BlockFi has declared bankruptcy. How has the cryptocurrency community reacted?

On the evening of 28 November, BlockFi filed for bankruptcy. The company cited the collapse of FTX as the main reason for what happened. In addition, in order to at least make amends in the bankruptcy case, BlockFi filed a lawsuit against FTX founder Sam Bankman-Fried. The company has become another victim of a prolonged bearish trend in the industry, and the cryptocurrency community has predictably reacted to the event. We tell you more about what’s going on.

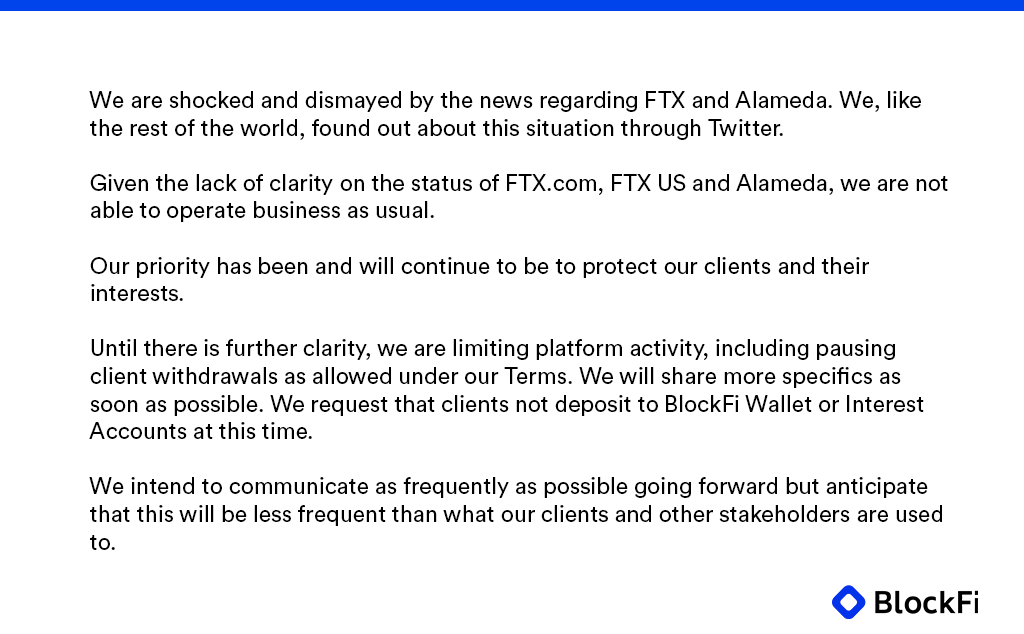

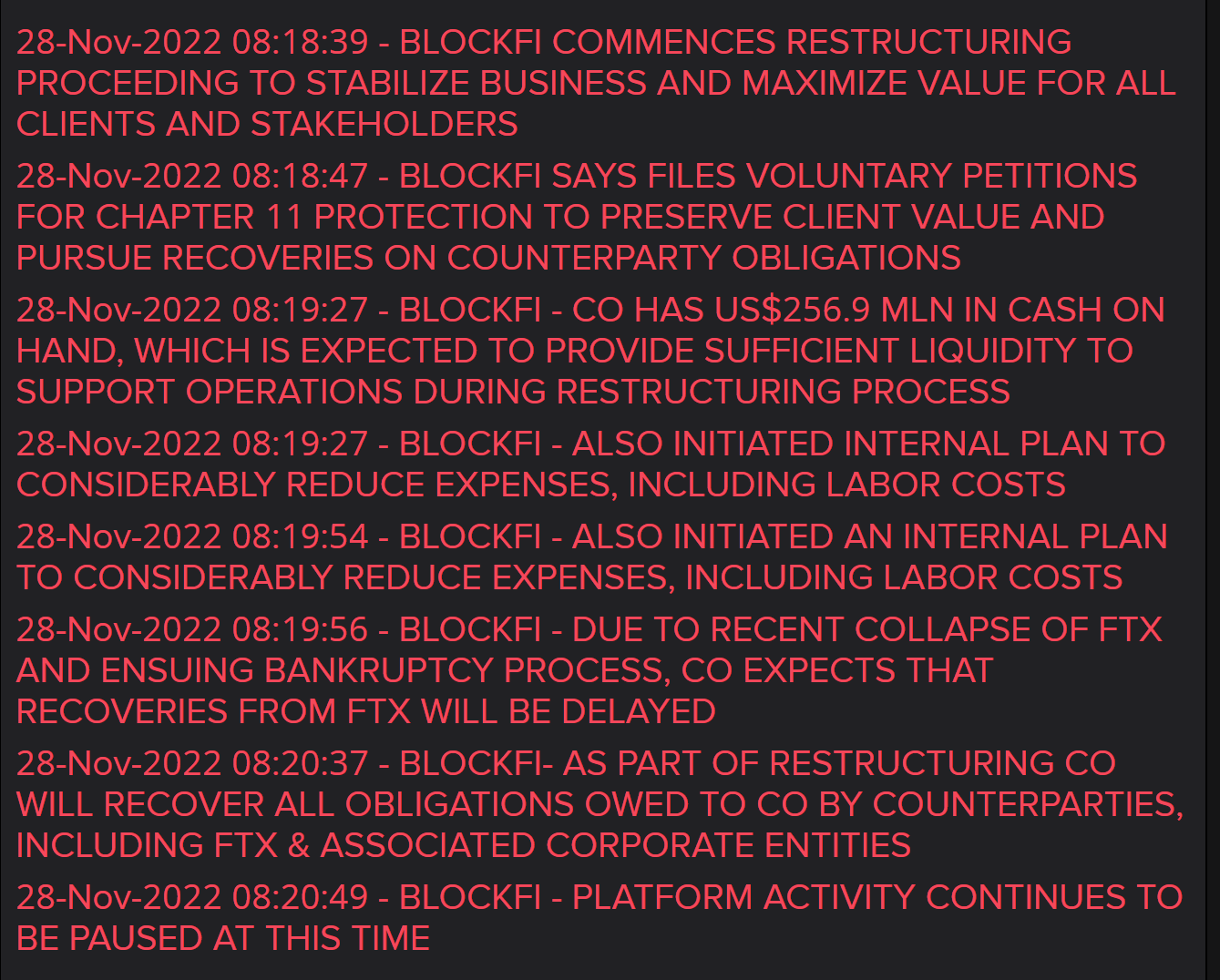

It should be noted that BlockFi’s problems started in the first half of November, i.e. shortly after the FTX exchange filed for bankruptcy. Initially, the platform’s representatives published a message about the suspension of users’ funds. It looked like this.

BlockFi representatives’ statement about the suspension of the platform

However, a few days before that, BlockFi founder Flori Marquez had noted on Twitter that there were no malfunctions in the operation of the trading platform. At the time, she also noted that the company was communicating exclusively with FTX’s US division, which at the time was allegedly out of the loop.

Tweets from BlockFi founder Flori Marquez about the alleged lack of issues with the platform

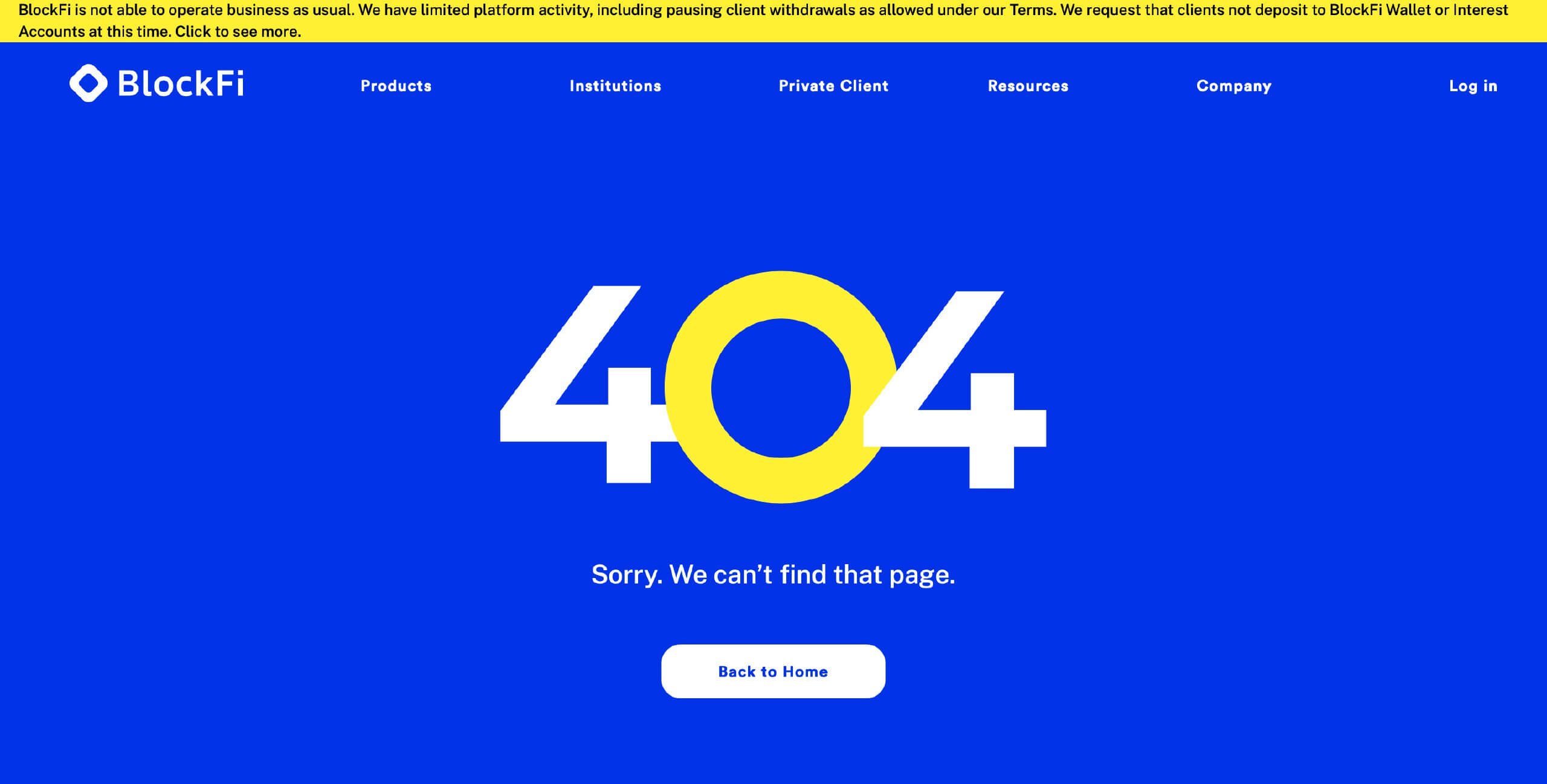

As a result, the company’s employee section was missing from its website, further causing panic among users whose funds were stuck on BlockFi.

BlockFi’s deleted employee page

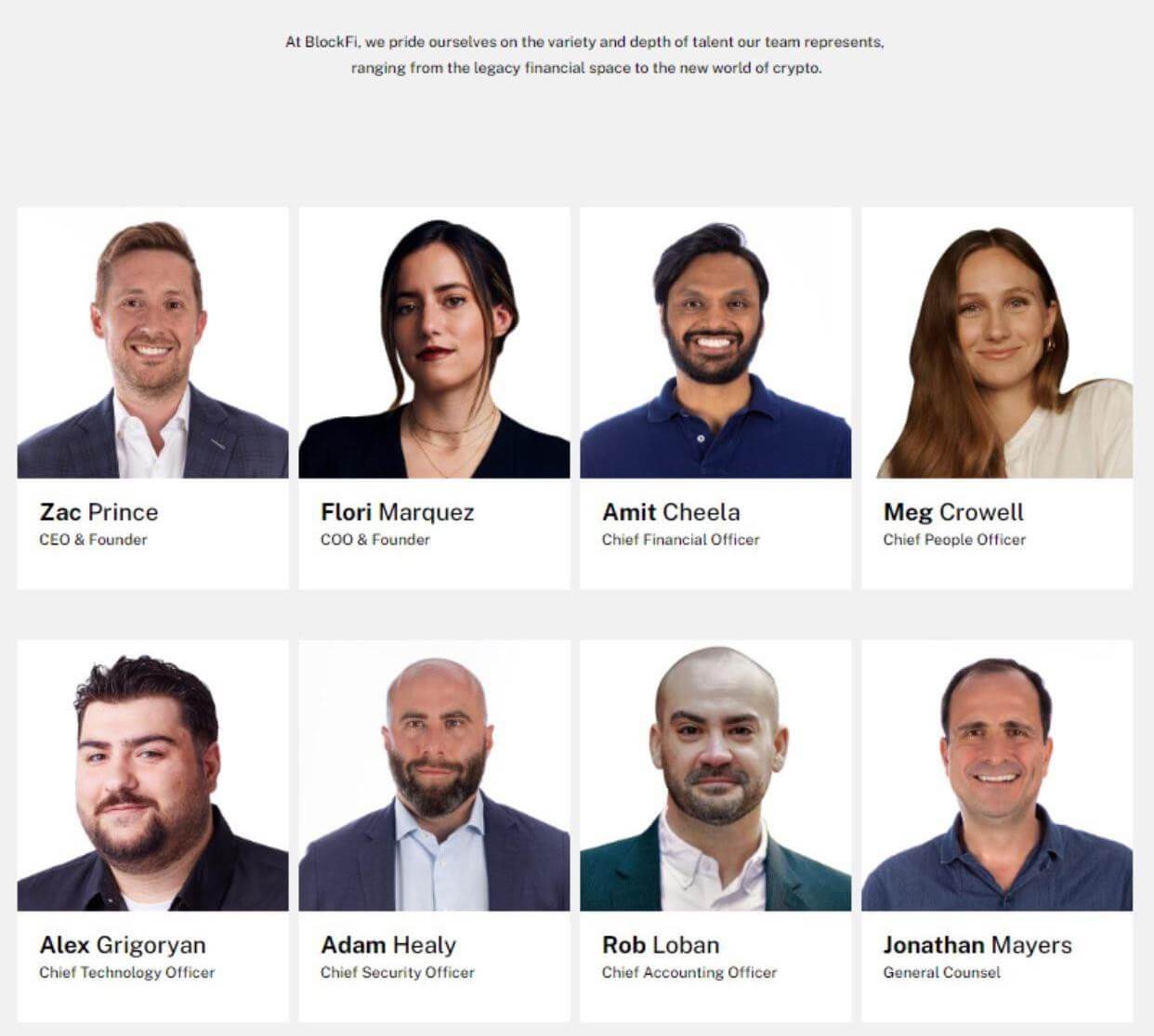

However, cryptocurrency enthusiasts were still able to find the old version of the page.

BlockFi team before the removal of this page

Who has gone bankrupt in cryptocurrencies

Podcast host Matt Odell doesn’t believe BlockFi’s speakers’ excuses – on his Twitter account, he posted the reason for the company’s collapse, which he believes is real. Here’s his quote, cited by Cointelegraph.

BlockFi went bankrupt not “because of FTX”. BlockFi went bankrupt because it was making loans on customer deposits to high-risk traders who were playing reckless leveraged games.

In this case we are talking about margin trading, where a trader borrows money from the exchange against his capital with a certain leverage, i.e. a multiplier. Such practice almost always leads to huge financial losses including among professionals. For example, the legendary cryptocurrency fund Three Arrows Capital also experienced liquidation of its own trading positions on various exchanges.

The collapse of cryptocurrencies

NFTtech co-founder Mario Navfal said that what happened was no surprise to the community. Here’s his rejoinder.

BlockFi has filed for Chapter 11 bankruptcy. This is the day many of us expected, the end of an era for a lending platform that previously managed to survive – or so it seemed – Voyager and Celsius.

November 28 BlockFi newsfeed

Voyager and Celsius are the previous ‘victims’ of a prolonged bearish trend. Recall that many people associate the FTX bankruptcy with their collapse: the exchange allegedly became financially insolvent months ago, but its management only managed to postpone the inevitable.

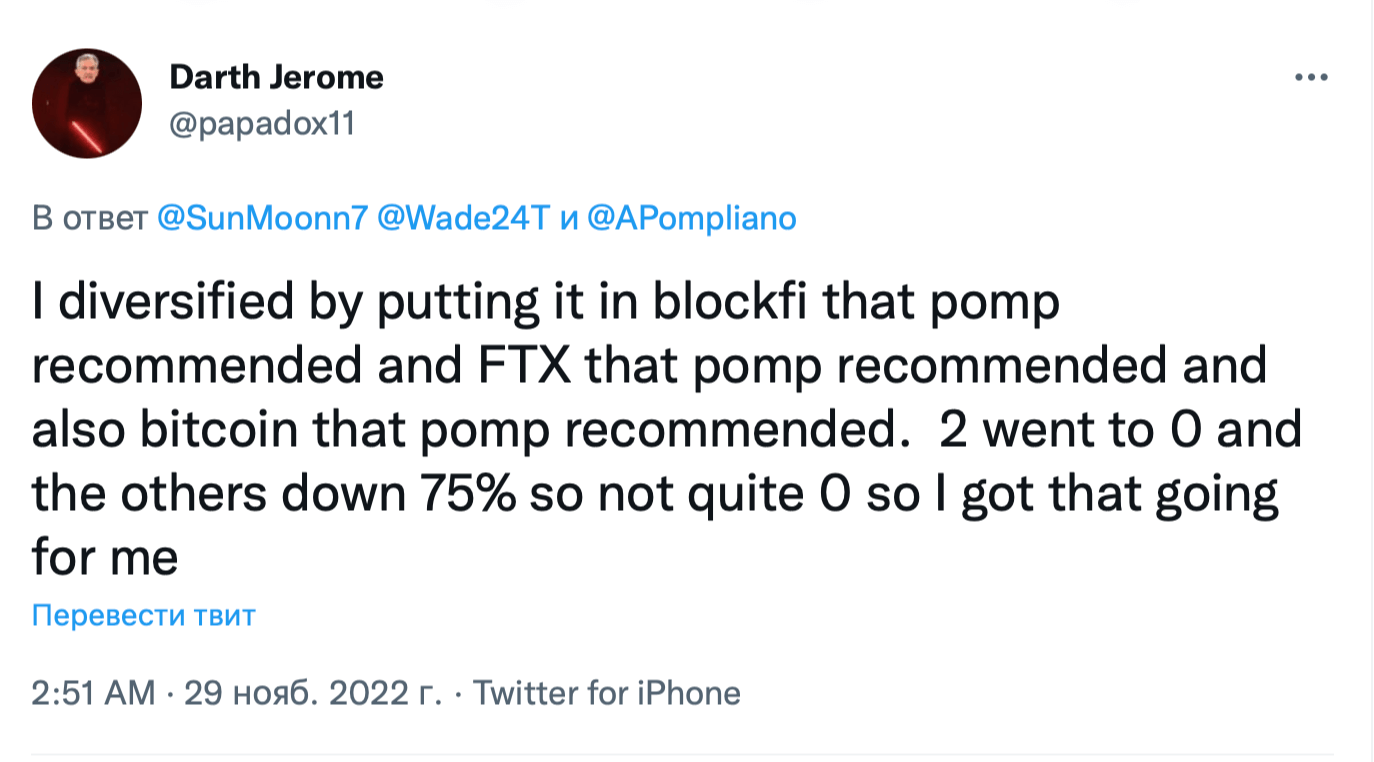

In the wake of BlockFi’s bankruptcy, a popular Bitcoin enthusiast named Anthony Pompliano received a lot of heckling in his direction. In the past, he has actively PRed both FTX and BlockFi. The investor, nicknamed Darth Jerome, tweeted about it.

I diversified by investing in BlockFi, FTX and Bitcoin, all recommended by Pompliano. Two of the investments fell to zero and the third was down 75 per cent, so not quite to zero.

Darth Jerome’s tweet.

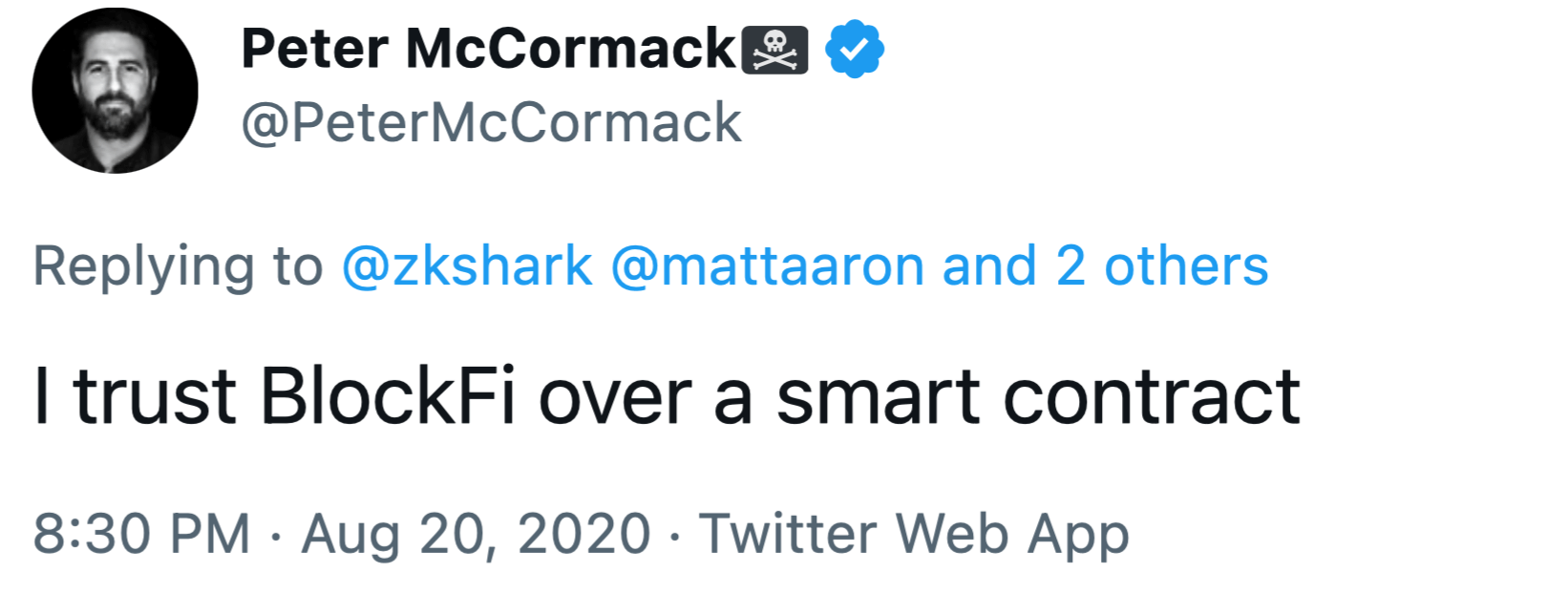

By the way, another cryptoblogger called Peter McCormack has previously stated that he trusts BlockFi more than a smart contract. Apparently, such a statement could also have been financially damaging to users of digital assets.

Peter McCormack’s tweet about over-trusting BlockFi

Meanwhile, BlockFi has sued Bankman-Fried, Decrypt reports. It’s done so in order to obtain shares in Robinhood, which Sam allegedly handed over to the platform as collateral earlier this month. BlockFi’s lawsuit alleges that a Bankman-Fried investment company called Emergent Fidelity Technologies, in partnership with London-based financial services firm EDF Man, which acted as a broker for Sam, “held collateral belonging to BlockFi”.

These assets were pledged by BlockFi under the terms of an agreement entered into on November 9. According to a filing with the US Securities and Exchange Commission, Bankman-Fried first bought his 7.6 per cent stake in Robinhood in May 2022. At the time, the investment was valued at around $600 million.

FTX founder Sam Bankman-Fried

The filing, filed in the same New Jersey court where BlockFi sought bankruptcy protection, said Sam’s company had “defaulted on its obligations under the collateral agreement” and that it had “defaulted despite a written notice of default”. BlockFi representatives said they will now look to “enforce the terms of the collateral agreement and return the collateral, which is the property of the bankrupt”.

We believe that the collapse of BlockFi's bandwidth platform will force users to become actively aware of decentralised ways to earn cryptocurrency. For example, in the scheme we described earlier, SOL can be steamed using the Ledger hardware wallet, which is non-custodial and independent of centralised bodies. Accordingly, such DeFi-activities are sure to become more popular.

Look for even more interesting things in our Millionaire Crypto Chat. There we discuss other important news related to the world of blockchain and decentralisation.