The head of cryptocurrency exchange Binance thinks the next few months will be difficult. Why?

Binance has been caught in the crossfire of criticism and panic this week. Withdrawals from the trading platform hit a record high in months, reaching the level of billions of dollars in just 24 hours. At the same time, several popular people in the industry have voiced their mistrust of Binance’s integrity in publicly confirming its reserves. What’s going on? We tell you in more detail.

It should be noted that Binance did experience user panic the day before. It was mainly caused by the actions of certain well-known representatives of the blockchain community, who suddenly started accusing the exchange of insolvency and in addition called to withdraw money from there.

What their motive is unknown, but many Binance users did withdraw crypto. For example, the equivalent of $6.1 billion was withdrawn from the platform on Tuesday. However, it’s important to note that the equivalent of $6.5 billion was deposited on it on the same day, which means many traders still trust what’s happening with the platform.

The volume of deposits and withdrawals from cryptocurrency exchange Binance for December 13, 2022

On the same day, Binance chief executive Changpen Zhao commented on what is happening with the following quote on Twitter.

In general, I think it is a good idea to conduct a “stress test of conclusions” for each centralised exchange on a regular basis. Such “tests” incur costs in the form of network commissions, but they keep the industry healthy.

What is going on with the cryptocurrency exchange Binance?

The overall situation in the industry is tough. Against this backdrop, Binance CEO Changpen Zhao expects the next few months to not be easy either. He mentioned this in his address to the exchange’s team. Although it may be a long time before the end of the “crypto-zima”, Zhao assured that Binance will survive this challenging period and will only get stronger in many aspects.

Here is one of the quotes from Zhao’s address that Decrypt reporters obtained.

There are expectations of turbulence in the next few months, but we will get through this difficult period and become stronger after that.

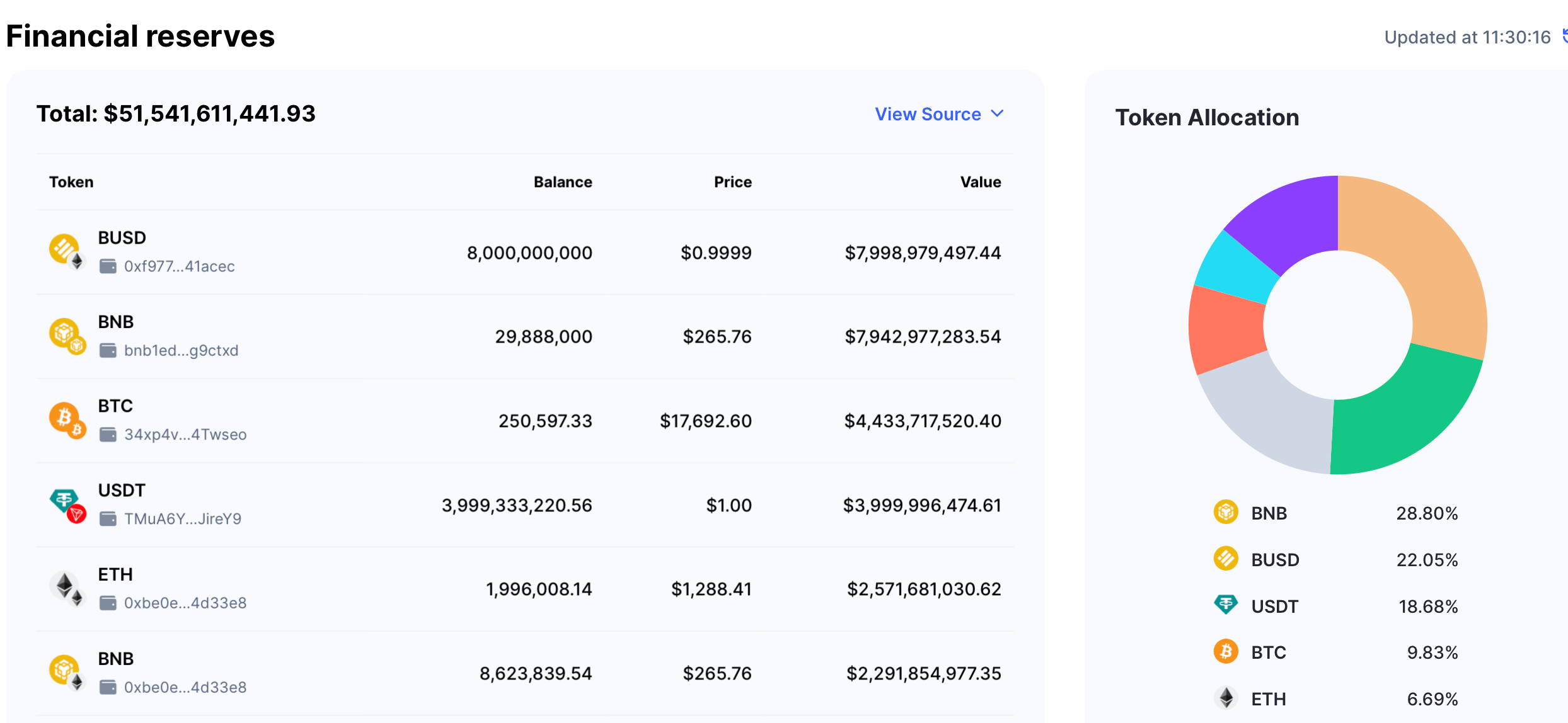

Proof of Binance reserves on CoinMarketCap

Chanpen mentioned the increased focus on trading platforms after the FTX bankruptcy. It’s a tough situation, he said, but Binance will be able to bear all the pressure as the exchange is “built to withstand the downside”. Zhao’s warning does make sense, as many experts have also begun to question the resilience of the market’s largest cryptocurrency exchange.

The day before, former Securities Commission member John Reed Stark expressed his distrust of the evidence of its reserves provided by Binance. He noted that the data does not reflect the full picture of what is happening. A similar view was expressed in a recent tweet by Kraken cryptocurrency CEO Jesse Powell, who insisted that the trading platform should report its liabilities in addition to its reserves.

Kraken founder Jesse Powell

According to four anonymous sources from Reuters news agency, US Justice Department prosecutors are considering taking legal action against Binance and some people in its management circle, including Changpen Zhao himself. Binance is suspected of failing to comply with anti-money laundering and sanctions laws.

To be fair, similar news headlines arise almost every year. And they usually end up going nowhere. On Monday, for example, Reuters sources reported that the US Attorney's Office is allegedly considering charging Binance cryptocurrency exchange executives with possible money laundering and sanctions evasion.

Hours later, Binance representatives published a response article highlighting the topic and what information they had shared with the reporter. They also added the following quote.

Reuters is wrong again. They are now attacking our law enforcement team. A team we are incredibly proud of, as they have made cryptocurrency safer for all of us. Here’s the full statement we shared with reporters, as well as a blog about our great team.

Binance chief executive Changpen Zhao

Canadian businessman and investor Kevin O’Leary also added to Binance’s potential problems. At yesterday’s congressional hearing, he suddenly claimed that it was a Binance executive who was to blame for the collapse of FTX, having allegedly taken out a competitor and now becoming a monopoly in the crypto space.

In doing so, Kevin somehow failed to mention the multibillion dollar hole in FTX’s budget, which was caused by the actions of the exchange’s head Sam Bunkman-Fried. It is also known that O’Leary may have received $15 million from Bankman-Fried as funding. Be that as it may, he voiced this strange position.

Meanwhile, Bitcoin trading has seen a lack of serious optimism among traders. That said, numerous indicators suggest that now is hardly the best time to buy the major cryptocurrency. This was stated by crypto analyst Philip Swift the day before.

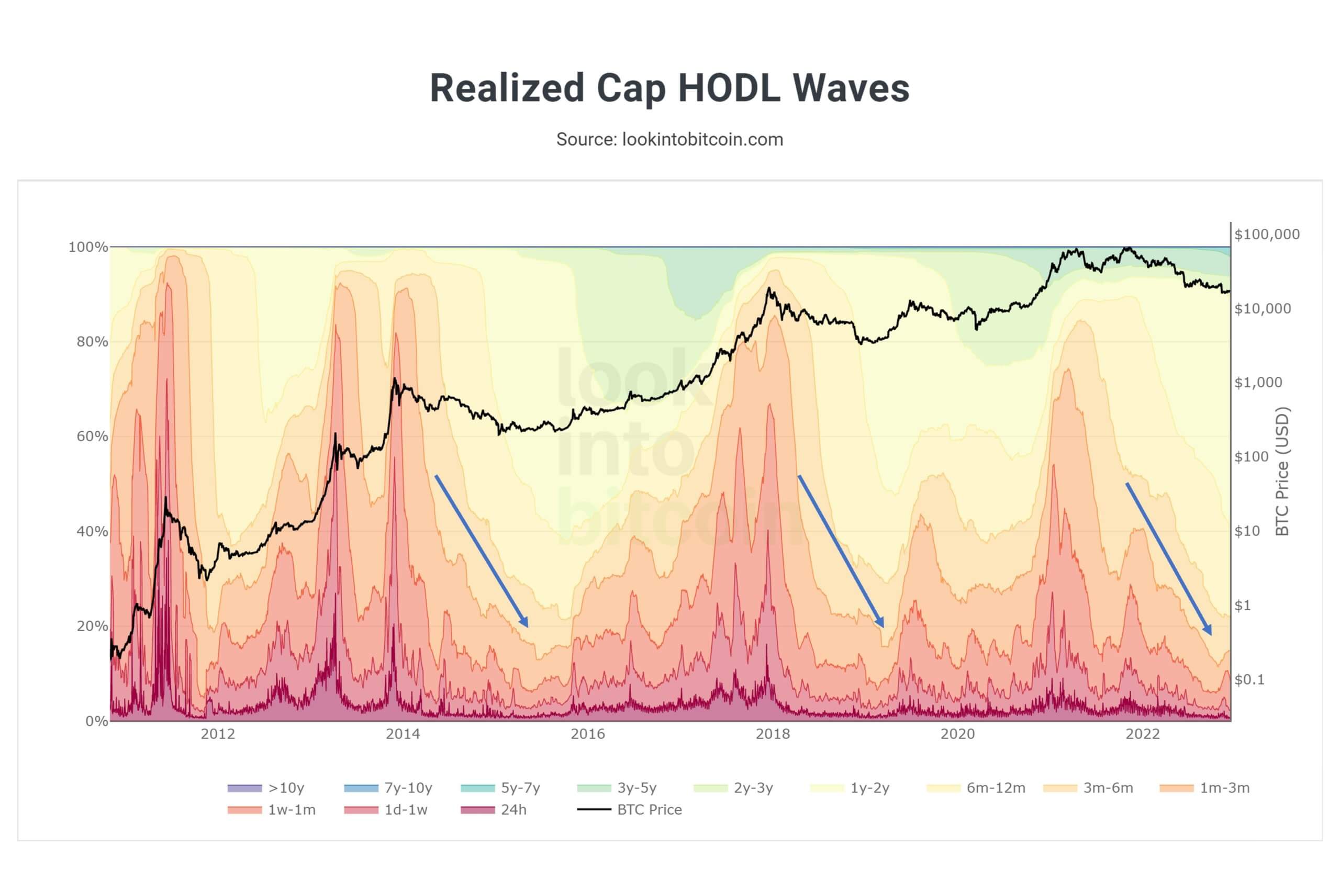

Swift based his argument on the readings of the so-called HODL Waves indicator. To recap, HODL Waves groups coin transactions by their “age”, meaning the metric determines how long BTCs have been idle on wallets before being transferred to the blockchain. This data shows how often long-term or short-term coin holders make transactions.

😈 MORE INTERESTING STUFF CAN BE FOUND ON US AT YANDEX.ZEN!

This metric is based on another metric called Realized Cap HODL (RHODL) Waves, which shows the aforementioned transaction time ranges in relation to the realised Bitcoin price. This is the price at which each coin was moved. Here’s what Swift writes about it.

So RHODL Waves tells us the underlying value of bitcoins that have been stored in wallets for different periods of time. Each time period is shown in waves on the chart.

Currently, RHODL shows a clear minority of coins moving in the blockchain shortly after they have been used in previous transactions. These transactions most often involve coins that were last moved within the last 6-12 months.

Realized Cap HODL Waves

Note the chart above – the darker the colour of the wave, the more recently the coins involved in the transaction have moved in the last time. This suggests that BTC is losing its appeal in the eyes of short-term traders. According to Swift, buying Bitcoin for the long term is not a bad deal in terms of risk-to-potential return in the current timeframe. However, investors traditionally need to make their own decisions rather than relying on the opinion of others.

We believe that various law enforcement agencies may indeed have questions for the management of Binance amid the proceedings against the arrested FTX founder Sam Bankman-Fried. However, it is important not to forget that the source of the problems here is precisely the former head of the latter. Therefore, the comments of the aforementioned Kevin O'Leary seem completely detached from reality.

What do you think about this? Share your opinion in our Millionaire Cryptochat. There we will discuss other important developments from the blockchain world.