Analysts have identified how difficult it is to hack into a Bitcoin address in real life

To access a cryptocurrency wallet, you “only” need to know the private key – a 256-bit secret combination in the case of Bitcoin, which is most often in the form of a mnemonic phrase of 12, 18 or 24 words. However, for many newcomers to the crypto industry, it is difficult to understand the security of a cryptocurrency wallet in such terms. How secure is this protection, and is it realistic to just guess the private key? To use an analogy from life, winning the most popular lottery in the US is a lot easier than hacking into a bitcoin address. We describe the situation in more detail.

As is traditional, let’s start with an explanation. Within blockchain, there are two types of keys: private and public. A public key is a combination that is used to receive funds, that is, to send crypto-assets to a certain person. It can be shared with everyone.

At the same time the private key must be in the sight of the address owner only, and the combination itself allows access to the coins at a certain address and to dispose of them. If the private key is accessed by anyone else, they will be able to appropriate the coins and conduct transactions with them, so the combination must be carefully guarded.

Bitcoin’s strength against fiat

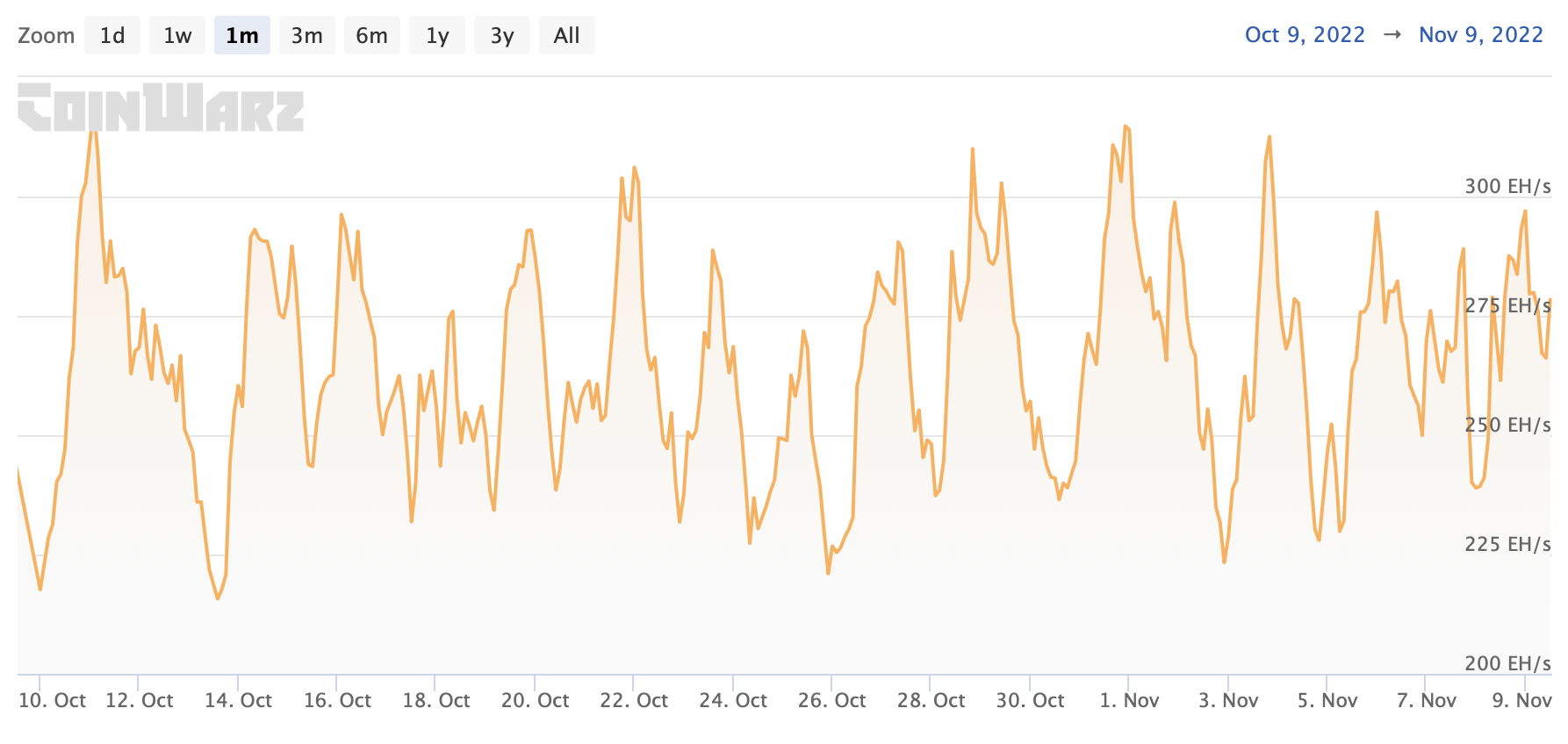

At the same time, the Bitcoin network is protected by the hash rate, which is the total amount of processing power of special devices called ASICs. The higher the figure, the more difficult it is for attackers to theoretically manipulate blocks and transactions in the blockchain.

We’ve clarified the latest data: today, the hash rate stands at 278 hashes per second, and it’s been relatively stable over the past month. Here is the corresponding graph.

Bitcoin network hash rate graph

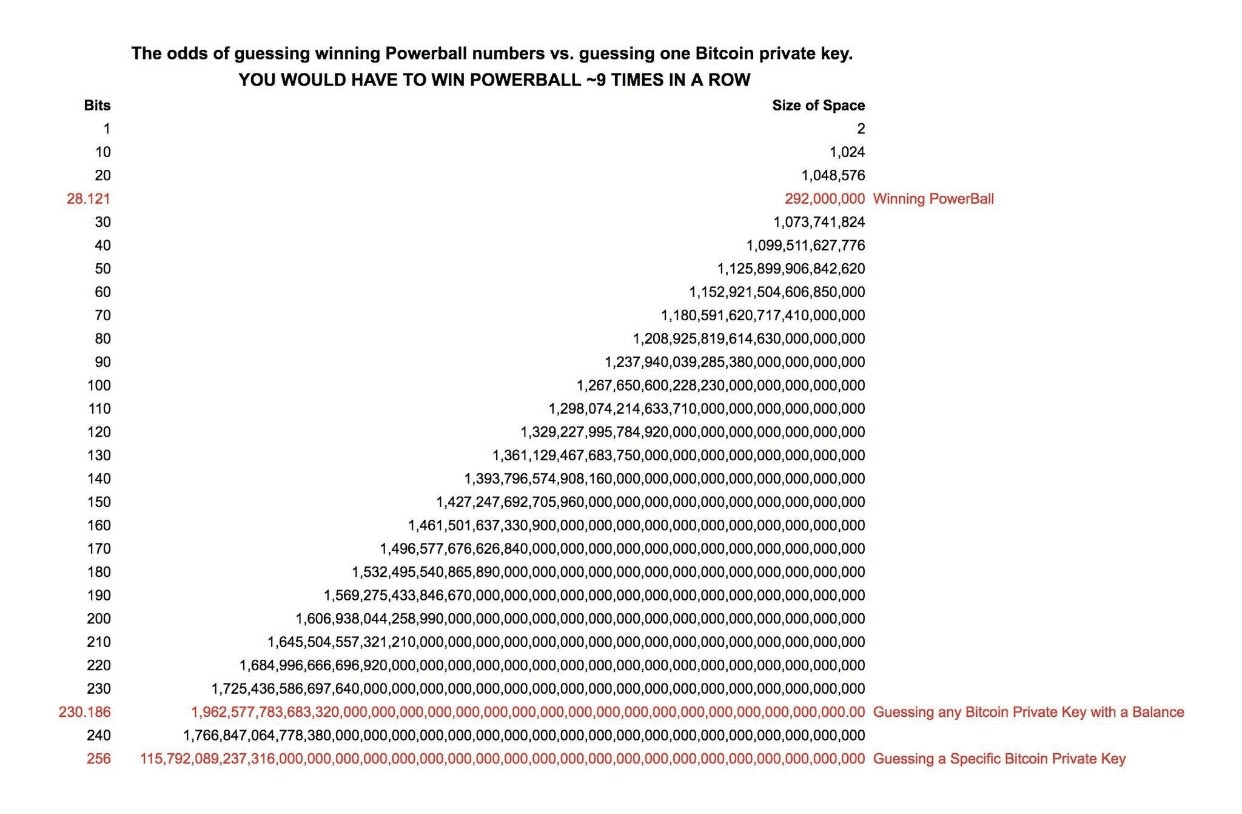

Because a Bitcoin private key is a unique sequence of characters, it can theoretically be guessed – by a matching method or otherwise. However, in reality, it is almost impossible to do so.

Is it realistic to crack a cryptocurrency address?

CryptoSlate journalists published an interesting study. According to it, the chances of guessing a private key are equivalent to winning the Powerball lottery nine times in a row. Well, guessing a particular private key is much more difficult than just guessing an existing combination from an address that has a certain amount of BTC.

Probability of winning the Powerball lottery and guessing private keys

As a reminder, the Powerball is an American lottery where the jackpot draw is almost always a sensation. The jackpot has had no winner for the past three months and the prize pool is now at an all time high of $1.9 billion.

Powerball

So the activity of fraudsters in the cryptosphere will “help” you lose your coins with a much higher probability. That’s why the Australian Securities and Investments Commission (ASIC) recently issued a public warning mentioning the key signs of a fraudulent digital asset scheme.

ASIC noted that criminal schemes fall into three categories. The first category is investing supposedly in a real asset, but the scammers give the victim a link to a fake website or app. The second type of fraud involves fake tokens used to launder money. The third category of fraud is the use of cryptocurrencies to make illegal payments.

Cryptocurrency fraud

The main signs of cryptocurrency fraud are “unexpectedly receiving an offer”, “fake celebrity ads” and asking “a romantic partner you only know online” to send money in cryptocurrency. Other red flags include being asked to pay for financial services in cryptocurrency, being asked to pay more money to access funds, withholding investment income “for tax purposes” or offering “free money” or “guaranteed” investment returns.

The regulator also said that fraudsters often put pressure on victims to transfer cryptocurrency. To prevent this problem, ASIC has also advised crypto investors not to use web apps that are not available on the Apple Store or Google Play.

We think these examples from the Australian regulator are rather superficial, as there are many more ways to lose money in the crypto world. In addition, as recent events have shown, this could include simply holding the token of a popular exchange whose management recklessly uses user funds in their transactions. So preserving capital is even more of a concern for the crypto investor than increasing it.

You can learn more about other anti-fraud rules in our Millionaire Crypto Chat. There we will discuss other important developments from the blockchain world.