Bitcoin’s volatility has fallen to its lowest level. How will this affect the cryptocurrency market?

The previous week ended with Bitcoin holding the $21,000 price target, although BTC is now valued slightly cheaper. At the same time, the first shift in macroeconomics is visible in the markets, the reason for which is now based only on hints and rumours. However, the US Federal Reserve seems to be going to raise the benchmark lending rate more gently in the future, which gives hope for a local bull run in both crypto and equities. The latter, meanwhile, are much more volatile than Bitcoin. We tell you more about the situation.

What’s next for cryptocurrencies?

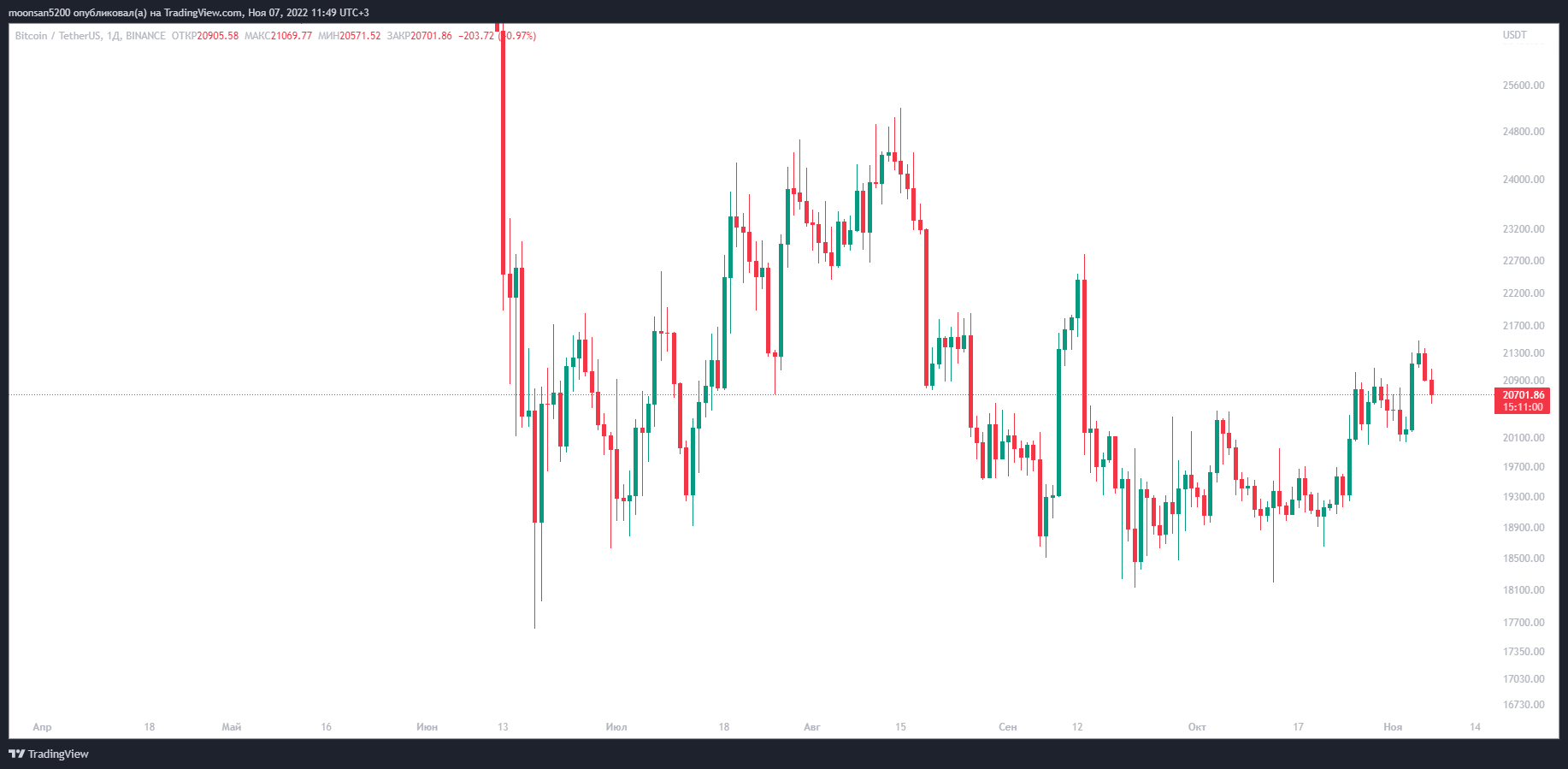

The price of the major cryptocurrency hit a seven-week high last week, with Bitcoin then jumping as high as $21,473. Unfortunately, BTC did fall below the $21,000 line tonight.

1-day chart of Bitcoin

The reasons behind the collapse of Bitcoin and the coin market in general have to do with the uncertainty surrounding the cryptocurrency exchange FTX and the Binance platform's response. Read more about the story in detail in a separate article.

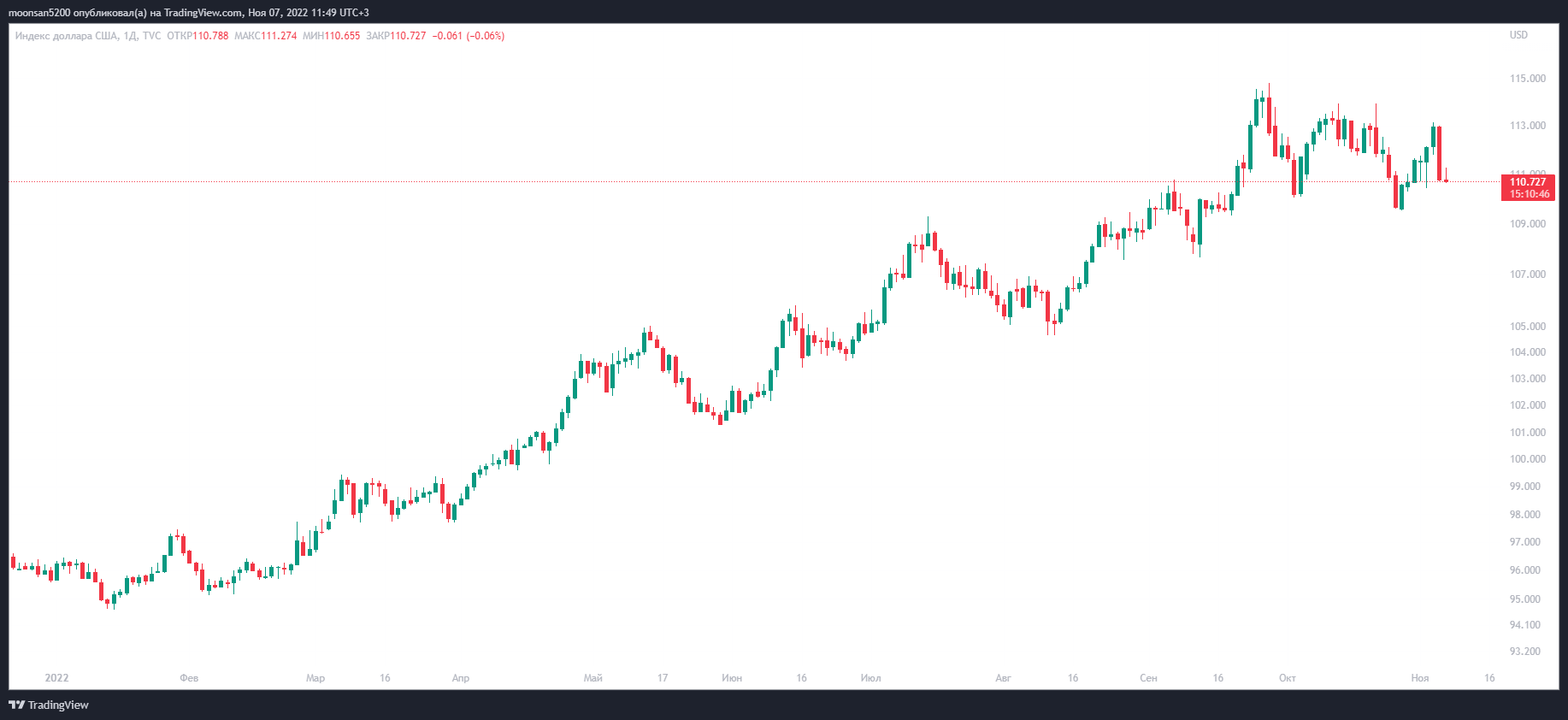

The Dollar Index (DXY) chart, on the other hand, shows a 2 per cent drop in just one day. This is the biggest overnight collapse of DXY in several years, Cointelegraph reports.

1-day chart of DXY.

Recall, the DXY displays the strength of the U.S. dollar against a basket of the world's six other most popular currencies. The recent rise in the index has been attributed to a steady increase in the US Federal Reserve's lending rate, making the cryptocurrency more secure. That said, the bullish movement on DXY is mirrored by the collapse in most markets, as investors prefer to exit in a strengthening dollar. The reverse is also true: even a local DXY collapse leads to gains in crypto and the stock market.

Michael van de Poppe, CEO of trading firm Eight, commented on the market situation.

And just like that Bitcoin has broken all the highs, the volume is rising, the cryptocurrency price is back above the $21,000 line. My guess is that we will continue from here to the $22,500 level, but there will be a slight correction before we continue, as we have removed all liquidity. Time to buy all the collapses on the BTC chart.

Note that this is just one version of a possible development, which may not come true. Accordingly, van de Poppe's thinking should not be taken with complete confidence, and he has been wrong many times before.

Bitcoin price forecast by Michael van de Poppe

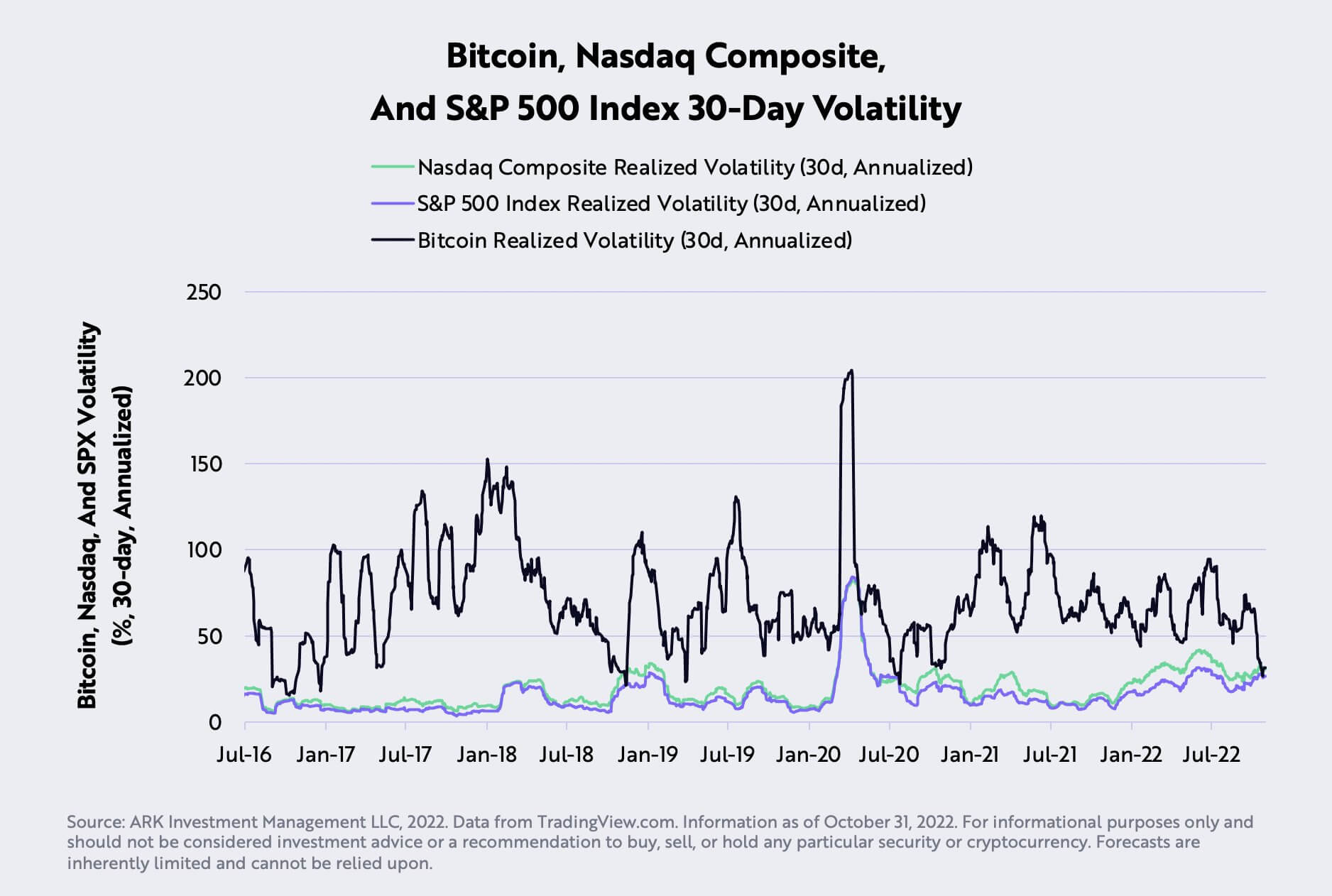

Crypto analyst Yassin Elmanjra of ARK Invest also noted a new paradigm that has taken shape for the first time in crypto history. Here’s his quote.

For the first time ever, Bitcoin is less volatile than the S&P 500 and Nasdaq stock indices. The last time the coin’s volatility was this low, BTC rose from $9,000 to $60,000 in less than a year.

Again, this analogy means nothing, as historical events do not have to repeat themselves. So blindly counting on a similar growth now is definitely not a good idea.

Bitcoin’s 30-day volatility against the S&P 500 and Nasdaq

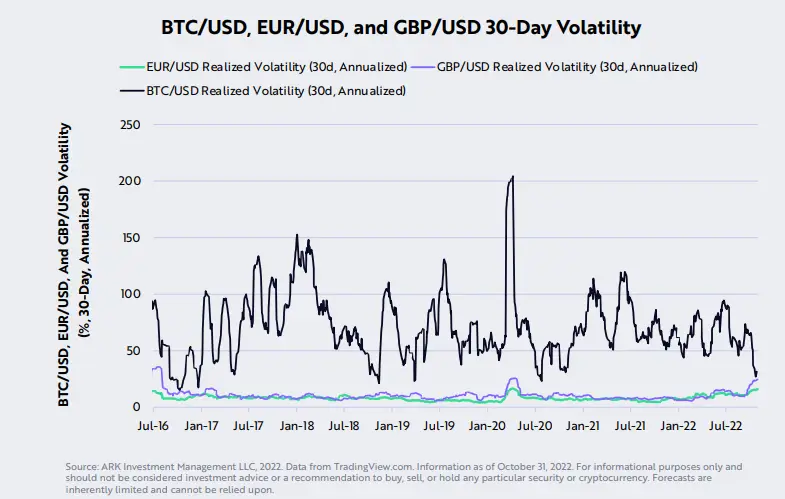

The major cryptocurrency is showing high stability against not only equities but also traditional currencies. Here’s a quote from a recent Ark Invest report on this.

For the first time since October 2016, Bitcoin’s 30-day realised volatility has almost equalled that of the British pound and euro. While the Fed’s hawkish stance may increase the figure, Bitcoin’s strength against foreign currencies is an encouraging sign.

Bitcoin’s 30-day volatility against traditional currencies

Overall, even despite BTC’s recent spurt above the $20,000 line, the trading situation remains stubbornly heavy. The negative factors in the macro economy affecting crypto have not gone anywhere. Again, until the US Federal Reserve changes its course in raising the benchmark lending rate, don’t expect a more noticeable bull run in the medium term.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

Meanwhile, the US Securities and Exchange Commission (SEC) has done its part in the fight against cryptocurrencies. The regulator indicted five members of the Trade Coin Club pyramid scheme, which defrauded more than 100 thousand investors of over 82 thousand BTC. At the current exchange rate of the cryptocurrency, the total damage is estimated at more than $1.7 billion.

Among those prosecuted is Dover Torres Braga, who created and operated Trade Coin Club, making at least $55 million in illegal profits in BTC. Also on the list were other masterminds of the scheme, Joff Paradise, Keleinalani Akana Taylor and Jonathan Thewalt. They received $1.4 million and $2.6 million and $625,000 respectively.

Cryptocurrency scammer

According to CryptoSlate sources, Trade Coin Club attracted investors with promises of investment returns of 0.35 per cent per day. The returns were allegedly generated by bots that automatically traded different cryptocurrencies. Braga pocketed investor funds for his personal use and for payments to platform promoters.

Instead of profits generated by the crypto-asset trading bots, the pyramid paid out funds withdrawn from the deposits of new investors. The US Securities and Exchange Commission is prosecuting members of the scheme’s management for violating anti-fraud, securities registration and broker-dealer regulations. In addition, the agency is also demanding financial compensation for the victims.

We believe it is difficult to assess further movements in the cryptocurrency market in the current environment. However, it is important to understand that the bearish trend will not last forever, and sooner or later the digital asset industry will move to growth. Investors should therefore prepare for a reversal if they want to make the most of the bullrun's prospects.