Cryptocurrency exchange Coinbase will back Ripple in court against the Securities Commission. What does this mean?

In December 2020, a lawsuit was filed against Ripple Labs, the company behind the XRP token issue and support. The US Securities and Exchange Commission (SEC) acted on the side of the plaintiff. Overall, the lawsuit has dragged on for nearly two years now, with Ripple Labs gradually gaining new supporters. The day before, the largest US cryptocurrency exchange Coinbase joined their camp – it provided the court with some documents, which should help the defendant’s position in the conflict. We tell you more about the situation.

It should be noted that the US Securities and Exchange Commission regularly tries to create problems for various blockchain projects. For example, the latest to come to the regulator’s attention was Etherium ETH after the cryptocurrency network switched to the Proof-of-Stake algorithm.

Then SEC Chairman Gary Gensler suddenly announced that PoS cryptocurrencies could be considered as securities. Moreover, this opinion was voiced immediately after the so-called merger in the Etherium network, i.e. the start of its operation on the Proof of Ownership consensus algorithm. Read more about the situation in a separate article.

SEC head Gary Gensler

Can Ripple win in court?

Recall that the conflict between the SEC and Ripple Labs revolves around allegations of issuing unregistered securities. According to the SEC, those are XRP tokens, which Ripple has been issuing since 2013. The SEC’s lawyers have estimated that the company’s allegedly unregistered securities issue is worth more than $1.3 billion.

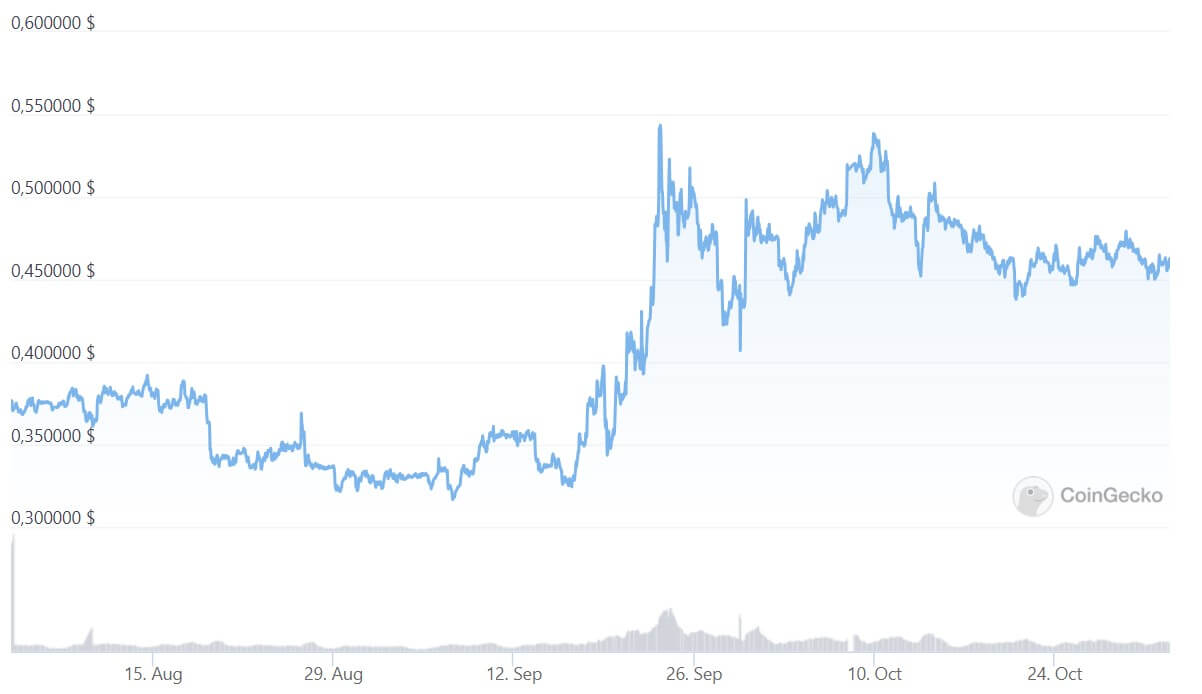

XRP exchange rate over the past 90 days

The court case is not yet closed, but Ripple is already considered a favourite in it. This is especially true after relatively recent events, when one of RippleNet’s community lawyers claimed that the company had “won a major victory in the conflict. Its arguments in court are already supported by several organisations and well-known personalities, including the Blockchain Association and Rhode Island lawyer John Deaton.

On Monday, Coinbase representatives filed a motion in the U.S. District Court for the Southern District of New York and asked Judge Analisa Torres for permission to file an amicus curiae brief in support of Ripple’s legal position in the case. By its very nature, this legal document contains advice or information about a case from an organization or individual who is not a party to the case and is acting as a “friend” of the court.

Ripple Labs executive Brad Garlinghouse

As Decrypt’s sources note, Coinbase General Counsel Paul Grewal commented on the motion. Here is his relevant rejoinder.

One of the basic principles of due process of law under the guarantee of our Constitution is that public authorities cannot condemn conduct as a violation of the law without providing fair notice of the illegality of that conduct. In suing XRP token issuers after public statements signalling the legality of these transactions, the US Securities and Exchange Commission overlooked this fundamental principle.

Ripple XRP

In other words, XRP tokens have been issued for several years in a row before the Commission formally went to court. That said, there is still no clear set of rules in the US to determine whether some cryptocurrencies are similar to securities. In other words, the Commission’s claim does not seem logical.

Coinbase’s lawyers also argue that most digital assets traded on exchanges do not represent ownership interests and do not generate income for investors in the same way that public company shares can. Here’s the relevant rejoinder.

Existing US Securities and Exchange Commission registration requirements for national securities exchanges are not currently appropriate for determining the performance of digital asset trading platforms.

Incidentally, Ripple is not the only cryptocurrency company currently engaged in legal battles with the Commission. In parallel, the regulator has another lawsuit going on with Grayscale. Grayscale is siding with the plaintiff, and in this case, the SEC has once again refused to accept a spot ETF for Bitcoin. Coinbase also supports Grayscale – the exchange representatives repeatedly spoke out in favor of the company and against the financial regulator’s irrational demands.

At the same time, Etherium creator Vitalik Buterin believes that there is no hurry to adopt a spot ETF for Bitcoin. The developer believes that the digital asset industry should mature first, without compromising on core values like decentralization and privacy. You can find out more about Buterin's viewpoint at the link.

Etherium creator Vitalik Buterin

We believe that the abundance of resources on Ripple's side will indeed help the XRP issuer in the litigation. Apparently, the US Securities and Exchange Commission cannot take nearly two years to make its case, despite its reputation and extensive experience in court cases. Which means Ripple does have a chance of succeeding - and the Coinbase decision will certainly contribute to that.