How long can the cryptocurrency bear market last for Bitcoin miners?

The bearish trend of 2022 has become tougher for miners than previous cycles of market decline. According to analyst Jaran Mellerud of Hashrate Index, the current state of the bitcoin mining business could become more difficult for the foreseeable future. The situation is also getting worse due to bankruptcies of major mining companies that have already taken place or are imminent. We report on the situation in more detail.

We have clarified the current data: the situation for Bitcoin miners is still challenging today. Still, BTC is 75 percent behind its record high, while mining the cryptocurrency, given the serious competition, is now almost more difficult than ever.

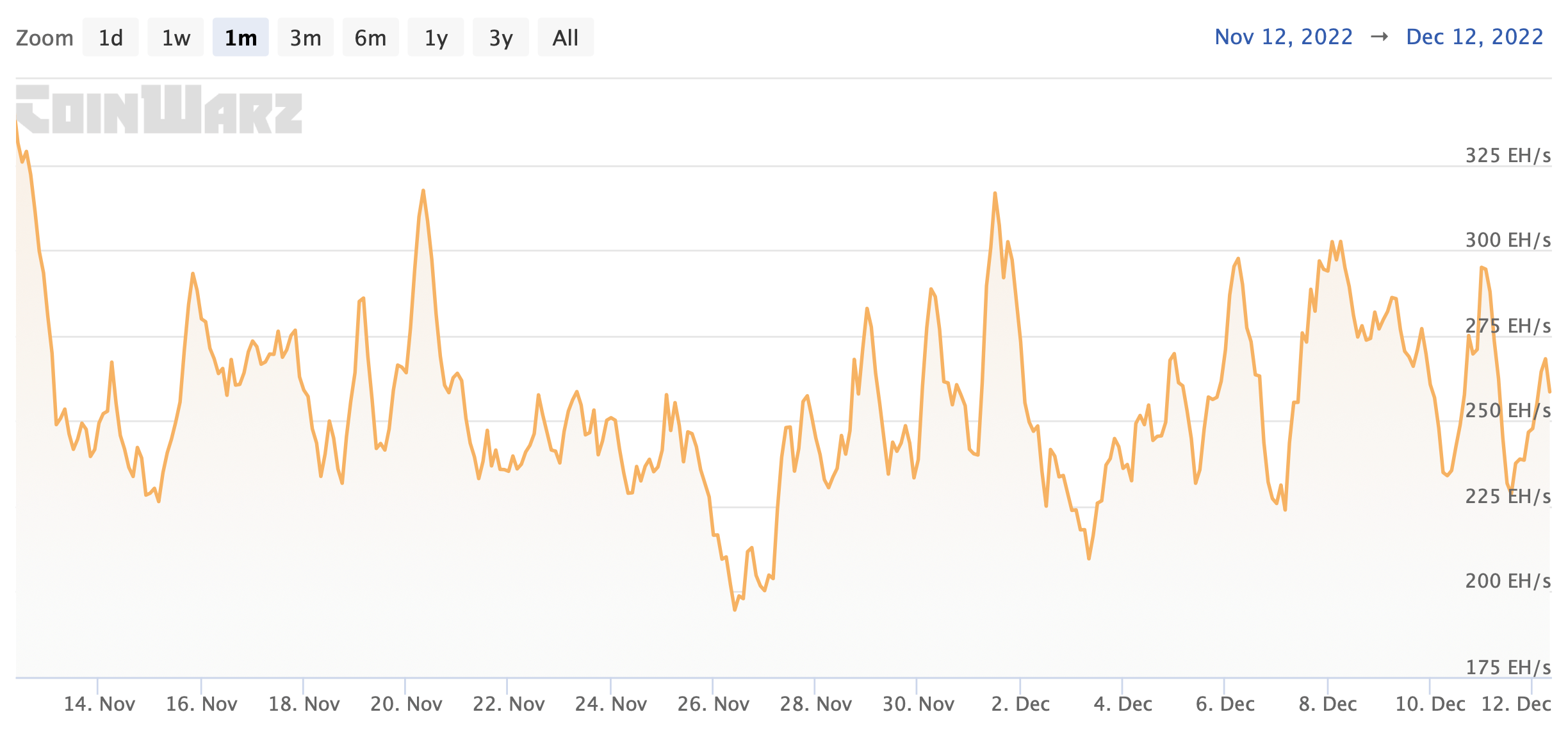

To illustrate, you can see the hash rate graph, which even this weekend was approaching the 300 hashes per second mark.

Bitcoin network hash rate graph for the last month

At the same time, the difficulty of mining BTC is 7.32 percent behind its peak. That’s how much this figure dropped at the beginning of last week. Accordingly, the profitability of any computing hardware is now near its bottom.

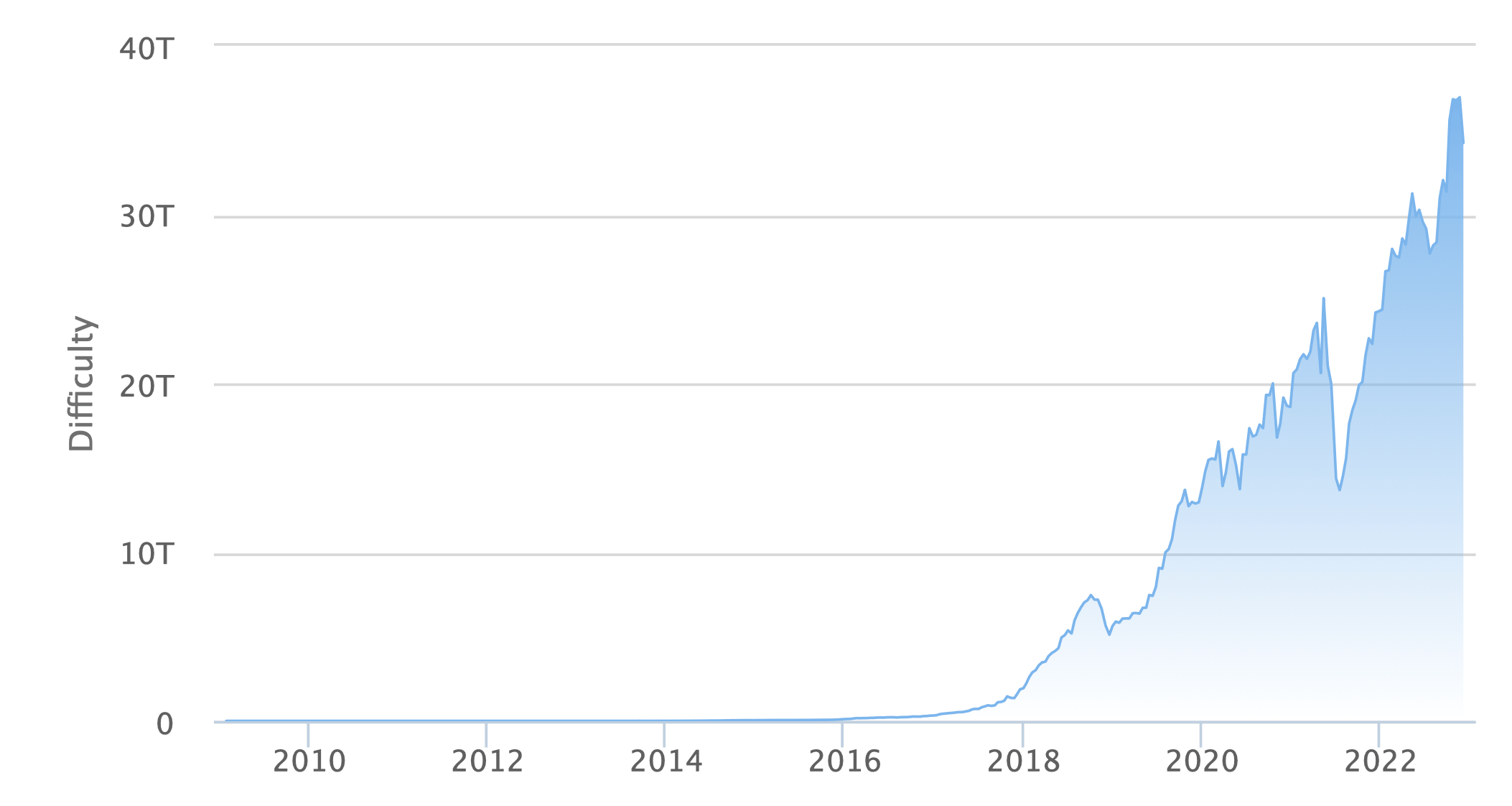

Bitcoin mining difficulty graph

When will Bitcoin stop falling?

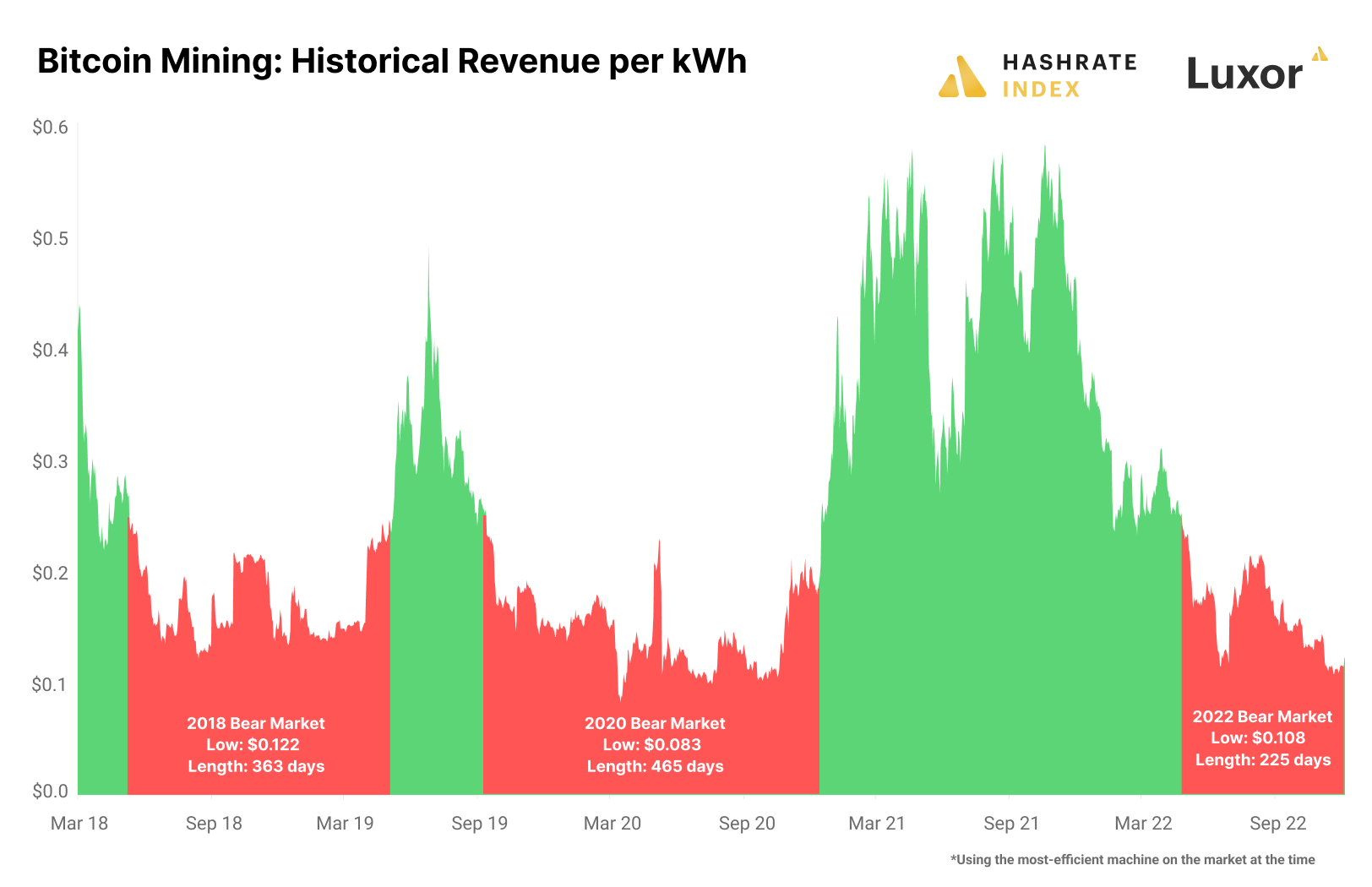

The profitability of mining can be estimated by taking a miner’s income per kilowatt hour (kWh) of electricity they consume. According to Mellerud, a bearish trend usually has a sustained period when the revenue per kWh is less than $0.25. The figures in these calculations are taken from the performance of the most efficient mining equipment on the market at the moment.

According to Cointelegraph sources, the 2018 bearish trend lasted for almost a year, which saw revenue per kilowatt hour dip to $0.12. After the downtrend, Bitcoin began a short period of growth before another collapse already in 2019, when revenue per kilowatt hour fell to $0.083 at all. The hard period for miners lasted 463 days, with the Bitcoin price falling to an estimated $5,000.

Dynamics of income per kilowatt-hour for miners

The current bearish trend for the mining industry began in April 2022. As of December 8, the cycle had already lasted 225 days with a minimum income of $0.108 per kilowatt hour. Compared to the previous downtrend, the difficult market situation could continue for more than 130 more days. Consequently, alas, some mining companies simply will not live up to the next bull run.

Traditionally, it should be noted that events from the past do not guarantee their recurrence in the future. Therefore, such comparisons should only be taken as an illustration of what is happening now. However, this does not mean that things will be the same as they were in the future.

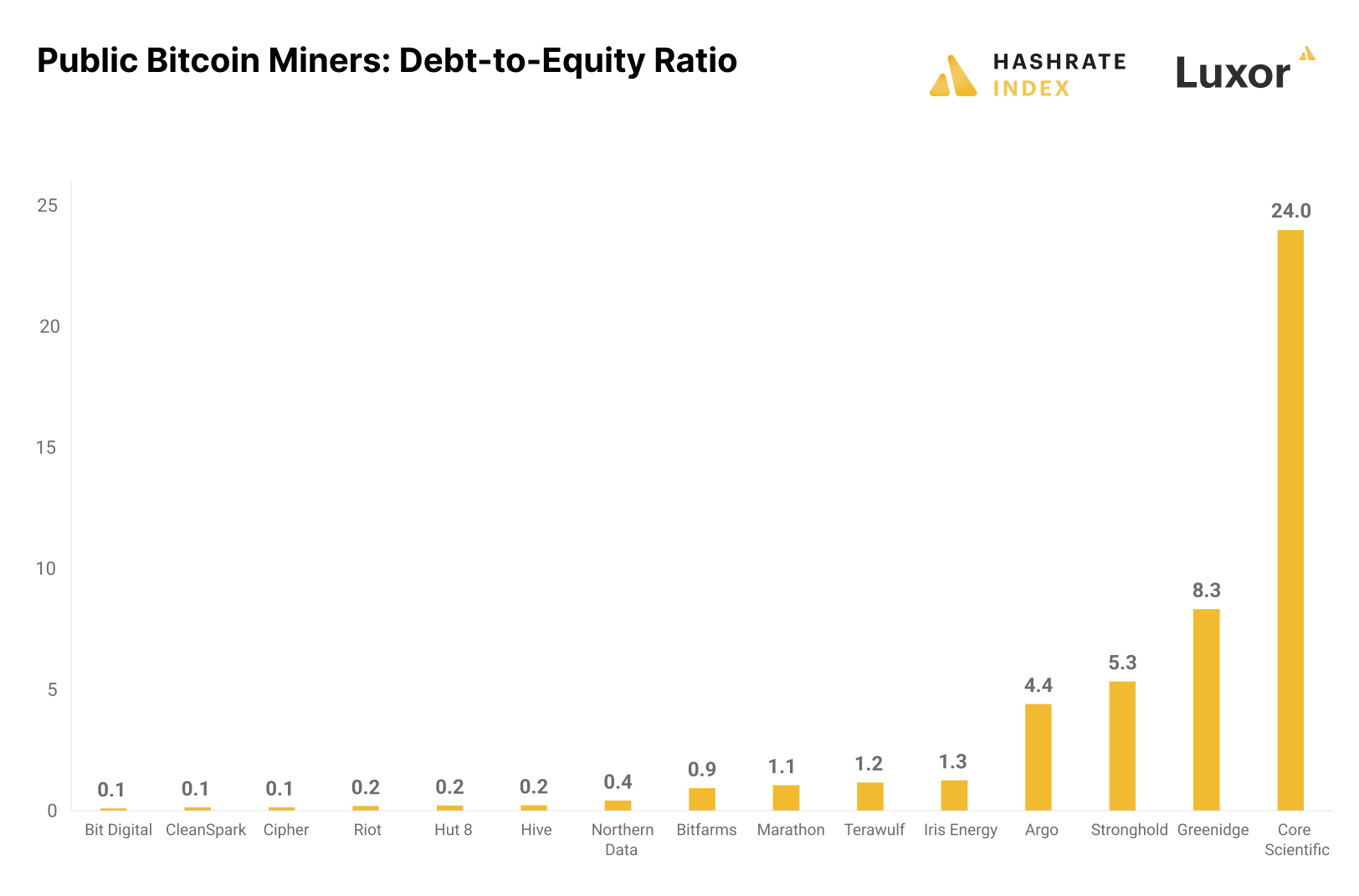

Debt to capital ratio of some mining companies

The situation in the large-scale mining business is best illustrated by the chart below, which is the total market capitalization of companies involved in the field. As can be seen, the current figure lags several times behind its peak.

Capitalisation of mining firms

During the peak by the end of 2021, the figure reached $17 billion. During the bull run since November 2020, the capitalisation of mining firms has risen from $2 billion. However, the figure has now fallen by more than 90 per cent in the countdown from its record.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.ZEN!

The entire crypto market has so far reacted very sensitively to the aftermath of the bankruptcy of major exchange FTX in early November 2022. Against this backdrop, institutional trading platform FalconX announced on its blog the previous day that 18 per cent of its “unencumbered cash equivalents” remain locked up on FTX. In a worst-case scenario, i.e. if the entire amount is not recovered, FalconX would “remain afloat”. Company officials said it still has enough cash reserves.

That said, they had previously been reluctant to say whether FalconX had any assets locked up on FTX. A fortnight ago, during his interview on Bloomberg TV, the platform’s CEO Raghu Yarlagadda dodged a direct question about possible losses on FTX. When queried again, he said FalconX was “operating within risk tolerance” and therefore the company “came out of this situation with a bit of a balance sheet position”.

FalconX CEO Raghu Yarlagadda

Recall that it has been over a month since it became clear that FTX had serious liquidity problems and then the exchange declared bankruptcy. Since then, however, not all companies have disclosed the necessary details of their financial exposure to FTX. The US Securities and Exchange Commission has therefore announced new rules on financial reporting for such troubled firms.

That said, this is not the first time analysts have generally tried to predict the duration of a bear market. For example, in July 2022, representatives of Grayscale Investment concluded that the so-called cryptozyme could last another 250 days at that time. This means that the industry will not start growing until March 2023.

Bitcoin’s recent rate changes

It looks like the situation for Bitcoin miners will be wanting for now. Still, the difficulty of mining BTC continues to remain near its peak, while BTC is not far from its intermediate bottom. Accordingly, the longer this continues, the harder it will be for the owners of computing equipment to stay in business.