Coinbase analysts predict a tough 2023 for altcoins. How long will the cryptocurrency market fall?

Next year will be a tough one for altcoin holders – that’s the conclusion reached by analysts at Coinbase, the largest US cryptocurrency exchange. According to them, a prolonged period of falling prices for many coins will extend into 2023, with its duration likely to exceed most expectations. Experts also expect an outflow of capital from altcoins to the most popular coins like Bitcoin and Etherium. We tell you more about the experts’ expectations.

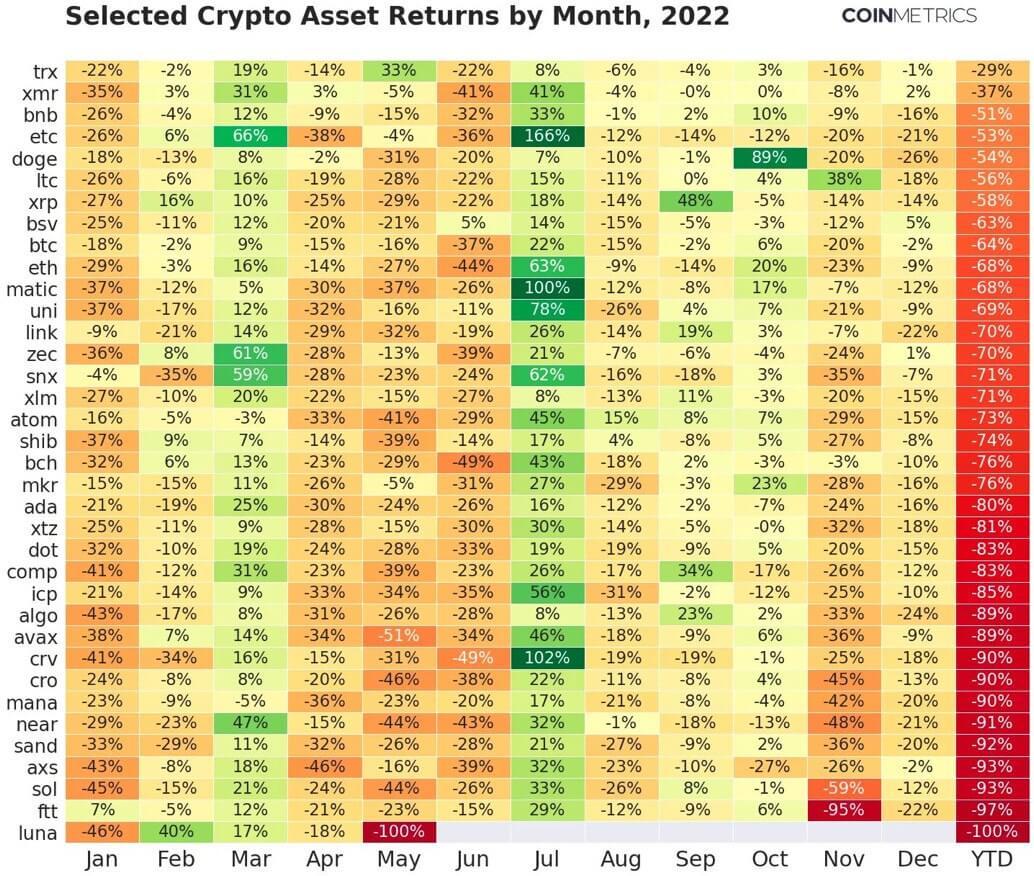

Note that 2022 was also a very challenging year for cryptocurrencies. To make it clear, here is a table of changes in rates of popular coins and tokens by months, with the total amount of decline shown in the right column.

Changes in cryptocurrency rates in 2022

As you can see, Terra LUNA lost the most, dropping almost to zero in May 2022. As a result, the volume of its price decline amounted to 100 percent.

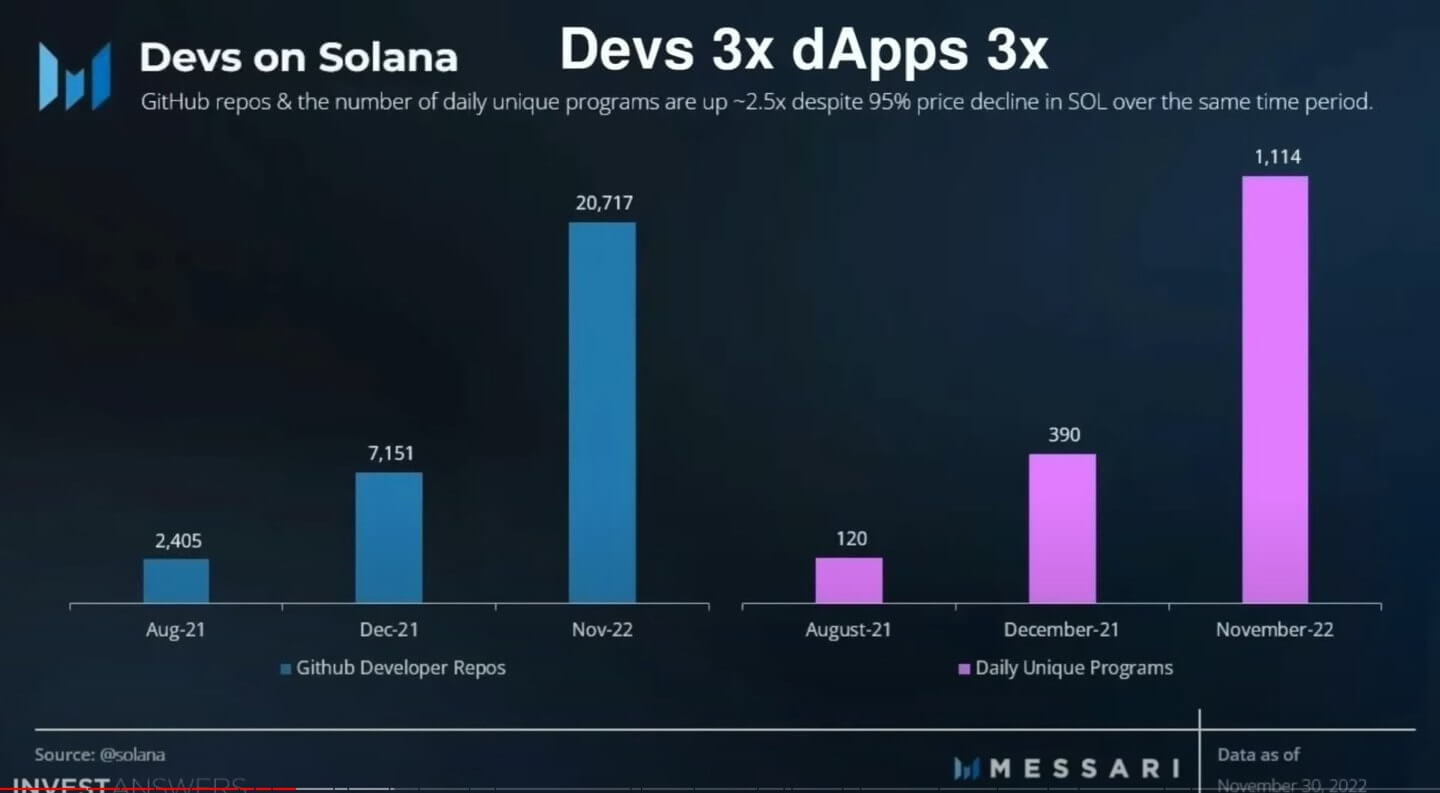

Among the anti-leaders in the ranking is Solana SOL, which collapsed by more than 90 per cent on the back of the FTX crash. However, it is worth noting here that developers continue to believe in the network and are creating projects based on this blockchain. As evidence of this, the number of unique programmes on the GitHub platform with which developers are interacting on the Solana network. It has increased 2.5 times since December 2021, which means developer activity is extremely high.

Solana blockchain-based developer activity on the rise

What will happen to cryptocurrencies in 2023?

The bankruptcy of several major cryptocurrency companies this year, coupled with a prolonged market decline, has severely undermined altcoin investors’ confidence. Here’s a quote from an analyst report on the matter.

We believe investors’ willingness to hoard altcoins has been hit hard by the decline in trading activity in 2022, and it may take many months for market players’ expectations to change.

In other words, holders of popular cryptocurrencies have already been burned by the events of 2022. For now, investors may simply prefer to avoid such crypto-assets to avoid further traumatising their own portfolios. And while the protracted collapse phases of coins and tokens in hindsight are usually the most appropriate time to buy, this argument may simply not work given the damage that was done the day before.

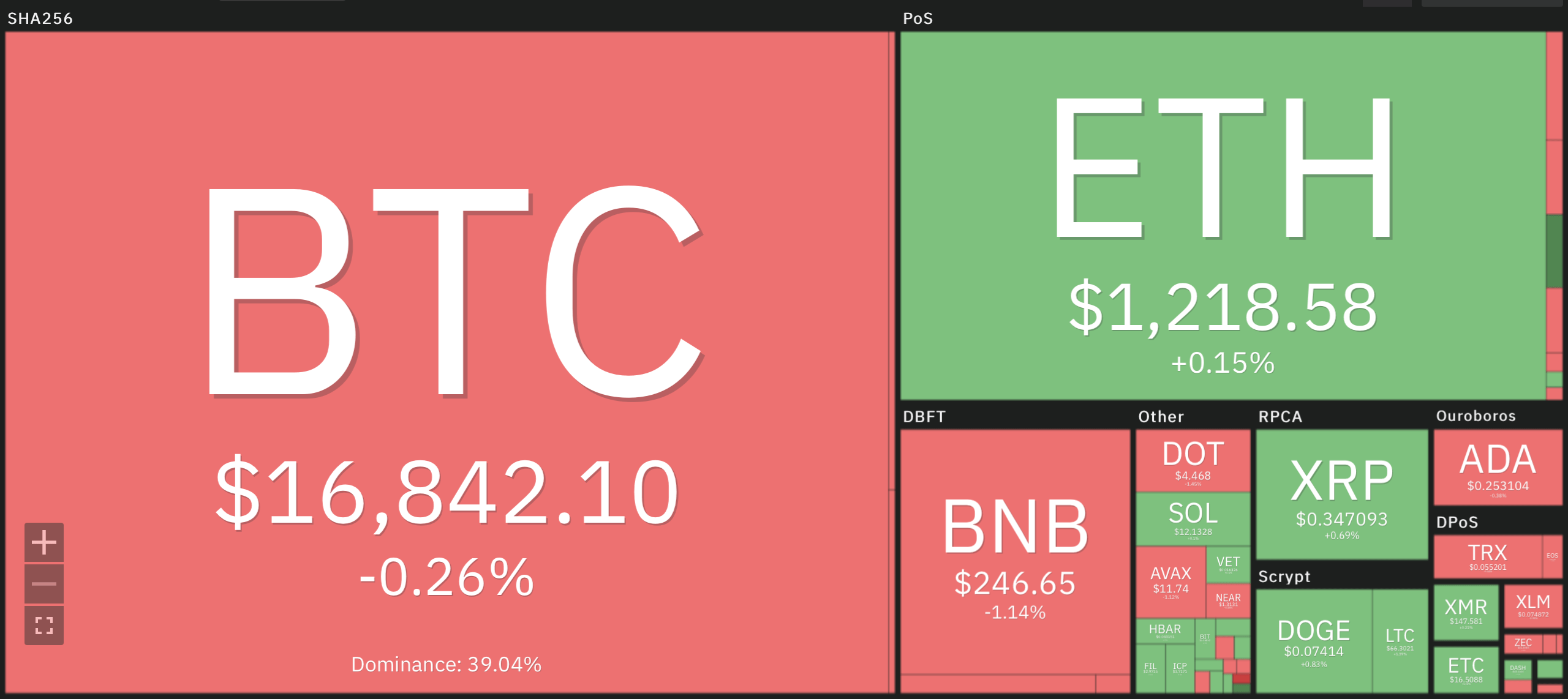

Cryptocurrency rates today

According to CryptoPotato sources, based on the duration of previous bear cycles, the cryptocurrency market is not expected to show any noticeable growth until the second half of 2023. The situation is also complicated by the collapse of major crypto exchange FTX last month. Analysts continue.

Liquidity constraints could also disrupt the market in the short term, as many institutional players are deprived of assets stuck on FTX.

As a reminder, many big players have indeed suffered due to the collapse of the FTX cryptocurrency exchange. For example, the blockchain platform BlockFi was working very closely with the trading platform, resulting in the company filing for bankruptcy at the end of November. In fact, a similar scenario could await other giants, which are still teetering on the brink of serious problems. The cryptocurrency exchange Gemini, for example, suspended crypto-assets withdrawals for Earn users in November. It has still not been possible to reactivate them.

Gemini crypto exchange creators twin brothers Tyler and Cameron Winklevoss

In this regard, analysts expect that it is those cryptocurrencies that have real utility both in and outside the cryptosphere that will gain the most value among investors. In other words, no one will be chasing a haip around another altcoin, as was the case with DOGE last year.

😈 YOU CAN FIND MORE INTERESTING THINGS IN OUR YANDEX.ZEN!

One reason for the uncertainty and fear of another market decline could be crypto futures trading. Sasha Ivanov, founder of the Waves crypto project, made such a statement on Twitter. Here’s his rejoinder, cited by CryptoSlate.

Waves doesn’t need futures trading. They are a breeding ground for uncertainty, panic and making money on short positions profitable because of it. I earnestly ask all centralised exchanges to close futures trading on Waves.

As a reminder, futures trading involves the use of leverage, i.e. borrowed funds from the exchange. Consequently, users trade a much larger amount of crypto assets as collateral than they have on hand. Large trades can accelerate the price of a particular asset, leading to significant volatility and rate hikes. This is true for both ups and downs.

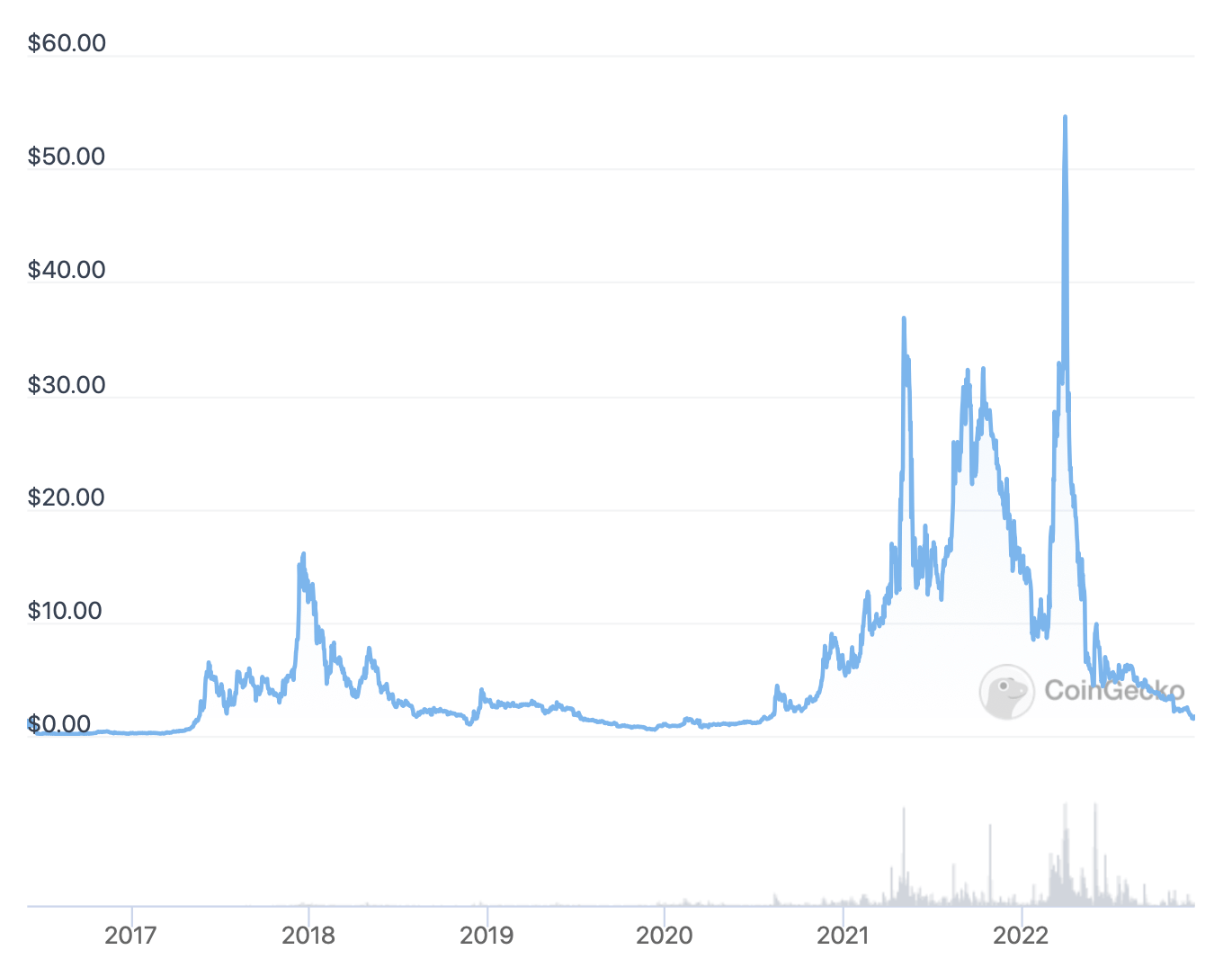

The Waves token has already fallen 98 percent since reaching its all-time high.

Waves exchange rate over time

Is futures trading really that bad for the crypto market? In fact, asset derivatives trading has been practiced by people for decades in various traditional markets. That said, futures themselves generally allow market participants to buy and sell an asset on a predetermined future date and at a predetermined price, which among other things allows them to make money on a sale or so-called short position.

Waves CEO Sasha Ivanov

There is nothing criminal about it, as long as no one resorts to insider trading. The latter is one type of manipulation, which involves artificially pressuring the price of an asset by spreading false information to make money on a short position, i.e. a fall in the price. In all other cases, banning futures trading looks simply meaningless.

We believe that the forecast of Coinbase analysts may well be relevant. Still, even if you ignore the FTX crash and the damage to the cryptocurrency industry because of this event, many countries in the world are facing an economic crisis right now. As long as key central bank rates remain high, the investment climate in general is not good. As such, there is a chance that crypto will really not be the main focus for next year. However, we will traditionally find out the final outcome in practice.

What do you think about it? Share your opinion in our millionaires’ cryptochat. There we will discuss other important developments from the world of blockchain and decentralisation.