How many Bitcoin millionaires are left after a bearish trend: Glassnode analysts’ answer

Crypto-millionaires are becoming a rarer breed by the day, experts at analytics platform Glassnode have concluded. During the bearish trend, i.e. the collapse phase of the coin market, their number decreased by almost 80 percent. At the moment, there are only just over 23,000 crypto-addresses whose balance can be valued above a million dollars. The real number of crypto millionaires is likely smaller, as one person can own as many wallets as they want. We tell you more about what’s going on.

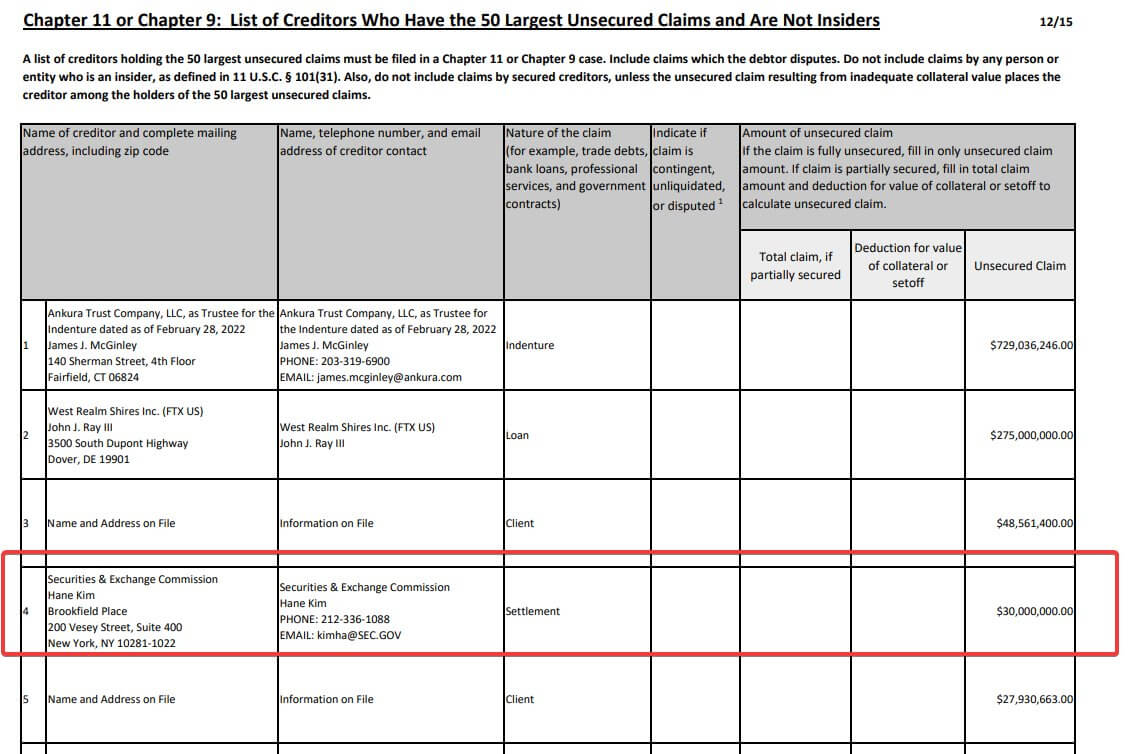

Note that not everyone was able to survive the current bearish period in the cryptocurrency market. Last night BlockFi, a blockchain platform, joined this list by filing for bankruptcy. As it emerged shortly thereafter, the company’s unsecured claims amount to $1.28 billion, with $275 million of that amount coming from its US unit FTX, which is now also bankrupt.

BlockFi’s unsecured claims data

Approximately $250 million of user funds have been blocked on the platform. BlockFi’s total number of creditors is expected to exceed the 100,000 mark.

BlockFi lender data on the BlockFi lending platform

In addition, the list of the company’s biggest creditors includes a representative from the US Securities and Exchange Commission, whose unsecured claims are equivalent to $30 million.

BlockFi’s biggest creditors

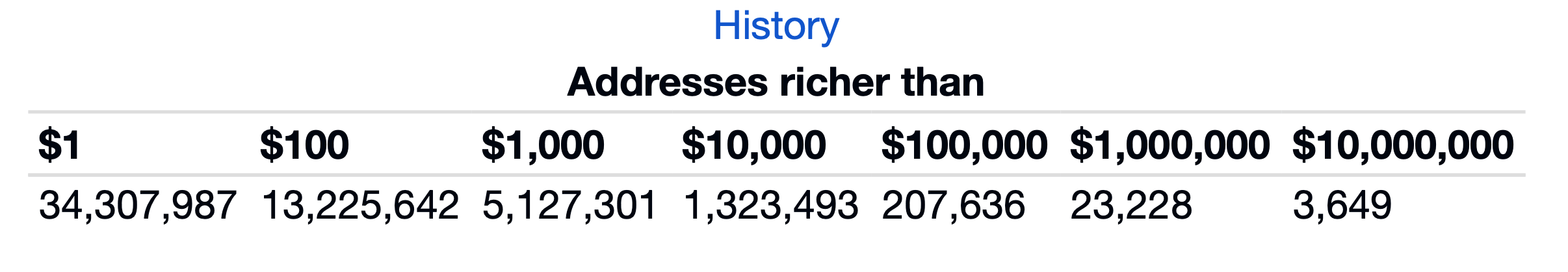

How many rich people hold cryptocurrencies

As of 25 November, Glassnode counted 23,245 cryptocurrency wallets with balances above a million dollars in BTC. Just a year ago, when the price of Bitcoin was approaching its all-time high, there were at least 112,898 millionaires’ wallets. Here’s the relevant graph, which shows the change in trend.

Falling number of crypto millionaires’ wallets

In other words, the number of crypto-addresses from the aforementioned category has dropped by 79 per cent over the year. Over the same time period, the price of Bitcoin has fallen by around 77 per cent, and it makes sense that the decline in the number of the rich is directly related to the value of the major cryptocurrency.

Another metric, the total number of cryptocurrencies themselves, is on the rise. According to Cointelegraph’s sources, this metric had passed the 952,000 address level by November 27, which is a new all-time high.

Growth in the number of cryptocurrency wallets

A similar increase can be seen in the graph of the number of cryptocurrencies with non-zero balances. Here is a graph of this figure.

Growth in the number of cryptocurrencies with a non-zero balance

The last two graphs suggest that the concept of cryptocurrencies continues to spread in many people’s daily lives. In the long term, it’s these two metrics that matter, and the number of crypto millionaires is sure to break the record on the new bullrun, as cryptocurrencies are becoming a more popular phenomenon among investors one way or another.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.ZEN!

Cryptocurrencies also hold large volumes of bitcoins. Their blockchain movements traditionally attract a lot of attention, and bots are the first to notice such events. Yesterday, the Whale Alert bot reported 127,351 BTC worth over $2 billion moving from Binance to an unknown address.

Binance transaction notification

Given the recent bankruptcy of FTX, a large suspicious transaction at the largest trading platform has caused bewilderment and panic among investors. Binance chief executive Changpen Zhao was quick to reassure everyone with the following post on Twitter.

The auditor is demanding that we send a certain amount to ourselves to demonstrate that we are in control of the wallet. Don’t be fooled by the panic.

In other words, in this way third-party auditors want to make sure that certain addresses really belong to Binance. By doing so, they will be able to confirm the veracity of the cryptocurrency exchanges' reserve data, which is now publicly available. Well, this will add points of transparency to the centralised trading platforms.

Binance’s big transaction

The Binance executive also referred to his old post from four years ago, in which he briefly described the mechanism for large transactions by the exchange.

We will be moving some funds between our cold wallets. A sign of a new cold wallet on Binance is two small transfers from and back to an existing wallet, followed by a large transaction. No need to worry. The funds are safe.

The platform manager has now noted that such transactions will take place over the next few days. As he clarified earlier, it could take several weeks for auditors to verify the blockchain address data at Binance's disposal.

As a reminder, Binance recently published proof of its own reserves backed by crypto tools. Every customer can now check the availability of their bitcoins on one of the trading platform’s cold wallets on the exchange’s page.

Binance CEO Changpen Zhao

Note that you can find out the current number of Bitcoin millionaires and owners of other cryptocurrencies on this page. Specifically, there are 23 thousand BTC millionaires today, while 10 million is owned by 3.6 thousand users.

Wealth distribution among Bitcoin investors

We believe that such analyst data is a good reminder of the need to get rid of cryptocurrencies in time and switch to conventional stabelcoins. Otherwise, the unrealised income will evaporate, and the investor will return from the category of millionaires to ordinary people. The only exception here might be holders who expect to hold crypto-assets for at least a few years.