Cryptocurrency exchanges have begun to publicly validate their reserves. What are the disadvantages of this system?

The bankruptcy of cryptocurrency exchange FTX has spurred the publication of proprietary reserve reports by many trading platforms. Recall that Changpen Zhao, head of major platform Binance, recently hinted that such a practice could boost investor confidence in the industry. Many people liked the idea, but not all, because Zhao’s proposal has plenty of critics. So how do they argue their position? We tell you.

As is traditional, let’s start with an explanation. The need to validate cryptocurrency exchanges’ reserves arose after the recent collapse of the FTX platform. As it turned out, the company in question had approximately $900 million in liquid assets – that is, ones that can be easily and quickly sold.

At the same time, the company had roughly $9 billion in liabilities, which was ten times the amount of assets on hand. This imbalance caused serious problems for FTX when users withdrew crypto from the trading floor en masse. This is one of the problems that led to the company failing and filing for bankruptcy.

FTX Arena

As a result, user confidence in cryptocurrency companies has sagged noticeably. Traders and investors who keep their money on trading platforms have taken to demanding that the platforms validate their own assets. In other words, they want to make sure that if assets are withdrawn from the platform, users can get their own money. This is where the idea of exchanges demonstrating reserves came from.

How to choose a cryptocurrency exchange?

In an interview with Decrypt, Casa Project CTO Jameson Lopp said that publishing crypto reserves – or so-called Proof-of-Reserves – “cannot fully prove the fact that a company has fewer liabilities than liquid assets.” Nevertheless, Lopp had previously published the following tweet.

Proof-of-Reserves is not a panacea. In that case, you still have to trust the attestation of auditors. You still have to trust that there are supposedly more reserves than liabilities. But it is still better to publish information about reserves than to publish nothing at all.

Casa project spokesman Jameson Lopp

Proof of reserves is a record of information which is validated by cryptographic proof. It shows how much reserves a company has at one point in time. And so it is essentially a way of proving that exchanges or other third parties are actually storing their users’ money, rather than using it to transact or fund other companies.

As a reminder, as it emerged the day before, FTX crypto exchange founder Sam Bankman-Fried was sharing the platform's users' money with the management of the trading company he founded, Alameda Research. And as sources have noted, at one point, Bankman-Fried, among others, sent more than half of the assets at his company's disposal there. It was this that triggered the liquidity squeeze when the massive asset withdrawals from FTX began.

The concept has been increasingly on the radar of crypto-enthusiasts lately. Even Binance is planning to work on a separate reserve proof protocol invented by the creator of Etherium, Vitalik Buterin.

Binance CEO Changpen Zhao

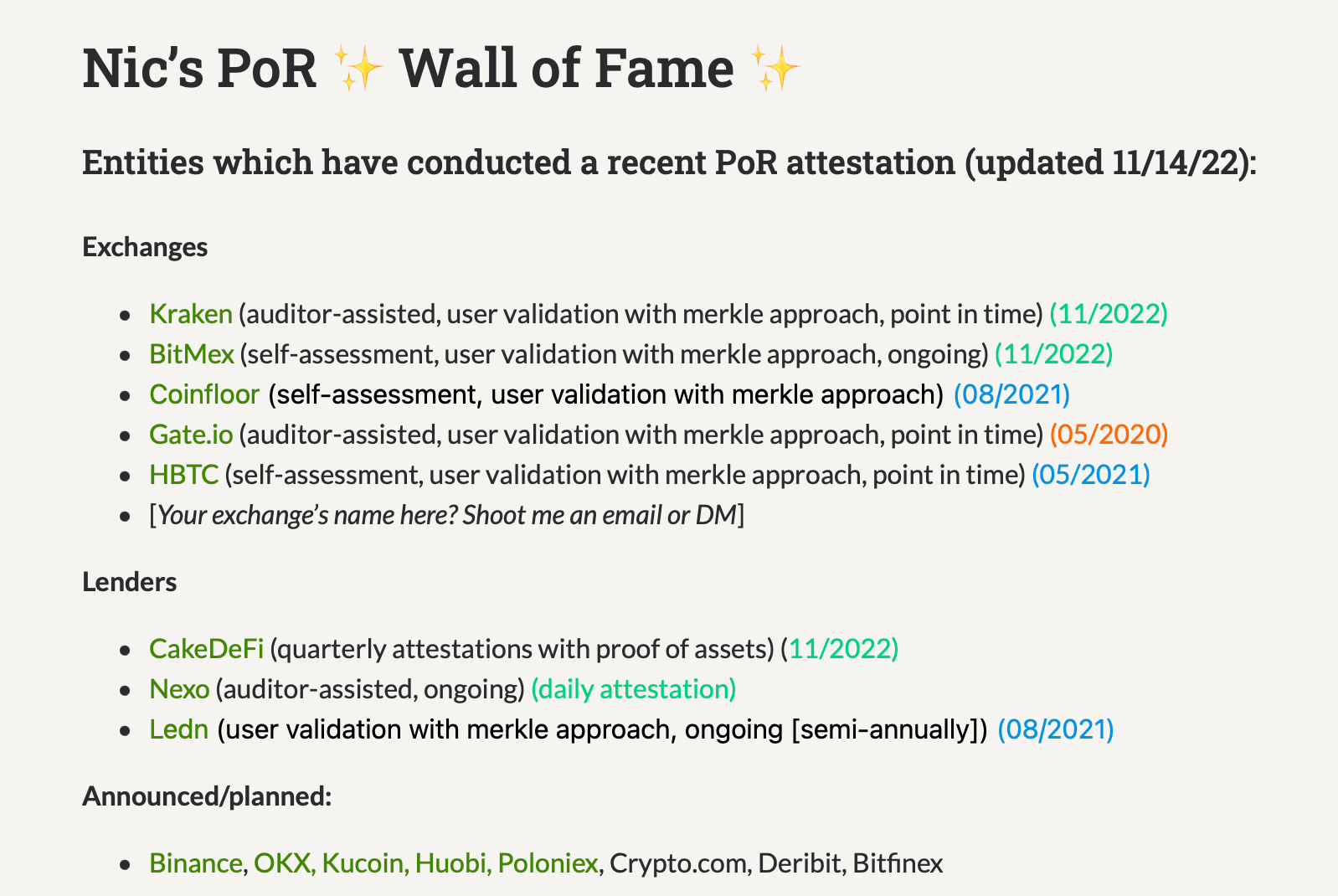

It should also be kept in mind that there are different types of reserve proofs, with some more stringent than others. Cryptanalyst Nick Carter, who has championed the concept of Proof-of-Reserves for years, endorses a form of proof that includes liability reporting in addition to reserve reporting. This is needed to show a clearer picture of a company’s financial position, notes the expert.

This seems to be the most complete and successful form of the concept available at the moment. The debt of exchanges is an important point, because if a platform has sufficient reserves, but is heavily dependent on a recently bankrupt crypto firm, it too can go bankrupt. And platform users have a right to know this, and before problems arise.

Nick Carter’s website, where he periodically posts about the reserve proofs of various crypto platforms

Again, proof of reserves is not a universal panacea. Investors first and foremost need to take care of their own cryptocurrencies. And that means if you have large amounts of cryptocurrencies in an exchange, it’s worth putting at least some of it into a Ledger-type hardware wallet. This device generates a so-called Sid-phrase when you start interacting with it, making the user the only full owner of the coins. You won’t encounter withdrawal blocking or anything like that here for sure.

We believe that the top cryptocurrency exchanges will find a way to confirm the availability of funds and certain liabilities so that users will not have any doubts about their liquidity. And once companies learn how to prove "solvency", traders' and investors' trust in them will slowly return. In addition it could in theory partly protect the industry from the situation that happened with FTX.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THERE’S EVEN MORE INTERESTING NEWS HERE.