Major investors and miners are taking record losses. What does this mean for the cryptocurrency market?

The situation for large cryptocurrency holders or so-called whales is reminiscent of late 2018, when crypto hit its bottom during the previous bearish trend. Experts at analytics platform Glassnode stated this in their latest report. According to them, more and more whales are now incurring losses as the Bitcoin price continues to fall. In addition, the crisis has forced miners to get rid of their reserves of previously mined BTC more quickly. We tell you more about what’s going on.

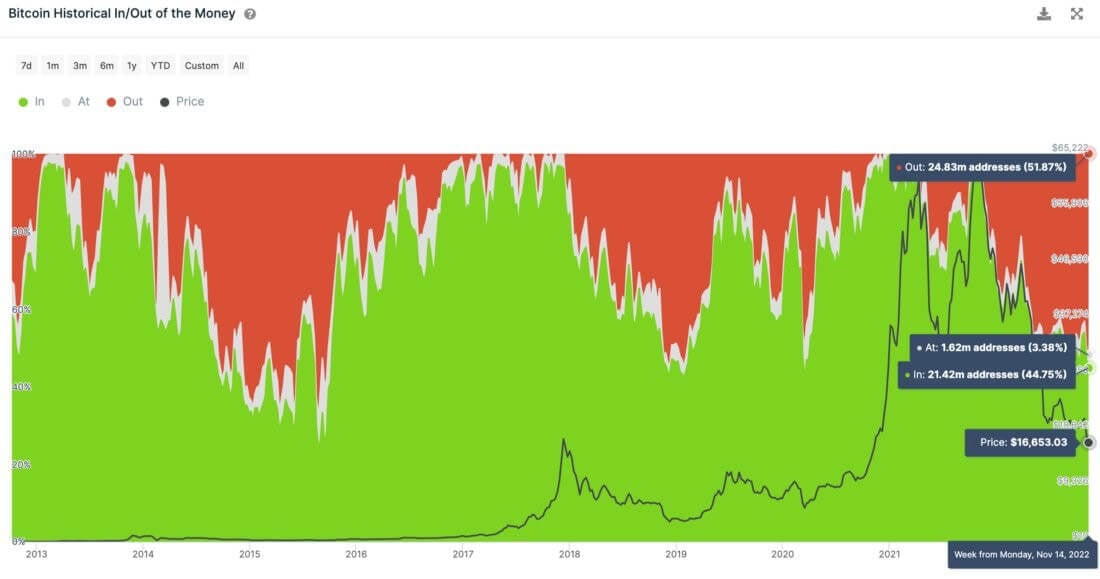

The problems in the cryptocurrency industry are indeed plentiful. According to IntoTheBlock analysts, almost 52 per cent of Bitcoin investors are now holding their positions in the red. This means that they have bought the cryptocurrency for more than it is currently worth.

Situation of Bitcoin investors’ returns and losses

In comparison, during the collapse phase of the market in 2018, this figure reached a low of 55 per cent. That is, the current magnitude of the collapse of BTC and other coins is quite comparable to the bottom of the previous bull run.

When will cryptocurrencies stop falling

Here’s a quote from Glassnode’s official Twitter account. The experts’ replica is cited by CryptoPotato.

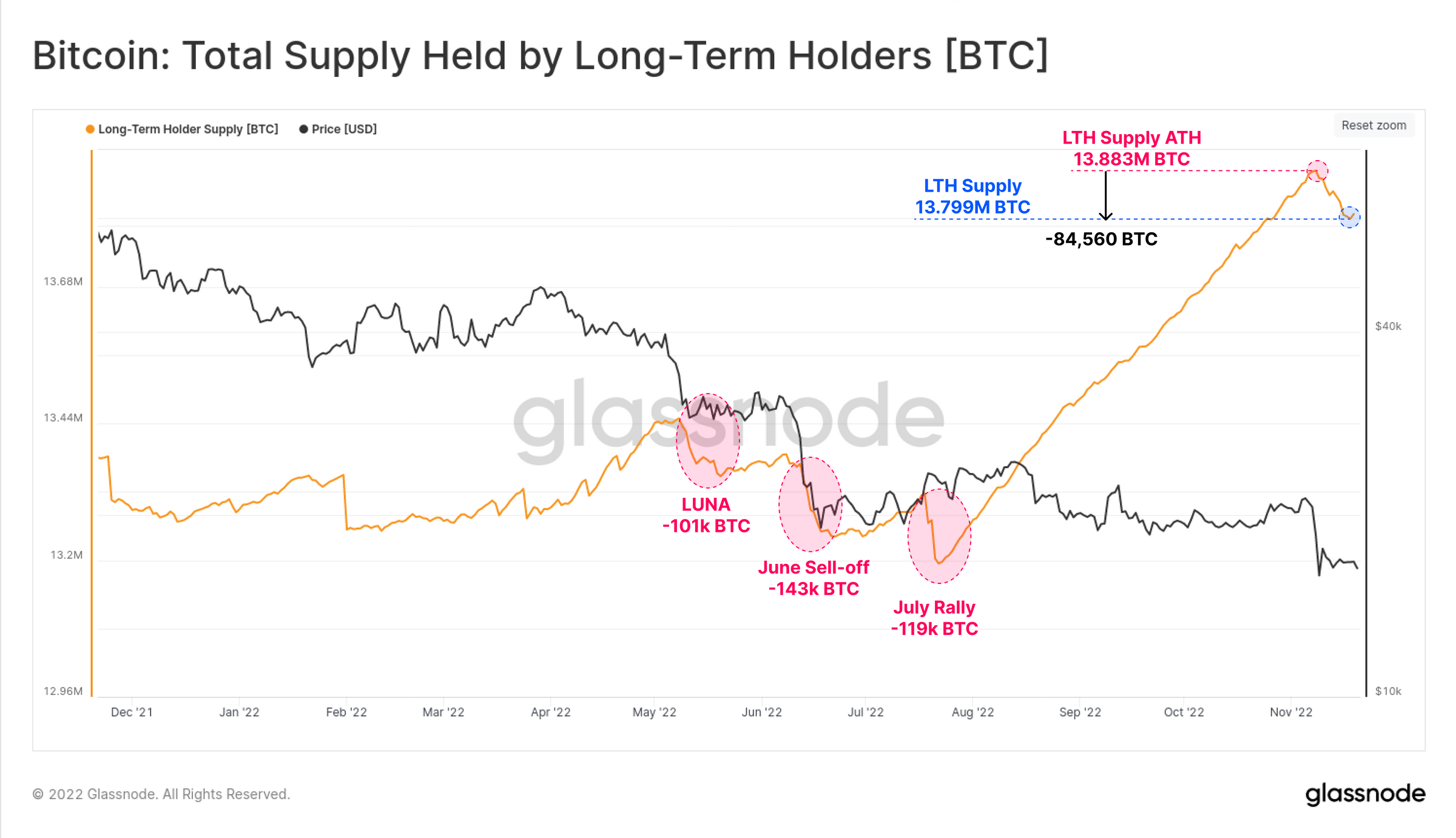

After the FTX collapse, long-term investors’ faith in Bitcoin seems to have been shaken. Their balance sheets have shrunk by more than 84 thousand BTC, with 5 thousand BTC transferred to exchanges. Bitcoin is now on very shaky support.

Dynamics of Bitcoin long term holdings

And yet, as you can see from the chart above, the volume of bitcoin in the wallets of long-term holders of the coin is much higher now than it was this spring, when the Terra crypto project collapsed.

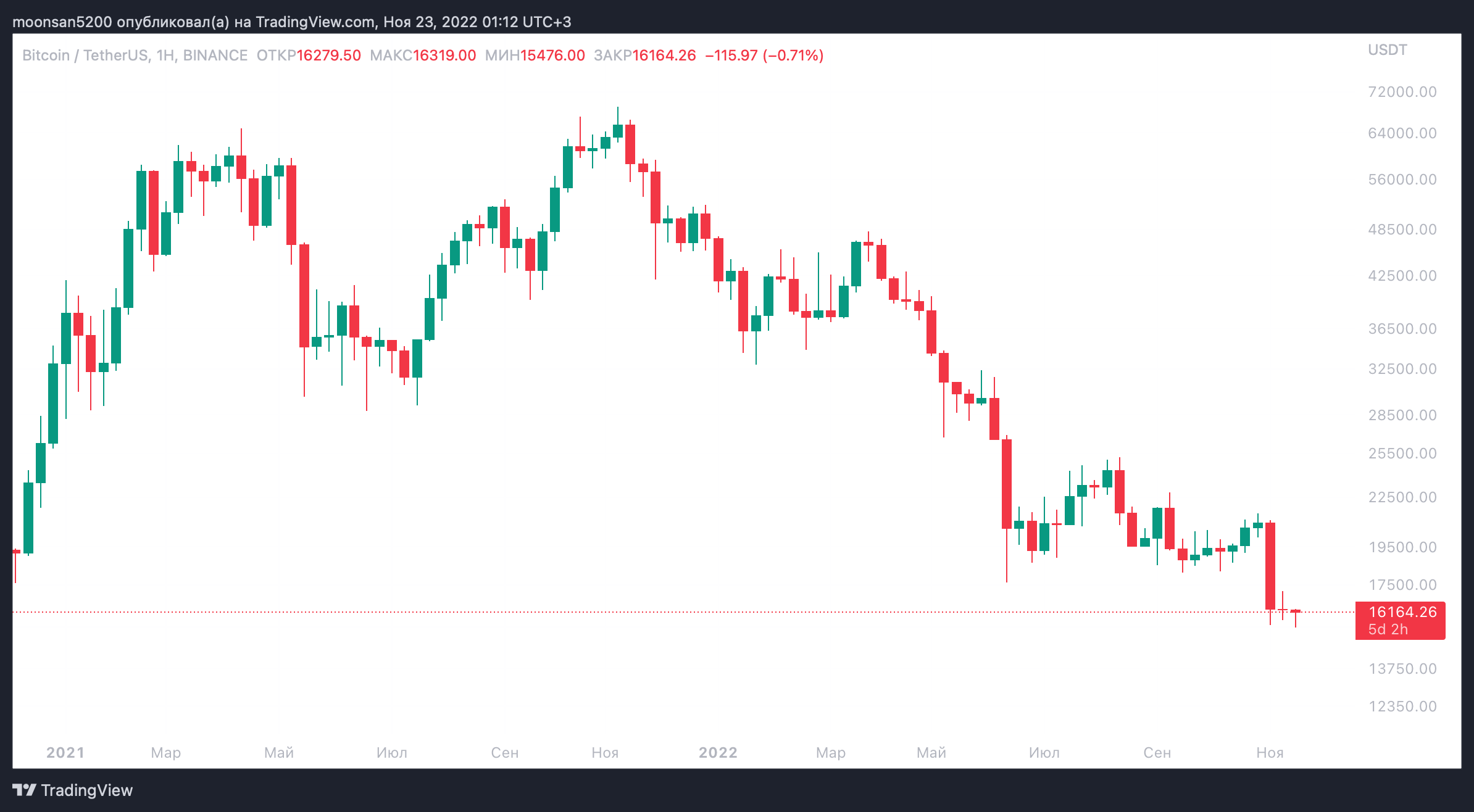

Bitcoin exchange rate on a 1-week chart scale

Overall, during the previous bear cycle, Bitcoin’s price fell 84 percent from its all-time high in about a year. This time around, it took about the same amount of time for BTC’s value to fall 77.3 percent from $69,000 to a new low around $15,665.

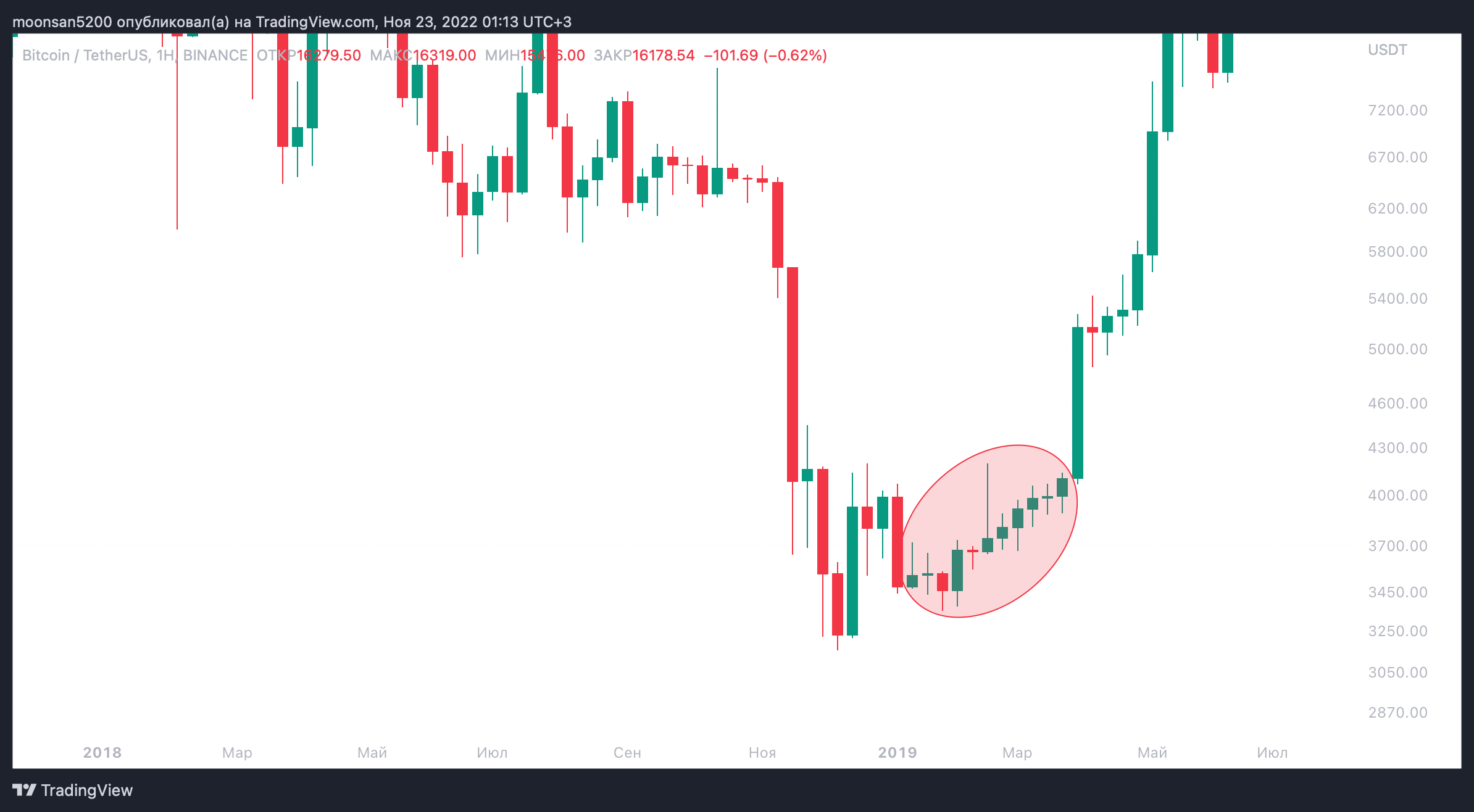

After hitting a bottom during the last bear cycle, Bitcoin has been oscillating in a narrow channel with low volatility for a few more weeks

For those waiting for the next bull run, there is no encouraging news yet: Bitcoin did hit its bottom in 2018, but the cryptocurrency needed at least another few months of a period of low volatility before the first noticeable wave of growth could be seen on its chart.

As a reminder, events in the past do not guarantee their recurrence in the future. Therefore, this comparison should only be taken as an illustration of the magnitude of the current collapse.

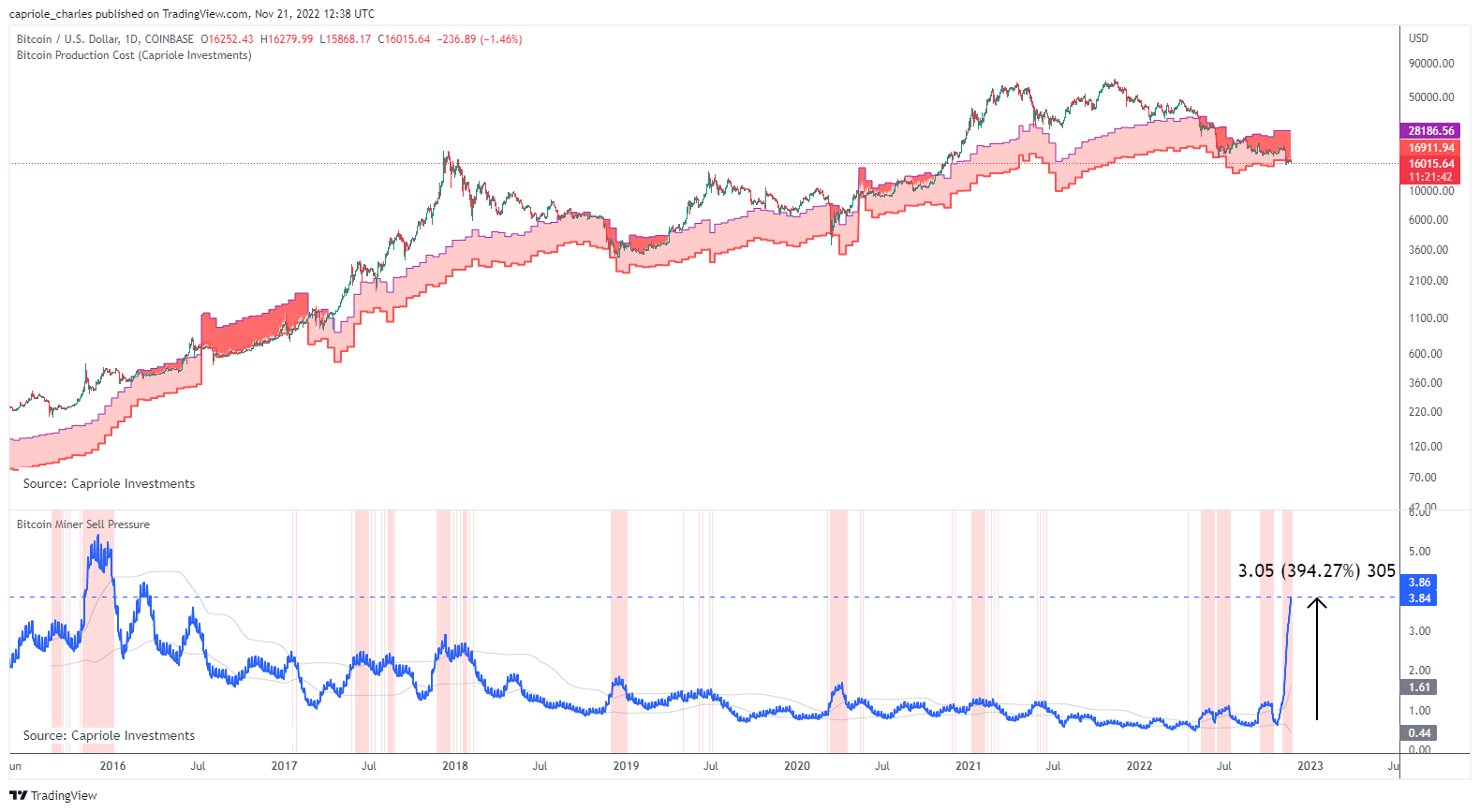

In any case, Bitcoin miners will have to tighten their belts for now. As cryptocurrency enthusiast Charles Edwards writes on Twitter, the volume of bitcoin sales by miners has reached its highest level in seven years. In the last three weeks alone, the figure has increased by 400 percent.

Bitcoin sales by miners

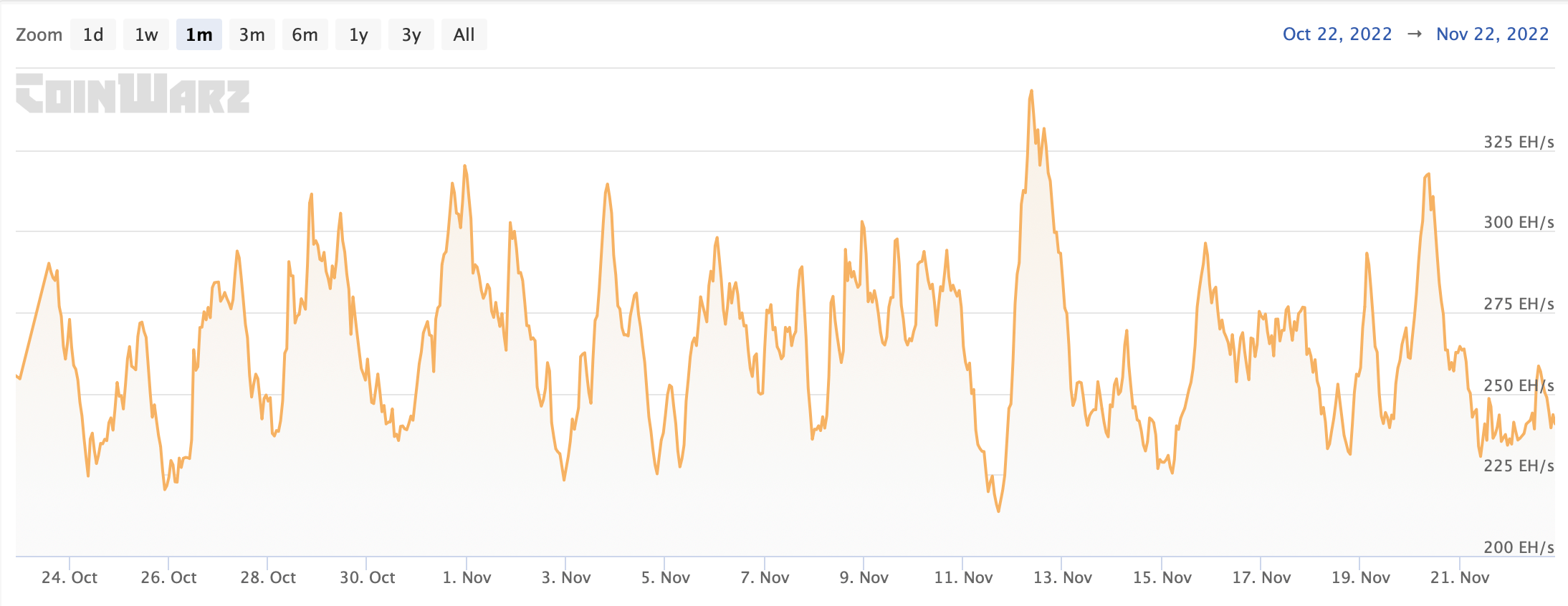

According to CryptoSlate sources, many miners have clearly gone out of business. Still, today Bitcoin’s hash rate fluctuates around 243 hashes per second, with it hitting an all-time high of 341 hashes per second on November 12.

Bitcoin network hash rate dynamics over the past month

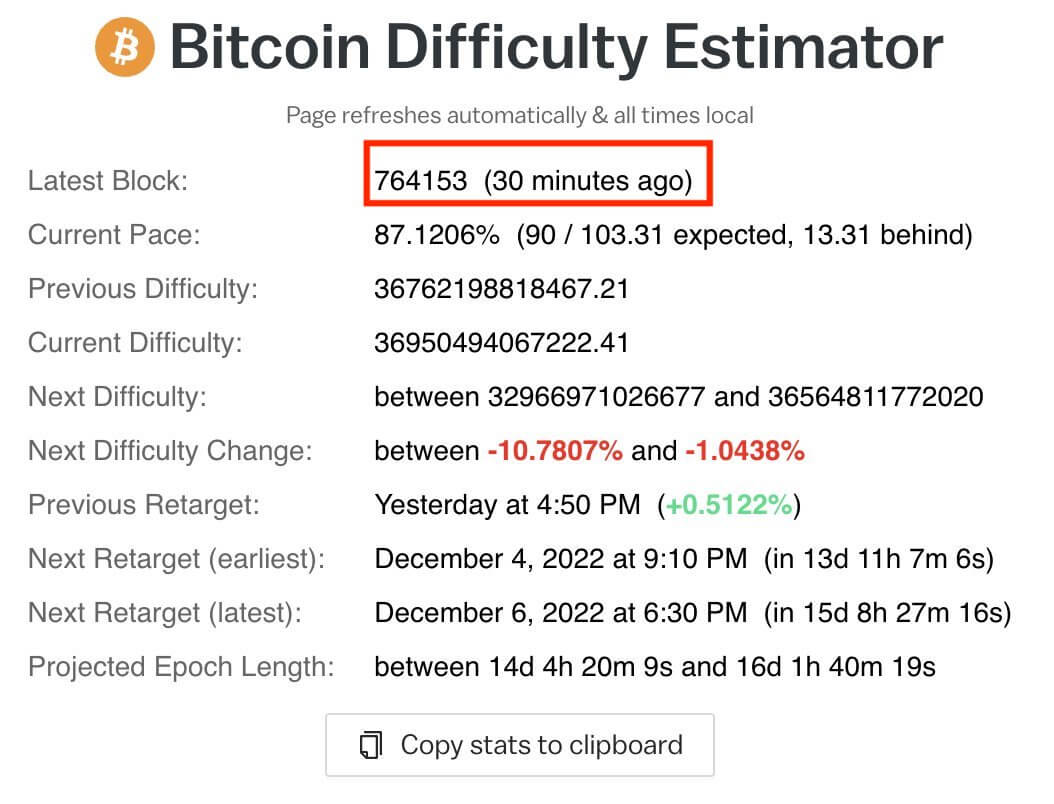

The disconnection of major miners from the network has caused delays in finding new blocks. This was reported on Twitter by a crypto user nicknamed Bitsbetrippin. The screenshot he posted shows that the delay in finding a new block was more than 30 minutes, although the standard time is 10 minutes.

Note that sometimes Bitcoin blocks take even longer to find. For example, in October 2019, it took two hours to find one block. Read more about that situation in a separate article.

Delay in the search for a new block

All this suggests that a new wave of Bitcoin collapse could cause a succession of bankruptcies among large mining companies. They will be forced to sell their BTCs even more actively from reserves to stay afloat, but this does not guarantee anything. Now the attention of crypto investors is drawn to the largest bitcoin holder among public companies called MicroStrategy. Still, due to the presence of debt, the platform is also dependent on the BTC exchange rate.

Meanwhile, the biggest Bitcoin miner among public companies, Core Scientific, is facing real problems. As noted by Bloomberg, the giant's loss in 2022 was $1.7 billion. The reasons for such disappointing results are the collapse in the value of BTC, the growth of the Bitcoin network hash rate, which has a negative impact on profitability, as well as the rising cost of electricity.

ASIC miner for Bitcoin mining

The current conditions in the cryptocurrency market seem to be more than enough to pose a real threat to the activity of large companies. Obviously, if the collapse of the industry continues, or if the coins stagnate at this level for a few weeks or months, we will see more bankruptcies among the giants. And then the situation will surely repeat the path of the industry in 2019-2020.