The crypto-asset sector has taken the top spot for investment among emerging technologies this year. What does this mean?

The emerging technology space has seen a prolonged decline in investor activity, but crypto-related categories – Web3 and DeFi – are still leading the way. That is the conclusion reached by analysts at Pitchbook in its latest report. According to them, investment in the future of the internet and decentralised finance has outperformed even the fintech and biotech sectors. Here’s more on what’s going on.

As a reminder, Web3 and DeFi represent the cryptocurrency industry. The first is a new standard for the internet, which will be based on blockchain. In this way, users will get rid of the monopoly of big players like Google, Apple and others, who collect data about them and sell the information to make extra money.

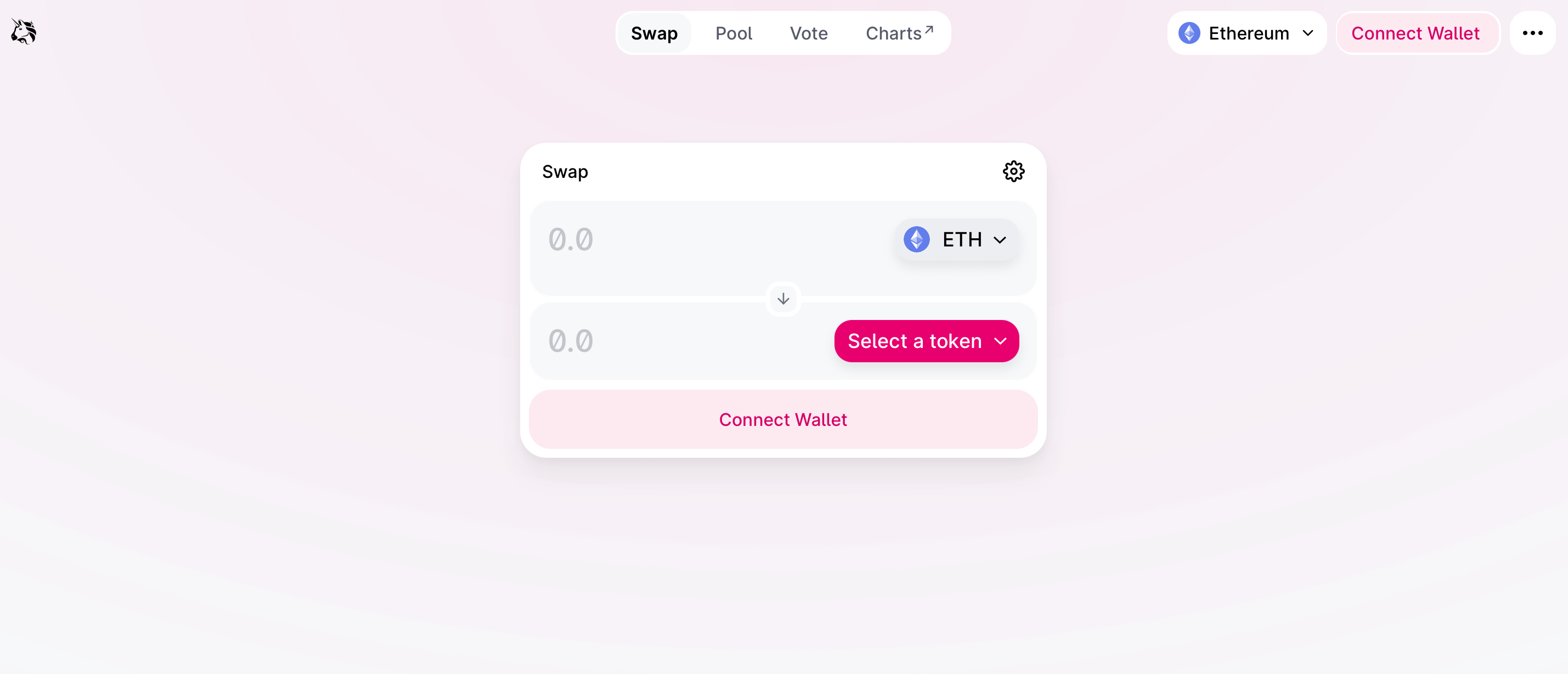

DeFi, meanwhile, stands for decentralised finance. They are represented by platforms that operate on a decentralised basis, i.e. independently of any authority. One of the best known examples of DeFi platforms is the decentralised exchange Uniswap, which we met back in 2020.

The interface of the decentralised exchange Uniswap

Is investing in cryptocurrencies now

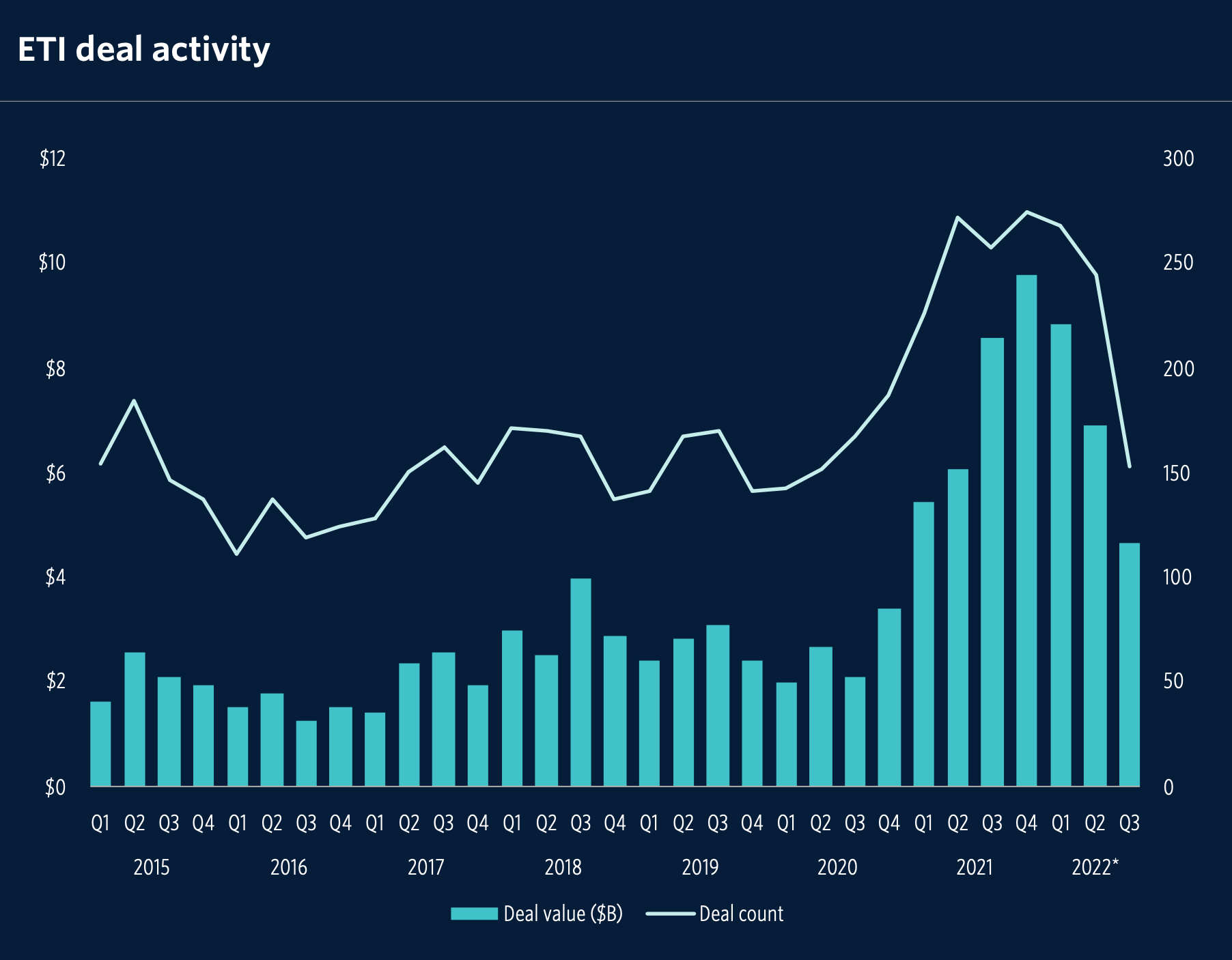

According to Decrypt’s sources, overall investment in the emerging technology sector has fallen for the third quarter in a row. In the third quarter, analysts counted 153 investments totaling $4.7 billion. While in the previous period, the amount of investment was $6.9 billion for 244 deals.

The graph below shows investment activity in the area on a larger scale.

Dynamics of investment in emerging technologies

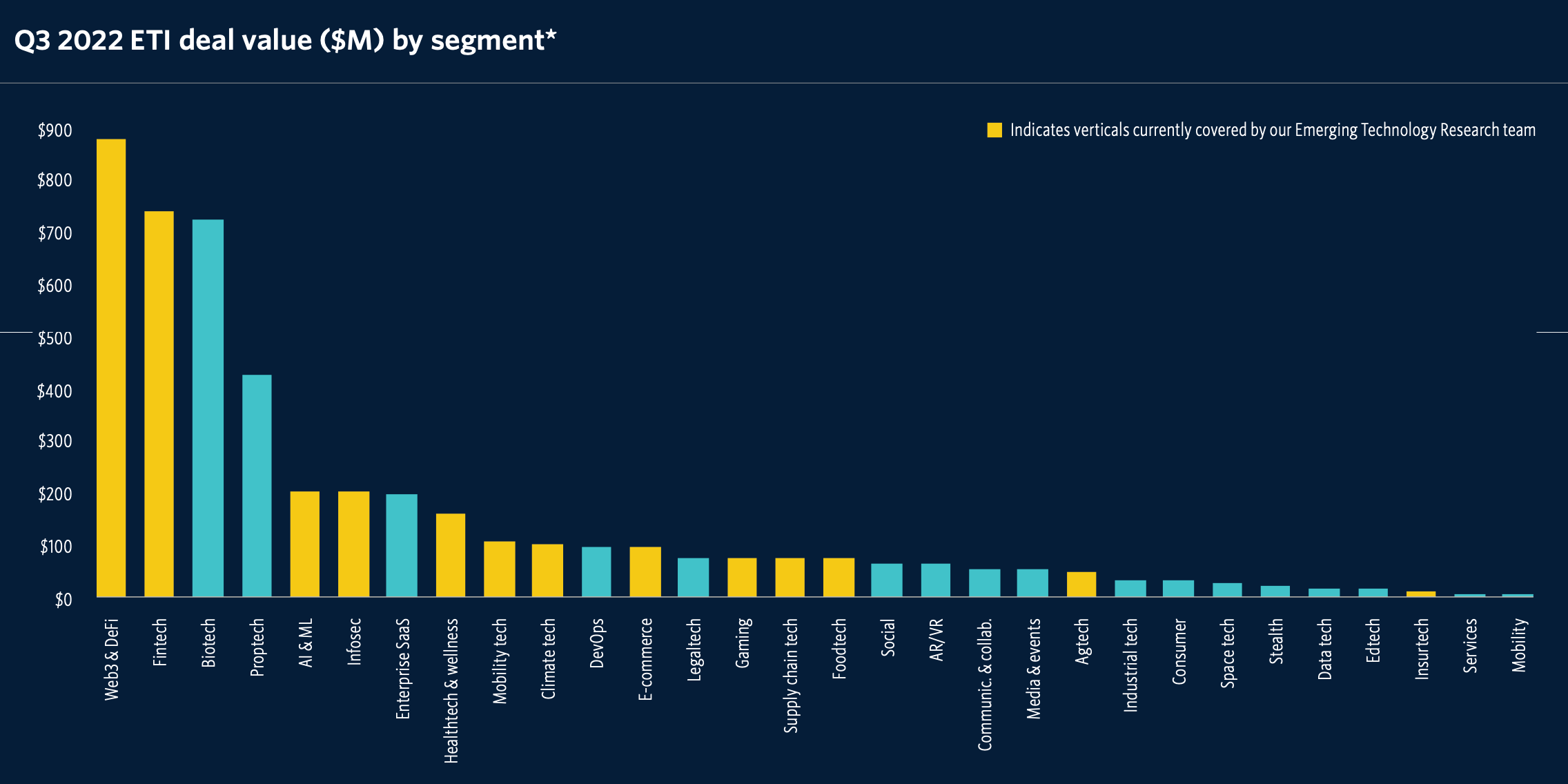

The Pitchbook report combines Web3 and DeFi into one category: crypto-related technologies ended up with $879 billion in the third quarter of this year. That’s first place among all categories. Second and third place went to fintech and biotech, each of which generated just over $700 billion in investment.

Category ranking by investment volume

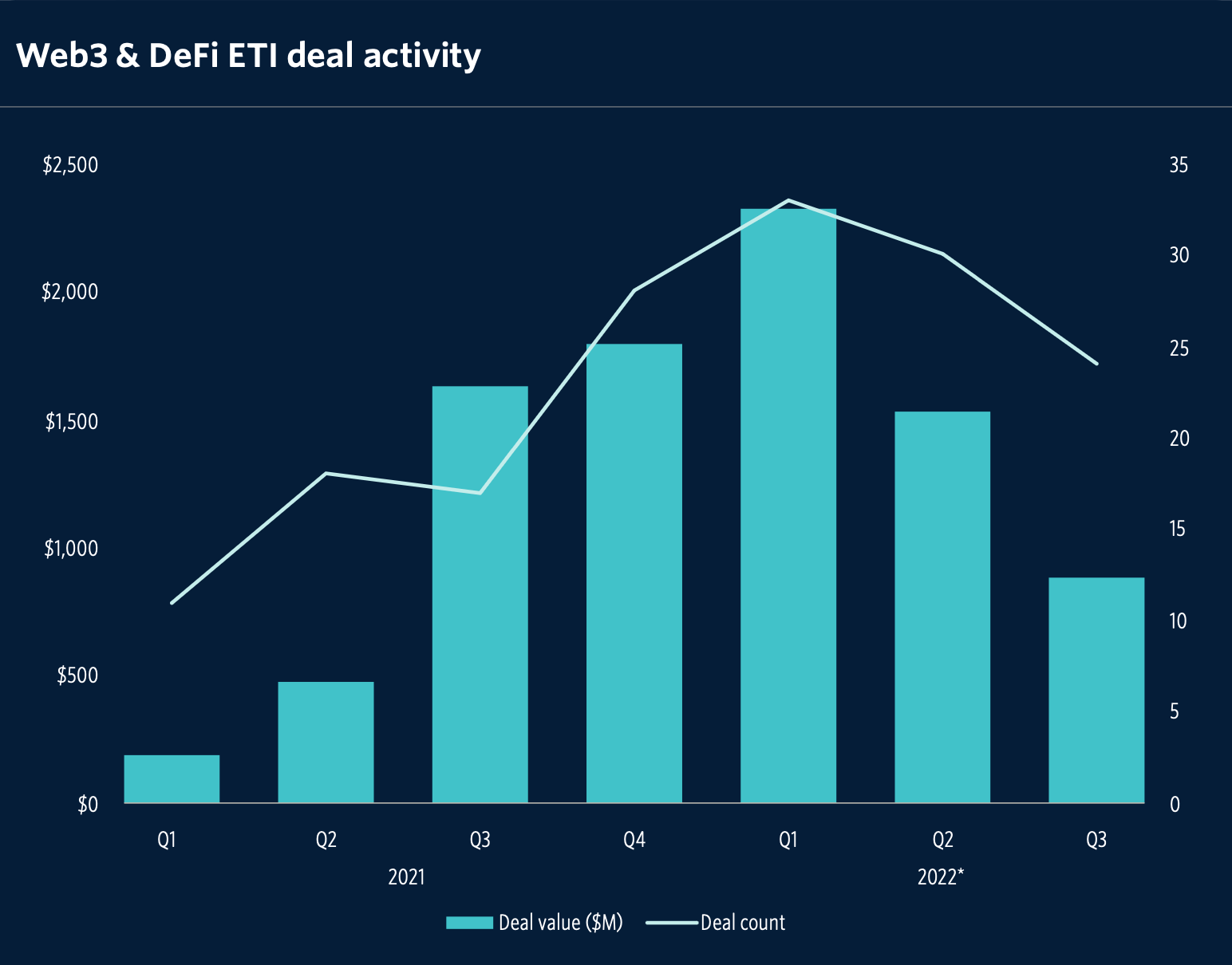

For more information, see the chart on the number and amount of deals in Web3 and DeFi by quarter. There is a clear correlation here with the overall direction of the crypto market, i.e. as its capitalisation has fallen, investor interest has also declined.

Dynamics of investment in Web3 and DeFi

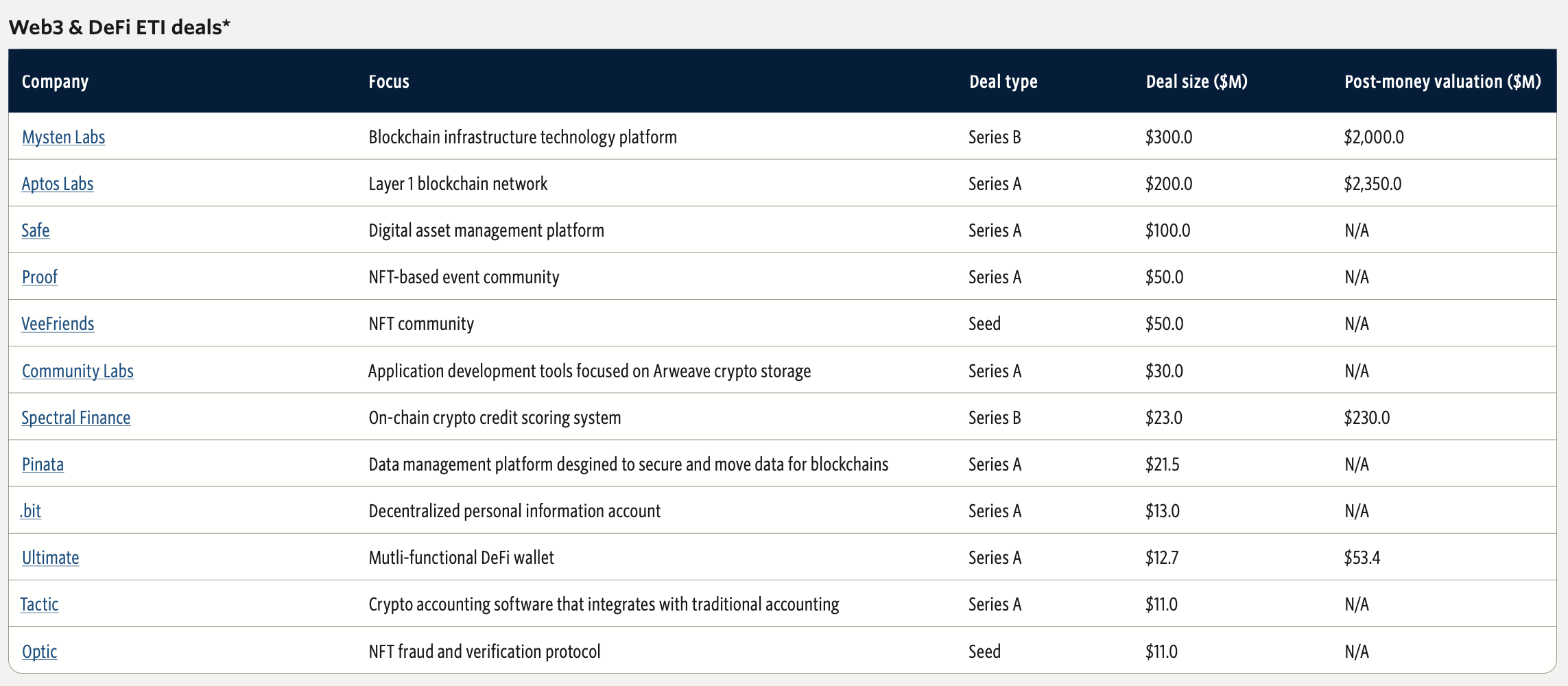

And here’s a list of the biggest deals in crypto investments. Mysten Labs and Aptos Labs led the way, raising $300 million and $200 million respectively.

Top cryptoprojects by investment

Be that as it may, the recent bankruptcy of crypto exchange FTX will lead to a further drop in investor interest in the Web3 and DeFi categories. Here’s how Pitchbook comments on this.

While the rise in investment in this category indicates sustained investor interest, the recent collapse of cryptocurrency trading platform FTX and the subsequent spread of the crisis across the industry is likely to have a negative impact on future investment levels.

And that makes sense, as investor confidence in the digital asset niche has now declined. However, this hardly makes sense: after all, the current problems for the coin industry have been triggered by the actions of centralised players, represented by cryptocurrency exchange FTX and its chief Sam Bankman-Fried. The latter has, among other things, used users' money at its own discretion, shared it with colleagues at trading company Alameda Research, and engaged in other activities that are far from ethical. At the same time, blockchain and decentralised applications continued to operate normally.

Experts also noted areas of the crypto market that are “less exposed to trading activity” and should be less affected by the crisis. This should include companies focused on developing individual blockchain projects. Market volatility should not affect them noticeably.

😈 YOU CAN FIND MORE INTERESTING THINGS FROM US AT YANDEX.ZEN!

One of the main conditions for mass adoption of decentralised finance is user-friendliness, and with that in mind, it is better to have all blockchains at your fingertips in one solution. The developers of Solana-based cryptocurrency wallet Phantom know this, and have therefore announced the addition of support for Ethereum and Polygon networks. Phantom CEO Brandon Millman said that crypto investors need a good alternative to centralised platforms after the recent FTX collapse.

Phantom

Here’s Polygon Studios CEO Ryan Wyatt’s comment on the matter.

The Polygon ecosystem is growing exponentially and we’re excited to bring more people into Web3. Working with Phantom will allow us to create a feature-rich wallet that’s ready for mainstream consumers to use when interacting with apps developed by Polygon.

Note that Phantom features user-friendly interface, intuitive NFT-token support, ability to stack SOL and more. We talked about the distinguishing features of the platform in a separate piece, which is available at the link.

Phantom wallet creation space in Solana Spaces

The developers of the wallet state that they want to make cryptocurrencies more accessible to everyone by offering a simple, easy-to-use solution with a unified interface for storing and viewing assets across multiple blockchains. The announcement also says that private beta testing of the new feature will begin in the coming weeks, with a public launch later this year.

We believe that this statistic confirms not only the potential of the digital asset industry, but also the faith investors have in it. Still, the panic in the market right now is mostly triggered by falling exchange rates, but the fundamental benefits of cryptocurrencies have not changed. Therefore, those coin enthusiasts who have spare cash to replenish their crypto stocks and are willing to wait a few years for a new bull run are taking advantage of the situation.