From orgies to racism: the cryptocurrency community has revealed details of Alameda Research’s management life

The collapse of crypto-exchange FTX has uncovered many unusual details about the platform’s already former management and associated trading company Alameda Research. Of particular interest is the Tumblr blog of former Alameda CEO Caroline Allison, who was, among other things, in a relationship with the founder of the entire ecosystem, Sam Bankman-Fried. Caroline’s publications are a tough mix of polyamory and sexual competition texts, with Bankman-Fried’s persona also appearing many times. In short, the former Alameda CEO’s texts reveal much previously unexplored about the popular billionaire’s philosophy of life. We tell you more about them.

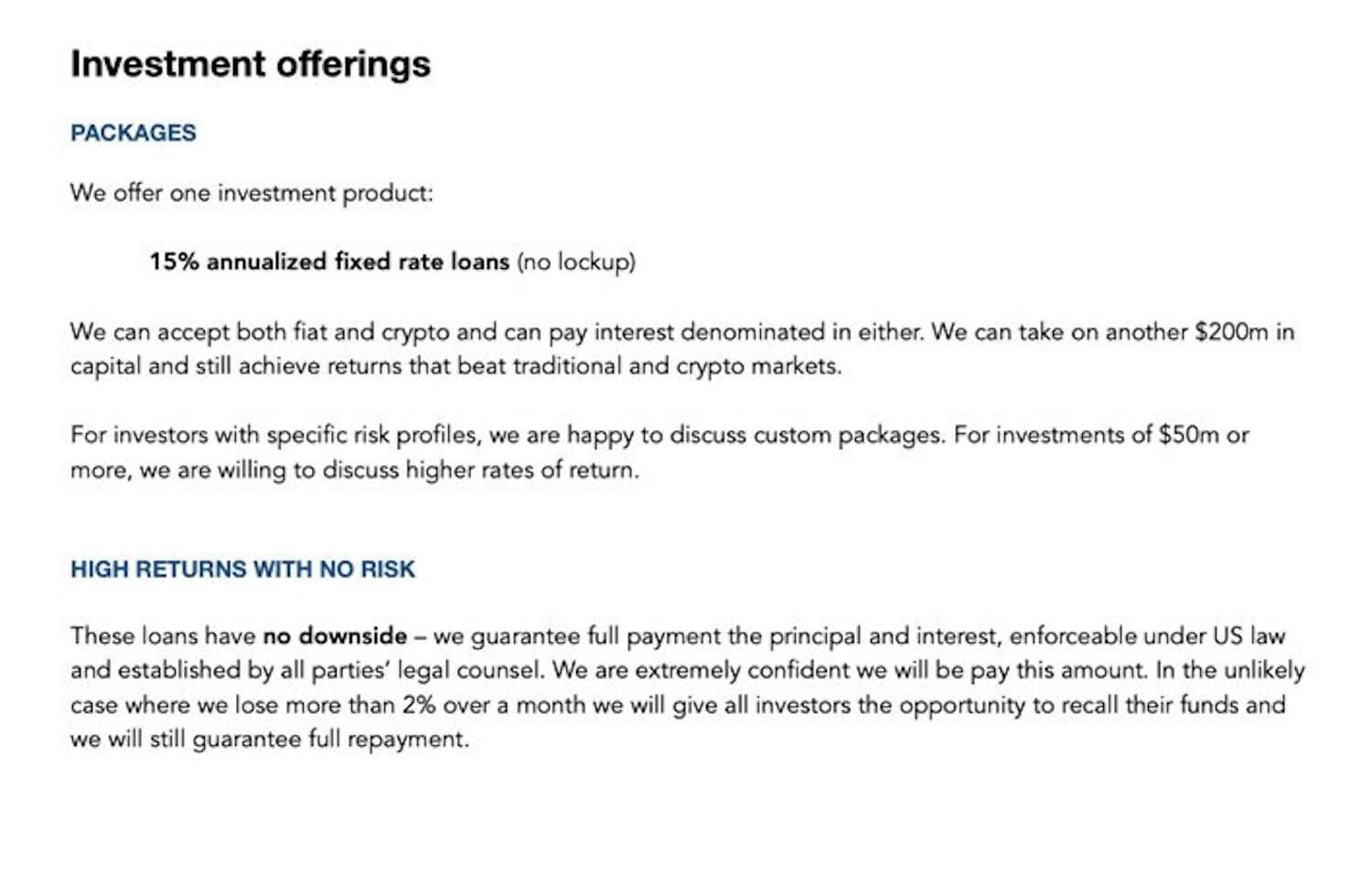

It should be noted that in retrospect Alameda’s activity does seem suspicious. In particular, just look at an old pitch presentation of the trading giant in which among advantages of the company a separate block is mentioned “high profitability without risks”. It looks like this.

The pitch presentation of Alameda Research.

Experts believe that this particular point may present the company’s representatives with new problems from the law-enforcement authorities. Still, to promise no risk in investments is a sign of fraud. All pages of the presentation are available here.

How FTX and Alameda representatives lived

Until this week FTX founder and CEO Sam Bankman-Fried was living with nine other colleagues in a $30 million penthouse in the Bahamas. According to Decrypt’s sources, most of the high-level decisions regarding the operations of FTX and its associated $32 billion Alameda Research were made by these ten roommates, who were occasionally romantically and sexually involved with each other.

Allison’s blog referred to the group as a “polycula” – a romantic network of several people, usually linked by overlapping sexual relationships. It’s a bit like a sixties hippie hangout, and given that format of life, people like that hardly want to trust a company with billions of dollars – and their money at the same time.

Bankman-Frieda luxury apartments in the Bahamas is already up for sale

It will be recalled that the aforementioned people used a loan in the FTT naked token exchange FTX to support the financial situation of Alameda, which allegedly already in the second quarter of this year became financially insolvent, and without any notification to users.

In addition, there were earlier reports of insider trading between Alameda and FTX – the company procured tokens in advance that were to go on the exchange via a listing. And since the listing usually leads to short-term appreciation of a certain coin, such “knowledge” could be used for financial gain.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.ZEN!

Allison’s Tumbrl account was deleted last week, but some details from publications on it remain online. Specifically, the account was registered in 2014 under the nickname Fake Charity Nerd Girl (something like “fake charity nerd girl”) and the signature worldoptimisation. The personal details revealed by the author of the account over its eight years of existence are entirely consistent with Allison’s biography. In addition, in a March 2021 post, Ellison announced her Twitter account and posted a link to her social media platform profile.

The FTX headquarters was a “polyamory arena” – here’s one of the blog’s quotes about it.

When I first started getting into polyamory, I thought of it as a radical break from my traditional past. But frankly, I’ve come to the conclusion that the only acceptable style of polyamory is best described as something like an “imperial Chinese harem”.

The author of the account constantly demonstrated a fascination with sex and power dynamics. For example, in one post she noted that the two key qualities of a “pretty boy” are “controlling most of the world’s major governments” and having “enough power to physically overpower you”.

One of Allison’s posts

The entries also show a marked fascination with “human biodiversity”, an online euphemism for the fields of racial science and eugenics popularised by far-right activists. All this is in a rattling mix with a fascination with the Harry Potter universe and the racial differences between different castes of people in India. Admittedly, Allison has tagged such posts with the hashtag #racism with a hint that they might be “offensive to some people”.

Ellison has also shown a great deal of weirdness about the cryptocurrency business directly. Here’s a snippet from her interview, for example, in which she stated that she only used basic maths in her work and rejected the concept of stop-loss as a risk-management tool.

As a reminder, a stop-loss allows you to get rid of an asset if its price falls to a predetermined level. In this case, the trader can minimize losses - especially if the value continues to fall. And not wanting to use stop-losses is an odd decision, including with assets worth billions of dollars.

Finally, Allison has openly written on her blog that crypto is supposedly a medium for fraudsters. Here’s a relevant quote.

I didn’t start working on all this as a real fan of cryptocurrencies. Crypto is mostly scams and memes.

Alameda Research was one of the most important players in the industry until a few weeks ago, providing liquidity to a huge number of exchanges and investing in new start-ups, so its potential collapse looked like something unimaginable. But dig a little deeper and it is clear that Alameda was too successful to begin with.

We think the situation with cryptocurrency giant FTX will have a direct impact on the crypto niche for some time to come. Obviously, there will be more such revelations and surprises. Still, if Sam Bunkman-Fried has allowed customer money to be used for the needs of his Alameda colleagues, he's clearly done something else just as strange.

What do you think about this? Share your opinion in our millionaire cryptochat. There we will discuss other important developments related to the world of blockchain and decentralisation.