FTX’s financial problems were only a matter of time. But where did the crypto-exchange’s money go?

Rumours of a possible liquidity crisis at the world’s third-largest cryptocurrency exchange have turned out to be true. Just a day after assuring its Twitter followers that all was supposedly fine, FTX CEO Sam Bankman-Fried announced a potential deal with Binance to buy FTX due to a liquidity crisis. We recount the details of the event in more detail.

The crisis came as a surprise to many, as FTX bailed out many companies during the bearish trend caused by the fall of Terra and the insolvency of the Three Arrows Capital fund. On top of that, the giant generated the equivalent of a billion dollars in revenue last year – a huge amount even in the crypto world.

FTX CEO Sam Bankman-Fried

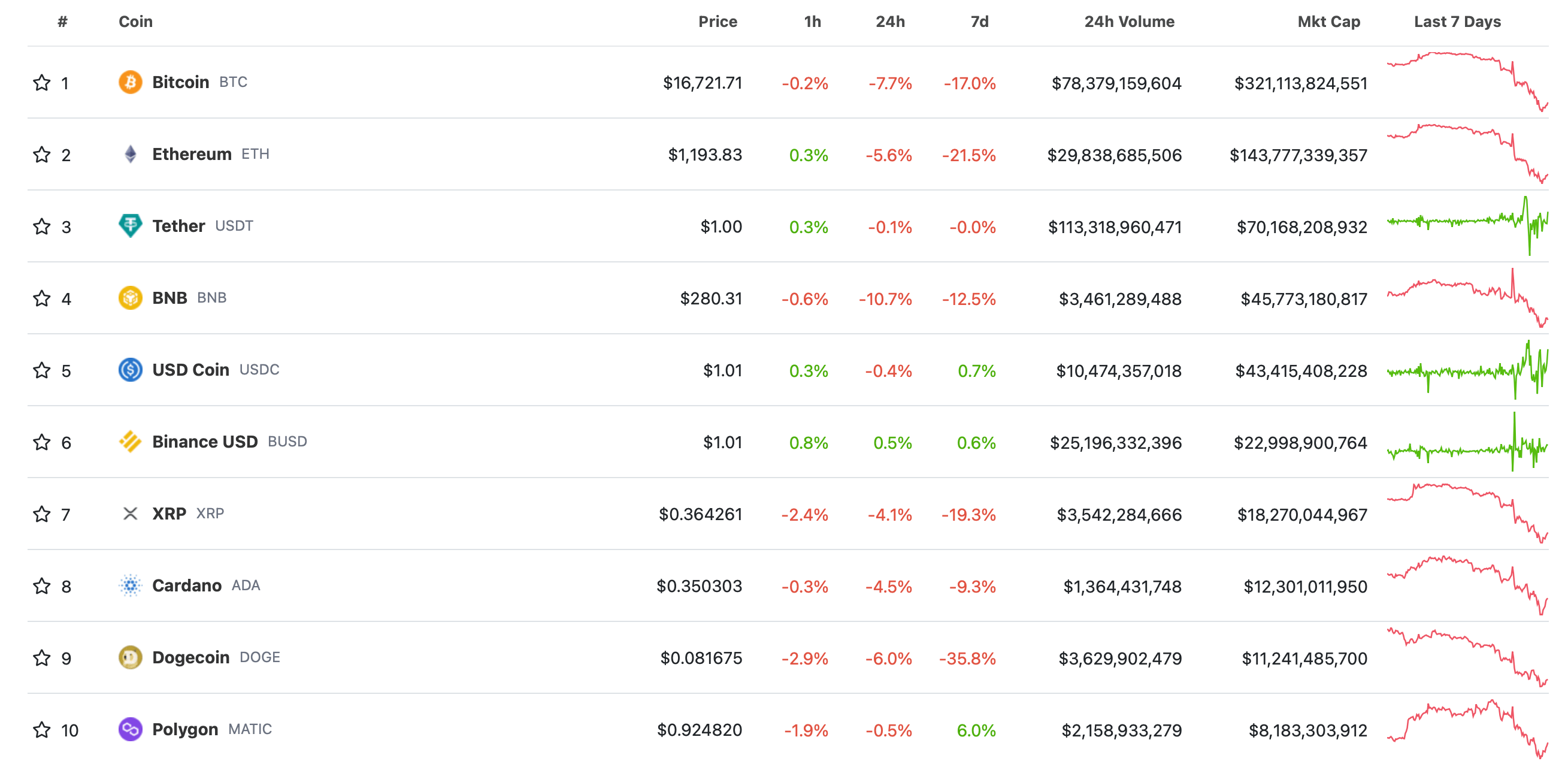

Overall, Binance CEO Changpen Zhao has reserved the right not to acquire FTX, and tonight he did indeed backtrack on his intentions, causing another wave of market declines. The coin situation this morning looks like this.

Ranking of top cryptocurrencies by market capitalisation today

At the root of all these developments is the financial failure of FTX and Alameda Research, a trading firm closely associated with Bankman-Fried. Head of analytics platform Coinmetric Lucas Nuzzi tried to look into the financial transactions of both companies and found something interesting there.

Why FTX collapsed

Alameda and FTX merged their venture capital operations in August 2022. There are rumours on the internet that Alameda allegedly faced a crisis of its own back in the second quarter of this year. FTX bailed the firm out financially, which ultimately turned out to be a disaster for both companies.

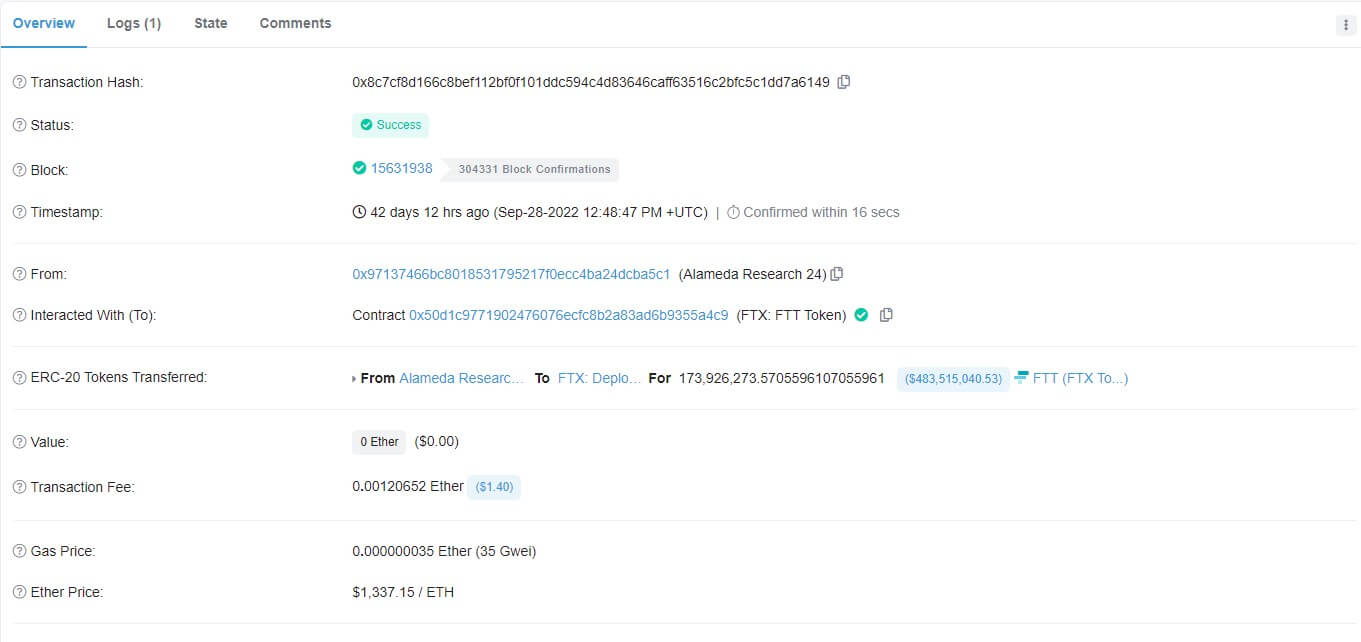

Nuzzi has published evidence of FTX’s support for Alameda. So, it all started a little over forty days ago, Cointelegraph reports. We’re talking about September 28, 2022, when 173 million FTTs worth more than $4 billion suddenly started moving on the blockchain.

The surge in the number of FTTs on the blockchain

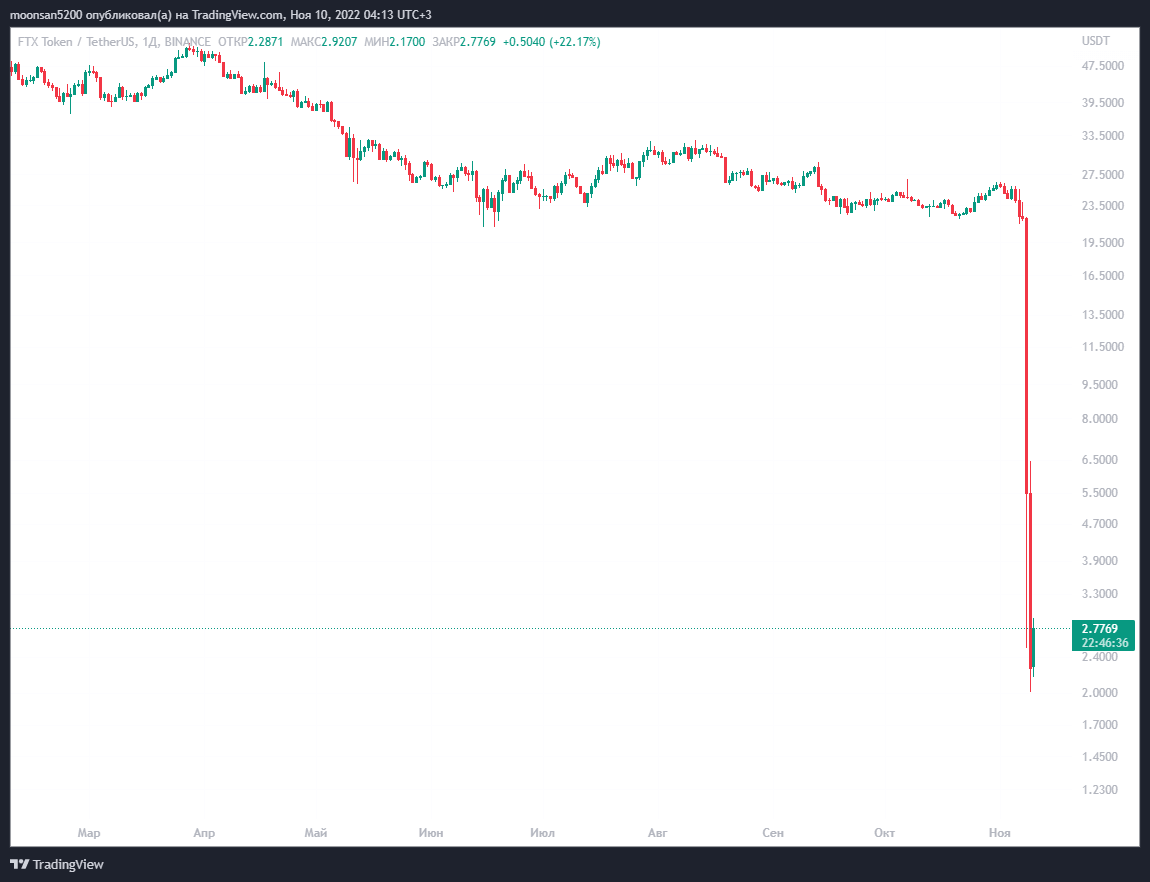

For reference, FTT is a native FTX token. Its price has suffered the most from the events that have occurred. You don't have to crunch the numbers - the chart below speaks for itself.

FTT exchange rate on the 1-day chart

On the day of the coin move, FTT’s total transaction volume for the day was $8.6 billion – a historic high for the altcoin.

FTT transaction volume for the day

Nuzzi went through all the transactions of the day using a special script. In the end, he found a suspicious transfer that interacted with the ICO FTT smart contract, i.e. the initial token offering. The smart contract “automatically” released 173 million FTT from the ICO, with the recipient of the transaction being Alameda Research’s wallet. This, from Nuzzi’s words, is where the fun part begins. Here’s his rejoinder.

Alameda then sent the entire balance to the creator of the FTT smart contract, which is controlled by someone at FTX. In other words, Alameda took $4.19 billion worth of FTT only to immediately send it back to FTX.

FTT token transfer transaction

The analyst suspects that Alameda Research became financially insolvent back in the second quarter of this year at a time when Three Arrows Capital and a host of other cryptocurrencies declared bankruptcy. A 173 million FTT bailout from FTX with a holding period until September saved the day, but eventually the tokens had to be returned, which was reflected in the September transaction.

Reuters sources note that some of the funds sent were owned by users of the FTX exchange. Naturally, Sam had no right to dispose of them in this way, and he did not even report the actions to the other top of the company to avoid leaks. However, journalists are not sure about these sources.

In other words, Alameda used the native FTX token to delay the inevitable. Such dangerous moves have definitively shaken the firm’s financial stability, as reflected in the financial report leaked a few days ago. Nuzzi has another “crazy theory” – Binance management knew about the problems from the very beginning and were just waiting for the right moment to “finish off” their competitor. However, this is only a probability, which we are unlikely to ever see confirmed.

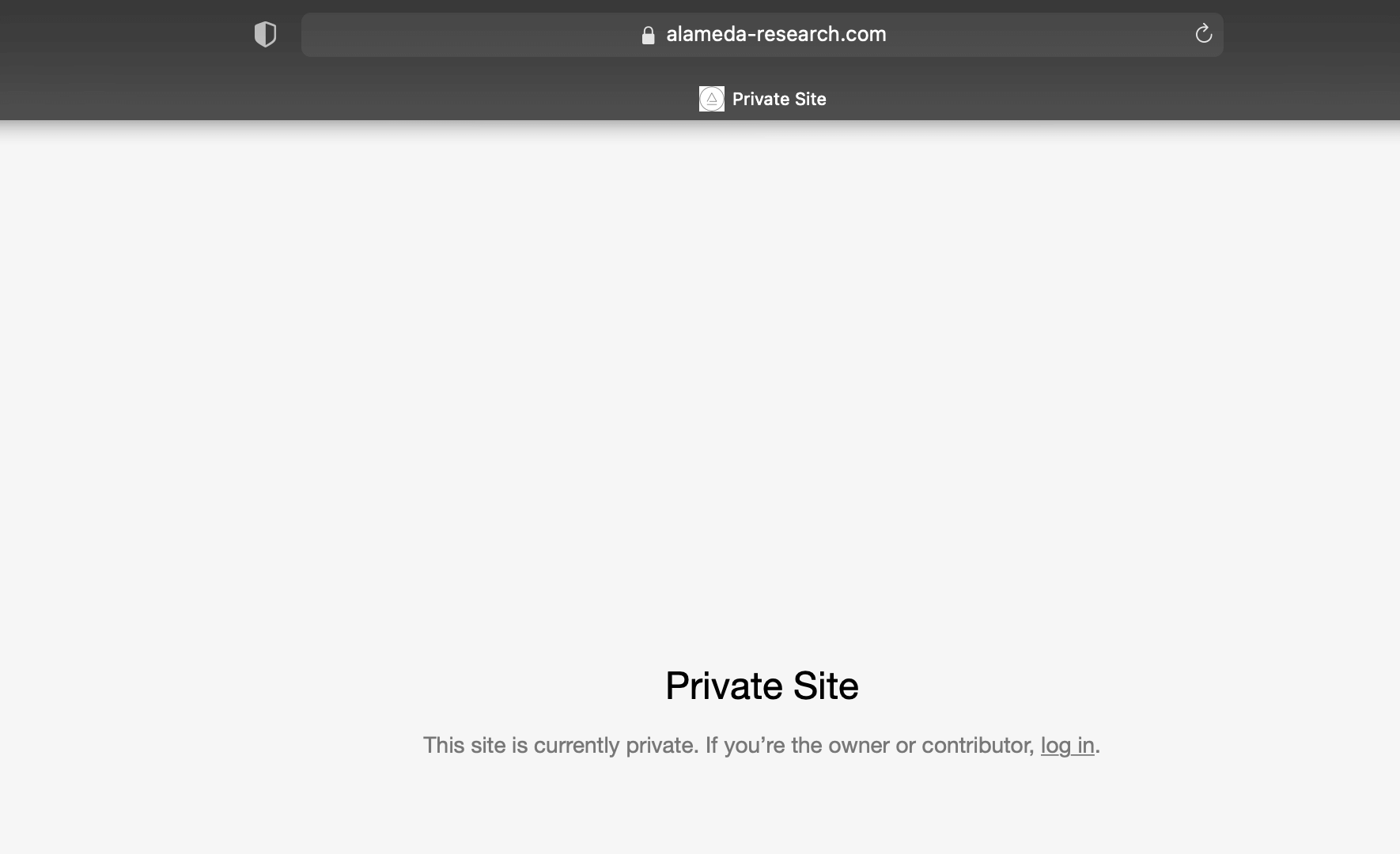

It is important to note that Alameda Research's website stopped opening last night. It is now marked in the browser as private - and that's another cause for concern.

Alameda Research website

Bankman-Fried’s actions will leave thousands of ruined investors in their wake. That’s why the crypto market needs regulation, said US Senator Cynthia Lummis. Here’s a quote from her recent press release.

The recent events between FTX and Binance are the clearest example of why we need clear regulations for digital asset exchanges in the United States.

Senator Cynthia Lummis

😈 YOU CAN FIND MORE INTERESTING THINGS FROM US AT YANDEX.ZEN!

Given the obvious influence of big Influencers on price movements with just a few tweets, Lummis noted the following.

Market manipulation, credit activity and whether client funds and assets have been adequately protected are just some of the many issues that my colleagues and I will have to consider in the coming days.

Manipulation here is the very fact that the Zhao and Bancman-Fried confrontation is public. While it benefits Binance in terms of eliminating a competitor, for the crypto industry as a whole this situation comes as a major shock and cause for price falls. Just yesterday, Chanpen once again added fuel to the fire with his statement – Binance does not consider it economically feasible to buy FTX. Which means that the exchange remains in limbo and the market is definitely in uncertainty in the near future.

We believe that the current situation will have a serious impact on the future of the cryptocurrency industry. Obviously, there will be stricter regulation - at least in the US. Also, users will clearly make more use of decentralised exchanges, which involve retaining ownership of their coins.

The funny thing about all this is that Sam Bankman-Fried could have saved his own company by not doing the same thing with Alameda. And his willingness to help his colleagues seems bizarre, since he was essentially taking a risk on a business that is capable of generating a billion dollars a year during a bull market. As current events show, the risk was definitely not worth it.

You can find out about other interesting news in our millionaires cryptochat. There we discuss other important developments from the blockchain world.