The pension fund has lost tens of millions of dollars because of the FTX bankruptcy. What about the rest of the companies?

The Ontario Teachers’ Pension Fund had previously invested $95 million in the FTX and FTX US trading platforms. Following the bankruptcy of the exchanges last week, the organisation issued an announcement stating that the collapse of the Sam Bankman-Fried companies would have a “limited impact” on pension payments. Investments in FTX and FTX US represent around 0.05 per cent of all assets under management at the organisation, but the damage is still measured in millions of dollars. We tell you more about what is happening.

As a reminder, several companies have previously confirmed their interaction with the FTX crypto exchange and the impact of the latter’s collapse on their normal operations. In particular, the blockchain platform BlockFi has suspended transactions as well as user withdrawals, with the company again voicing “protecting customers and their interests” as its top priority. The announcement was made at the end of last week, when the company announced the temporary suspension.

Here is the relevant publication by the platform’s staff.

BlockFi representatives’ statement on the suspension of the platform

Funnily enough, that’s where BlockFi’s management communication ended. Specifically, nothing else was posted on the company’s Twitter feed.

The latest tweet on BlockFi’s official Twitter

The same goes for the account of BlockFi founder Flori Marquez. Her activity on this social platform has so far only ended with a retweet of the post above.

Retweet of BlockFi founder Florrie Marquez

Who lost money because of FTX

Experts note that this is the second time Canadian pension funds have been featured in this kind of news. In August, one of Canada’s largest pension funds called CDPQ announced a write-down of its $150 million investment in the bankrupt Celsius Network platform.

That said, there are other pension funds outside Canada that have been indirectly linked to FTX and other entities under Bankman-Fried. For example, Alaska Permanent Fund Corp. and Washington State Investment Board have invested in the Global Growth Fund III investment product from investment firm Sequoia Capital.

FTX CEO Sam Bankman-Fried

The latter last week also issued an announcement regarding FTX and said its investment in the platform was “limited”. According to Decrypt’s sources, the firm has invested $150 million in FTX and FTX US, but has $7.5 billion in unrealised and realised profits, so the impact from the FTX collapse should not be significant.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

Earlier, cryptocurrency exchange Binance CEO Changpen Zhao said that regulators and the cryptocurrency community in general need to pay more attention to the issue of exchange control. Binance has also released a proof of concept for its own reserves. Its example has already been followed by other major trading platforms – OKX, Kucoin and Crypto.com.

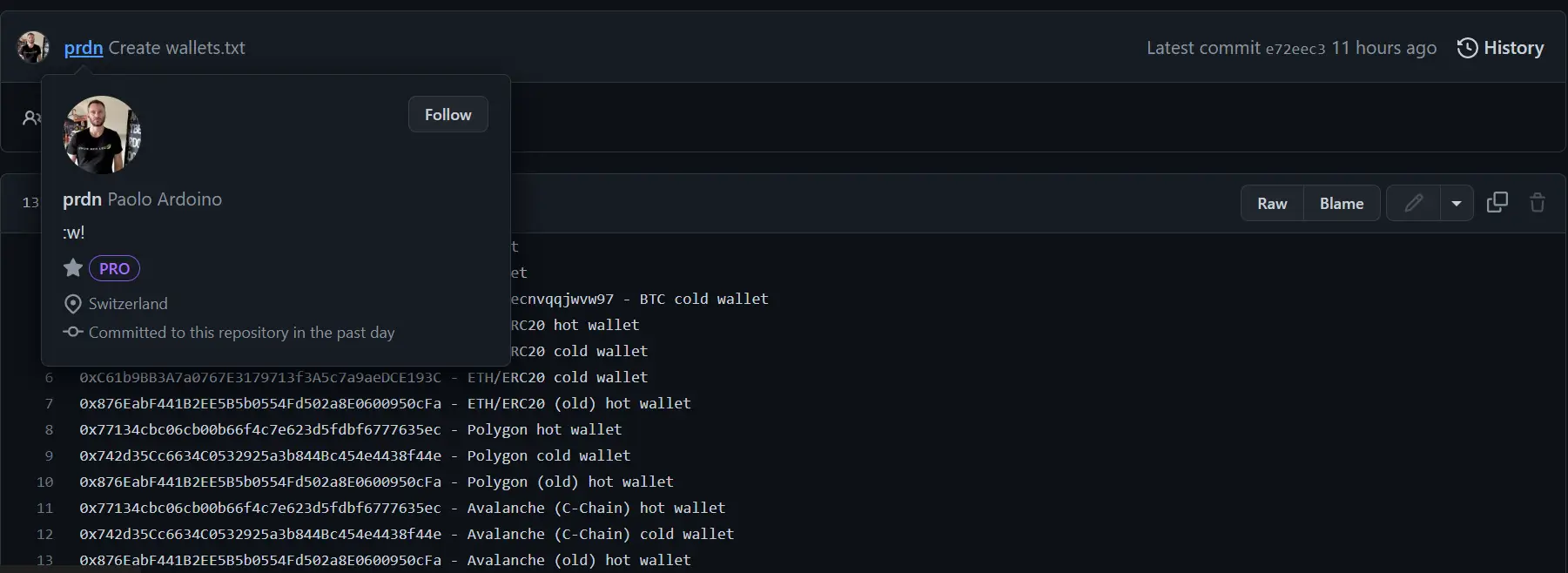

The Bitfinex exchange, which is closely linked to stabelcoin issuer Tether, has also joined their ranks. Bitfinex chief technology officer Paolo Ardoino published a list of the exchange’s main cryptocurrencies, which was last updated on 11 November.

Proof of Bitfinex reserves

More proof of Bitfinex reserves can be assessed on GitHub. There are 135 cryptocurrencies here. Ardoino also listed the platform’s main reserves in the most popular cryptocurrencies: 204338.17 BTC and 1,225,600 ETH.

In June 2018, Bitfinex developed an open-source library called Antani, which aimed to provide transparency in terms of solvency confirmation, storage and delegated vote confirmation. Ardoino confirmed Bitfinex's plans to revive the system, which will allow users to verify their balances without compromising privacy.

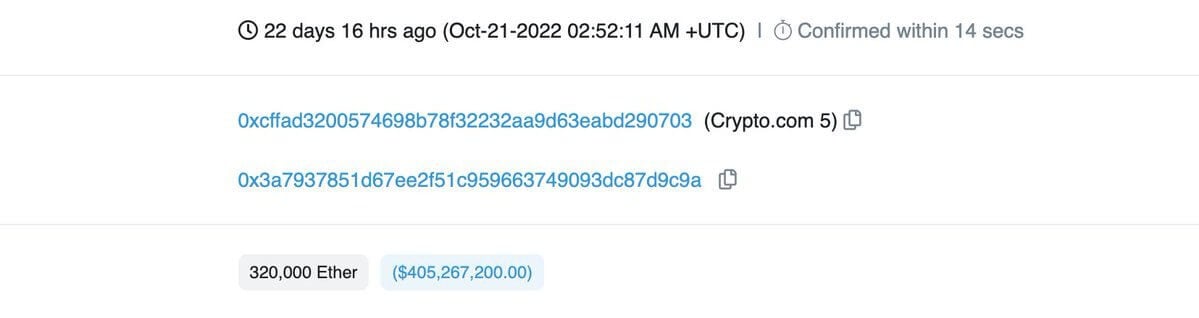

Note that over the weekend, members of the blockchain community noticed strange blockchain transactions involving popular exchanges. Specifically, on October 21, crypto exchange Crypto-com sent 320,000 ethers to the Gate-io platform, the equivalent of 82 percent of its current ETH holdings. Here’s the corresponding transaction.

Transfer of 320,000 ethers from Crypto-com to the Gate-io platform

As platform manager Chris Marsalek noted, the coins were supposed to go to a new cold storage facility. However, ETH ended up being mistakenly transferred to another exchange from the approved address list, or so-called white list.

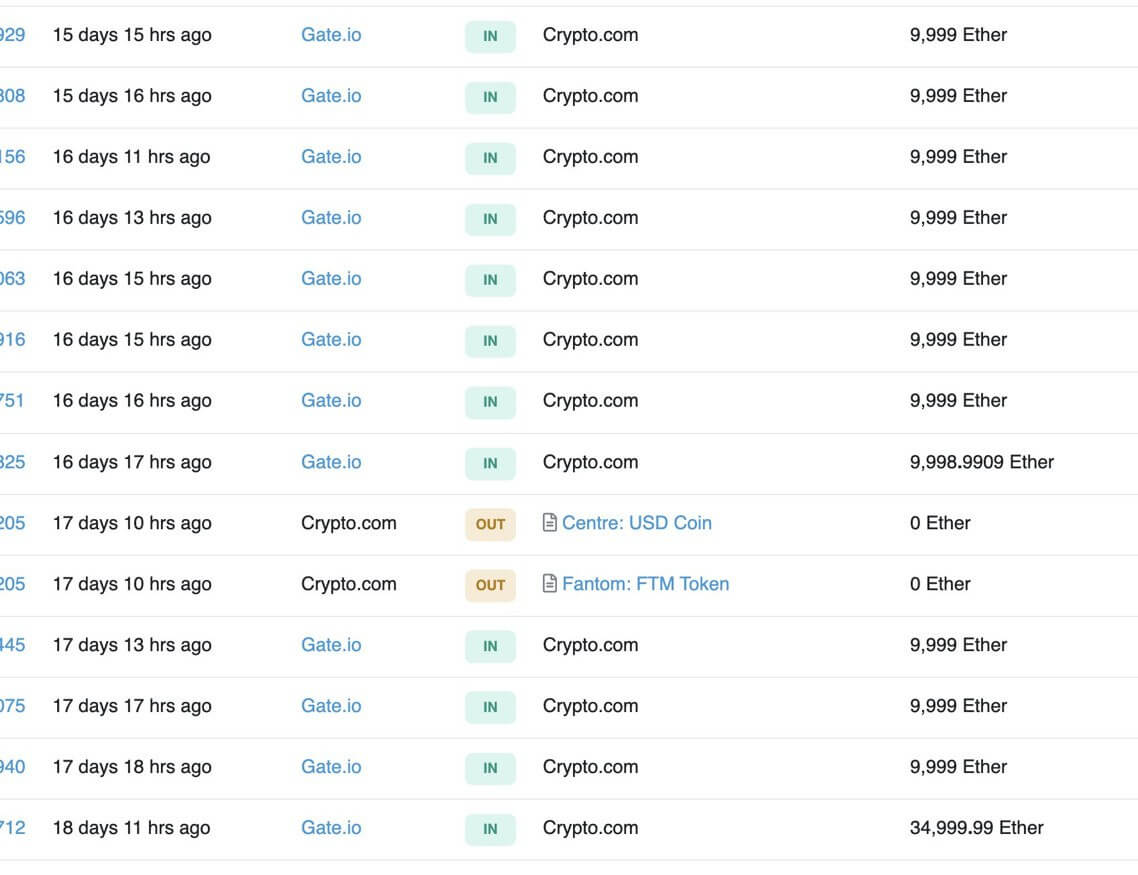

A week later Gate-io returned 285 thousand ETH to Crypto-com exchange, which is noticeably less than the 320 thousand previously sent.

Return of 285 thousand ethers from Gate-io to Crypto-com exchange

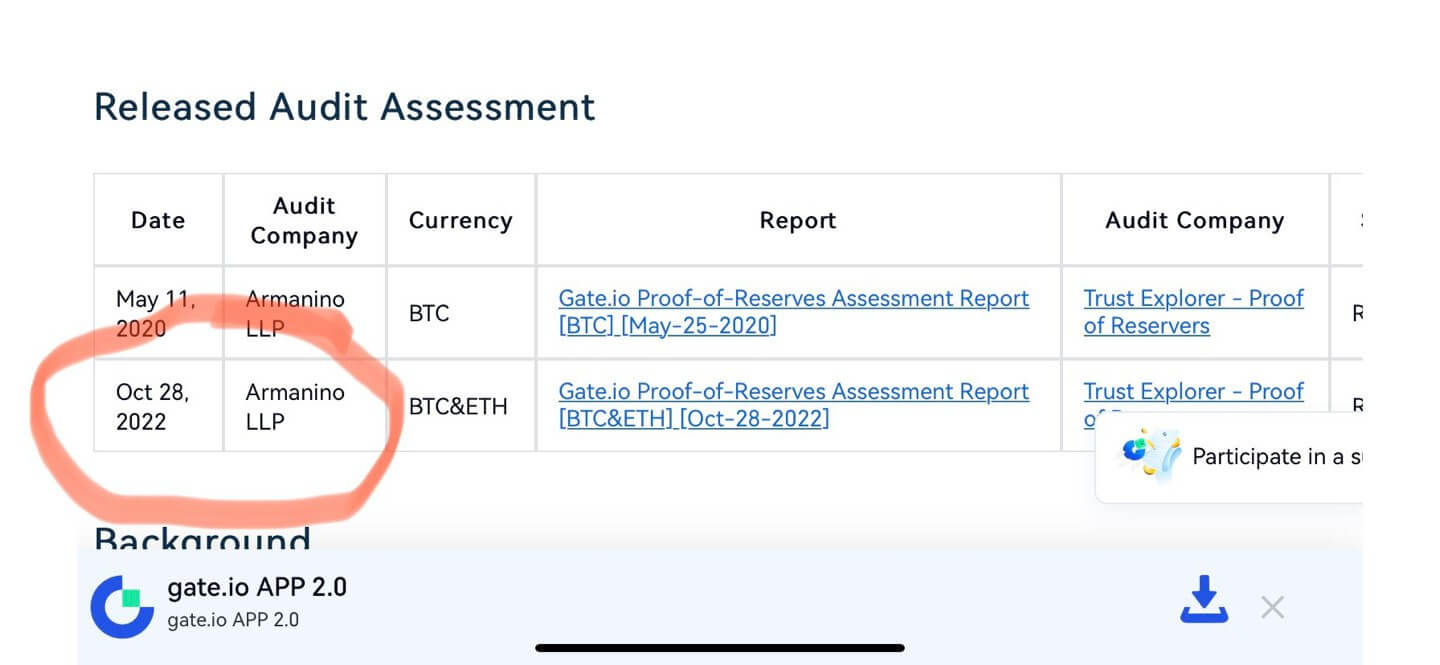

It turns out that a week after the “accidental” transfer, the Gate-io platform staff issued proof of reserves to the public. Here’s the corresponding report.

Gate-io’s report on its own assets

The money was then sent back – albeit not in full. Accordingly, exchange representatives clearly did not think anyone would notice such transactions. Especially since they had been made in advance.

Binance founder Changpen Zhao reacted to the news on his Twitter. Here’s his rejoinder.

If an exchange is forced to move large stocks of cryptocurrencies before and after its own blockchain demo, it’s a sure sign of trouble. Stay away from something like this and stay safe.

That said, Crypto-com head Chris Marsalek said today that the exchange’s balance sheet is robust and the impact of the FTX crash was minimal. After transactions like this, however, there are doubts about this.

Binance CEO Changpen Zhao

We believe that many companies will indeed face financial and operational problems due to their relationship with FTX. However, sooner or later this will come to an end and the impact of a major trading platform's collapse on the industry will be much less. So here one is only left to agree with the words of Binance chief executive Changpen Zhao. He said that the current developments are a cleansing of the cryptocurrency industry, which at the same time has proved to be "a bit painful".

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. MORE INTERESTING NEWS HERE.