Congressman asked not to link the collapse of FTX to the problems of the cryptocurrency world. Why is he right?

The collapse of cryptocurrency exchange FTX was a major blow to the entire digital asset industry. The subsequent collapse of coins, which has not ended until today, has probably caused some investors to stop investing in crypto and draw the wrong conclusions about the industry. However, that’s not the right thing to do. Congressman and Minnesota Representative Tom Emmer insists on that. According to him, the failure of FTX has nothing to do with decentralized assets or platforms in general. We tell you more about his point of view.

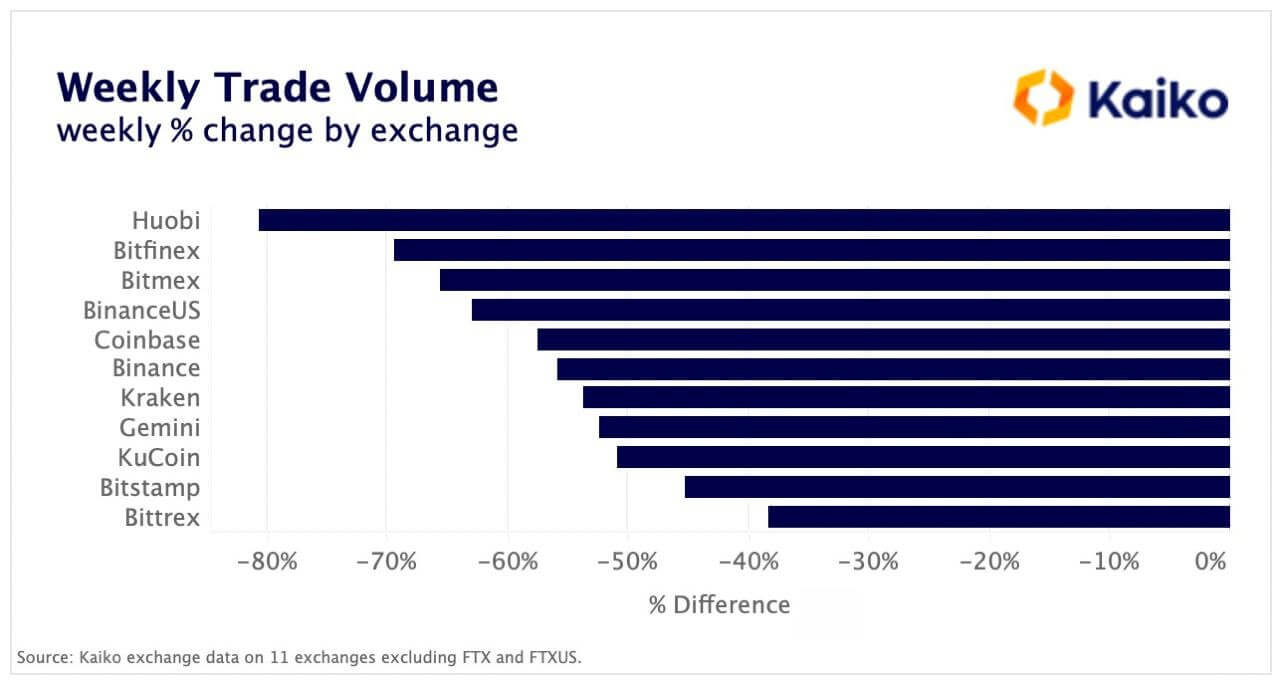

Note that the collapse of FTX already has several important implications. Firstly, centralised trading platforms like Binance, Coinbase and others have lost some users. As we found out the day before, their trading volumes have dropped significantly over the past week. And this is clearly due in part to the fact that some investors are now refusing to store their own coins on the exchanges.

Changes in trading volumes on cryptocurrency exchanges over the past week

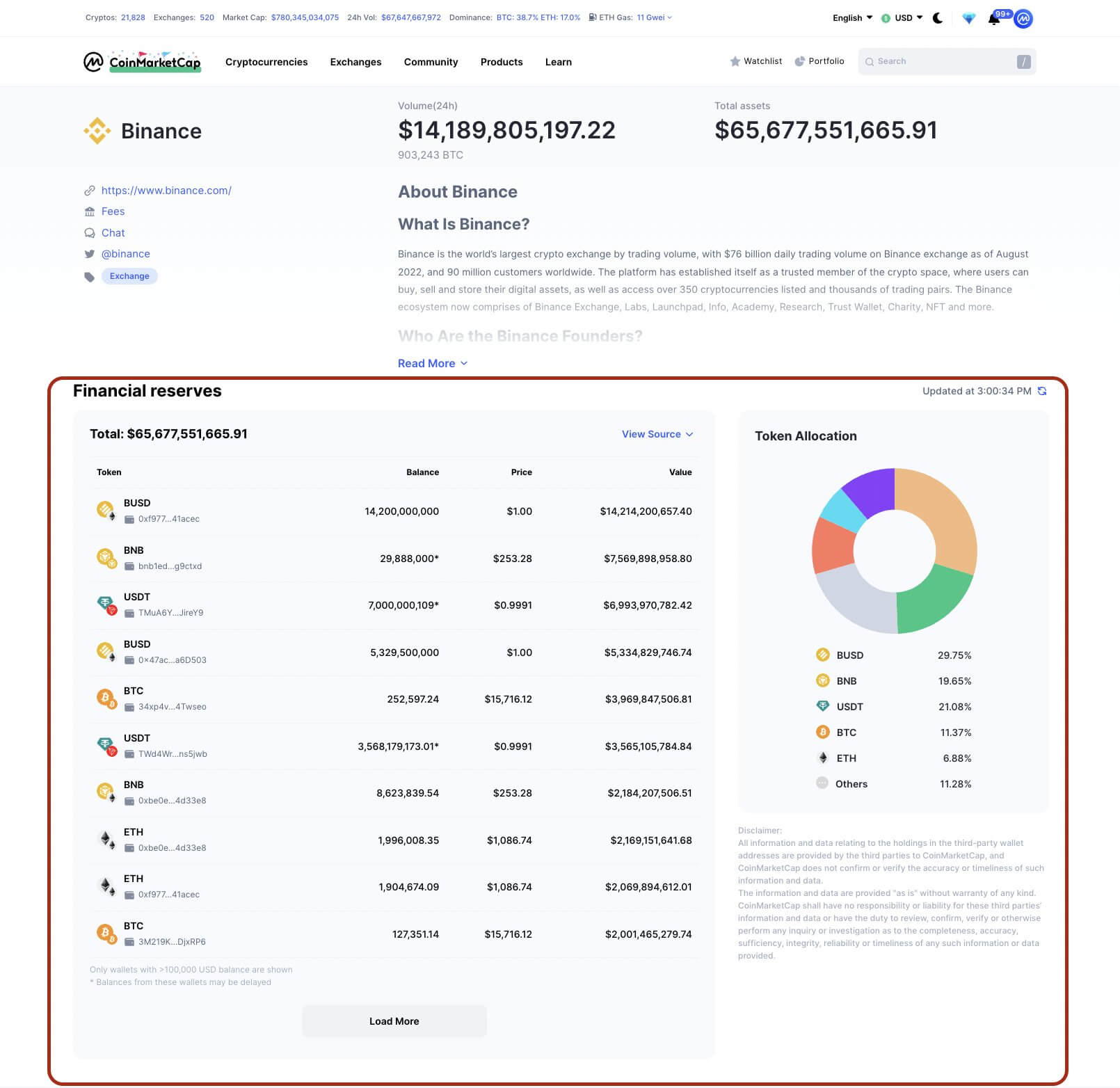

At the same time, centralised cryptocurrency exchanges are trying to rebuild user trust. To do so, they are releasing reports on their own coin reserves, which the CoinMarketCap platform is already able to display, among other things.

Binance reserves page on CoinMarketCap platform

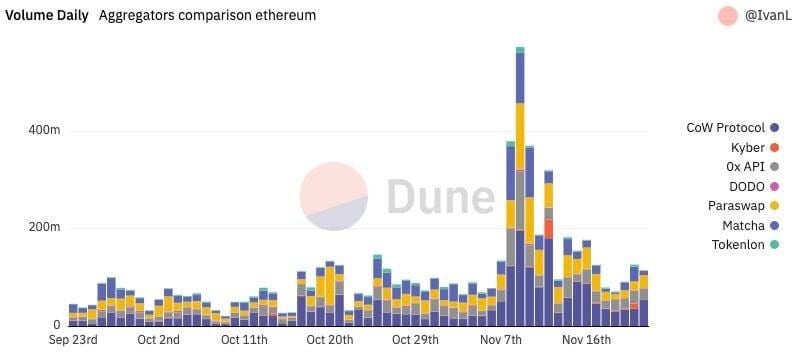

Finally, the day before there was also a notable increase in trading volumes on decentralized exchanges like Uniswap, which do not require coins to be sent outside their own wallets, like Ledger. Now the total trading volume on DEX in November has already reached the equivalent of $91 billion, which is 79 percent more than in October.

Trading volumes on popular decentralized exchanges

Be that as it may, the events of this autumn should not be seen as a downside to the crypto world.

What’s next for cryptocurrencies

According to Congressman Tom Emmer, there are two people to blame for the current situation in the cryptocurrency world and the further consequences for the industry – FTX founder and former FTX chief Sam Bankman-Fried, and SEC head Gary Gensler. Here is the official’s relevant rejoinder, which was aired on Fox Business.

This is not just the collapse of FTX. It is the collapse of the field of centralised finance and Sam Bankman-Friede included.

According to Emmer, the interaction between regulators and FTX management violated business ethics, government oversight and regulatory procedures. He thus alluded to the meeting between Bankman-Fried and Gensler that took place on 23 March.

The politician continues. His retort is quoted by Decrypt.

They collaborated with Sam Bancman-Fried and others to give them special treatment from the US Securities and Exchange Commission that others did not have.

According to Emmer, Gensler just had to investigate certain cryptocurrency companies. In particular, he asked where Gary was after the collapse of Voyager, Celsius and Terra LUNA.

Terra creator Do Kwon

In the end, Emmer can’t understand why the US Securities and Exchange Commission went after “good players” while also making “behind-the-scenes deals” with those who were doing improper business. He continues.

Sam Bunkman-Fried was pushing the Special Treatment Act through Congress. And when it finally became clear what it was and the industry started raising red flags, that’s when it all fell apart.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

Emmer emphasised that he doesn’t see the current events as an issue directly with cryptocurrencies and decentralised finance.

It is about centralised finance, which needs to be placed under the regulatory umbrella, and Gary Gensler has done nothing to make that happen. Decentralised finance is about something else. It’s also not about the cryptocurrency sector – it’s purely about Sam Bachmann-Fried and the regulators.

And it really is. After all, the decentralised asset industry implies complete transparency in transactions. In fact, this is what led representatives of the trading company Alameda, which also had a hand in the current collapse, to redeem their own liabilities in decentralised protocols in the first place. Otherwise, the collapse of the giants would have been evident even earlier.

FTX chief Sam Bankman-Fried on the floor of Congress

Recall, earlier, a similar view was expressed by JP Morgan bank representatives. They stated that all the current problems in cryptocurrencies are triggered by centralised players, not decentralised protocols.

At the same time, Changpen Zhao, head of cryptocurrency exchange Binance, shared a positive outlook for the digital asset industry. He believes a niche recovery will happen fairly quickly. Here’s his rejoinder from Twitter.

Some people, myself included, have stated that the current events will “set the industry back a few years”. However, if you think about it, that’s fine. There is no progress without setbacks. The same thing happened in 2008 in regulated traditional finance, and after 70 years of development. The industry will recover quickly and become even stronger.

That is, Chanpen suggests that the coin industry will become stronger after all. And given the nascent trend of transparent reserves of cryptocurrency exchanges, this is indeed a certainty.

Binance chief executive Changpen Zhao

We believe that Tom Emmer's position is absolutely correct. The blockchains of Etherium, Solana, Avalanche and other projects have not become worse because of Sam Bankman-Fried's actions - nor have decentralised finance protocols become less transparent. So the problem here lies primarily with the management of FTX and Alameda Research, who have obviously conducted illegal activities with user funds. And now the regulators need to show their own stance, which would ideally help to prevent this kind of thing from happening again.

What do you think about this situation? Share your opinion in our millionaire cryptochat, where we will talk about other topics as well.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THE ACE IS COMING SOON!