Analysts and traders tell if Bitcoin price could fall to $10,000

After the bankruptcy of cryptocurrency exchange FTX, Bitcoin’s price plummeted to a new low in the last couple of years. Prior to that, the cryptocurrency had been hovering around the $20,000 line, which had become psychologically important for traders. However, now another level – the round number of $10,000 – is attracting attention on the chart. Will BTC fall that low? Experts have different opinions on this matter, so let’s try to understand and substantiate the most interesting points of view.

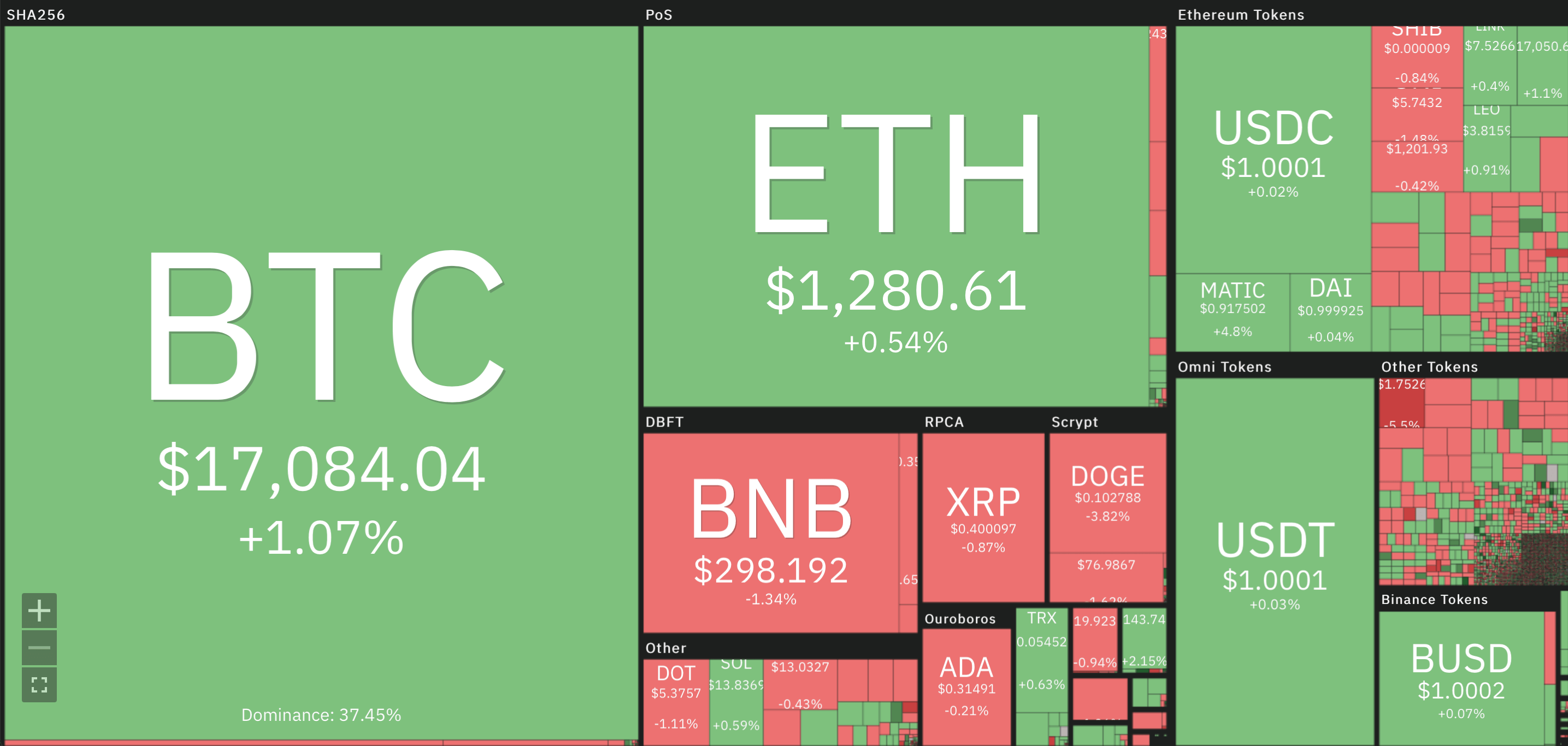

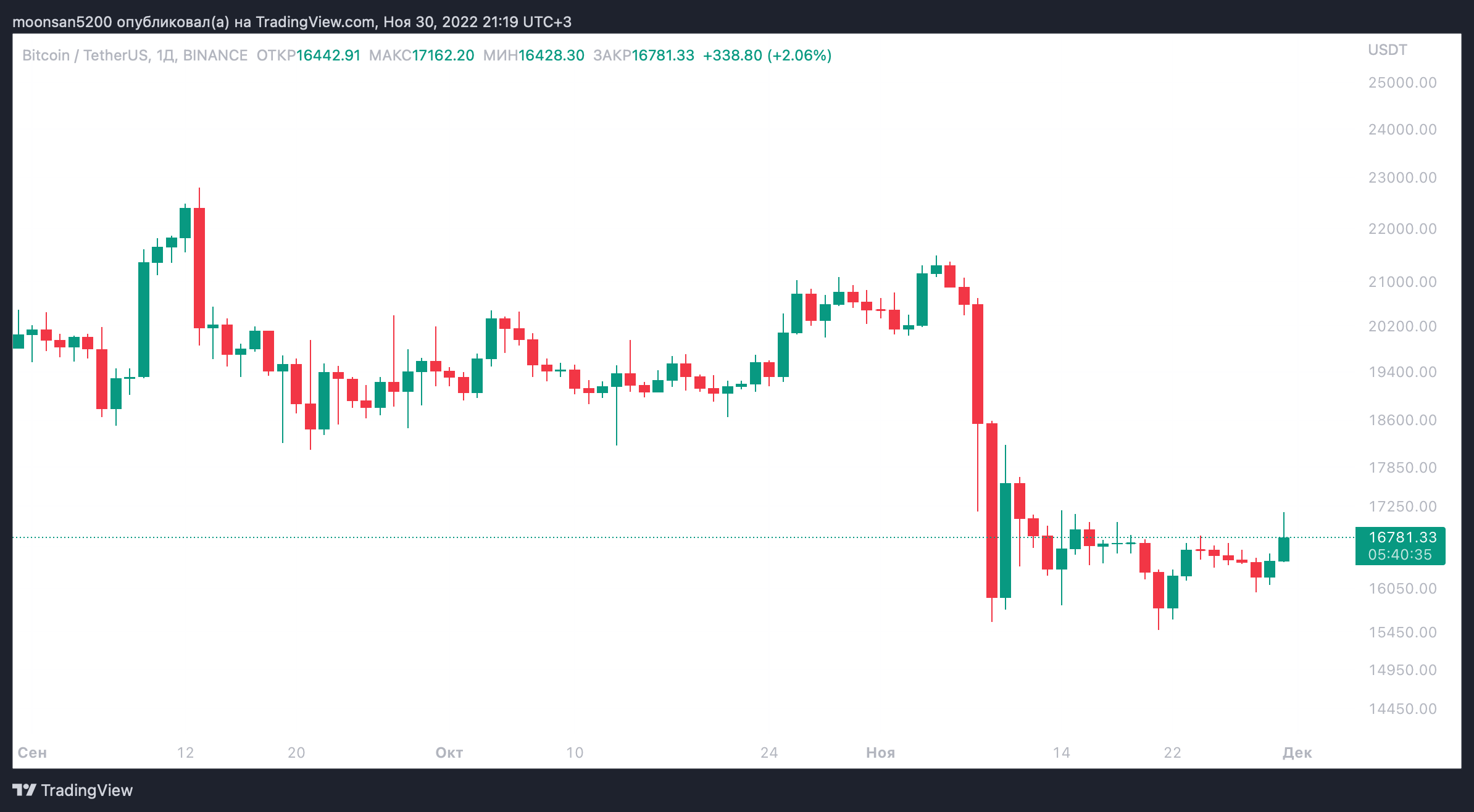

It should be noted that right now the market looks relatively good. Particularly, yesterday BTC managed to jump above $17K and it has tentatively settled there so far.

Cryptocurrency rates today

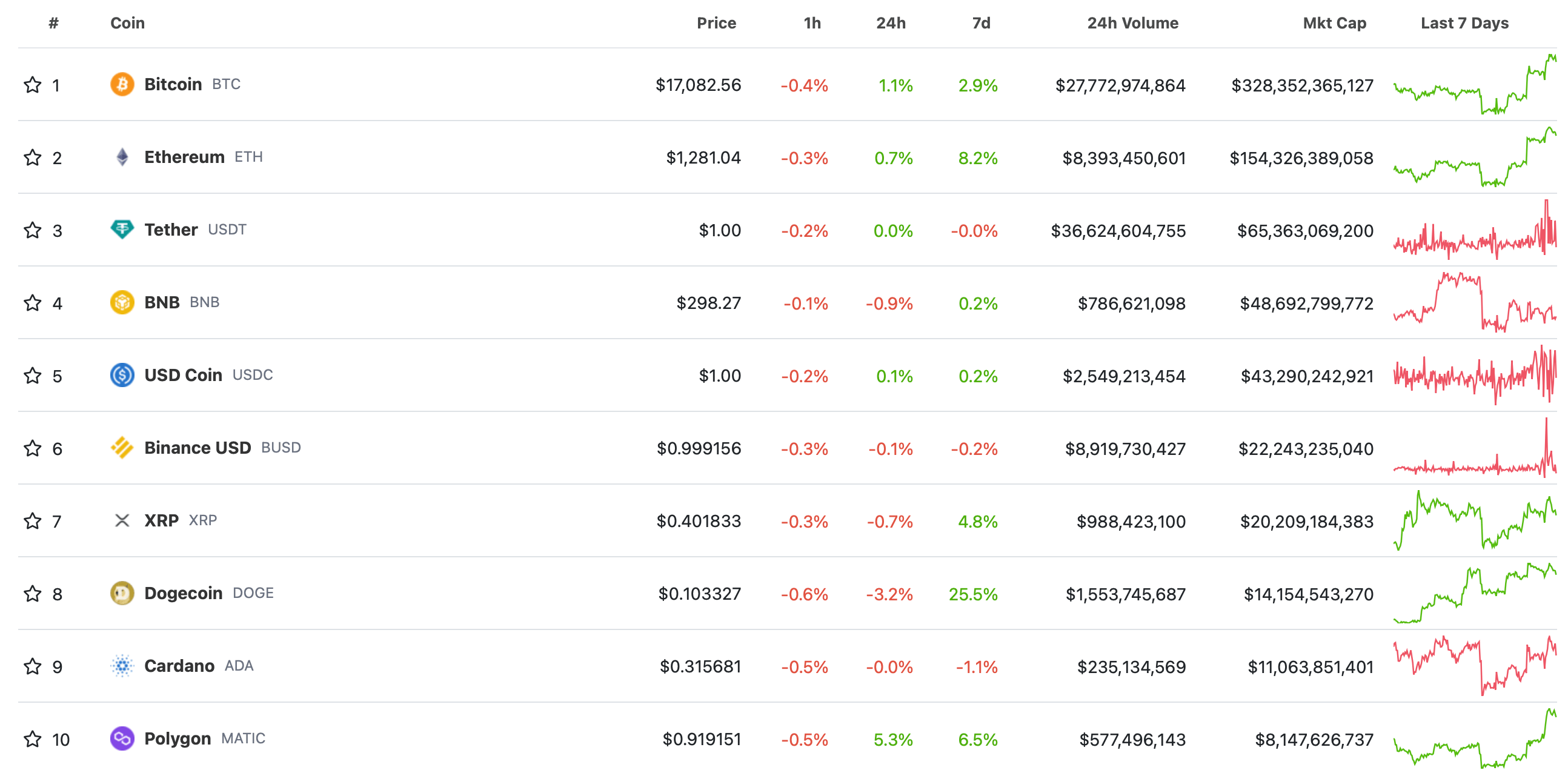

At the same time, on the scale of the week, the top coins by market capitalization predominantly showed growth.

Ranking of top coins by market capitalisation

When will Bitcoin start rising?

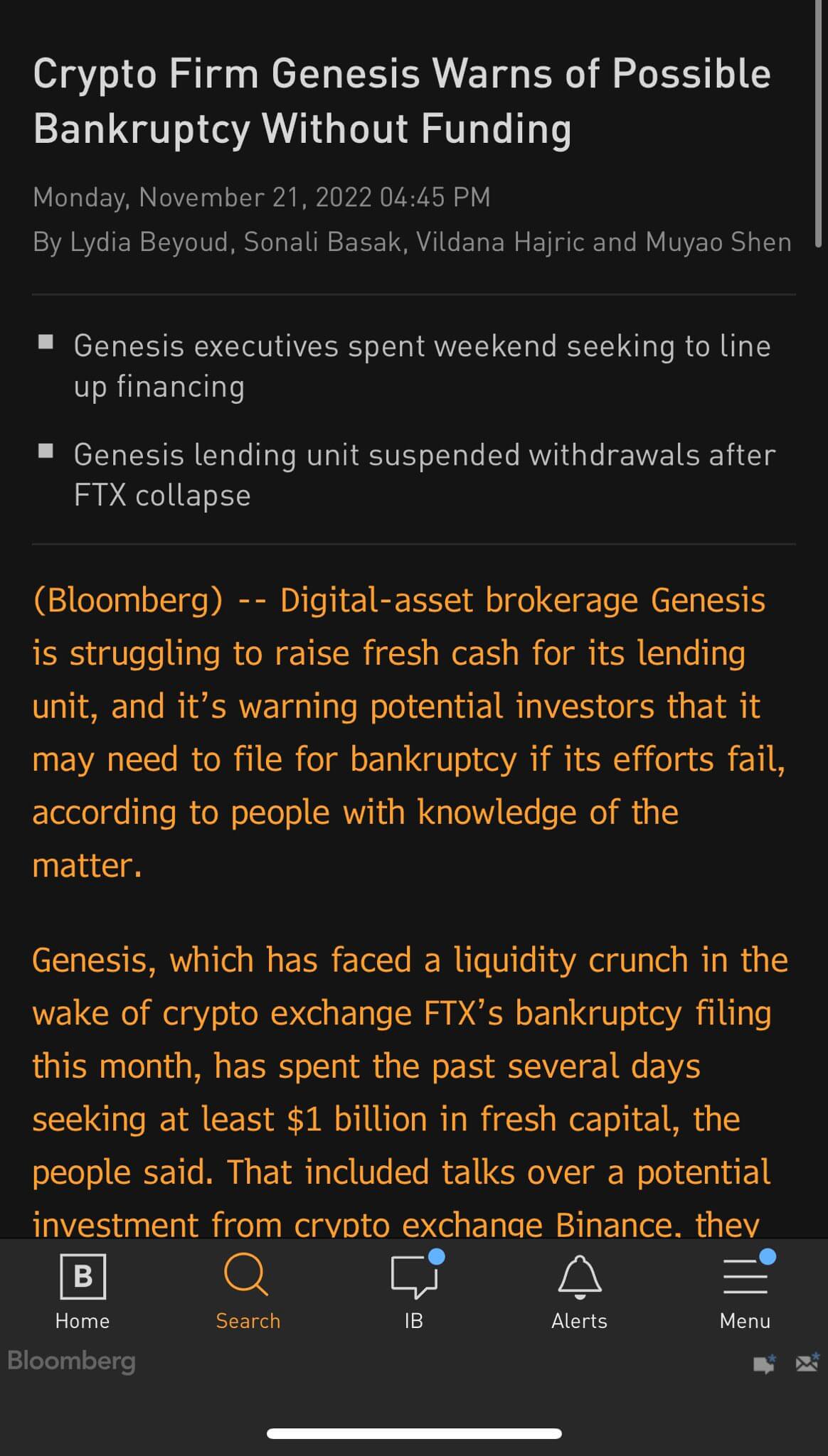

Co-founder and former CEO of cryptocurrency exchange BitMEX, Arthur Hayes, believes Bitcoin may well drop to the aforementioned level. Here’s his November 21 tweet, which Hayes wrote after news of the potential bankruptcy of crypto platform Genesis.

So there you have it. Now all my friends in restructuring will be asking if I know anyone at Genesis and I can connect them with them. BTC = $10k.

Genesis bankruptcy news

Note that so far the situation with Genesis has tentatively improved. Well Arthur Hayes is already known for his predictions that don't come true. In particular, in March 2022 he published an article called "Five Ducking Digits". In it, he discussed, among other things, the prospects for ETH after the cryptocurrency's network switches to the Proof-of-Stake consensus algorithm, along with a simultaneous reduction in the issuance of new ethers. As a result, the former BitMEX executive concluded that one ETH could be worth $10,000 by the end of the year if the Ethereum blockchain's transition to PoS is successful.

Arthur Hayes’ prediction of an ETH at $10,000 by the end of 2022

A similar prediction was voiced by Mark Mobius, co-founder of Mobius Capital Partners LLP, during an interview a couple of days ago. He expects Bitcoin to fall to $10,000 and would not invest his or his clients’ money in crypto right now. However, he made an encouraging clarification.

But cryptocurrencies aren’t going anywhere as there are still investors who believe in the industry. It’s amazing how Bitcoin’s price is holding up despite the collapse of FTX.

Mobius Capital Partners LLP co-founder Mark Mobius

There are more optimistic predictions – here, for example, is a quote from Decrypt’s Zhong Yang, head of research at CoinGecko.

Bitcoin appears to have found support after the FTX crash at around $16,000. However, we are actively monitoring the aftermath of the FTX bankruptcy – in particular the potential bankruptcy of Genesis and other developments.

Bitcoin exchange rate on a 1-day chart scale

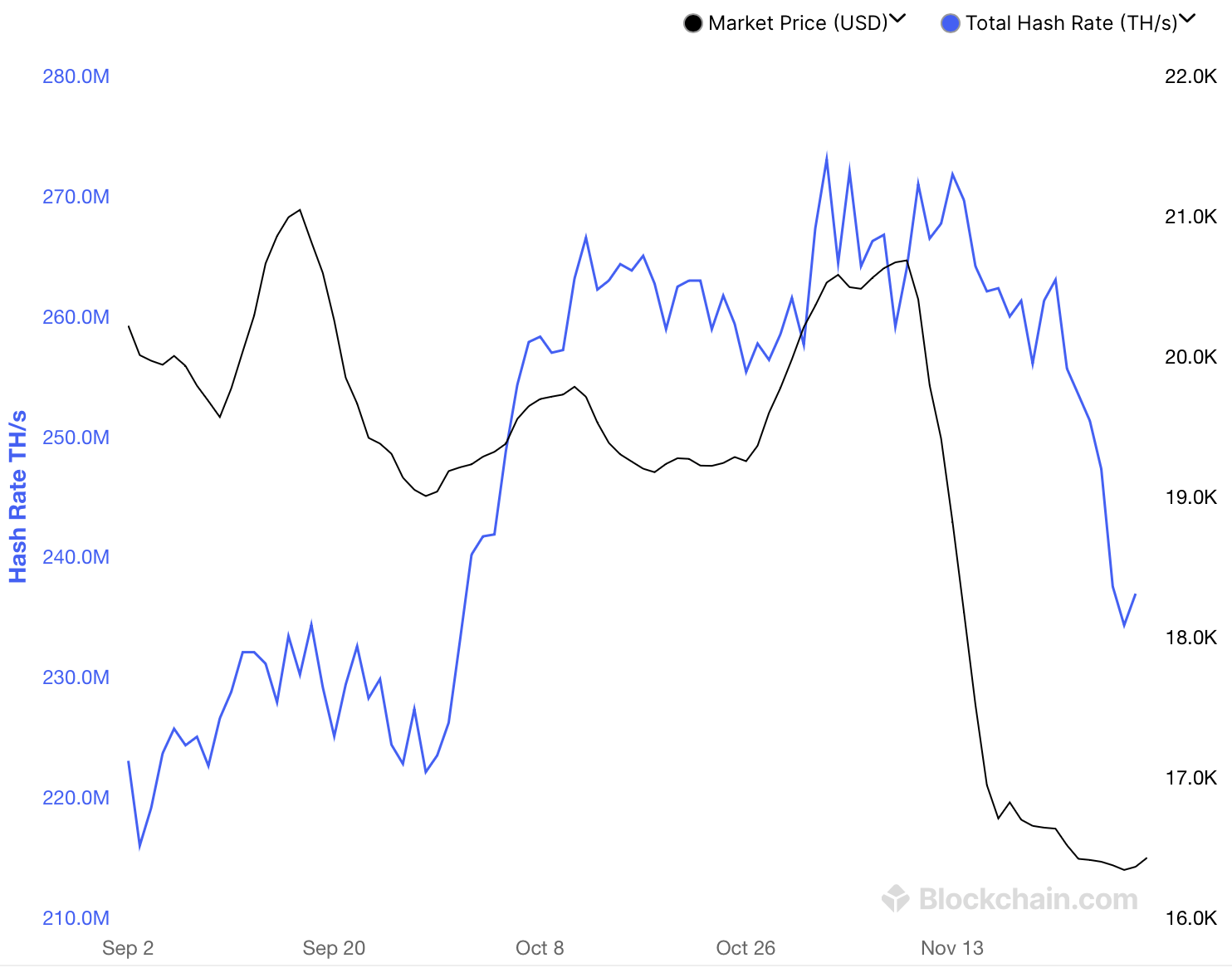

CoinGecko is also closely monitoring the behaviour of miners, who right now are under intense pressure due to a significant dip in Bitcoin mining profitability. Young notes that the situation could still change in the foreseeable future, as uncertainty in the macro economy is weighing on the crypto market. He continues.

On a broader scale, the ongoing difficult macroeconomic environment as well as the geopolitical conflict in Ukraine could cause further BTC volatility in the near future.

Bitcoin’s hash rate over the past 3 months

Another positive outlook was shared by Juan Pellicer, head of research at IntoTheBlock. In his opinion, a Bitcoin collapse even to $12,000 “looks unlikely” unless there is a negative large-scale event in the market. Here’s his quote.

I believe the general sentiment is that there is more chance of the cryptocurrency rising than falling. However, there could be a prolonged bearish trend of 12-24 months ahead of us, during which investor confidence will be restored and an understanding of the impact the recent major bankruptcies have had on crypto in general will come.

Macroeconomics is a separate area that is also getting a lot of attention right now. Here’s what Delphi Digital markets analyst Jason Pagoulatos has to say about its prospects.

From a macroeconomic point of view, this is the worst background in the last fifty years, combining many factors of previous economic crises – inflation, energy, technology costs, house prices, all in one year.

The expert noted that until big investors see a significant improvement in the macroeconomic situation in the form of lower inflation and lower lending rates in the US, they will not invest much capital in cryptocurrencies. This is logical, because crypto has not performed well during the current crisis.

That said, some coins have made significant gains on the news and in bad conditions, such as Dogecoin, which has almost doubled in value in a short period of time because DOGE is supposedly being integrated into Twitter.

In general, Pagulatos has been confident of BTC falling into the $9,000 to $12,000 zone for months now. And usually the long term predictions that their authors have to stick to for the sake of their own reputations turn out to be irrelevant.

We believe that the digital asset industry could, in theory, survive its price bottom. And if no additional large-scale negative events like the FTX collapse occur in the coin niche, the assets could probably move to a low-volatility stage, i.e., relative price stability. In the case of coins, however, you can't be completely sure, which means investors should traditionally prepare for the worst-case scenario.

What do you think about it? Share your opinion in our Millionaire Crypto Chat. There we will talk about other important topics related to the blockchain industry.