A class action lawsuit has been filed against the creators of the iconic NFT collection. What didn’t the investors like?

Justin Bieber, Paris Hilton, Jimmy Fallon and Madonna are all involved in a new lawsuit against Yuga Labs’ “misleading advertising” for popular NFT projects. At the heart of the case is a collection of unique Bored Ape Yacht Club (BAYC) tokens. The plaintiffs in the case are Adam Titcher of California and Adonis Real of Florida, investors who had previously purchased the non-interchangeable tokens of the aforementioned projects. We tell you more about what’s going on.

Note that this is not the first lawsuit related to the cryptocurrency industry this month. Last week in particular, a federal judge in California, Michael Fitzgerald, dismissed a class action lawsuit against several celebrities, including Kim Kardashian and Floyd Mayweather. The lawsuit, which was filed earlier this year, was based on their advertising of a worthless cryptocurrency project, EthereumMax (EMAX).

According to the judge, the authors of the lawsuit should not have acted under the influence of one-day trends, i.e. essentially trusting celebrity advertisements. While such an argument sounds logical, newcomers to the crypto world usually do not know how to research projects on their own. On top of that, they may not even be aware of the different cycles within the coin market and the extent of the industry’s collapse during a so-called bearish trend.

Cryptocurrency market sagging

That said, Kim Kardashian has previously paid a $1.26 million fine for this ad. The author of the claim at that time was the US Securities and Exchange Commission.

What the NFT is being criticised for

The lawsuit, filed on behalf of investors by John Jasnock of Scott+Scott Attorneys at Law LLP in the US District Court for the Central District of California, focuses on the excessive hype surrounding the BAYC universe. “The ‘value’ of the tokens Titcher and Real acquired was allegedly based entirely on the fact that their investment could give them access to an ‘elite club of investors’, Coindesk reports.

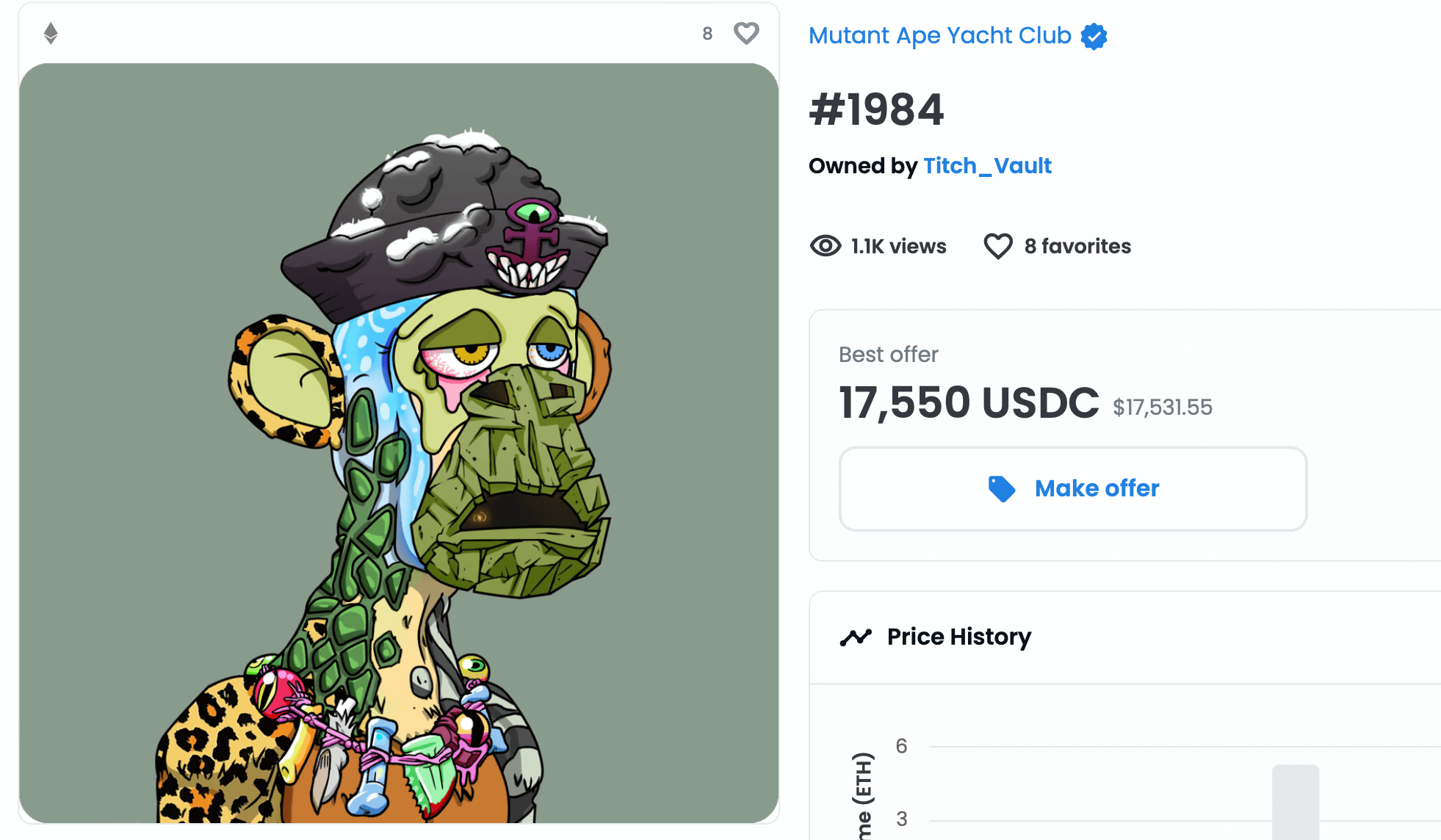

Titcher purchased Mutant Ape Yacht Club token #1984 in August 2021. The purchase cost him 5.3 ETH, or about $17,000 at the coin’s exchange rate at the time.

Mutant Ape Yacht Club token #1984

In April this year, the investor also received Otherdeed for Otherside token #16235, which is now priced at around 1.16 WETH.

Otherdeed for Otherside token #16235

Meanwhile, Real bought ApeCoin (APE) tokens, which are also closely related to the BAYC universe. That said, the court documents do not disclose the exact amount of tokens it purchased.

A total of 37 defendants are named in the lawsuit, including the management of Yuga Labs, payment platform MoonPay and its CEO Ivan Soto-Wright, Reddit co-founder and investor Alexis Ohanian, popular NFT creator alias Beeple and many others.

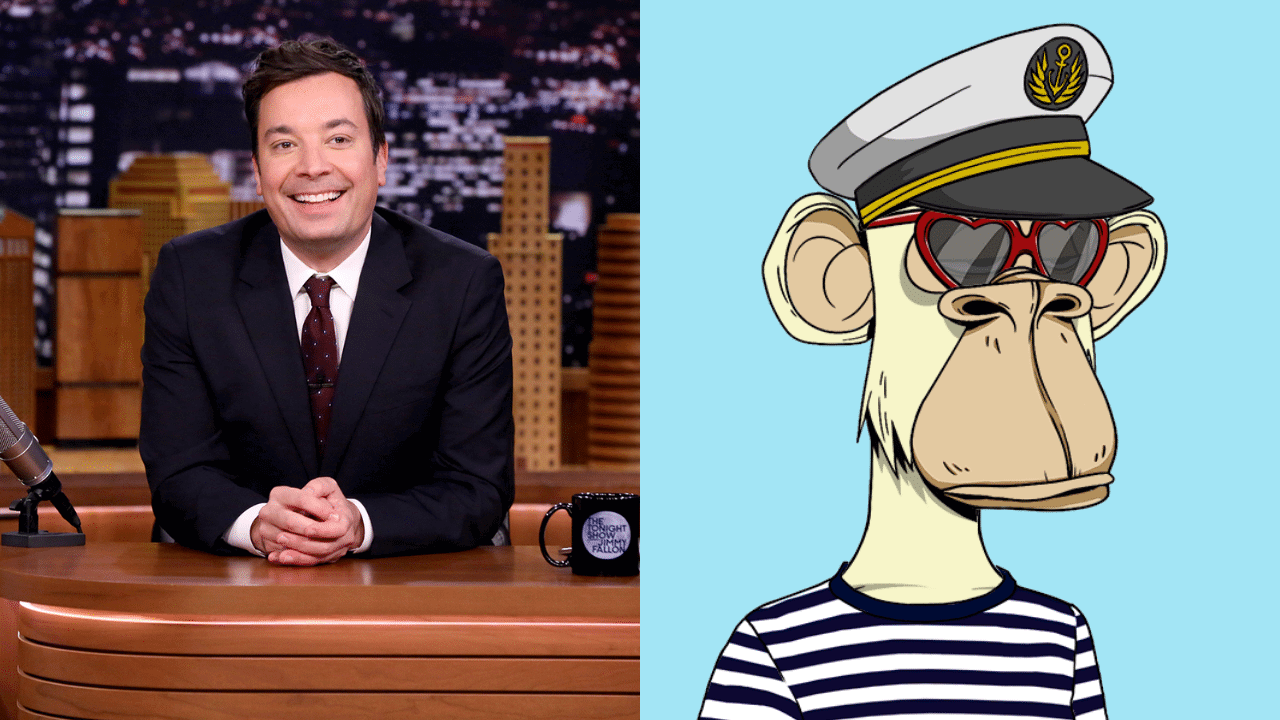

Jimmy Fallon’s BAYC token

The plaintiffs claim that BAYC and related NFT universe projects “largely impose the view that joining an elite private club brings investors status and gives them access to events, benefits and other lucrative investment opportunities exclusive to token holders.” Here’s the relevant quote.

The exclusivity of the BAYC membership was based entirely on the inclusion and support of very influential celebrities.

Note that the promotion of the Bored Ape Yacht Club collection has indeed been active. What a mention of the NFT during an airing of the Jimmy Fallon show, which included Paris Hilton. Here is this clip, and the mention of this collection occurs at the end.

However, a Yuga Labs spokesperson called the claims “opportunistic and parasitic”. In other words, the case is allegedly being used solely for the opportunity to make money from a popular project. Here’s the rejoinder.

We firmly believe they are baseless and look forward to seeing proof of this.

BAYC

All in all, this is not the first time Scott+Scott lawyers have tried to wage a legal war against celebrity promotional campaigns in the cryptosphere. The firm was also behind a proposed class action lawsuit filed against Kim Kardashian and Floyd Mayweather over their promotion of the EMAX token.

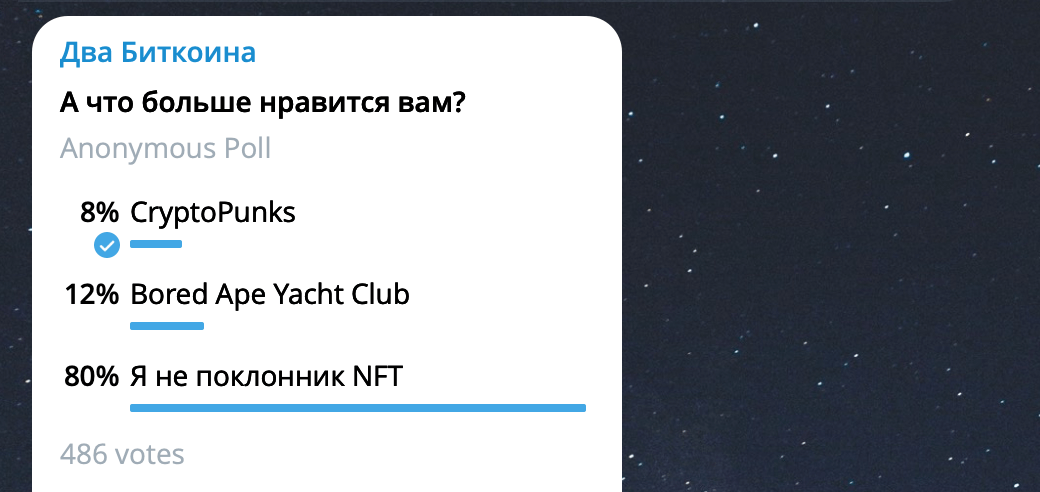

That said, we previously asked subscribers to 2Bitcoin's Telegram channel which collection they liked better - Cryptopunks or Bored Ape. It turned out that the latter is still more popular, although most subscribers are not interested in the topic of non-interchangeable tokens.

Results of the poll about NFT tokens in the 2Bitcoin channel

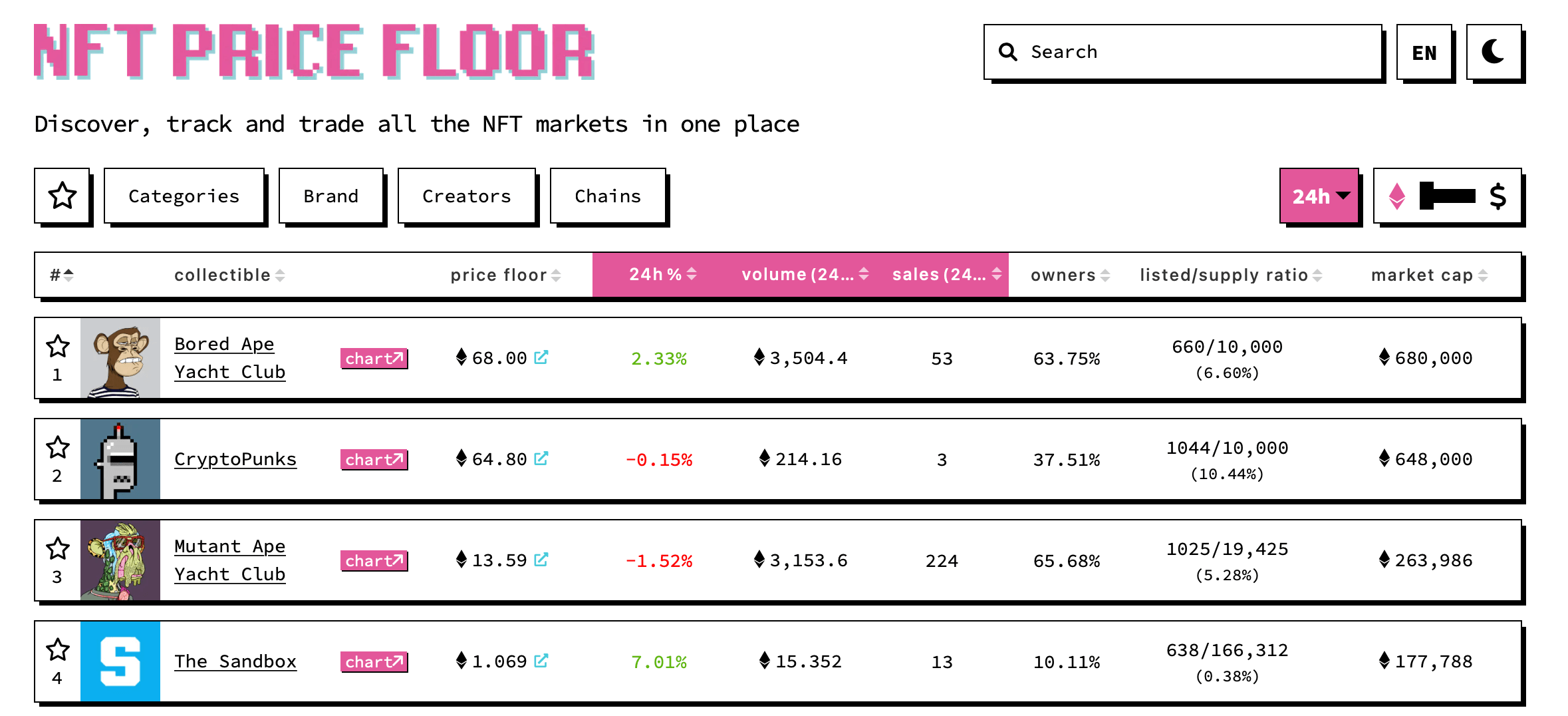

Overall today, Bored Ape Yacht Club remains the most expensive and most popular NFT collection. The corresponding ranking looks like this.

The most popular NFT collections by their lowest price

We find it rather difficult to predict the outcome of this lawsuit. Still, by analogy with the EthereumMax token case, the judge may state that investors should not have trusted the promotion of the collection, and the reason for this situation was their inflated expectations. In addition, we can remember the bearish trend, during which the value of crypto-assets predictably falls. And NFT is no exception here.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THERE’S EVEN MORE INTERESTING NEWS HERE.