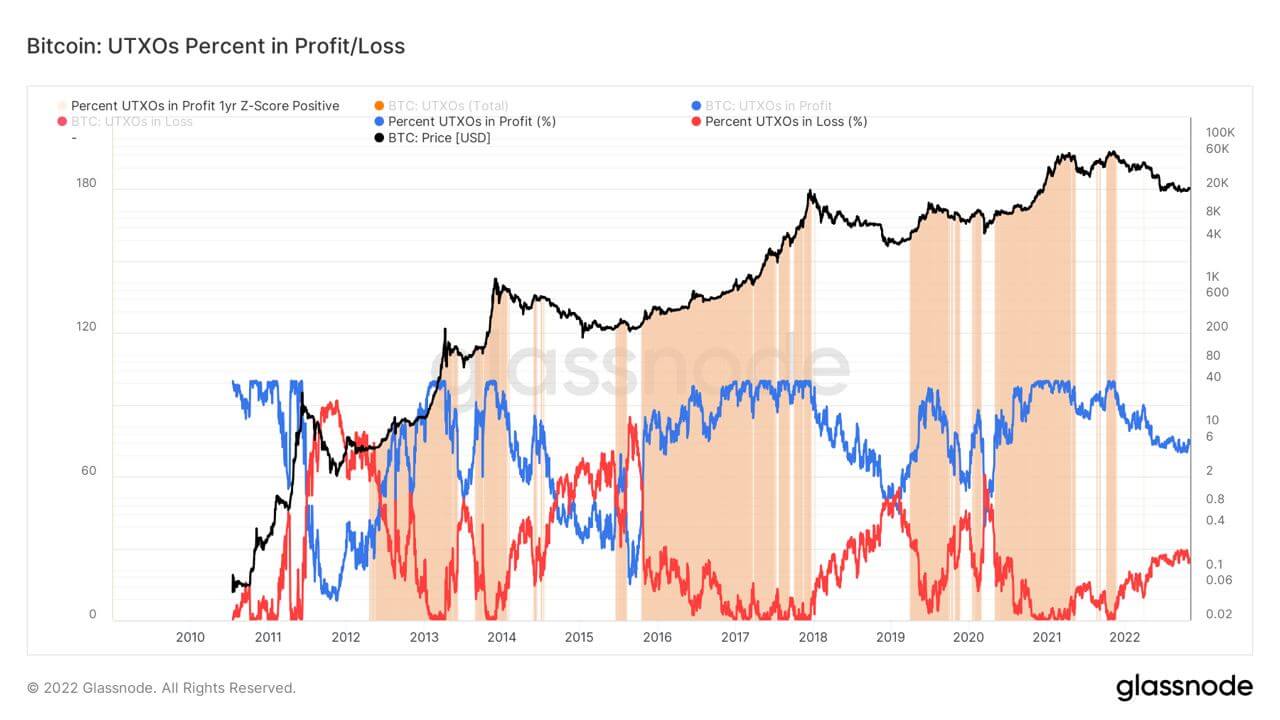

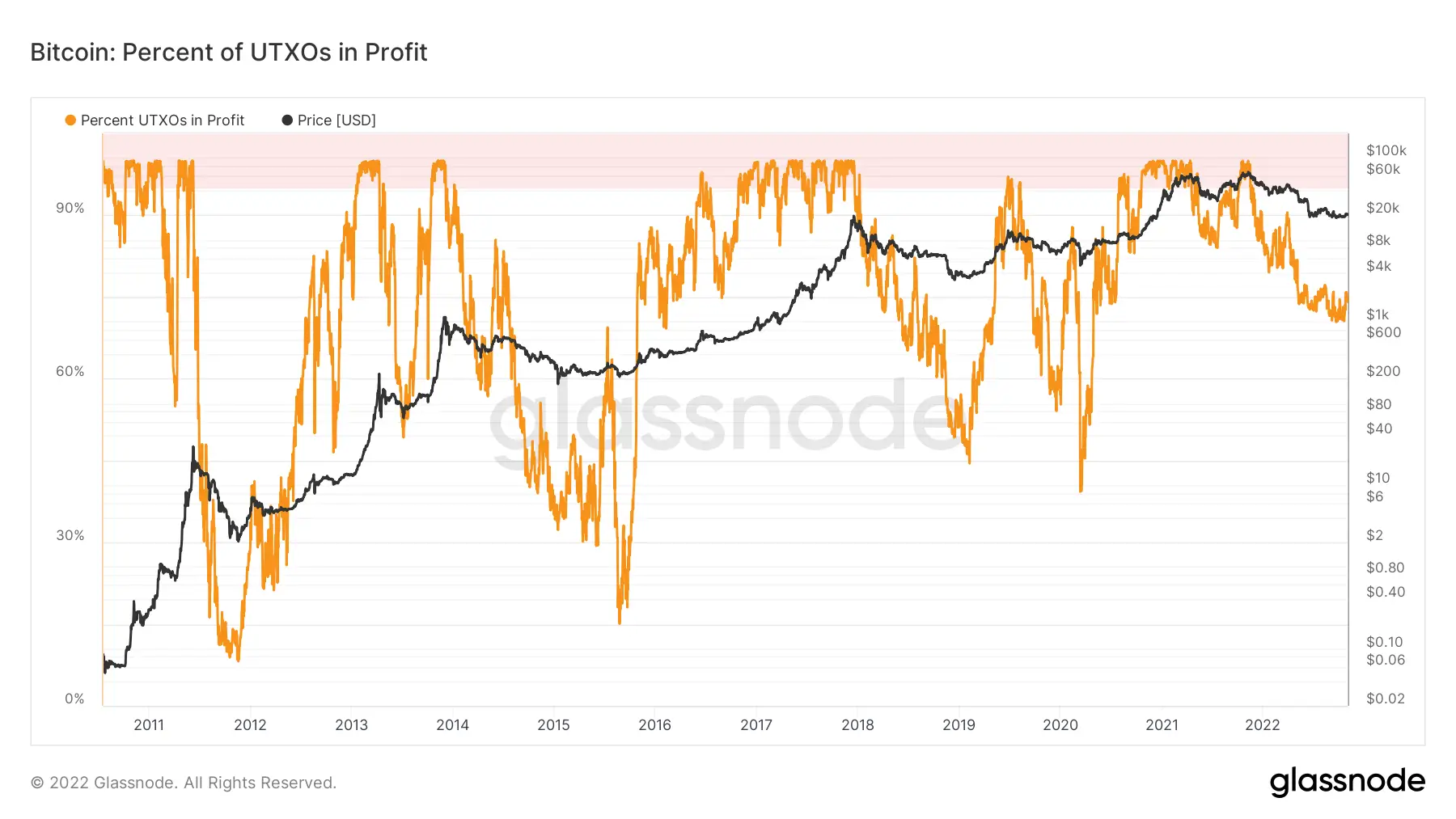

At the same time, a chart with the dynamics of Bitcoin unspent transaction exits (UTXO) profits and losses shows that so far the level of losses in the blockchain does not correspond to the average bottom at the end of a bearish trend.

UTXO in profit/loss and long-term Bitcoin chart

As of October 29, about 75 per cent of UTXOs were still in profit.

UTXO at a loss

In comparison, by the end of the “crypto-zima” of 2018, the same figure was dipping below 50 per cent. In other words, it is possible that Bitcoin holders could suffer more losses in the future due to a new local price collapse. Although there is also a possibility here that those willing to get rid of the crypto have already done so, and new buyers have managed to come out on the plus side due to the recent growth of BTC and the market as a whole.

😈 MORE INTERESTING STUFF CAN BE FOUND ON OUR YANDEX.DEN!

Was June 2022 ultimately the bottom of the digital asset market? Many analysts are trying to answer this question with their fundamental and technical analysis indicators. Capriole CEO Charles Edwards has also published his own metric called Yardstick. It is quite simple and indicates that Bitcoin is severely oversold, that is, the first cryptocurrency is too low in value.

Will Bitcoin fall again?

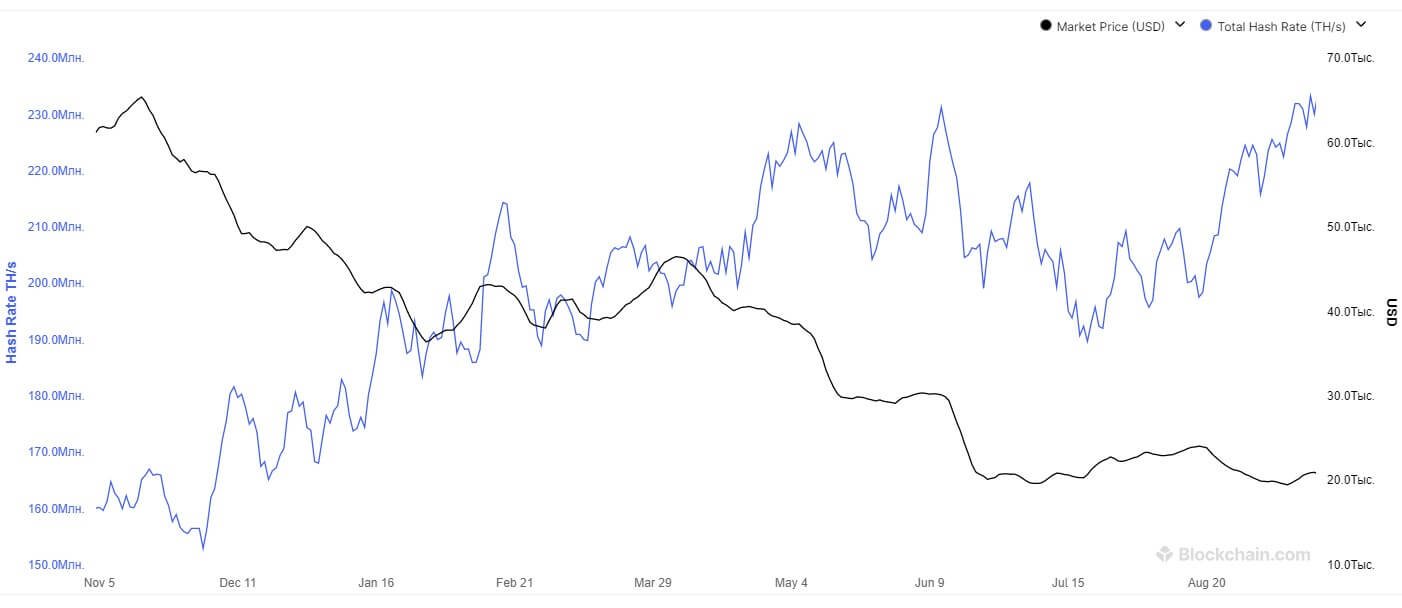

Bitcoin Yardstick measures the ratio of a major cryptocurrency’s capitalisation to its hash rate, or the total processing power of all miners’ devices in the network. The lower the reading of the indicator, the more oversold the digital asset is, and thus the likelihood of its growth becomes higher.

According to Cointelegraph, Yardstick indicates a large difference between hashrate and price. Large movements on the hashrate chart in one direction are thought to precede the same movements on the BTC price chart. Right now the hashrate is near its all-time high, but the BTC price has fallen 70 percent since reaching its peak last year.

Bitcoin’s hash rate for the year

Here’s a commentary on the matter from Edwards himself.

Today we are seeing the second lowest Bitcoin Yardstick value in the cryptocurrency’s history. This means that in relative terms Bitcoin is unusually cheap, given the amount of energy used in the world’s most powerful computer network.

Yardstick index reading

During the peak of a bullish trend, the Yardstick value reaches its maximum – the opposite situation occurs, when the price significantly outperforms the hash rate. But the above relationship also works here – as soon as the hashstick chart shows a noticeable decrease, the Bitcoin value also goes down.

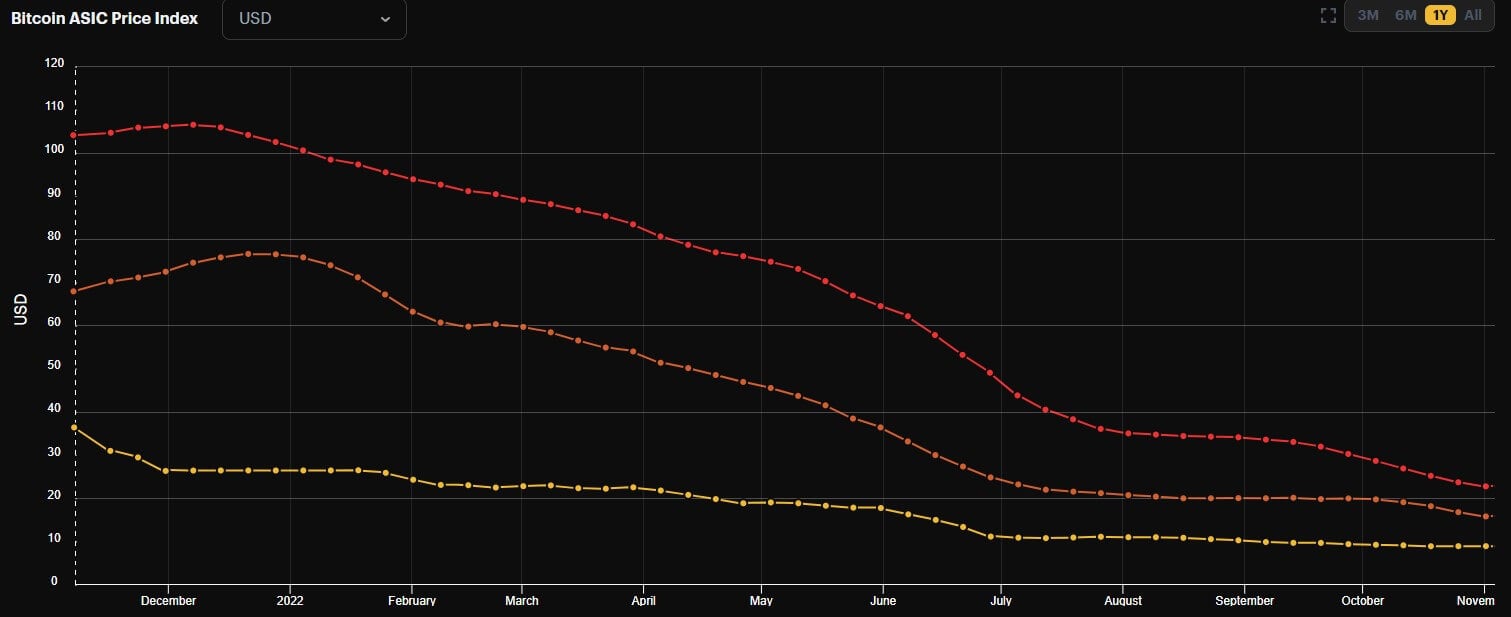

As the hash rate increases and the BTC price remains relatively stable, the profitability of mining decreases. However, the cost of equipment is also getting cheaper, which has been taken advantage of by the mining company CleanSpark. It recently bought 3,843 Antminer S19J Pro ASIC miners for $5.9 million. That is, the purchase cost the company $15.50 per terahesh of power.

This is much cheaper than the average price of an ASIC-miner with the same efficiency. Right now, this figure is hovering around $23.

Average price of ASIC-mainers of different capacities (dollars per terraheesh)

According to information from representatives of CleanSpark, the total number of devices managed by the company now reaches 50 thousand units. The equipment was most likely purchased from rival Argo Blockchain. The company's October 31 report indicates that it sold 3,843 units of Bitmain S19J Pro, which is how many CleanSpark purchased.

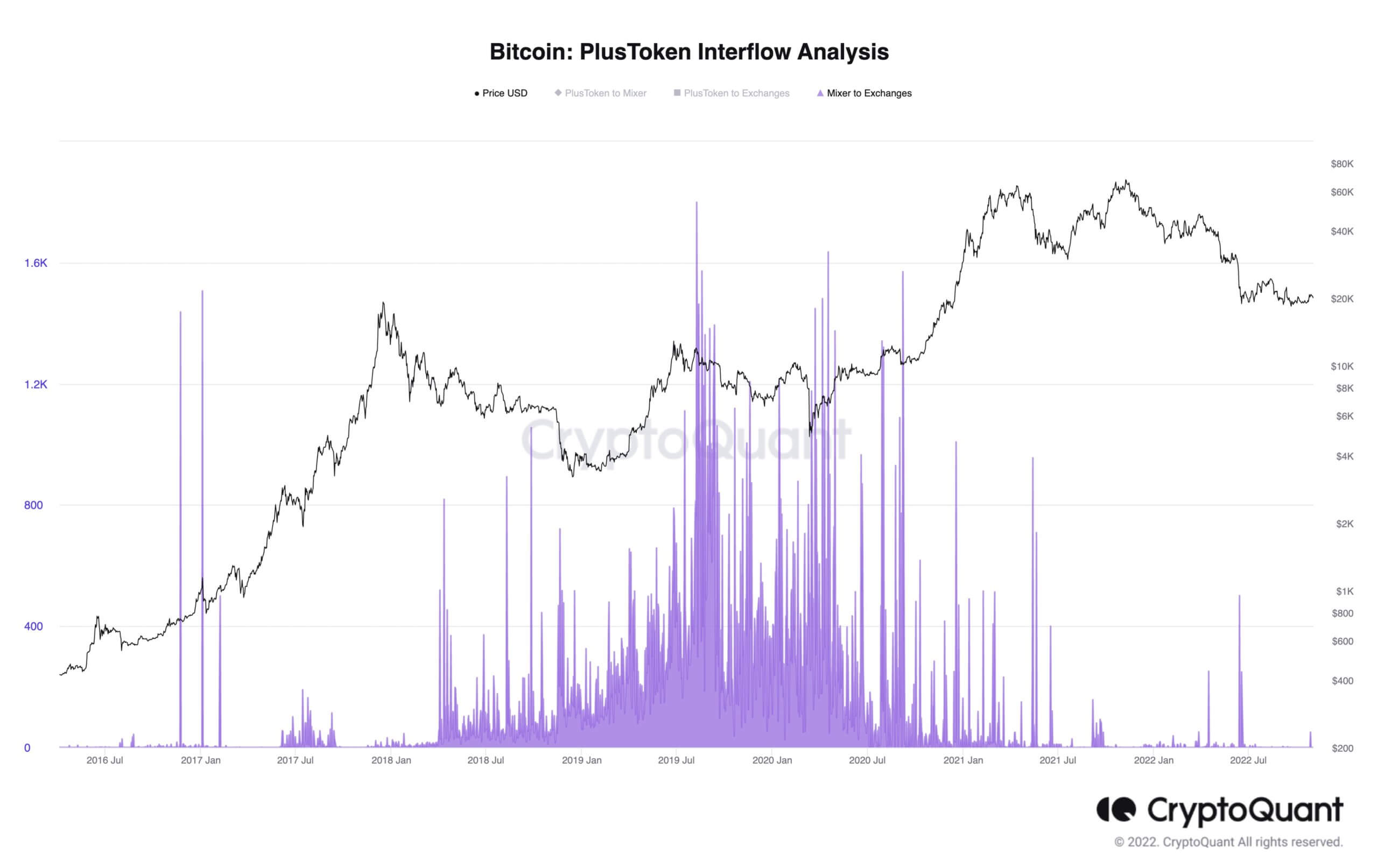

All this hints at the serious popularity of digital assets in the world. And it really is, with even the Chinese government among long-term Bitcoin holders. CryptoQuant co-founder Ki Yong Zhu has posted some interesting statistics on Twitter about this.

It turns out that back in 2019, government agencies in the country confiscated 194,000 BTC, 833,000 ETH and huge amounts of other cryptocurrencies after the massive PlusToken fraud scheme was shut down. In comparison, MicroStrategy has only 130 thousand BTC in reserves.

Ranking of public companies owning BTC

At the current exchange rate, the value of crypto-assets seized by the government exceeds the $6 billion level. Such a large amount is a consequence of the success of the PlusToken pyramid scheme. As a reminder, it started operating in 2018, with fraudsters mainly targeting investors from China and South Korea.

After some time, law enforcement authorities managed to catch some PlusToken executives. However, not everyone involved in the pyramid scheme is behind bars: other participants in the scheme are still withdrawing stolen bitcoins through cryptomixers. Ki-Young-joo noted that 50 BTC were withdrawn from the PlusToken-linked wallet last week alone.

Transactions from PlusToken-linked wallets

China is not the only country “acquiring” cryptocurrencies through seizures. Earlier this year, the US Department of Justice seized more than $3.6 billion worth of bitcoins, with the coins linked to the 2016 Bitfinex crypto-exchange hack. Before that, another high-profile case was the seizure of 70,000 BTC from Ross Ulbricht, creator of the illegal Silk Road trading platform. Ulbricht is now serving a life sentence in a US prison.

In our view, the digital asset market can't be in decline forever, in addition, it's been almost a year since Bitcoin set a record price. So sooner or later the analysts' forecast will come true and the industry will move from a bearish trend to plateau and further growth. Whether June 2022 was the bottom in the end, time will tell.