Analysts have compared the stages of cryptocurrency collapse in 2022 and 2018. What came out of it?

The last major bear cycle in the digital asset market was the so-called cryptozyme of 2018. During that downtrend, the price of Bitcoin fell from a then-record $20,000 to almost $3,000 in a few months. Now the industry is again going through bad times in its history, but can the current trend be compared to the 2018 data? And what happens if it does? We tell you more about what is happening.

Note that the bearish trend of 2022 has been dragging on for quite some time, with numerous bankruptcies and collapses to remember. For example, one of the first major victims of the market crash was the Terra LUNA ecosystem, which faced the UST “stabelcoin” being detached from the dollar and falling almost to zero. In the summer, the so-called liquidity crisis was experienced by Celsius, which blocked user withdrawals.

We can also recall the death of cryptocurrency fund Three Arrows Capital, which had the equivalent of billions of dollars in crypto under management back in the spring. Finally, the FTX exchange joined the list of bankrupts in November, although it was by no means the worst event for the digital asset industry.

Three Arrows Capital crypto fund co-founder Su Zhu

With all that has happened, the current bearish trend is already the second longest. And this makes analysts make comparisons of the current situation with the past of the coin market.

When will cryptocurrencies start rising?

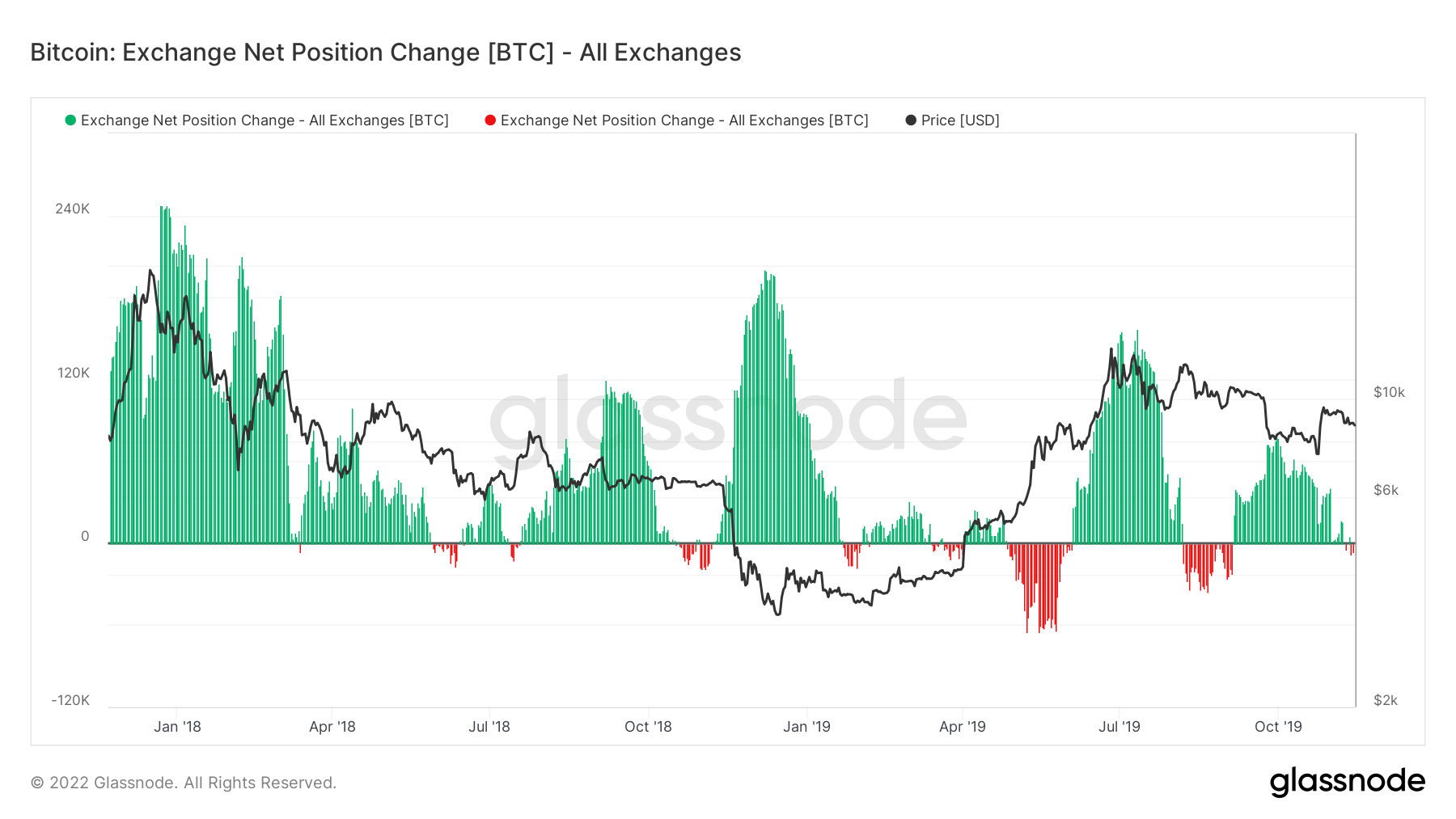

Between January 2018 and the fourth quarter of 2019, there have been large inflows of bitcoins to cryptocurrency exchanges, which is clearly shown in the chart below.

Bitcoin moves from (red) and to (green) cryptocurrency exchanges in 2018-2019

While at the beginning of the period under review, the balance of coins on the exchanges was around 1.7 million BTC, by the end of 2019 that figure had risen above 3 million BTC, according to CryptoSlate.

As a reminder, the inflows of a major cryptocurrency to trading venues can correlate with its price. There's a simple logic to it - coin owners are transferring coins en masse to exchanges when they want to sell them. Consequently, the greater the outflow of bitcoins, the greater the chance that the cryptocurrency's value will rise in the near future. And there is also evidence that investors are willing to wait quite a long period of time before the so-called bull run occurs.

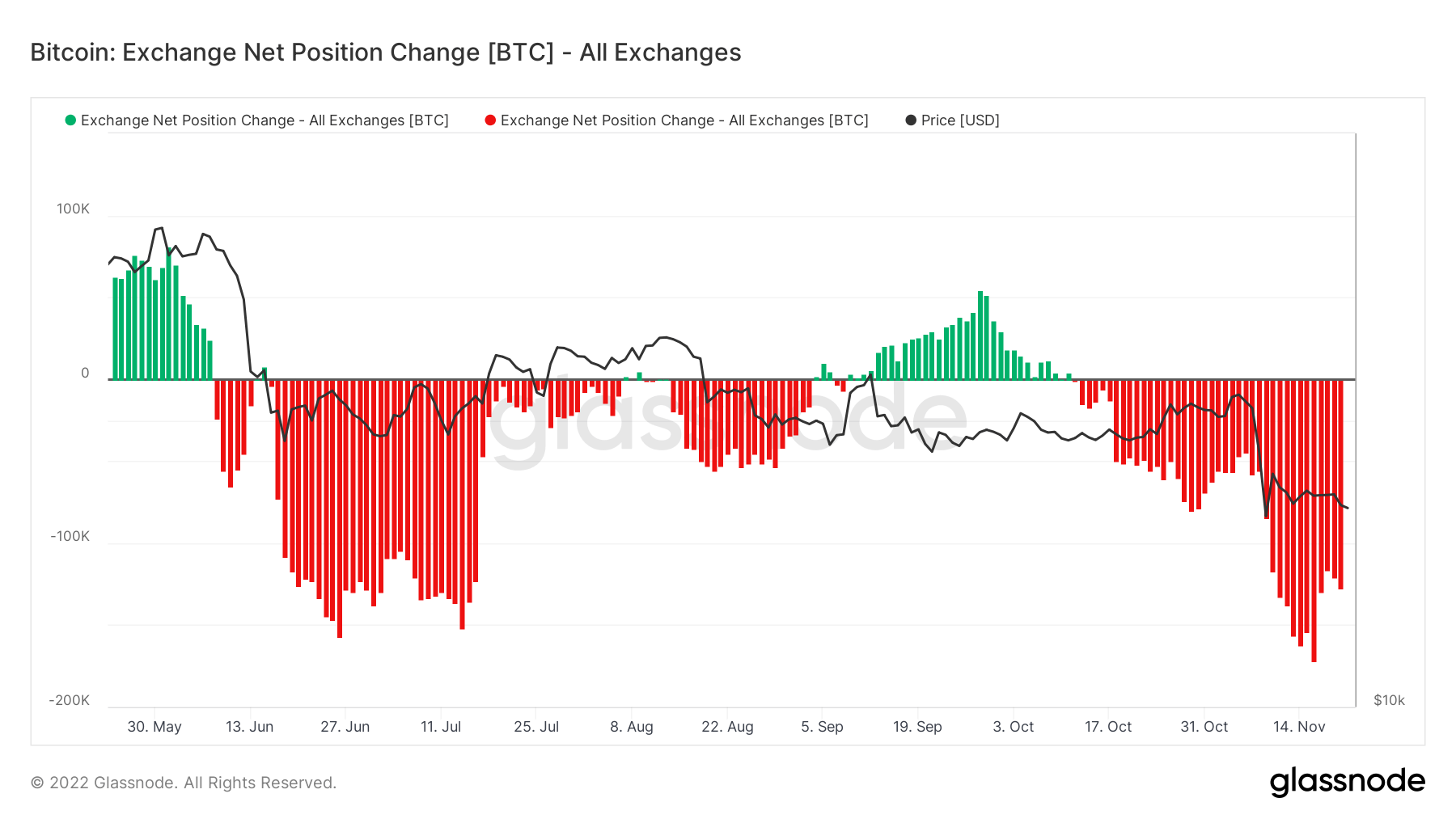

However, in the case of the current bearish trend, this concept is not borne out in practice. Throughout 2022, there have been large outflows of coins from exchanges, although the price of Bitcoin has continued to fall during this time.

Bitcoin moves from (red) and to (green) cryptocurrency exchanges in 2022

Even before FTX went bankrupt in early June 2022, a total of around 300,000 BTC were withdrawn from the exchanges. Since the collapse of the trading platform, this trend has only intensified amid investor panic about the safety of their bitcoins in the hands of cryptocurrency exchanges. It remains the case now, as the credibility of centralised platforms has been dealt a serious blow. However, the giants are combating this by adding transparency to their own reserves and other components of their operations.

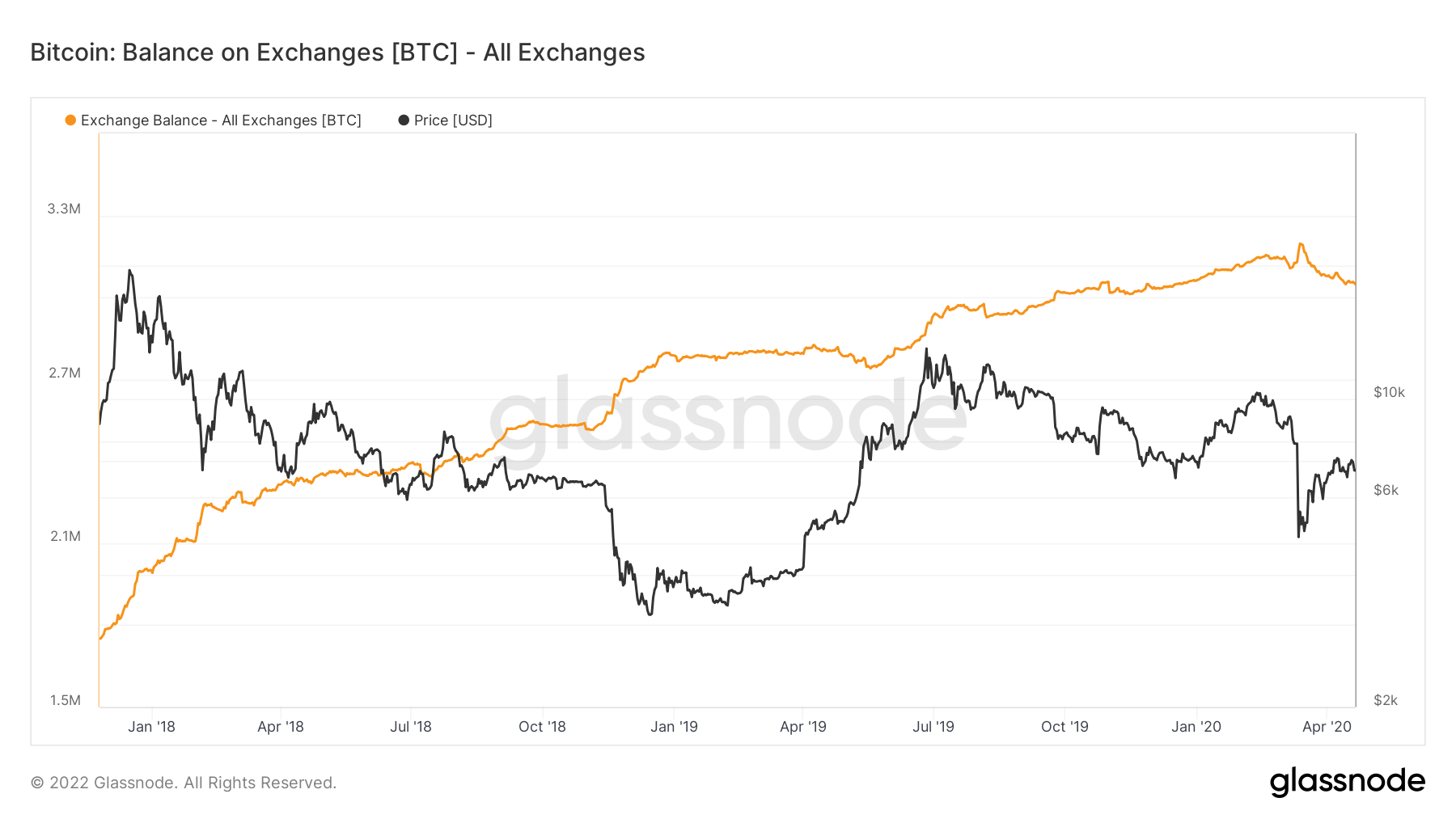

Bitcoin balance situation on cryptocurrency exchanges in 2018-2019

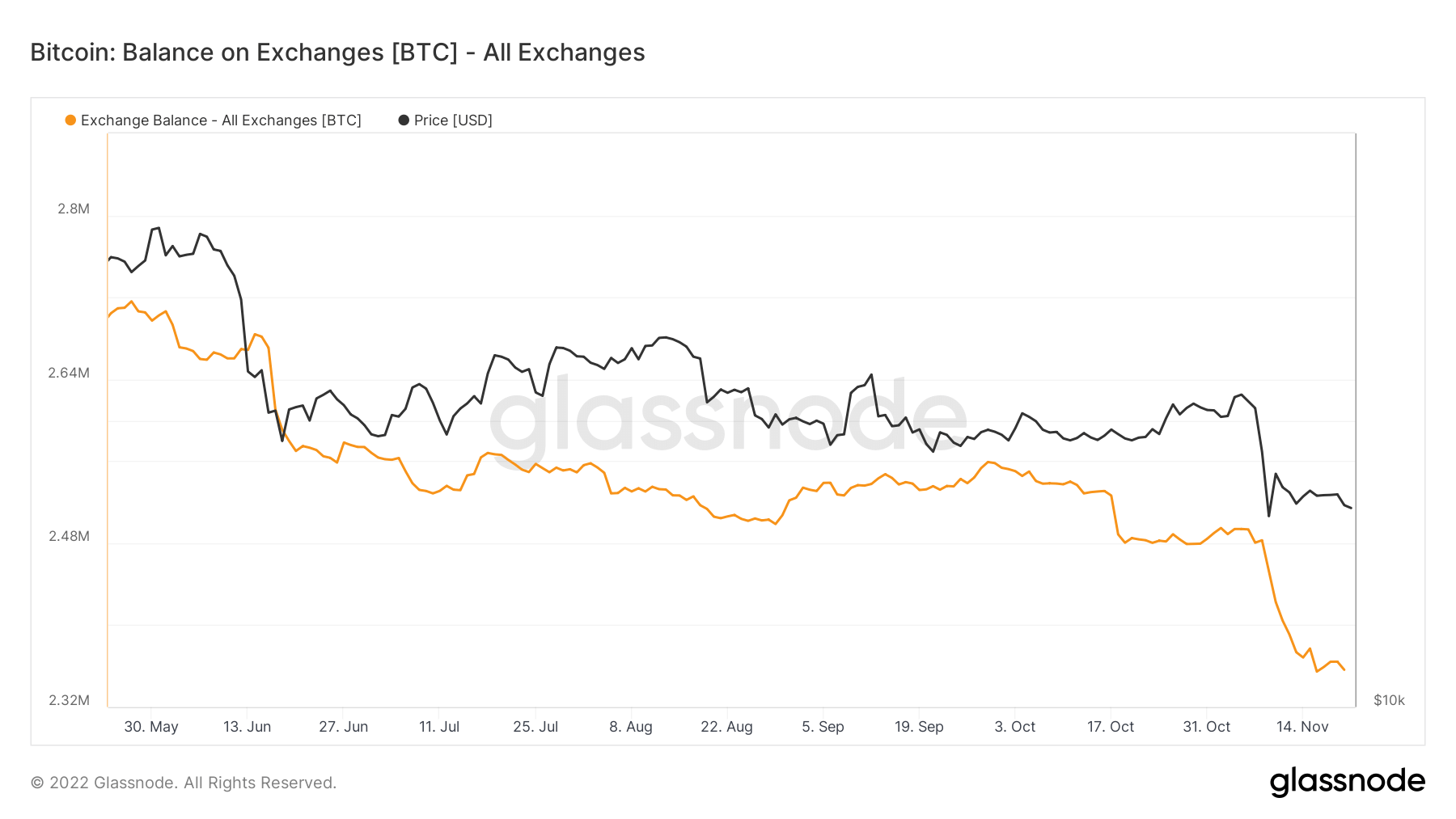

And here is the current situation for the indicator.

Bitcoin balance situation on cryptocurrency exchanges in 2022

Incidentally, in 2018, Bitcoin’s value fluctuated near its global bottom for about 136 days. In doing so, the bottom was found 80 per cent below the cryptocurrency’s previous all-time high line.

By today, Bitcoin’s price has managed to drop 76.9 per cent since reaching its all-time high. Assuming we have already hit the bottom or are very close to it, traders may have a relatively long and dull period of low volatility in trading ahead, which will last for several months. This has been the case in the history of the coin market at least in the past.

Daily chart of Bitcoin exchange rate

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

While the big green candles on the BTC chart are still a long way off, let’s pay attention to news from the field of fundamental analysis. The day before, the Belgian Financial Services and Markets Authority (FSMA) published a report acknowledging the fact that Bitcoin, Etherium and other decentralised crypto projects are not securities. Consequently, they do not need to be regulated under the relevant legislation, reports Cointelegraph.

Although Belgian or European Union law is not legally binding, the FSMA said that under its “phased-in plan” cryptocurrencies would be classified as securities if issued by an individual or entity.

However, regulators noted that cryptocurrencies that are not classified as securities could still be subject to other regulations if their issuing companies use digital assets as a medium of exchange.

Buying cryptocurrencies

The recognition of crypto as securities is a complex issue that has long been the subject of debate. Most crypto-enthusiasts oppose such recognition because it would lead to the application of “outdated laws” to new technologies.

The legal framework for securities was created decades ago, so it cannot be considered relevant for such a new asset class as cryptocurrencies. Obviously, separate regulations should emerge for the latter.

We think the differences in the current bearish trend are quite interesting. Still, the industry is now seeing a noticeable decline in cryptocurrency balances on centralised exchanges, as coin lovers have already drawn conclusions from the FTX crash. And that, in theory, could hasten a new bull run, as fewer coins on trading platforms are an obstacle to selling them. However, further developments in the market will be unique one way or another.

Look for more interesting things in our millionaires cryptochat. There we will discuss other important stories from the crypto world.