Analysts believe the price of Bitcoin will rise to hundreds of thousands of dollars. What will it take for that to happen?

Trading firm Capriole Investments has published another edition of its newsletter with market analysis and current forecasts. There is an interesting note in the publication: Capriole analysts believe that Bitcoin may well repeat the explosive growth of gold in the 1970s, making next year a much more fruitful period for cryptocurrency investors. In addition, in 2024, BTC could become the digital equivalent of gold itself and “one of the world’s most trusted assets”. Here’s a closer look at the experts’ views.

It should be noted that 2022 was a bad year for cryptocurrency investors. Many cryptocurrencies have lost much of their value, causing losses of over 90 percent for some coin lovers among others. With that in mind, the same BTC turned out to be a less attractive asset compared to gold and some stocks. You can read more about that in a separate article.

Gold and Bitcoin

When will Bitcoin start to rise?

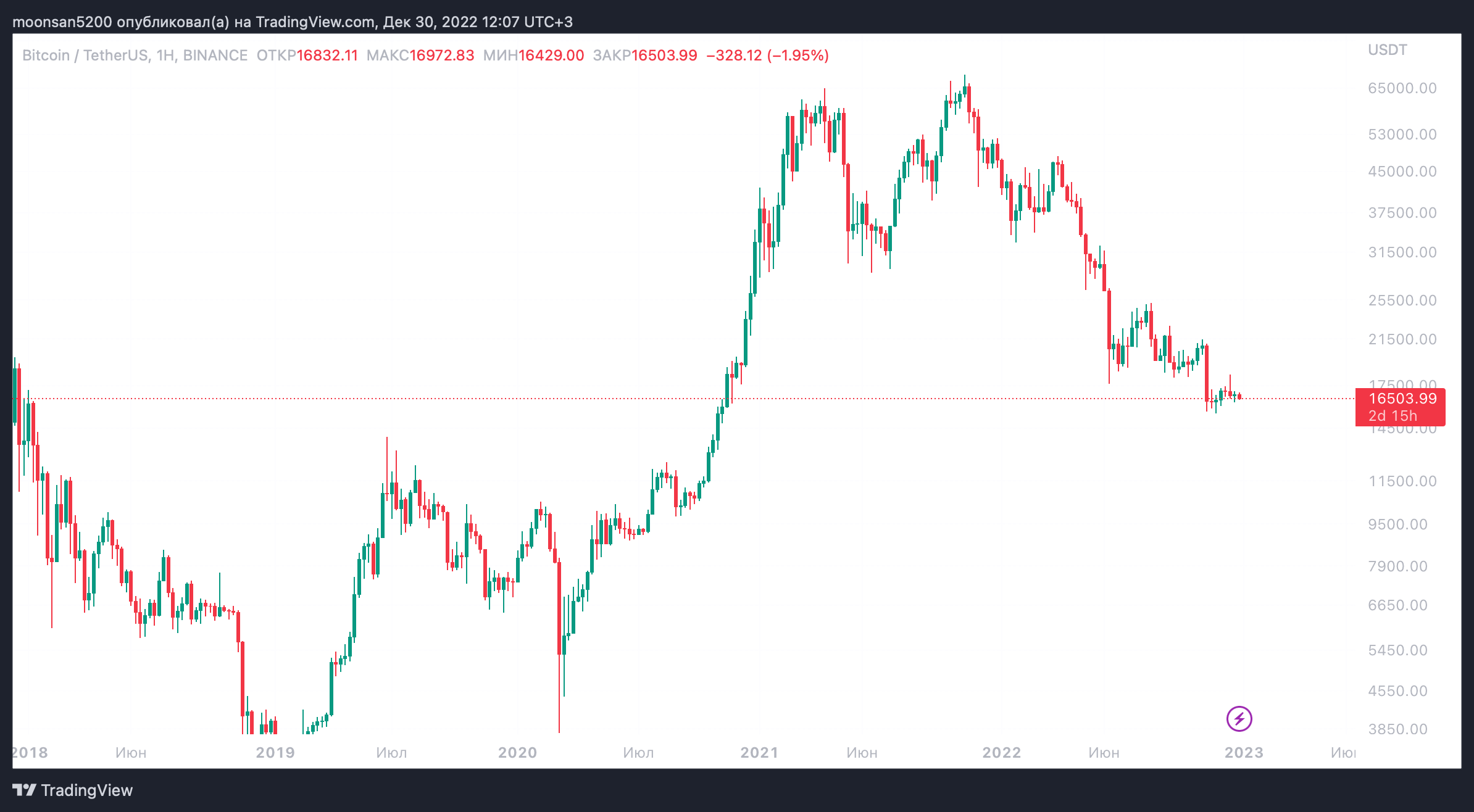

Such optimistic predictions are hard enough to reconcile with the dire returns of Bitcoin and other digital assets in 2022. As a reminder, the main cryptocurrency has fallen almost 80 per cent since January before it bottomed today. Its fall has been accompanied by negative news about the bankruptcy of many major cryptocurrency companies, which has essentially further accelerated the collapse of the entire market.

1-week chart of Bitcoin

The latest high-profile negative development was the bankruptcy of major crypto exchange FTX. In the past, renowned billionaire Bill Miller said he thought it was a "miracle" that Bitcoin's price was able to hold at its current level, rather than falling even lower.

Also shortly after FTX, BlockFi's trading platform, which was closely linked to the trading platform, fell victim to bankruptcy. This situation once again showed how strong the dependence of certain players in the niche on each other is.

According to Cointelegraph’s sources, Bitcoin could indeed drop in price all the way to a new bottom in the near future. However, analysts nevertheless describe a more optimistic medium-term future for the crypto market. The reason lies in the global economic history of the last century – in particular the United States after the dollar became completely detached from gold in 1971.

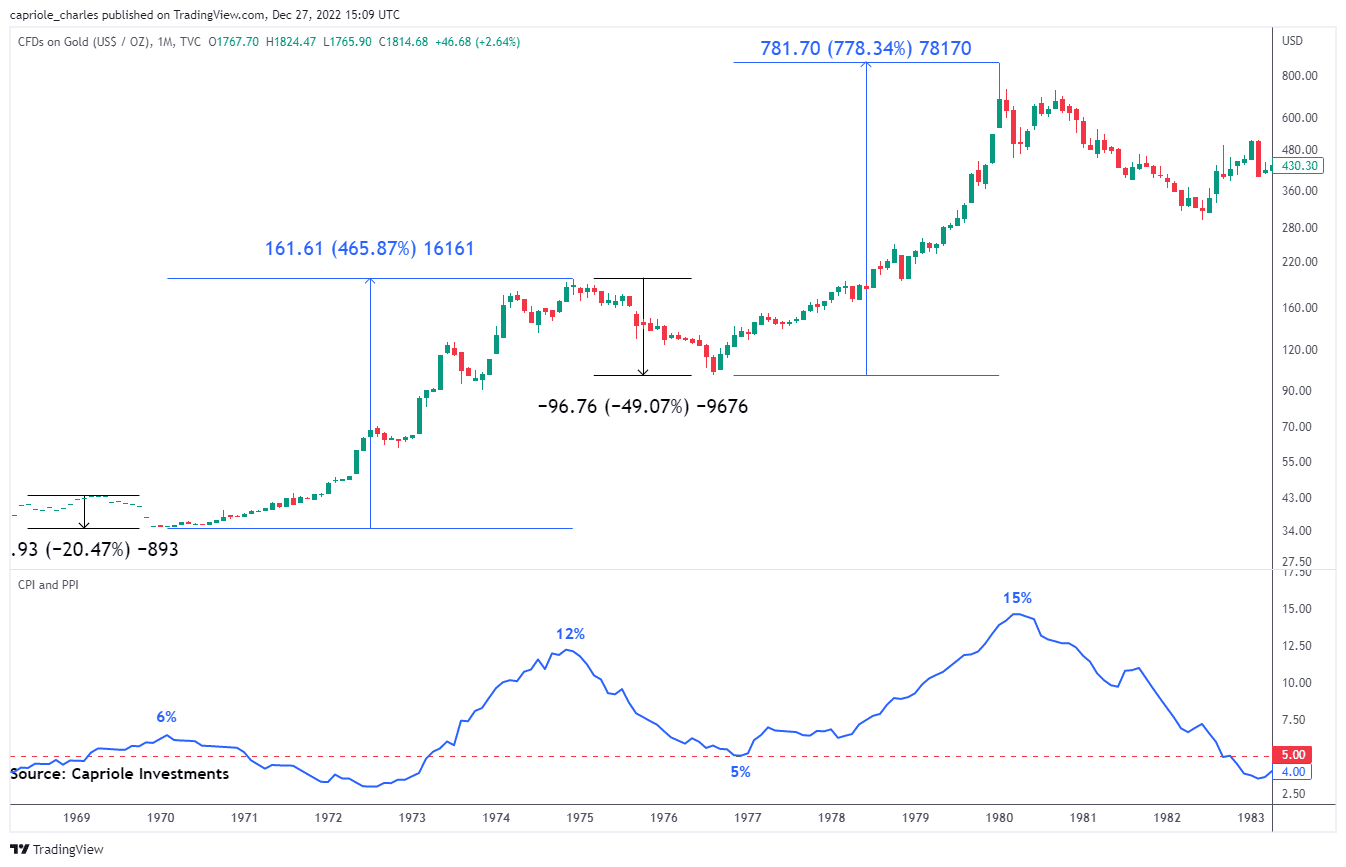

Gold’s growth cycles

Gold, as the world’s main safe haven for capital at the time, had been growing “fast” for a decade. And now, fifty years later, it’s Bitcoin’s turn, experts say.

Because gold was much less capitalised in the 1970s, and Bitcoin’s capitalisation today is even lower, its price was able to make big moves during a decade of inflation and high interest rates. This is one reason why we believe Bitcoin will behave in the same scenario this decade.

Traditionally, we should note that experts' predictions should be taken with restraint, as many of them are trivial and do not come true. Accordingly, investors and traders should rely on their own market analysis and beliefs. At the same time the analysts' versions are just a possible scenario.

Gold rate on the scale of a 1-month chart

That is, gold, with its relatively small capitalisation, was able to show impressive returns almost fifty years ago. And because Bitcoin is similar in its properties to the precious metal, with its capitalisation even smaller, the price of BTC could well replicate the jump of gold in the 1970s, analysts believe.

In addition, the massive drop in Bitcoin’s price within the crypto market this year looks insignificant when considering the size of global markets. Here’s the experts’ view on the matter.

Given that Bitcoin’s capitalisation today is only 2.5 per cent of that of gold, the cryptocurrency’s 80 per cent drawdown this year adds only 2 per cent to the overall decline statistics for “hard” assets, like gold and Bitcoin. This brings the total value of hard assets down to 24 per cent through November 2022, which compares with 1970 and 1975 for gold.

The upside potential for BTC remains impressive – even now the market value of Bitcoin is only 10 per cent of that of gold before its bullish trend of that time. Analysts continue.

Bitcoin has more upside potential than gold because it is smaller in volume. Similar demand for both assets would lead to a 40-fold change in the price of BTC.

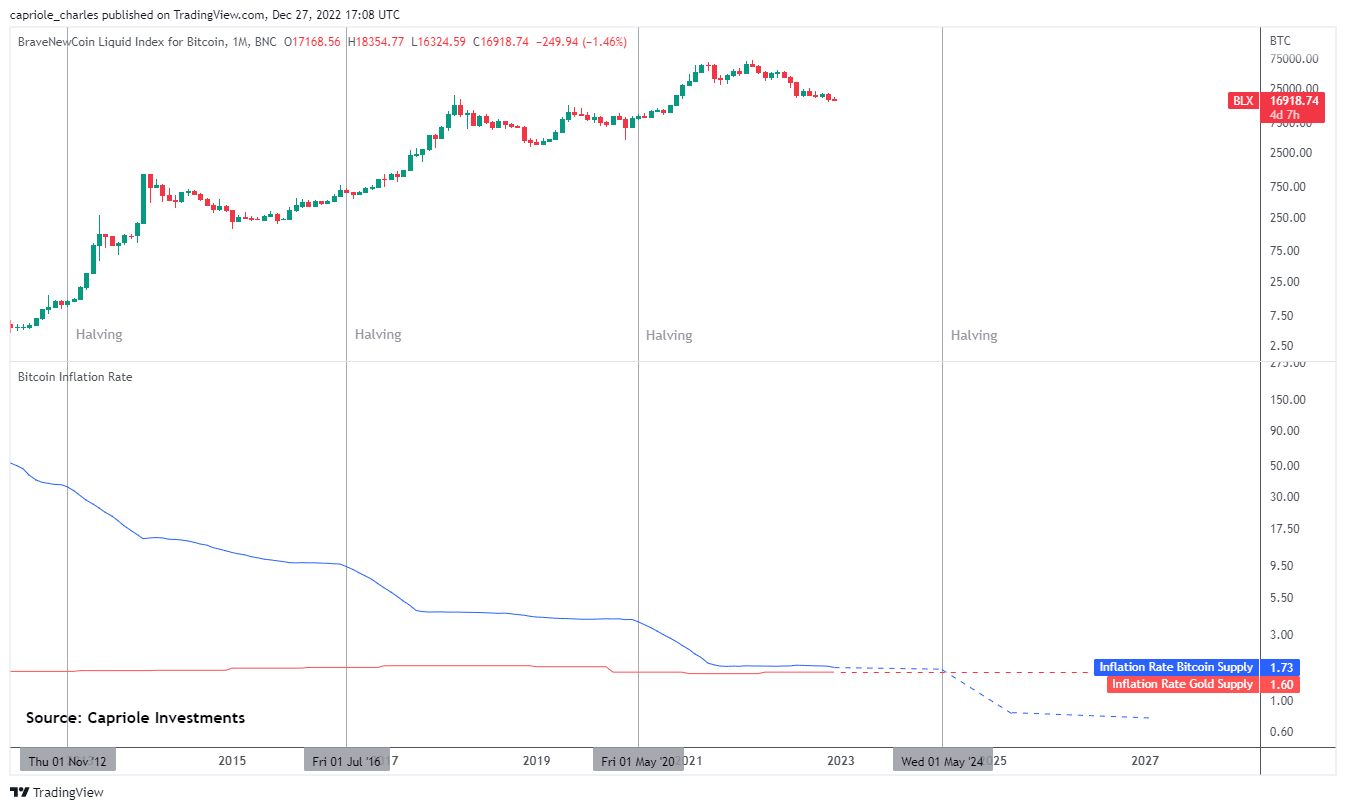

If Capriole’s prediction does come true, the main cryptocurrency has every chance to rise to at least $600,000 in the next few years. The analysts also remembered to mention another key factor – Bitcoin’s halving, that is, the regular halving of the cryptocurrency’s issuance, which occurs roughly every four years. In a sense, it can be compared to the constant reduction in the volume of mined gold, whose supply is limited in one way or another, similar to BTC.

Bitcoin halvings on its price chart

With a similar predictable rate of issuance, Bitcoin could become the “hardest asset” as early as 2024, after another halving cycle. As a reminder, then the remuneration for miners per mined block of the cryptocurrency will be reduced from 6.25 BTC to 3.125 BTC.

We believe that some experts are too busy looking for similarities in the behavior of markets at different time stages. Perhaps the current comparison of Bitcoin and gold makes no sense, because even then the precious metal was much more popular among ordinary people. Or perhaps, in the current environment, BTC will indeed come into the limelight and increase in value significantly. Obviously, investors should be prepared for any scenario and make appropriate decisions to avoid being a victim of their own open position.