How many bitcoins have been lost due to the collapse of various cryptocurrency exchanges: researchers’ answer

Bitcoin is known in part for its limitation of a maximum supply of 21 million BTC coins to be mined by 2140. This property was spelled out in the cryptocurrency’s protocol by anonymous creator Satoshi Nakamoto, and is unlikely to ever be changed, although there have been discussions about it in the past. In total, of the 21 million bitcoins mined, approximately 19.2 million have already been mined, with more than 1.2 million BTC lost forever due to the collapse or other problems of fourteen cryptocurrency exchanges in the past decade. These statistics are cited by experts. We tell you more about what’s going on.

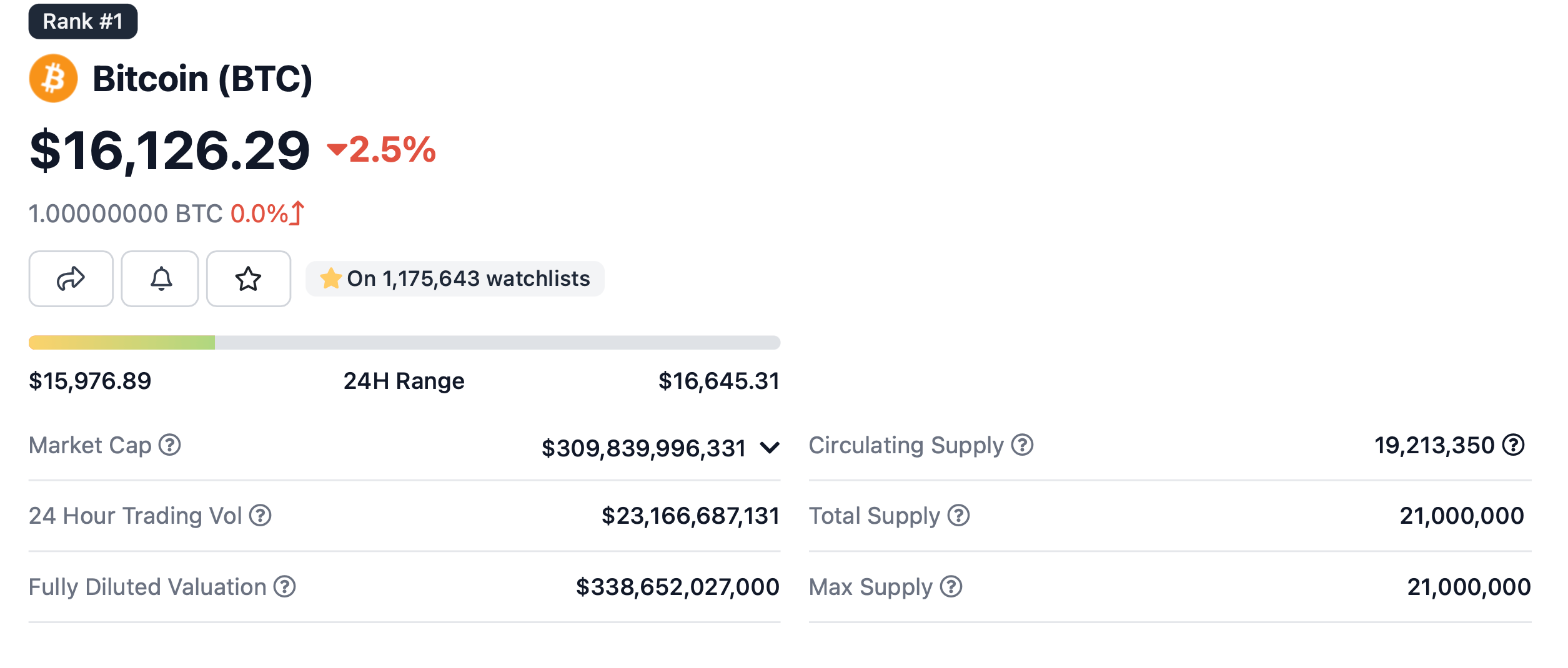

We have clarified the latest data: there are 19.21 million bitcoins in circulation today. A certain part of the cryptocurrency is lost forever, because, for example, early BTC users may not have held the coins responsibly due to their low price.

Bitcoin exchange rate and number of coins in circulation

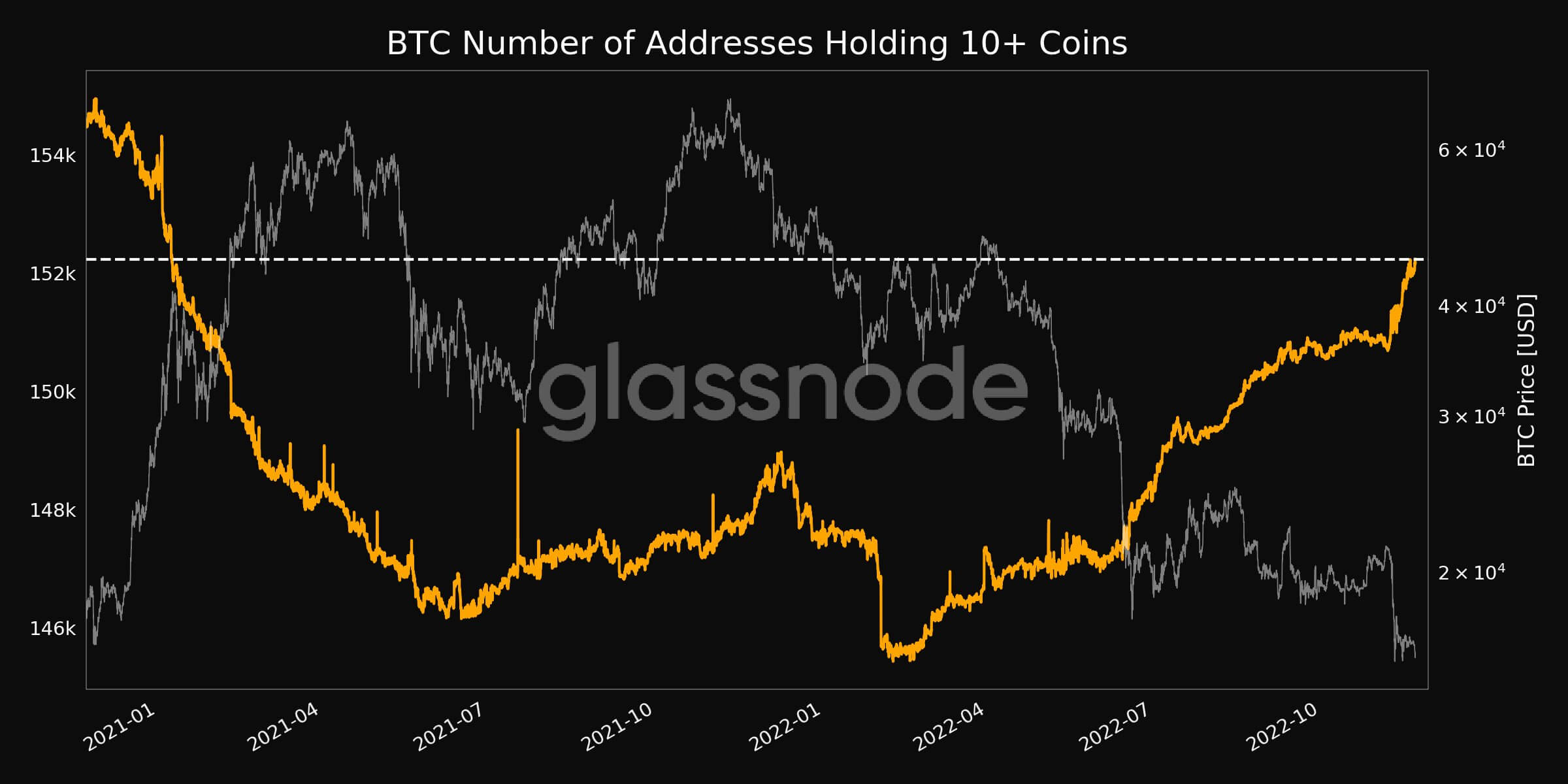

Despite the prolonged collapse of the digital asset niche, the accumulation of popular cryptocurrencies continues. The number of Bitcoin addresses with at least 10 BTC on their balance sheet has reached a high of the last 22 months, as the analysts at Glassnode have revealed. Today there are just over 152,000 of them. Which means that despite the uncertainty, investors are already ready to aggressively buy up the digital assets they need.

Number of Bitcoin addresses with at least 10 BTC

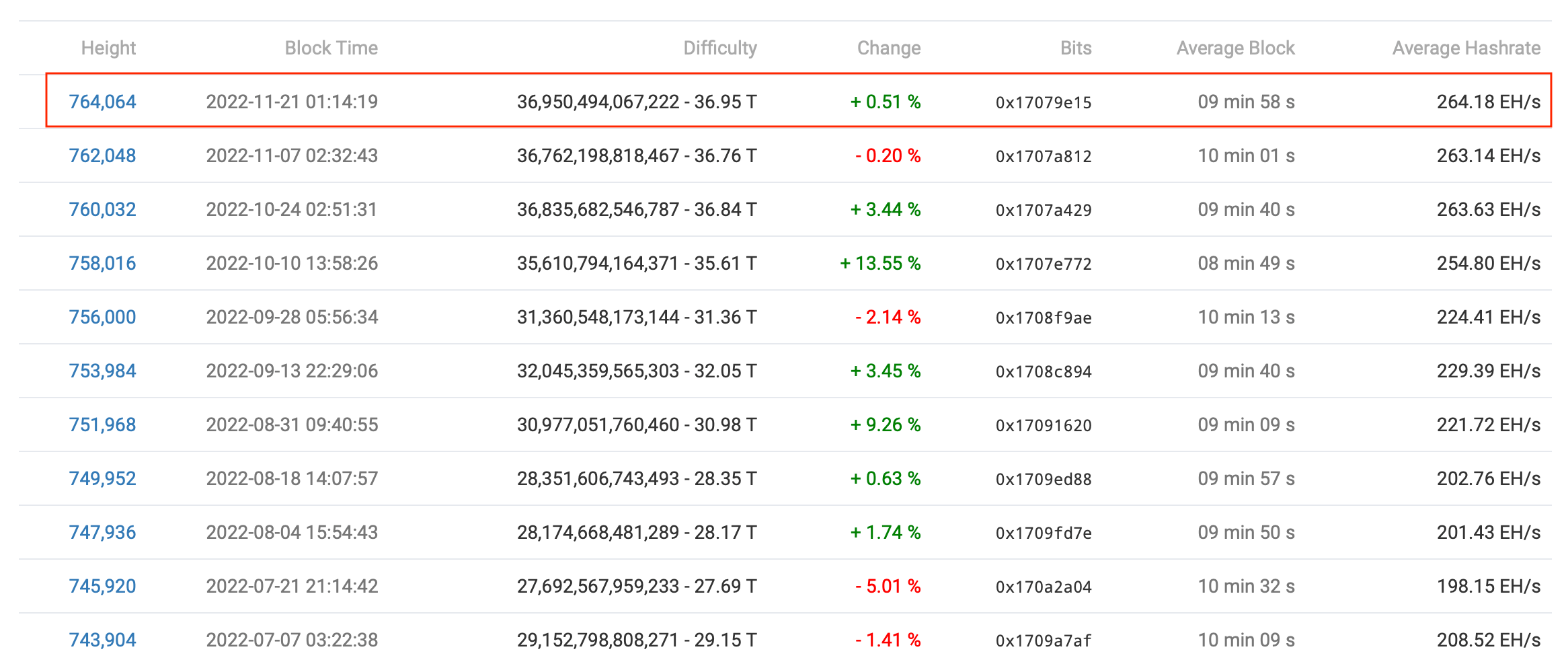

No less interest has been noticed in the Bitcoin mining niche. Another recalculation of BTC mining difficulty took place today, raising the figure to a record 36.95T. So mining the first cryptocurrency has never been harder.

Graph of Bitcoin mining complexity changes

How many bitcoins are in circulation?

According to Cointelegraph sources, only 5.7 per cent of the Bitcoin supply mined by miners is permanently lost in the closure, bankruptcy, hacking or other incidents of the aforementioned trading venues.

Crypto-exchanges and the volume of bitcoins lost on them

As you can see from the list, the notorious Mt. Gox cryptocurrency exchange is by far the leader in terms of the number of BTC lost. Bitfinex is in second place with about 120 thousand BTC lost during hacker attack. As a reminder, we previously wrote about a married couple who had some of their stolen Bitfinex funds confiscated in the form of cryptocurrencies.

At the bottom of the list is FTX, Sam Bankman-Fried’s trading platform, which went bankrupt a fortnight ago. During that incident, around 70,000 coins “fell out” of Bitcoin’s circulating supply. According to experts, lenders may not be able to get their hands on these coins in the coming years, so this volume of crypto-assets could well be written off – albeit tentatively.

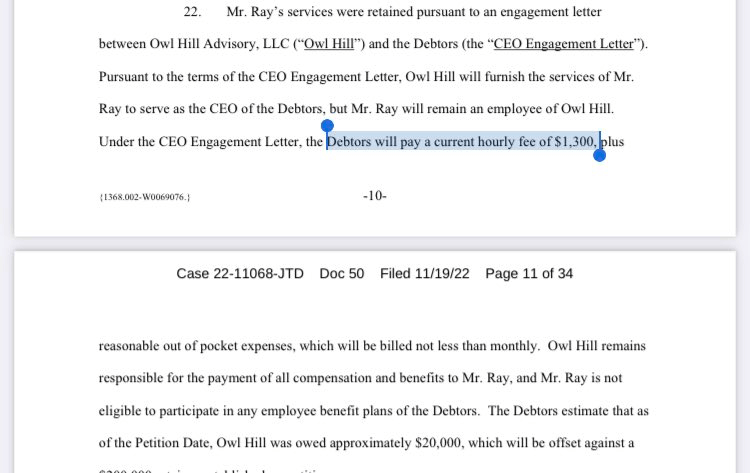

As revealed through court documents, FTX's new CEO John Ray is paid $1,300 an hour. He is an experienced lawyer who has previously helped creditors get money after the collapses of various popular companies.

Salary figures for the new FTX CEO

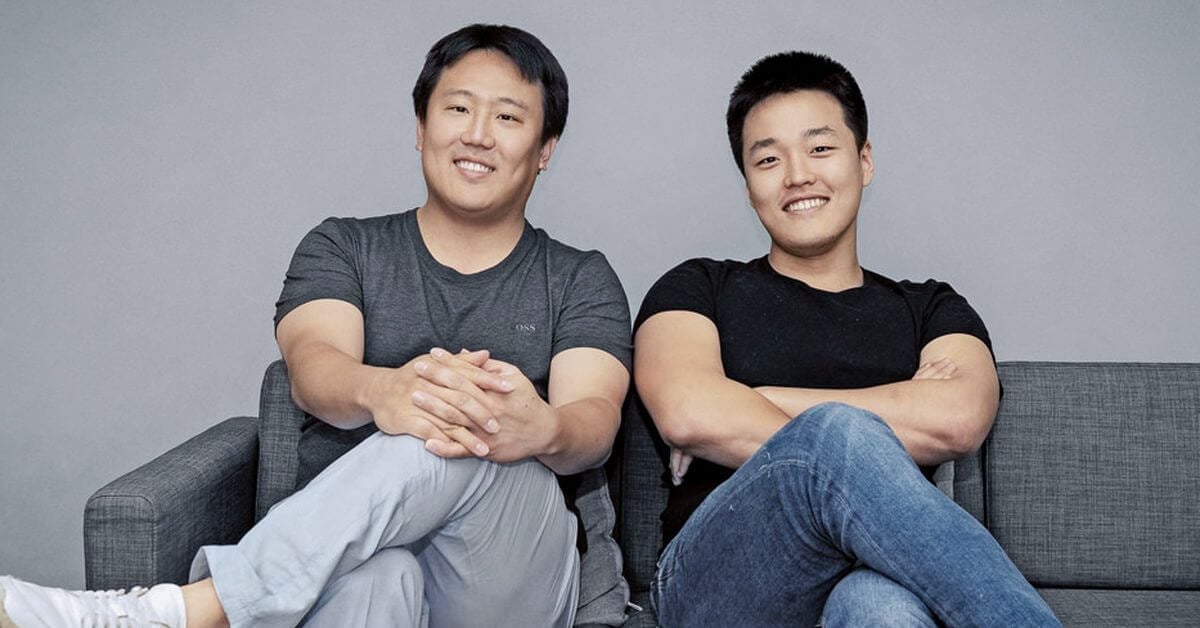

Apart from FTX, the failed crypto project Terra and its founder Do Kwon have been in the media news frequently this year. The day before, it became known that the South Korean prosecutor’s office seized assets worth more than $100 million belonging to Terraform Labs co-founder Shin Hyun Song (Daniel Shin). The reason for this action is his role in the collapse of the Terra ecosystem in May.

Terraform Labs co-founder Daniel Shin (left) and Do Kwon

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

The request to seize Shin’s assets is part of an investigation into the case against Terraform Labs, a company founded by Do Kwon. According to prosecutors, Kwon’s partner made illegal profits from Terra-related digital assets, including the tokens LUNA and UST, later rebranded as LUNC and USTC. Authorities believe that Shin violated local capital laws by secretly selling the tokens before the project collapsed.

Incidentally, Do Kwon himself recently promised to reveal his real location: he is allegedly organising his own cryptocurrency conference, to which he also invites law enforcement officials. To recap, Kwon is already wanted by Interpol and even a group of angry investors who lost their money in Terra. Still, the scale of Terra’s collapse runs into the tens of billions of dollars.

We believe that the collapse of FTX the day before will make many cryptocurrency enthusiasts familiar with proper coin storage - including the use of Ledger hardware wallets. At the same time, cryptocurrency exchanges will be trying to rebuild trust by validating the assets in their own possession. In other words, they need to prove that users' coins are always ready for withdrawal and are not being used to lend to other companies or, worse, trade. So in the long run, the death of FTX will surely make the digital asset industry more trustworthy.