What will be the long-term impact of the FTX collapse on the cryptocurrency industry: Binance CEO’s response

The collapse of cryptocurrency exchange FTX is just the tip of the iceberg seen by the cryptocurrency community last week. This was stated by Binance CEO Changpen Zhao, who was one of those who “pushed FTX towards the abyss” with his announcement of the sale of the FTT exchange’s native token and his refusal to buy FTX just one day after announcing the preliminary deal. The Binance executive was right: the problems with FTX are indeed enormous, but the platform’s collapse also “set the crypto industry back several years” in development, as Zhao himself also admits. So what will be the long-term consequences of what happened?

As a reminder, last week former FTX CEO Sam Bankman-Fried officially acknowledged the financial collapse of his exchange - a bankruptcy filing has been filed on its part. Events around FTX have been moving swiftly over the past couple of weeks.

In that same period of time it was revealed that the former head of FTX, among other things, misused the funds of users, in addition, he managed to share about 10 billion dollars with a trading company he founded, Alameda Research. All in all, Sam’s sins are plenty – and that’s bad news for the entire blockchain industry.

FTX platform head Sam Bankman-Fried

What’s next for cryptocurrencies

According to Zhao, FTX’s bankruptcy will lead to increased scrutiny of cryptocurrencies by financial regulators. In addition, the crisis will undermine ordinary investors’ confidence in Bitcoin and altcoins. Here’s a quote from the head of Binance on the matter.

I think we are set back a few years. Regulators will rightly have much more control over this industry, which frankly is probably even a good thing.

And here is the full version of Zhao’s interview at the Indonesia Fintech Summit 2022 event. We recommend watching it if you can hear the English language and want a better understanding of the topic.

For quite some time, regulators have relied on two key elements of crypto controls – the customer identity verification procedure (KYC) and the anti-money laundering (AML) set of principles. Centralised trading venues could not freely conduct business without complying with KYC and AML requirements. According to Zhao, these two elements alone are not enough.

Still, in this case, the cause of the problems was an FTX executive who, among other things, used a backdoor to surreptitiously transfer funds to Alameda representatives. As the researchers found out, it had no effect on the company's balance sheets, meaning FTX representatives were not aware of what was going on.

Zhao insists that regulators should focus on the exchanges themselves. In other words, they should take a closer look at their business models, check their reserves and introduce the practice of transparency of exchanges’ funds. Incidentally, Binance is already doing the latter – it recently published a preliminary proof of its reserves, which you can read more about at this link.

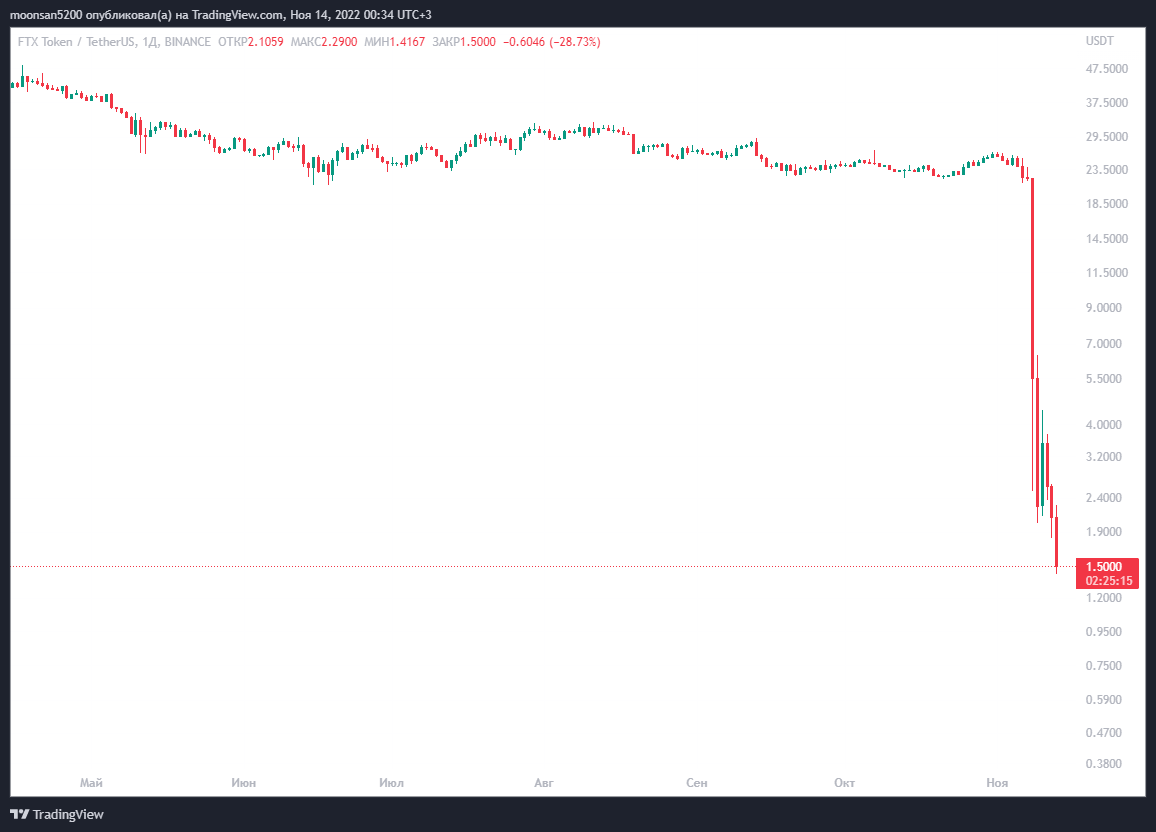

FTT token price drop

According to Cointelegraph’s sources, FTX’s problems will have a direct impact on those who held money there. Other ordinary investors will feel indirect problems in the form of falling cryptocurrency prices, but the implications for the entire crypto industry will be serious. In particular, it now needs a new system of risk regulation on a large scale. About FTX itself, Zhao left the following comment.

The last three days have only laid bare the problems that already existed. They had existed for quite some time before that. The crisis did not form in a matter of days.

For Zhao, the latest warning sign about FTX were the financial reports from Alameda Research, the trading company founded by Bankman-Friede. As it turned out, it was holding a significant portion of its reserves in FTT and was using the tokens to lend to itself in order to postpone the collapse of the entire system. That’s why Zhao had previously announced the sale of all FTTs from the exchange’s reserves, and by the end of last week it was reported that token trading on Binance had been suspended.

The day after the FTT sale was announced, Zhao was approached by Bancman-Fried, offering a deal that “made no sense from several angles at once”. But the Binance executive allegedly wanted to come to an agreement anyway to save FTX customers’ funds. He continues.

Initially we wanted to save users, but then news of misappropriation of customer funds – and especially investigations by US regulators – made us realise that we could no longer do that.

FTX CEO Sam Bankman-Fried

Changpen Zhao also shared news for the blockchain industry today. Here’s his quote from Twitter.

To mitigate the further cascading negative impact of the FTX situation, Binance is forming an industry recovery fund. Its aim is to help projects that are generally strong but are also experiencing a liquidity crisis. More details will emerge shortly.

Changpen Zhao, head of cryptocurrency exchange Binance

We believe that what is happening now is just one page in the history of digital assets and certainly not the end of it. Bitcoin survived the collapse of crypto exchange Mt. Gox, which accounted for the vast majority of crypto transactions at the time, but that has not prevented BTC from becoming much more popular and increasing in value since the platform collapsed. That will obviously be the case with FTX: the Bankman-Fried project is shut down and relegated to the dustbin of history, while the cryptocurrency industry will continue to grow steadily once the niche situation is at least stable.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There we will discuss other important developments related to the blockchain and decentralisation industry.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THERE’S EVEN MORE INTERESTING NEWS HERE.