Chainalysis analysts believe that the bankruptcy of the FTX exchange is not the worst event in cryptocurrency history. Why?

Glassnode analysts compared the magnitude of the Mt. Gox collapse to the FTX bankruptcy in a recent piece. In the end, they concluded that the latter event had a much smaller impact on the crypto industry. Still, the collapse of Mt. Gox ranks at the top of the anti-record for the amount of BTC lost: more than 650 thousand BTC dropped out of circulation after the hack and closure of the exchange. The marketplace ceased to exist in 2014, and at the time its impact on the crypto industry was far greater than FTX’s role today. Here’s a closer look at what’s going on.

It should be noted that there is an interesting situation with Sam Bachmann-Friede at the moment. One gets the impression that some news sources are trying to clear his reputation so that the FTX founder will face fewer problems in the future.

For example, The Wall Street Journal had an article the day before with a headline that Bachman-Fried originally tried to save the world by ridding it of a new pandemic and nuclear war. Now, however, the entrepreneur’s plans are not fated to come true.

Article about Sam Bachmann-Fried in The Wall Street Journal

The resource also released an interview with the 25-year-old who lost the equivalent of $800 due to the collapse of FTX. At the same time, the exchange’s biggest creditor is owed as much as $200 million.

Article about the victim of the FTX collapse in The Wall Street Journal

What’s particularly amusing is that Sam will be allowed to speak at the DealBook Summit event in New York. It’s likely that Banman-Fried will be participating online at the event, but still.

Worst event in cryptocurrency history

The official Chainalysis Twitter account has published the results of the study in the form of a tracker with an excerpt of the most important information. So, the first important fact: in the year before Mt. Gox closed, the exchange accounted for 46 percent of transactions among all trading platforms at the time, that is, in 2013. The same figure for FTX was only 13 per cent.

The gist of this comparison is in the following quote from Cointelegraph.

Objectively, Mt. Gox was a bigger industry player than FTX at the time of its collapse. This is good news, as the collapse of Mt. Gox did not destroy the crypto industry. However, companies’ trajectories matter too, especially when you consider the psychological impact of negative news on investors.

That is, analysts are hinting that the current problems in the coin industry will not put a stop to its future prospects. A similar viewpoint was voiced by Elon Musk in mid-month. He believes that Bitcoin and other coins will be fine, but it will take time for the niche to recover.

Share of exchanges in overall market activity

Mt. Gox was steadily losing market share in the months prior to the shutdown, meaning the collapse of the exchange was not a major surprise to some. FTX, on the other hand, was relatively stable until November this year.

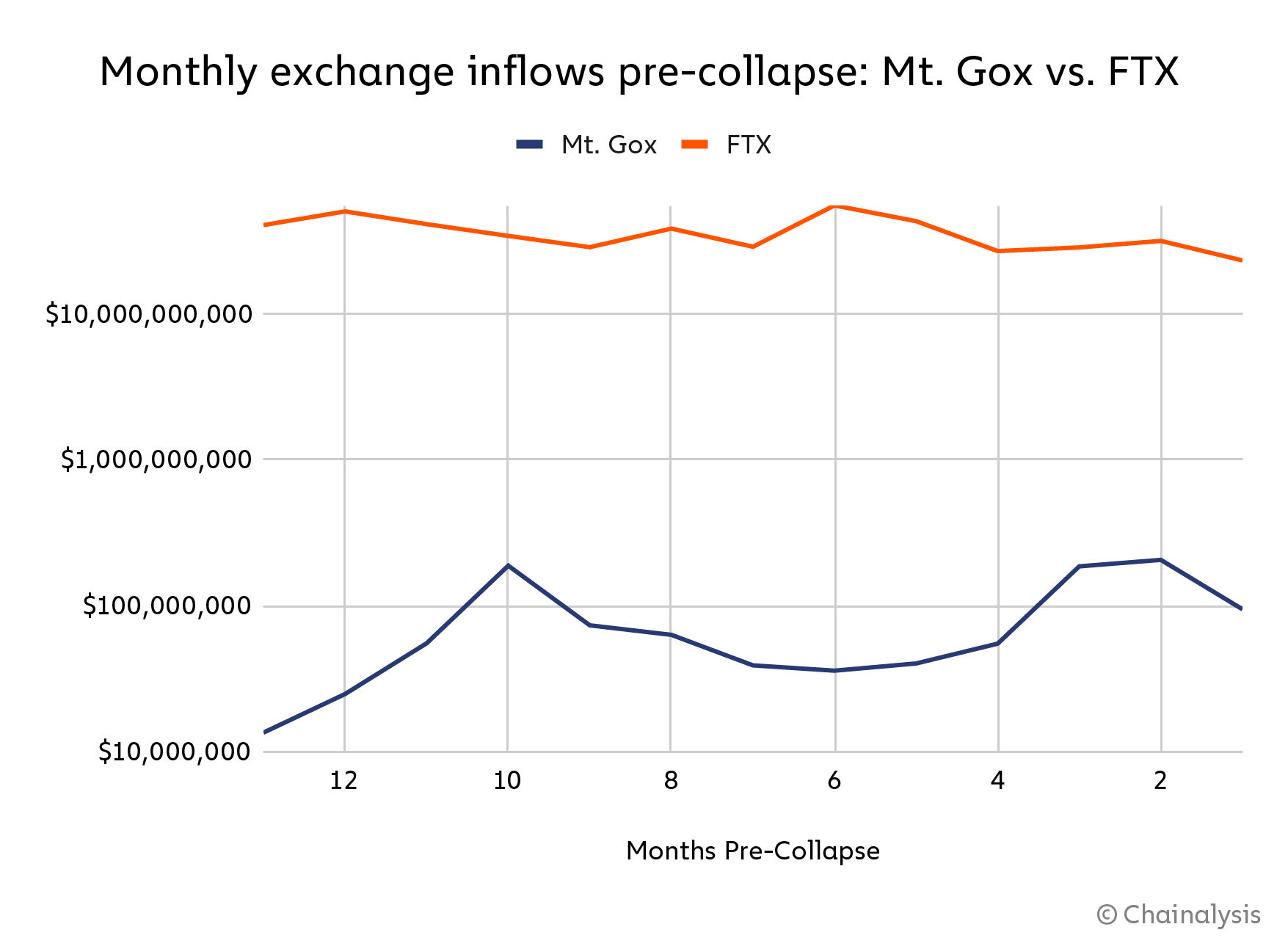

It would seem that in the case of FTX, the industry took a much bigger hit to investor confidence. But analysts suggest looking at a different metric – namely inflows in dollar terms. For Mt. Gox this metric was rising before the crash, while for FTX it was declining.

Inflows in dollar value on FTX and Mt. Gox

Here’s a replica that explains this trend.

Simply put, Mt. Gox has become one exchange of many in a period of growth, taking a smaller share of the larger ‘pie’. FTX, by contrast, took a larger share of the shrinking ‘pie’, outperforming other exchanges even as transaction volume declined.

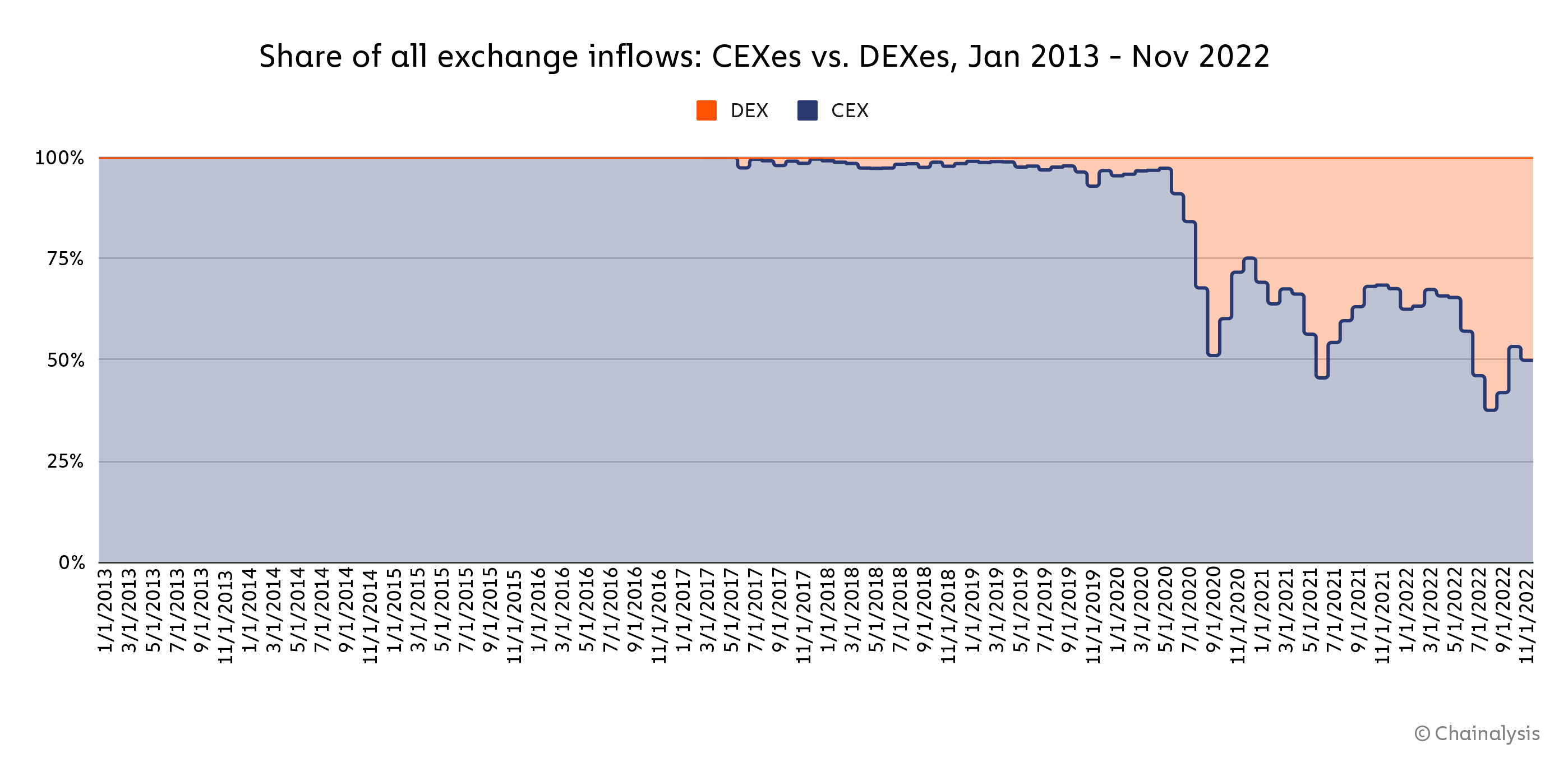

Another important detail is the emergence and popularisation of decentralised exchanges. At the time of Mt. Gox such exchanges did not exist at all, but nowadays, the decentralized exchanges account for a significant volume of trades. This fact also helped to reduce the damage from the bankruptcy of FTX.

The share of centralised and decentralised exchanges in trading

Speaking of bankruptcy: this procedure may be much more complicated and take much longer than it is usually assumed. And yet there have been some early successes. The BitGo custodian has recovered at least $700 million in crypto from various FTX accounts. According to CryptoPotato sources, BitGo was hired by FTX management shortly before the bankruptcy to manage the exchange’s accounts.

The funds are just a “drop in the ocean” of FTX’s huge list of debts to its creditors. Nevertheless, a start has been made, and lawyers are working to gradually find, account for and restructure the assets of the bankrupt exchange. One would like to believe that ordinary users will not have to wait decades for their compensation.

We believe that the collapse of FTX will not kill the digital asset industry. In fact, it will become safer and more secure over time. Still, centralised cryptocurrency exchanges have now begun to reaffirm their own reserves in order to regain user confidence. Well, digital asset owners have taken to familiarising themselves with non-custodial crypto storage at the expense of hardware wallets, which will keep more crypto assets safe from hacks over the long haul.

What do you think about this? Share your opinion in our millionaires cryptochat. There, we’ll talk about other important topics related to the blockchain and decentralised asset industry.