The creator of Etherium has named three major opportunities in cryptocurrencies for 2023. What are they?

Next year could be rich in new trends in the crypto industry that will soon become mainstream, Vitalik Buterin, the creator and co-founder of Etherium, made this claim in a recent interview. He said he expects at least three “big opportunities” to emerge in 2023 – mass adoption of cryptocurrencies, inflation-resistant stabelcoins, and online authentication of users to the address of their Etherium wallets. We tell you more about the developer’s idea.

It should be noted that next year could be quite challenging for the cryptocurrency industry. Guggenheim Partners chairman Scott Minerd hinted at this the day before. He believes that the digital asset world will face further challenges due to the recent collapse of cryptocurrency exchange FTX.

In this case, Minerd alludes to a so-called domino effect. In other words, some companies could still face bankruptcy-type problems due to close ties with the exchange.

The logo of cryptocurrency exchange bankrupt FTX

What the new trends in crypto will be

Vitalik’s interviewer named David Hoffman suggested that the field of new crypto project development will become “oversaturated” in the future due to the influx of a large number of developers. Buterin disagrees with this statement – he still sees plenty of opportunities for specialists. For example, in terms of cryptocurrency wallet development. Here’s Vitalik’s comment on that.

If you can make a wallet that’s going to be used by a billion people, that’s a huge opportunity.

Etherium creator Vitalik Buterin

Buterin also said that creating a hyperinflation-resistant and globally accessible stabelcoin would be revolutionary for the industry. He continues.

If you can create a stabelcoin that survives everything up to and including US dollar hyperinflation, that’s also a huge opportunity. An affordable lifeline for everyone during the next financial crisis will get a lot of value.

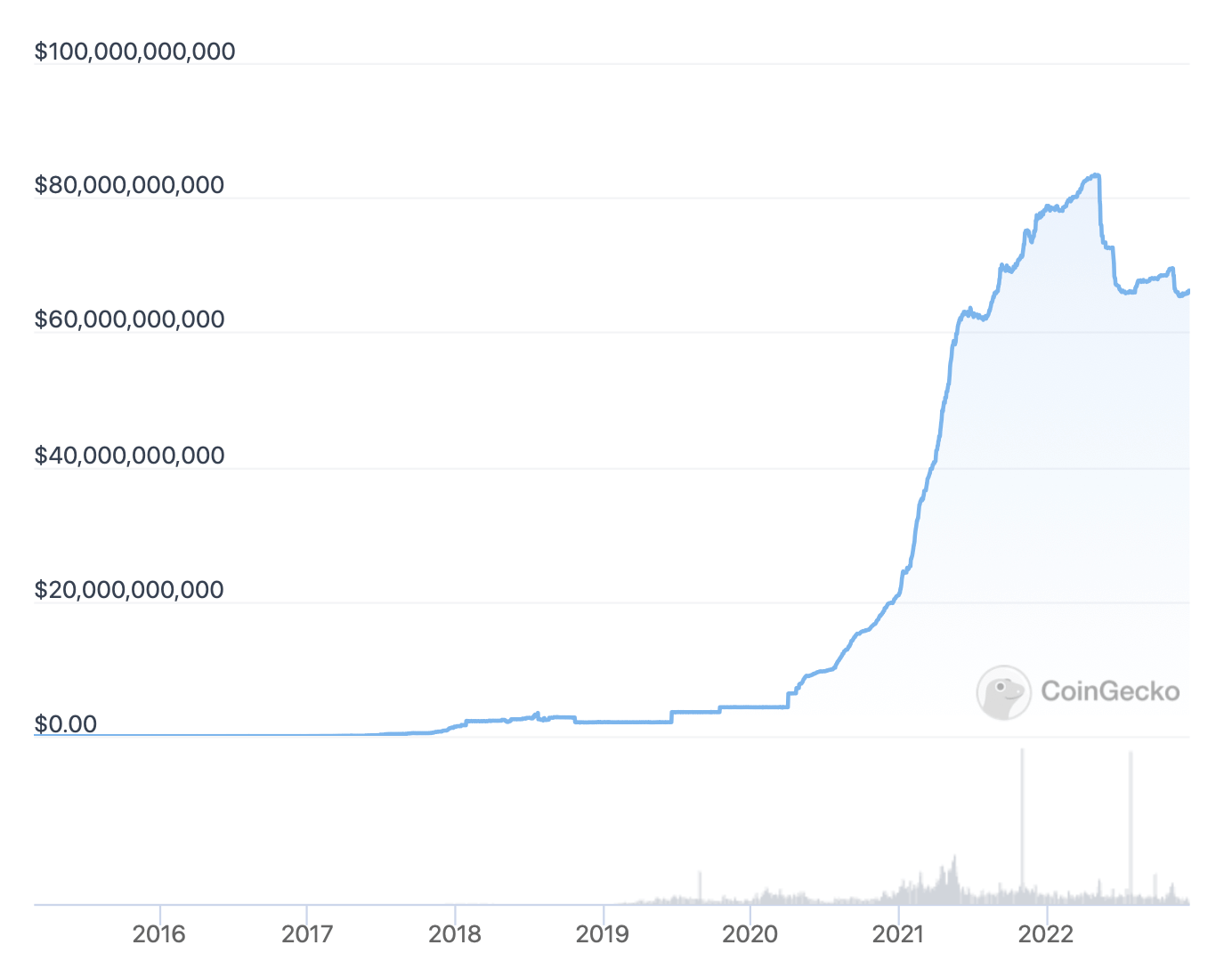

As a reminder, traditional steblecoins are backed by the assets of the issuer of that token, meaning that its "stability" depends on the financial strength of the individual entity. Algorithmic steblecoins can operate in a decentralised way and their exchange rate is regulated by smart contracts. Admittedly, the industry has already had the bitter experience this year of the collapse of a stabelcoin called UST within the Terra project ecosystem, resulting in billions of dollars in losses.

Obviously, in this quote Vitalik has made a reference to this very situation. That is, he suggests that developers should learn from the events of 2022 and then create a better product that millions of people can use.

Growth in capitalisation of the market’s largest stabelcoin Tether

The third trend for the future mentioned by Vitalik is the ability to log into his account at various sites on the internet through his Etherium wallet address. This will take away Google, Facebook, Twitter and other giants’ monopoly on user authentication. Here’s Buterin’s point of view on that.

If you can log into an account via Etherium while undermining Facebook, Google and Twitter’s monopoly on the internet, that in itself is a huge opportunity, right?

Note that previously, an address on the Etherium network, along with a unique NFT token on it, was used to replace a subscription to a streaming platform. Accordingly, in general, the idea of authorisation using private keys is not new, but it could become much more mainstream.

Here is the full video of the conversation with Buterin. We recommend that you watch it if you can understand English and have almost two hours of free time.

According to Cointelegraph’s sources, there is still room for revolutionary new cryptocurrency projects. Although Buterin admits that the number is gradually decreasing. This is a consequence of the development of the market and the growing competition between its players.

😈 YOU CAN FIND MORE INTERESTING THINGS FROM US AT YANDEX.ZEN!

An important aspect of the future prospects of the crypto market remains its regulation. Brian Armstrong, CEO of the largest US cryptocurrency exchange Coinbase, shared his thoughts on the matter. He said on Twitter that regulators would be better off targeting centralised platforms and allowing the field of decentralised finance to “flourish”. Here’s his rejoinder.

In my opinion, regulation should start with centralised platforms like stabelcoin issuers, exchanges and custodians because this is where we see the greatest risk of harm to consumers, and almost everyone agrees it needs to be done.

In this case, Armstrong clearly made a reference to the recent collapse of cryptocurrency exchange FTX. In response to this event, regulators and politicians from the US have taken to proposing stricter regulation of the digital asset industry, as well as creating restrictions on the operation of decentralised coins. Naturally, this is unfair, as in the case of FTX the source of the problems were ordinary people from the centralised company who broke the rules of operation.

Coinbase CEO Brian Armstrong

Tight controls on centralised exchanges would help “restore confidence” in the industry, Armstrong believes. Decentralised protocols, on the other hand, simply don’t need trust per se. Armstrong continues.

Decentralised protocols involve no intermediaries, open source and smart contracts are themselves “the ultimate form of disclosure”.

The Coinbase CEO has also proposed that regulators introduce a federal licensing and registration regime so that exchanges or custodians can legally serve customers, in addition to strengthening consumer protection rules and prohibiting market manipulation.

We think Vitalik Buterin's proposals do look interesting. And while the cryptocurrency industry has the same cool wallets like Phantom, not all of them support multiple blockchains at the same time. Consequently, developers of even successful products still have room to develop - and that's something to look forward to in the next year.

What do you think about this? Share your opinion in our Millionaire Crypto Chat. There, let’s talk about other important topics related to the situation in the world of decentralised assets.