The head of a major bank has compared cryptocurrencies to rocks. What did he mean by that?

Cryptocurrencies are virtually indistinguishable from pet rocks, JPMorgan & Chase Co. chief executive Jamie Dimon said on CNBC. Jamie Dimon. He also urged regulators to pay more attention specifically to the crypto industry rather than banks. In general, Dimon has long been sharply critical of the digital asset sector, although his bank has been actively associated with crypto and blockchain in general. We tell you more about what’s going on.

Note that the bank’s stance on digital assets is rather strange. On the one hand, JPMorgan became the first financial institution in the virtual space through its participation in the blockchain platform Decentraland.

JPMorgan’s virtual corner of the meta-universe

Yet a few months later, JP Morgan’s head of digital assets, Umar Farooq, called most cryptocurrencies rubbish. Meanwhile, the main uses of digital assets will allegedly only become clear in the future. You can read more about the experts’ views here.

JPMorgan chief James Dimon is more stable in his stance. He is the most frequent critic of cryptocurrencies – though not always logical and fair.

Crypto is being criticised again

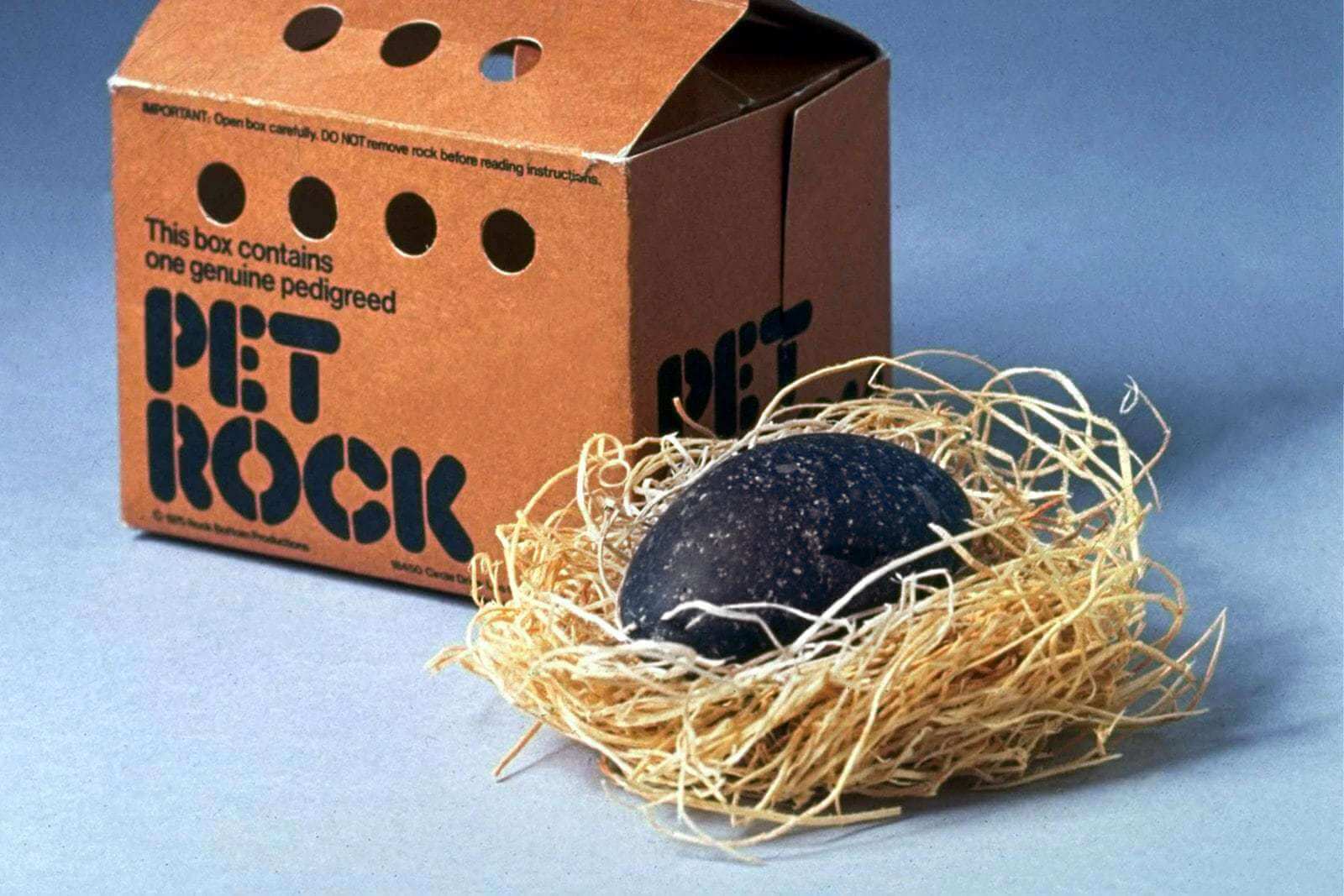

The "pet rocks" mentioned by James Dimon are collectible toys popular in the 1970s, created by American entrepreneur Gary Ross Dahl. These were stones that were sold in special packaging with holes for air, so that the object gave the impression of being a pet. The seemingly absurd idea appealed to customers, and Dahl managed to make a fortune after opening his Pet Rock company.

Despite the magnitude of the crypto market, Daimon still doesn’t believe in the real value of cryptocurrencies. Here’s his rejoinder, cited by CryptoSlate.

Bitcoin’s capitalisation is less than a trillion, we’re still not sure if it’s a real market.

Note that Dimon has previously shared negativity about digital assets. Specifically, back in 2017, he promised to fire any employee of his own bank who was caught in connection with digital assets. Jamie also made it clear that cryptocurrency investors in principle deserved to lose all their money. However, as we have already noted, the bank itself does not share such a stance and links to the niche of crypto, meta-events and so on.

JPMorgan CEO Jamie Dimon

There’s nothing new in Dimon’s argument. It’s about fraud in the crypto industry, the use of digital assets by criminals, and tax evasion. He continues.

There are 20-30 billion instances of ransomware that we know about, 20-30 billion coins that we know about, a lot of anti-money laundering regulations, terrorist financing, tax evasion, sex trafficking, why are we allowing this to exist?

After this line, a reference to Deutsche Bank, which has repeatedly been accused of money laundering and paid hefty fines for it, is fitting. For example, German authorities visited the company's offices because of relevant suspicions back in April 2022. So blaming the cryptocurrency industry exclusively for breaking laws is at the very least unfair.

Pet rock

Initially, Dimon was sharply negative about crypto. However, he changed his mind in 2018 when the crypto market grew rapidly. Already after the bull run, he was again critical of Bitcoin and altcoins, citing all the same problems.

As a reminder, common myths about the industry are easy to debunk. Yet in traditional finance, the scale of fraud, money laundering and financing of criminal gangs is far greater. And fiat money itself is a major tool for breaking the law. However, it is trivial for Dimon to bring this up.

😈 YOU CAN FIND MORE INTERESTING THINGS ON OUR YANDEX.ZEN!

Regulators’ interactions with the crypto market are becoming particularly tense in the context of the current world situation. After all, the Russian Federation has the record number of sanctions, and there are other countries in the world with similar problems – Iran and North Korea, for example. Sanctions evasion is still being seriously discussed, and it is causing problems for the crypto industry.

Andrew Fierman, head of sanctions at Chainalysis, believes that individual crypto platforms should take a proactive stance on sanctions. The Russian Federation, he says, is a bit of a “different story”, as sanctions against it affect both individual entities and individuals, as well as entire sectors of the economy. On this scale, it is hard to close all the loopholes to circumvent sanctions. Here is a relevant rejoinder from the expert.

This is one of the biggest problems in the industry as a whole. Not just in crypto, but in traditional finance as well.

Crypto and sanctions

There is, however, a way out – a proactive stance by crypto platforms. According to Cointelegraph’s sources, they could proactively prohibit access to crypto from individuals and entities on sanctions lists. Here’s the quote.

Proactively applying sanctions to organisations and entities that act in a way that is detrimental to the cryptocurrency ecosystem is an effective way to help stop them from engaging with the ecosystem at all.

Fierman mentioned several recent cases of enforcement by government agencies, namely the Office of Foreign Assets Control (OFAC). One involved the centralised exchange Kraken, which was fined hundreds of thousands by OFAC, and Bitfinex, which received an even larger fine.

We think that not seeing the potential in digital assets in 2022 is a rather strange position to take. It becomes especially strange because of the actions of JPMorgan Bank, which has already managed to get involved with the meta-universe and digital assets. So on the one hand we have a company supporting the development of new technologies and its management calling crypto almost rubbish. Obviously, customers should have certain questions with that in mind.

Read about other interesting news in our millionaires’ cryptochat. There we will discuss other important developments related to the blockchain and decentralisation industry.