Binance has published a rebuttal to rumours that the crypto exchange is in trouble. What are they talking about?

Shortly after FTX’s bankruptcy, the market’s largest cryptocurrency exchange, Binance, faced a barrage of criticism, rumours and negative news unprecedented in its history. Binance’s management has gone to great lengths to calm the panic: at the very least, the exchange has already published information about its reserves as proof of its own financial stability, as well as confirmed the data cited with the help of auditors. Now Binance has published a detailed post in Chinese, clarifying a few key things for investors. We tell you more about the event.

What’s going on with the Binance crypto exchange?

The first point of the exchange’s appeal is the incident with the temporary suspension of USDC withdrawals earlier this month. This was caused by a token swap where Binance converted all of its reserves from the Stablecoin category to BUSD.

Binance CEO Changpen Zhao

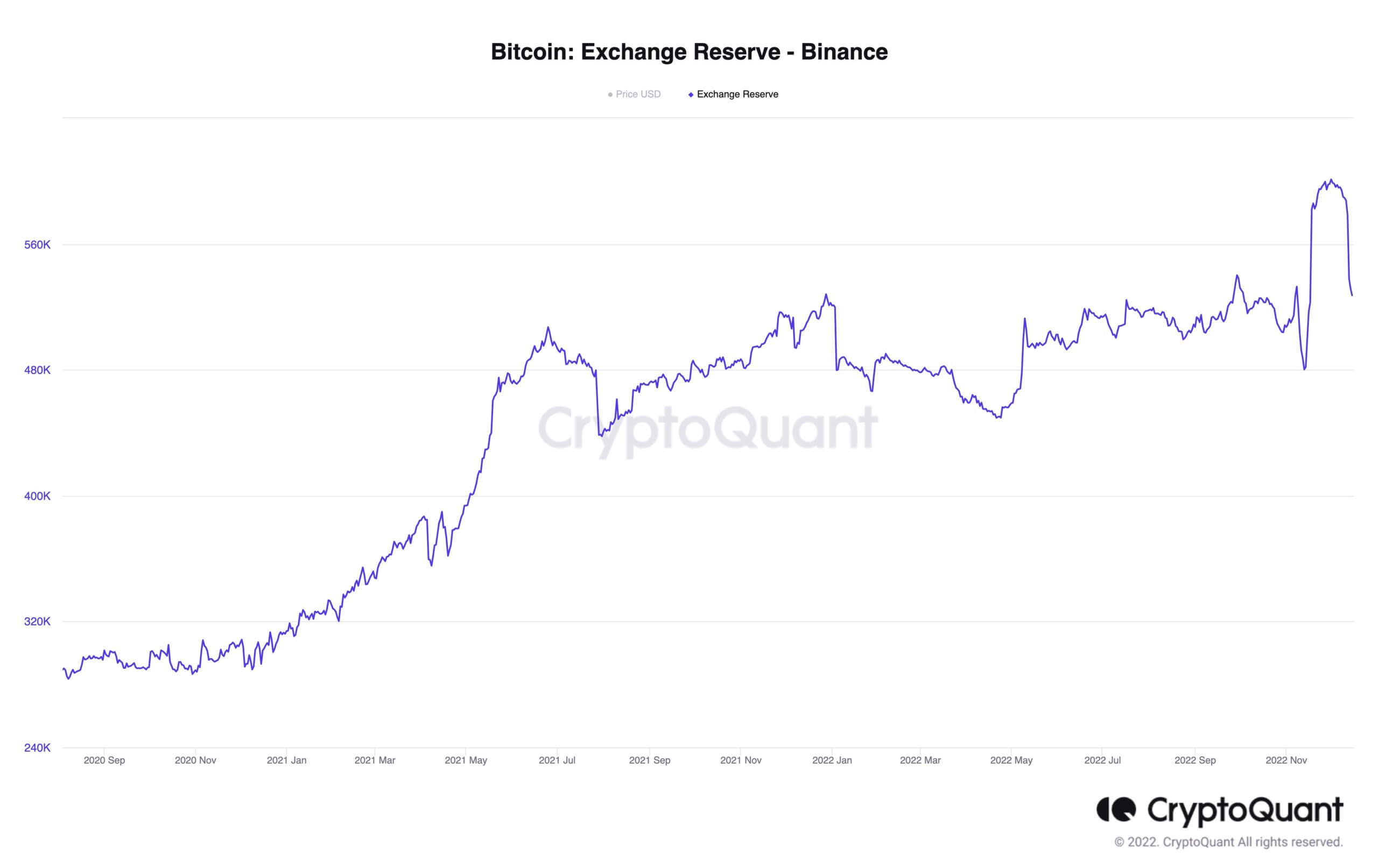

The second point is the matching volume of reserves to cover all withdrawal requests. Exchange officials claim that the ratio of reserves to potential coin withdrawals is just over 1:1, plus the platform generates relatively large revenue from trading commissions. On December 16, analyst platform CryptoQuant confirmed Binance’s claims. Here’s a quote from its report.

Binance does not misappropriate user funds for any transactions or investments, it has no debts, and it is not listed as a creditor of any company that recently went bankrupt.

Binance reserves confirmed by CryptoQuant

Incidentally, another item in the publication concerned the refusal of the auditing firm Mazars to cooperate with any crypto platform, including Binance. The exchange’s management sees the refusal as evidence that the auditors are not yet experienced in dealing with cryptocurrency reserves and do not want to take responsibility.

And that makes sense enough. In addition, the company may not want to take on additional risks because of its interaction with the digital asset industry, which has issued a major collapse in 2022.

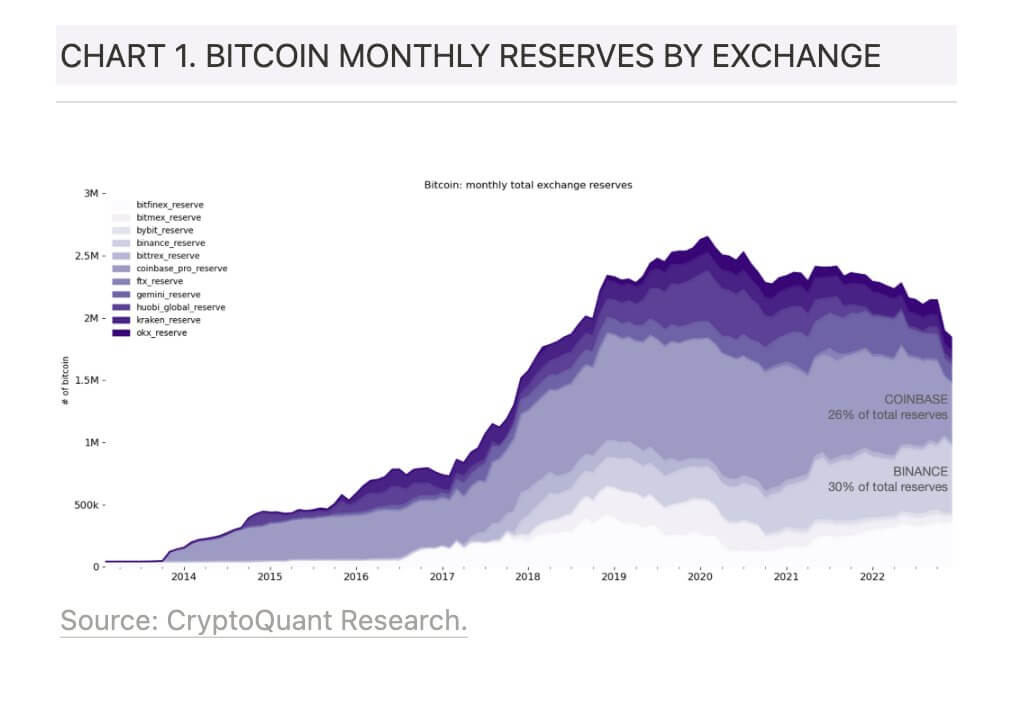

Crypto exchanges reserves according to CryptoQuant

According to Cointelegraph sources, Binance has also condemned the actions of some media outlets. Earlier, Reuters journalists said that the exchange was featured in an investigation by the US Department of Justice. The publication noted that the news exaggerated negative news about the platform and even spread fake information. Binance, meanwhile, is doing its best to cooperate with law enforcement agencies to combat fraud.

It should be noted that Binance holds the record among crypto exchanges for the number of partnerships with governments of different countries. Therefore, accusing the company of unwillingness to follow the legal frameworks of a particular state does not sound like a good idea.

Finally, the final remark dealt with the issue of the collapse of the FTX crypto-exchange Sam Bankman-Frieda. Recall that just days before FTX went bankrupt, Binance chief Changpen Zhao announced the sale of FTT tokens from his reserves and then backed out of a deal to buy his competitor’s exchange. All of this is within the law and quite reasonable, meaning Binance representatives have once again stressed that FTX’s bankruptcy is the result of the actions of its management and not the influence of Zhao.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

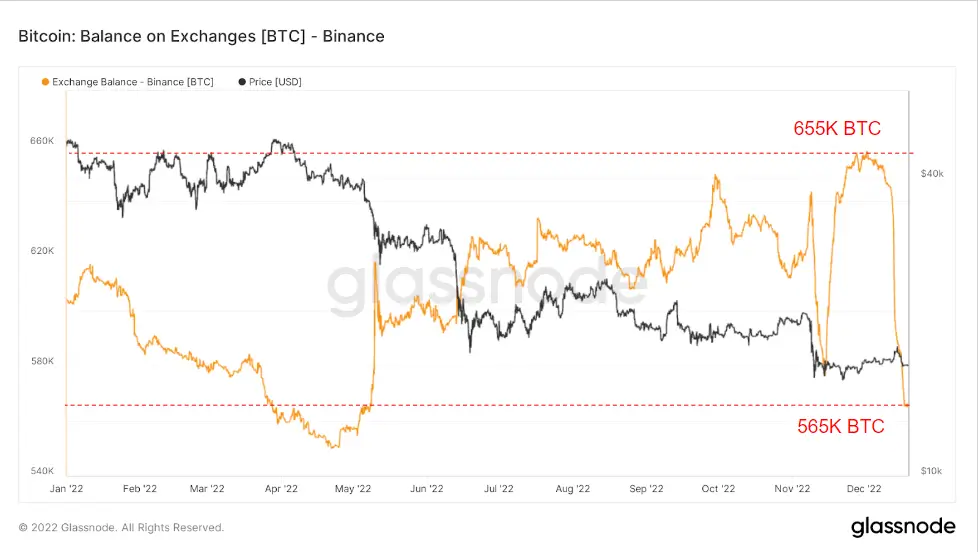

Binance’s official internet pages are unlikely to post negative information about the exchange. That said, a plausible picture of what’s going on can be gleaned from an analysis of the trading platforms’ blockchain reserves – work that has already been done by analysts at Glassnode. They found that the volume of bitcoins on Binance dropped to 565,000 BTC. At the same time, just a few days before the mass withdrawal of funds, it exceeded the 655 thousand BTC mark.

Dynamics of BTC reserves on Binance

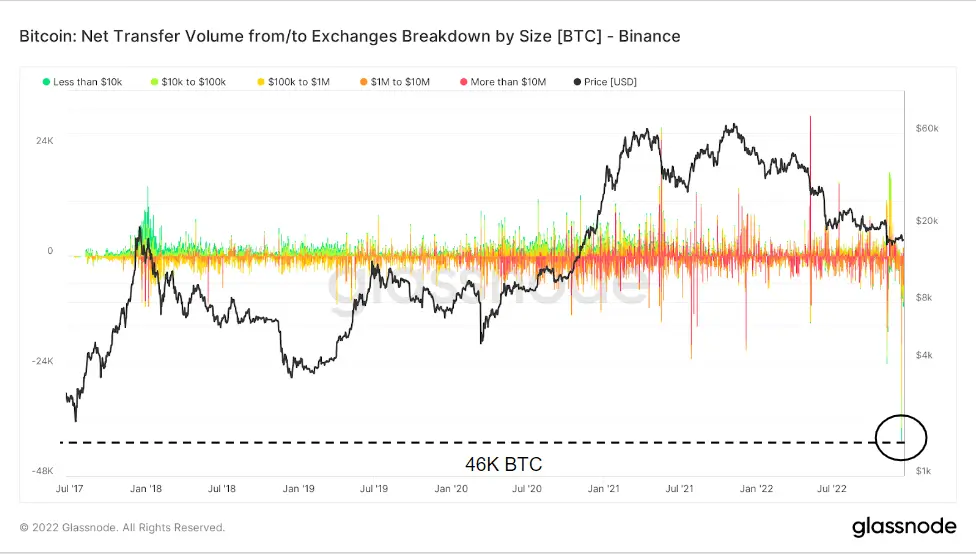

Analysis of bitcoin inflows and outflows by transaction value shows that most of the coin withdrawals in December were made by individual investors. The chart below ranks BTC I/O transactions on Binance by their dollar value, from less than $10,000 to more than $10 million. Transfers of less than $10,000 accounted for the majority of inflows to Binance until 2021.

Inflows/outflows to Binance, ranked by their size

But from 2021 until now, large transfers between $1 million and $10 million accounted for the most significant portion of inflows and outflows from Binance.

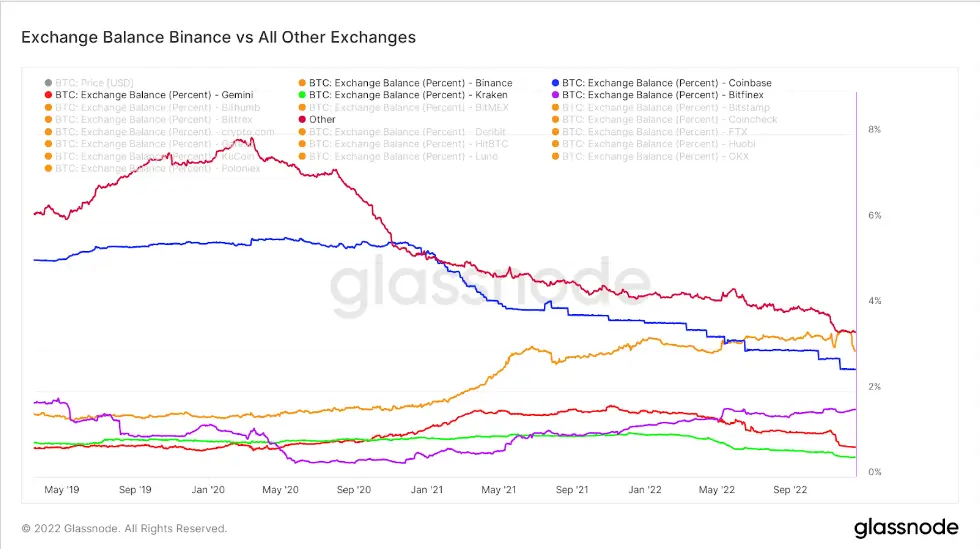

Other exchanges have seen a similar trend in bitcoin outflows. However, Binance saw the most notable decline in BTC balances this month, while other exchanges like Coinbase, Kraken, Gemini and Bitfinex saw smaller outflows.

What is happening can be attributed to a massive campaign to discredit the exchange. Many popular members of the blockchain community have been trying to get their own subscribers to withdraw coins from Binance for unknown reasons. For the sake of this, they have also hinted at the alleged insolvency of the exchange.

A comparison of Binance reserves and other exchanges

Overall, Binance continues to do business without obvious signs of problems, but a comparison of the outflows on Binance with those of the bankrupt FTX shows an unusual overlap. FTX had around 150,000 BTC at the beginning of the year. Thereafter, the exchange saw its BTC balance rise before falling sharply in the spring, but the figure returned to a yearly high in early summer. Then – in June 2022 – more than 70 thousand BTC were withdrawn from FTX in a fortnight.

Comparison of Binance and FTX reserves dynamics

The sharp outflow caused a downward trend in coin withdrawals, which lasted until November – the balance of bitcoins on FTX reached a two-year low. The exchange then went bankrupt.

A similar large outflow of coins from Binance could be seen as the start of a trend in bitcoin withdrawals from the exchange. However, comparing the situation with Binance and FTX is incorrect at the very least because Binance has billions of dollars worth of cryptocurrency in its cold wallets – and this is confirmed by blockchain. So hoping for a similar scenario for Changpen Zhao is unlikely.

We believe that this season of attempts to discredit Binance will end sooner or later. In general, this sort of thing happens quite regularly, and Reuters journalists have indeed developed a reputation for disliking the platform. One would like to believe that stakeholders will eventually stop spreading panic around Binance, because in the current market conditions such a thing could lead to the collapse of an entire industry.

Follow the market situation and other news in our Millionaire Crypto Chat. We talk about other important topics there as well.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. THERE’S EVEN MORE INTERESTING NEWS HERE.