The worst November for Bitcoin since 2018 comes to an end. What’s next for the cryptocurrency market?

With November coming to an end in a couple of days, it’s time to take stock for Bitcoin and look at the main indicators that could affect its price for the rest of the week. This has been one of the worst months in history for the crypto industry, both in terms of fundamental news and technical analysis. Still, the major crypto exchange FTX went bankrupt at the beginning of the month, causing BTC to fall to a new low. Will the price stay at current levels for long, and what is in store for us in the near future? Let’s break down three key factors that will help clarify this situation.

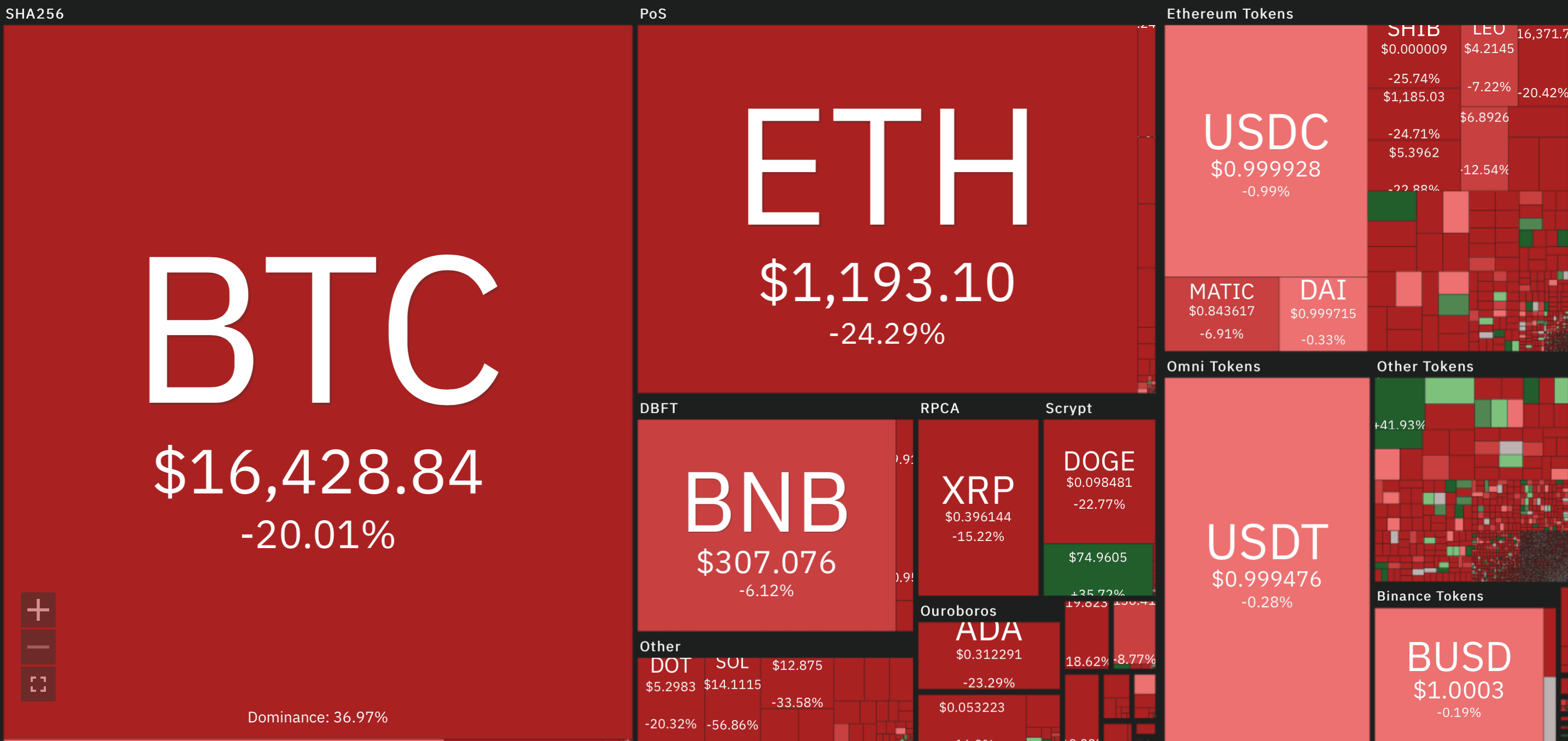

Note that November has indeed been a painful November in the history of the cryptocurrency market. This is especially noticeable due to the changes in coin exchange rates since the first of the month. It looks like this.

Changes in cryptocurrency rates from the first of November to today

Against the backdrop of what’s happening, major media outlets are publishing articles that cryptocurrencies could supposedly fall to zero. And this is quite popular rhetoric as the coin industry nears its bottom. Here’s an example of such a thing with The Wall Street Journal.

An article in The Wall Street Journal about cryptocurrencies allegedly being ready to die

What’s happening to Bitcoin miners

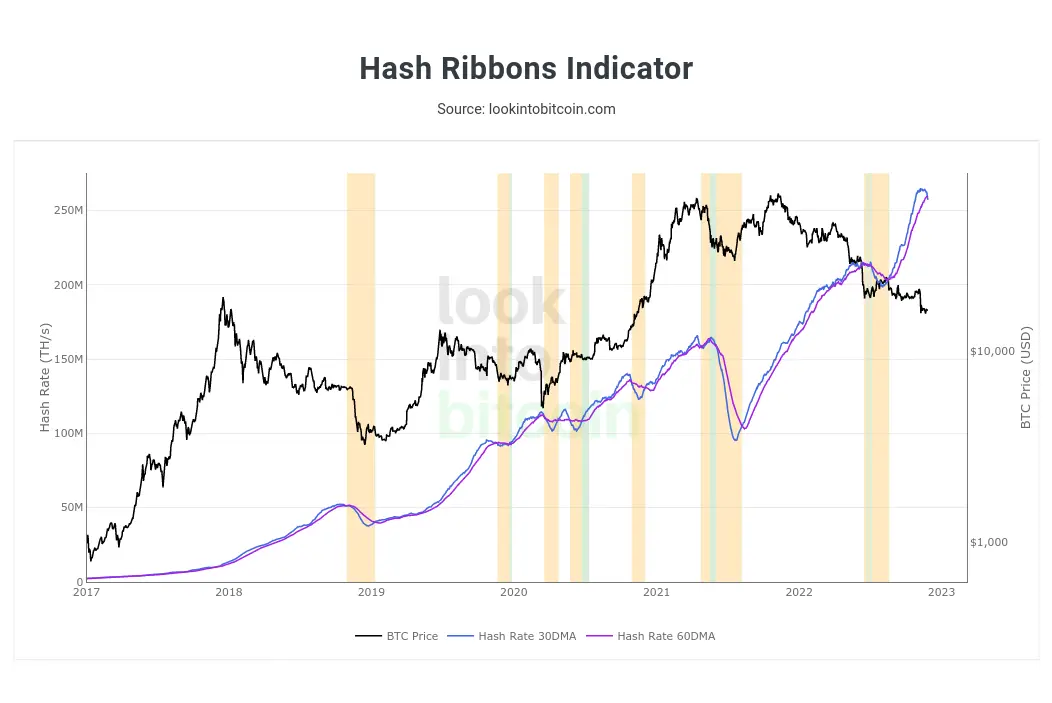

The so-called Hash Ribbons indicator, which shows the average hash rate trend over the past 30 and 60 days, signals a continued rough patch for Bitcoin miners. With the cryptocurrency’s price falling and hash rates continuing to rise, many miners’ business profitability has dwindled to near zero – and at times turned negative.

Hash Ribbons indicator

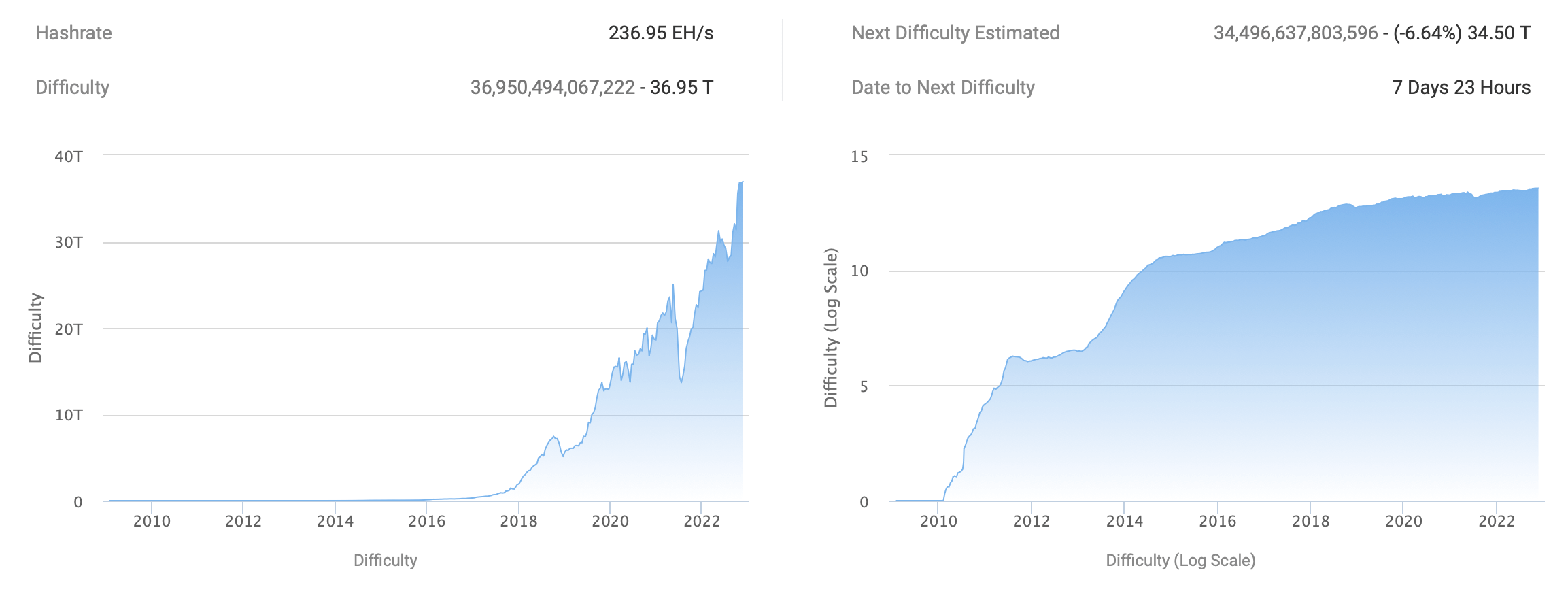

As a reminder, the main inconvenience for miners right now is the record difficulty of mining Bitcoin. It means that the profitability of mining the cryptocurrency for each individual ASIC miner is now as low as ever. The rising cost of energy, which has traditionally been a major expense category for owners of computing equipment, is also having an impact.

The chart above shows the crossing of the aforementioned average hash rate moving lines, which suggests a massive sale of BTC at a loss from miners’ reserves. Here’s how analyst Kripto Mevismi of Glassnode, cited by Cointelegraph, comments on the situation.

The complexity of Bitcoin mining is really high now, which means costs are rising. Doing business in such an environment is becoming increasingly difficult. That’s why miners are not operating at their full capacity. If they have efficient next-generation equipment, they get it up and running, but that’s about it.

According to the BTC-com platform, the next recalculation of Bitcoin mining complexity will take place on December 6.

Hashrate and mining complexity

Taking into account the local decrease in hashrate, the complexity should tentatively drop by 6.6 percent. This would then be the biggest collapse in the index since July 2021.

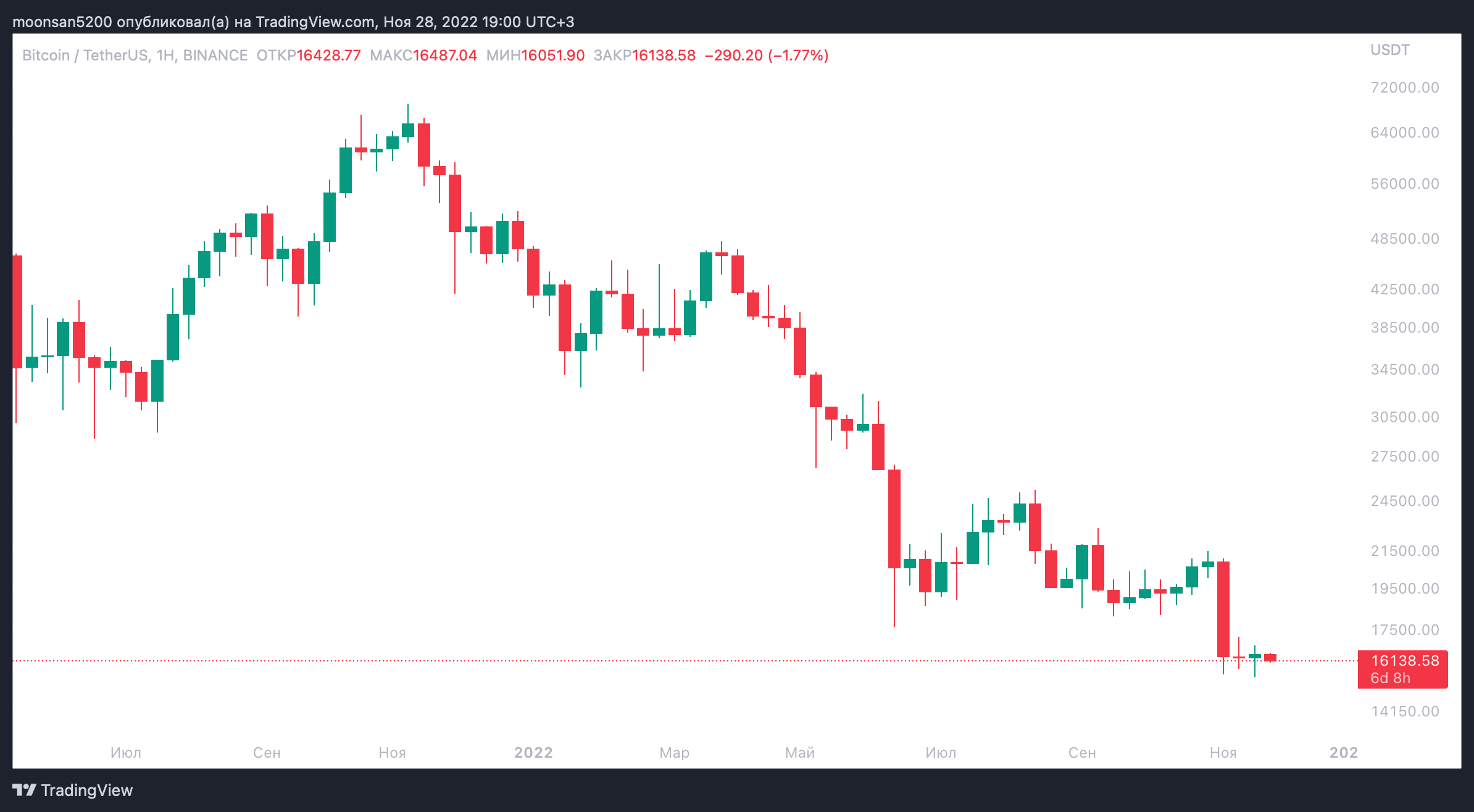

Worst November for Bitcoin

On the scale of the 1-week chart, the price of the major cryptocurrency continues to fluctuate around $16,000. The last notable red candle was the week in which it became apparent that the FTX collapse was already imminent. At that time, the coin market was falling particularly hard.

Bitcoin exchange rate on the scale of the 1-week chart

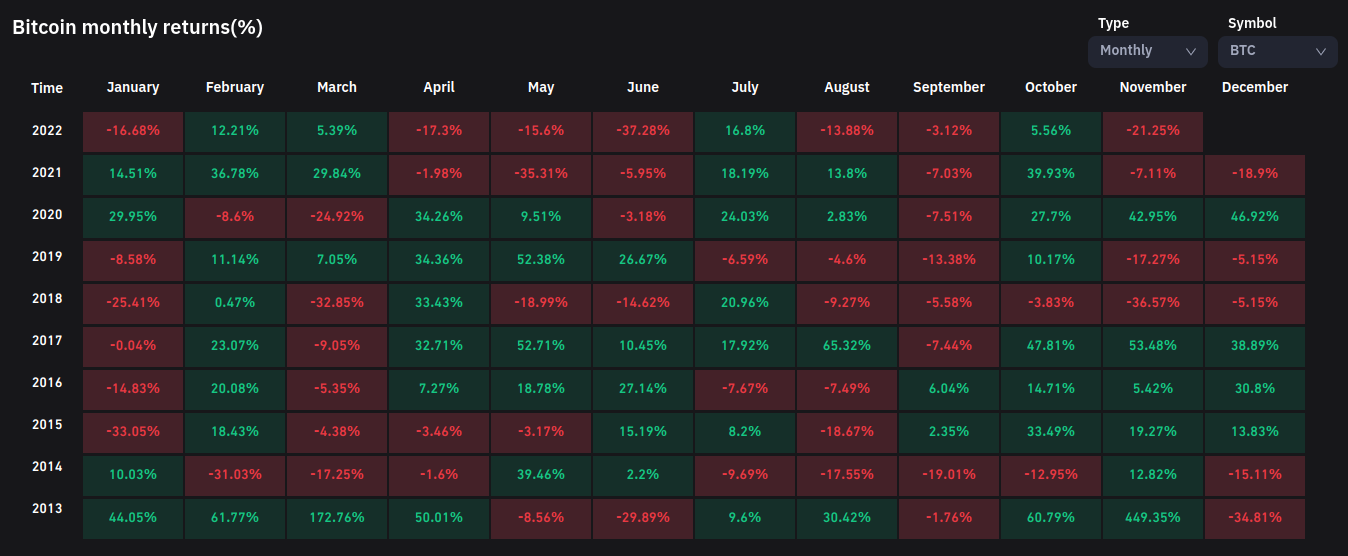

If the chart does not register any significant changes in the next couple of days, the profitability of Bitcoin investments this month will be at -21.25 percent. This would then be the worst November for the BTC price since 2018.

Bitcoin returns by month

As a reminder, it was previously reported that the major cryptocurrency had almost reached its bottom. The problem, though, is that the price of Bitcoin can now fluctuate for quite some time without noticeable volatility around the current support level.

Are investors buying cryptocurrencies

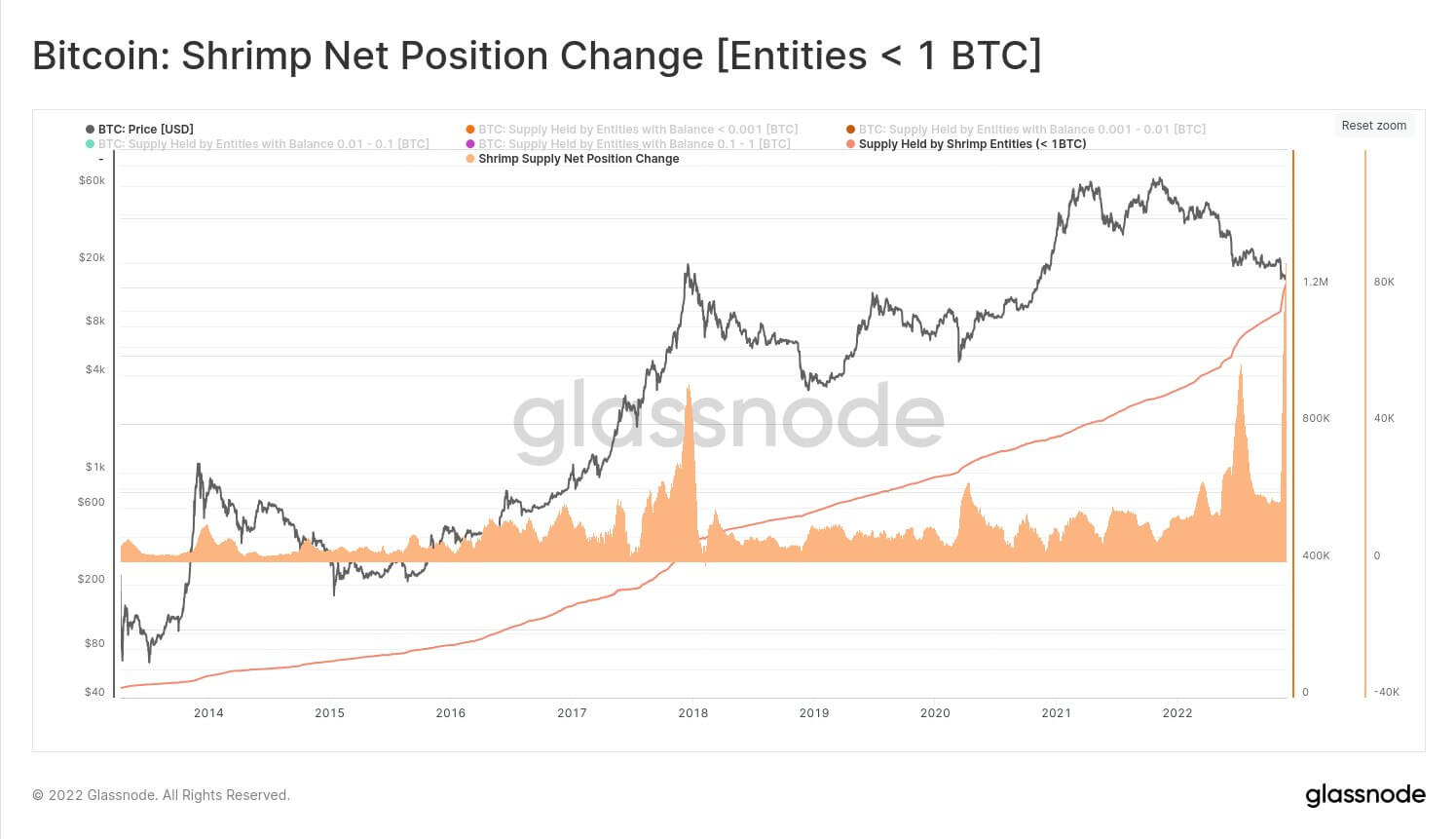

According to Decrypt’s sources, after the FTX collapse, so-called “shrimpers” bought another 96,200 BTC, which was the largest purchase by this category of investors on a monthly scale. They now have at least 1.21 million BTC or 6.3 per cent of the circulating supply of the major cryptocurrency in their wallets.

Changes in the number of cryptocurrency wallets ‘shrimp’

Cryptocurrency players are tacitly divided into several categories based on the amount of funds in their wallets. "Shrimpers" are small investors with balances of up to 1 BTC. Then come the "crabs", who may have 0.1 to 10 BTC in their account.

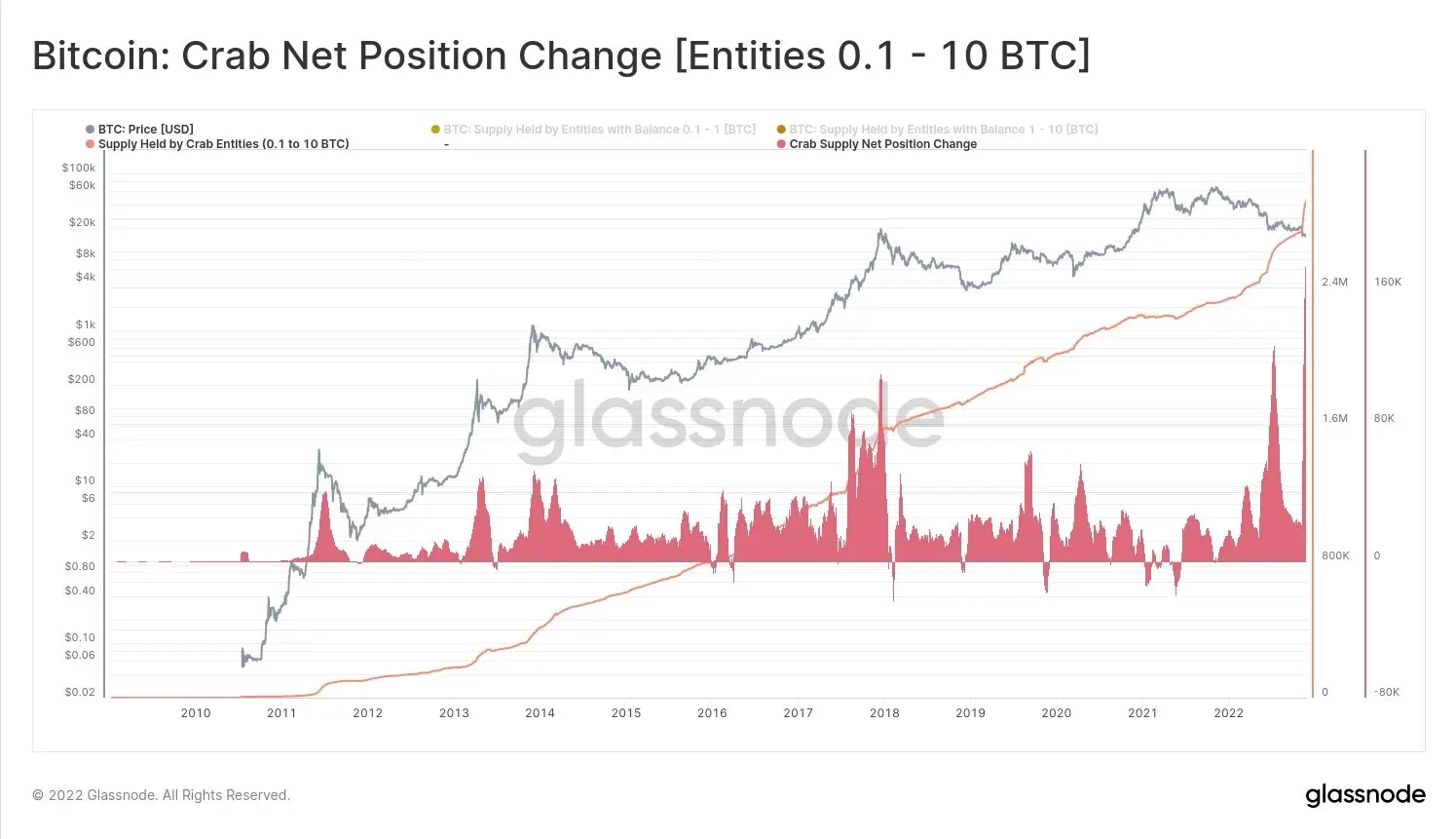

The “crabs” also show the historical peak of their activity, and this fact was commented in the publication by analysts of Glassnode.

Crabs with balances up to 10 BTC have also seen aggressive purchases totaling 191,600 BTC during the last thirty days. This is a historic high, eclipsing the peak of July 2022, when crabs bought 126,000 BTC in a month.

Changes in the number of cryptocurrency wallets “crabs”

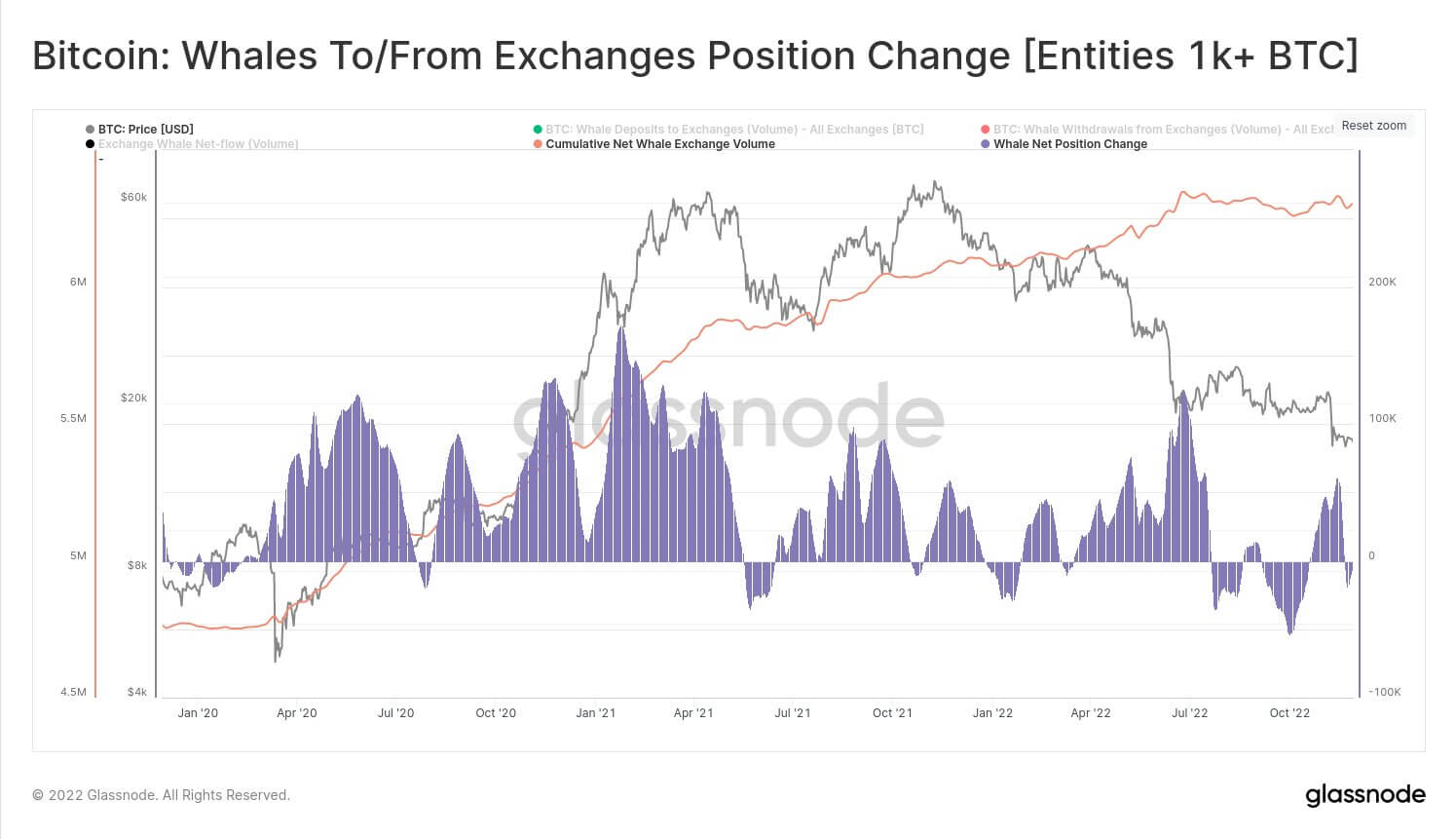

On the other hand, “crabs” with at least a thousand BTC are the leaders in transferring their savings to exchanges. They have sent at least 6,500 BTC to trading platforms in the last 30 days alone. But it’s still not much, as this largest category of market players owns 6.3 million BTC.

Dynamics of coin sales by “whales”

The rapid accumulation of the cryptocurrency by ordinary individual investors likely speaks to the belief of many investors that Bitcoin may have already hit rock bottom. Consequently, the cryptocurrency’s price has become low enough to be worth investing in. At the very least, that is the conclusion that can be drawn from buying activity.

We believe that the digital asset market will survive this situation as well. This is not the first time cryptocurrency crashes of this scale have happened, but each time the coins have not only gone through such a situation, but have eventually moved on to the bull run stage. Obviously, sooner or later it will happen again.