The head of Pantera Capital is confident that the bankruptcy of FTX has not affected the fundamentals of the cryptocurrency industry. Why?

The fall of cryptocurrency exchange FTX, which literally turned its founder Sam Bankman-Fried from a billionaire to a criminal in a day, has seriously damaged the image of the crypto industry. Many have even been under the impression that FTX’s bankruptcy is supposedly proof of the failure of cryptocurrencies in general. Pantera Capital hedge fund CEO Dan Morehead was quick to deny this information. According to him, the core organisations of the crypto market and the key principles of the industry continue to perform well. We tell you more about what’s going on.

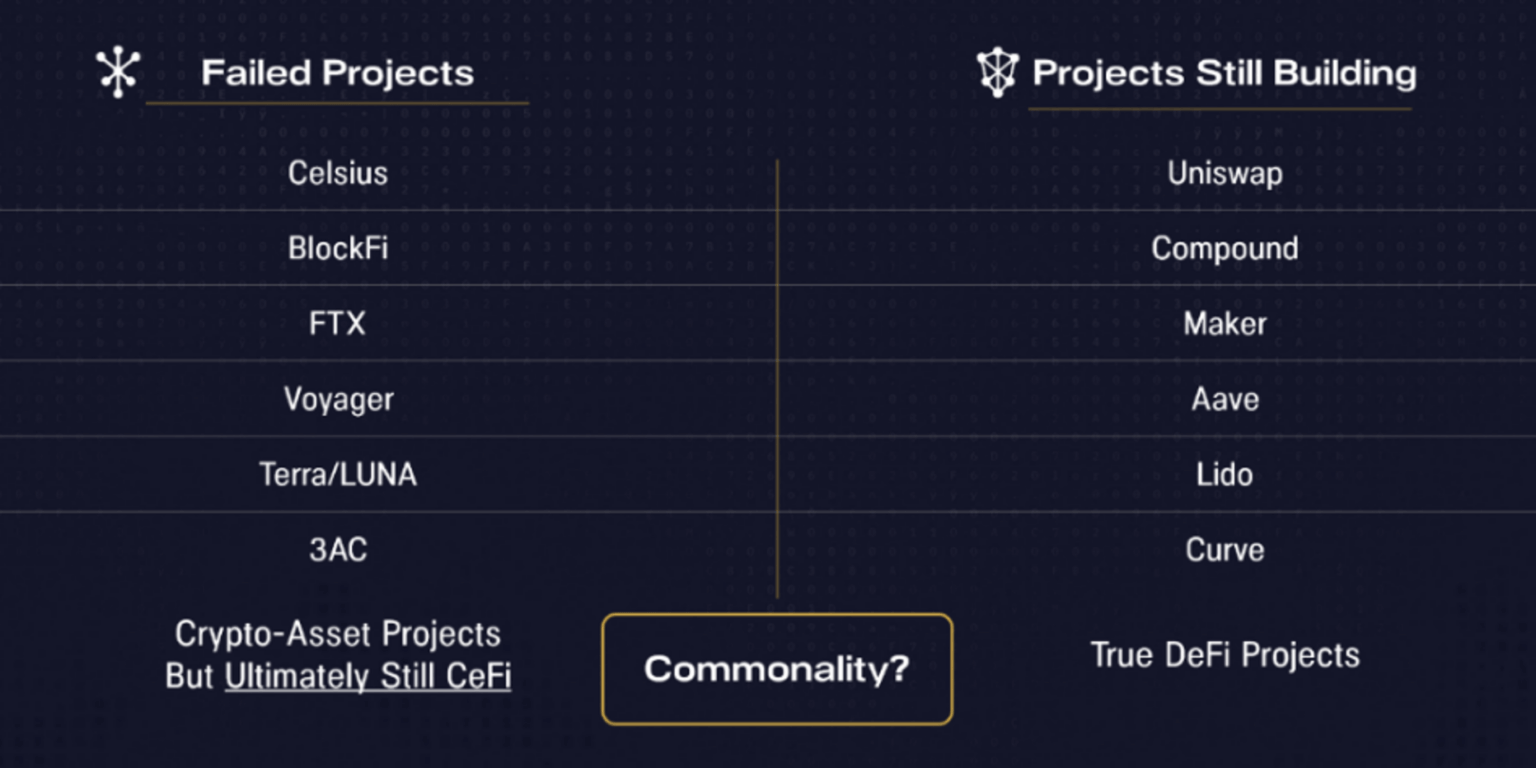

Note that the collapse of cryptocurrency exchange FTX really has nothing to do with the decentralised finance industry – that is, products that operate on the basis of smart contracts rather than centralised governance. This was emphasised by JP Morgan shortly after the FTX’s bankruptcy filing, among others. According to them, the current problems in cryptocurrencies are triggered by centralised players, not decentralised protocols.

Cryptocurrencies and tokens

Note that Morehead himself has already commented on what is happening to the blockchain industry amid the economic crisis. In particular, at the end of September he made it clear that he believes in the potential of cryptocurrencies. Well, the benefits of blockchain-based coins will be enough to ensure that the niche will successfully make it through this difficult period.

What’s next for cryptocurrencies

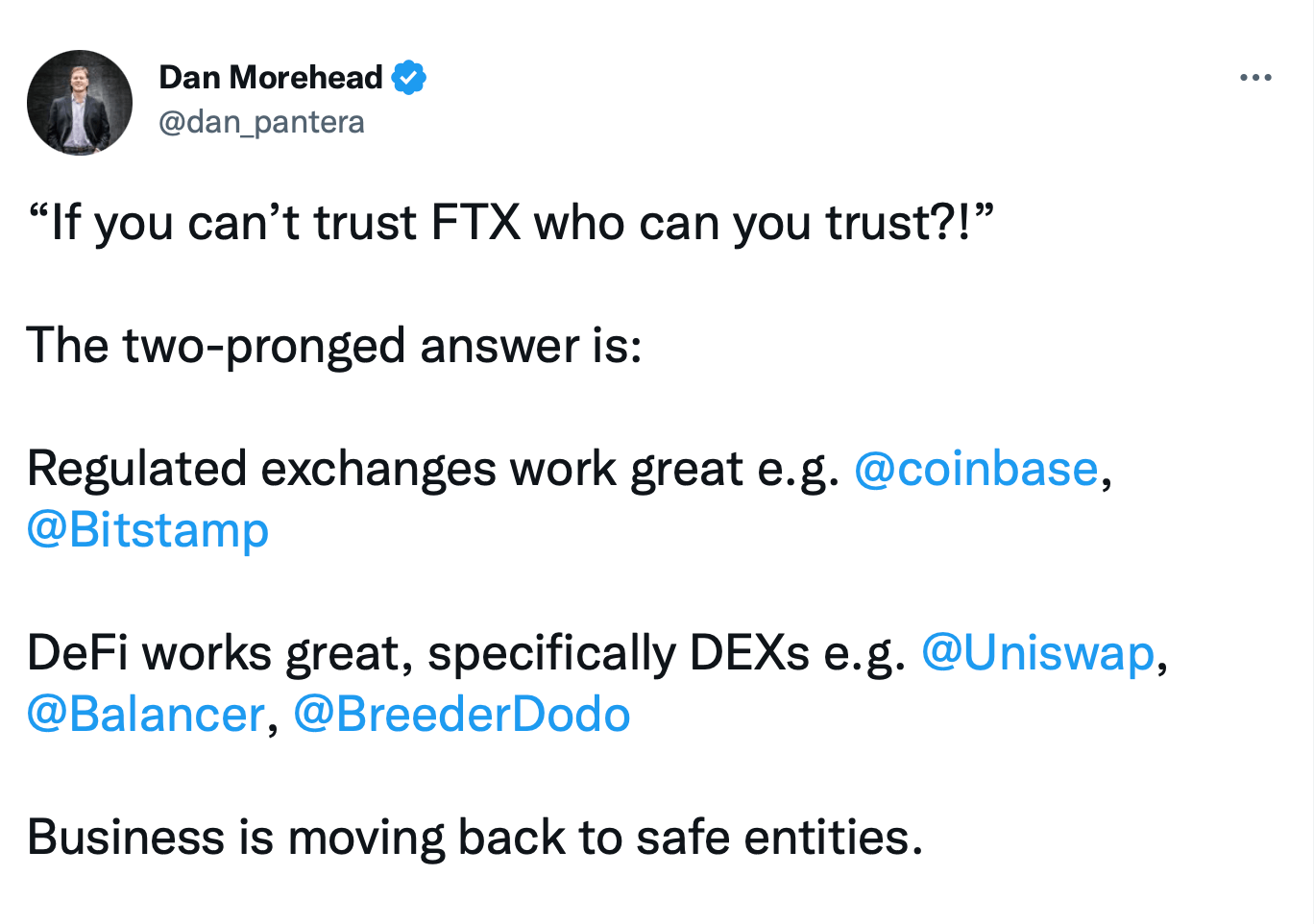

On his Twitter account, Morehead posted a short list of platforms and protocols that have not been shaken by the FTX collapse. Here’s his rejoinder to that, cited by Cointelegraph.

If you can’t even trust FTX, who can you trust then! There are two answers here. First, regulated centralised exchanges like Coinbase and Bitstamp are doing just fine. The decentralised finance industry is fine too, especially Uniswap, Balancer and Dodo. Businesses continue to toil in a secure environment.

Dan Morehead’s tweet

In an address to investors at Pantera Capital, the hedge fund CEO mentioned a few other reliable platforms – 0x, 1inch, Balancer and Kraken. Overall, Morehead applauded the transparent approach of the centralised platforms he mentioned in trading and handling client funds. He continues.

There are exchanges like Coinbase, Kraken and Bitstamp that, when a customer sends them money, simply deposit it in the bank. The solution is quite simple.

Failed and sustainable crypto industry projects

Additionally, the FTX bankruptcy hasn’t affected Bitcoin itself – the main cryptocurrency’s blockchain continues to function without any problems, as is the case with other popular networks, such as Etherium, Solana and Avalanche. This is important, because some people distant from the world of digital assets have started to panic and spread false myths about BTC, which in fact is in no way directly linked to any centralised exchange. The same is true for other popular decentralised assets.

😈 MORE INTERESTING STUFF CAN BE FOUND ON OUR YANDEX.ZEN!

In practice, the FTX story has not shaken most individual investors’ confidence in Bitcoin – as evidenced by a recent report from analytics platform Glassnode. BTC supply in the hands of individual investors has surpassed the 17 per cent mark – a historic high for the major cryptocurrency.

Will Clemente, an analyst at Reflexivity Research, commented on the record on his Twitter account. Here’s his rejoinder, cited by Decrypt.

Not perfect yet, but solid for an asset with a twelve-year history, definitely a course of action headed in the right direction. Bitcoin’s supply is dissipating over time, while the base of holders of traditional currencies is concentrating in one hand over time.

For the sake of accuracy, note that the Bitcoin network began operations on 3 January 2009. Accordingly, earlier this year it turned thirteen years old, and in a fortnight it will be fourteen.

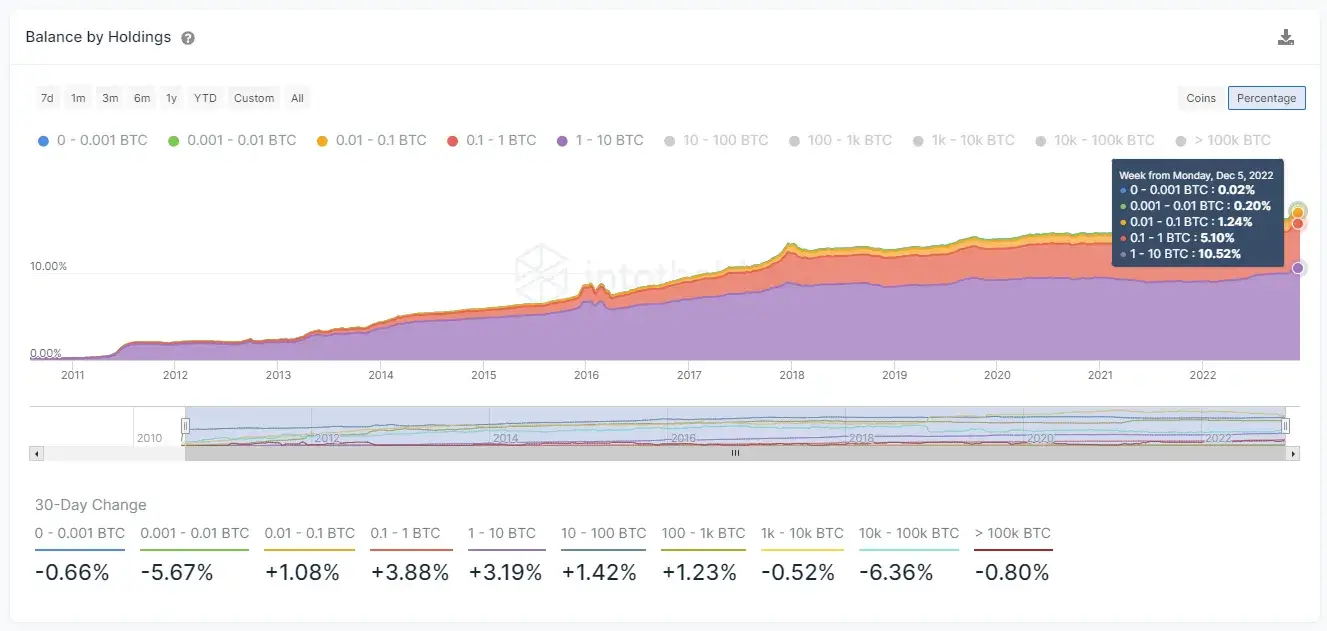

BTC supply in the hands of individual investors according to Glassnode

A chart from Glassnode, shared by Clemente, shows that the percentage of Bitcoin supply in the wallets of individual investors has been increasing steadily since 2011. In general, Glassnode defines “individual investors” as those holding less than 10 BTC, or $169,000 at current cryptocurrency exchange rates.

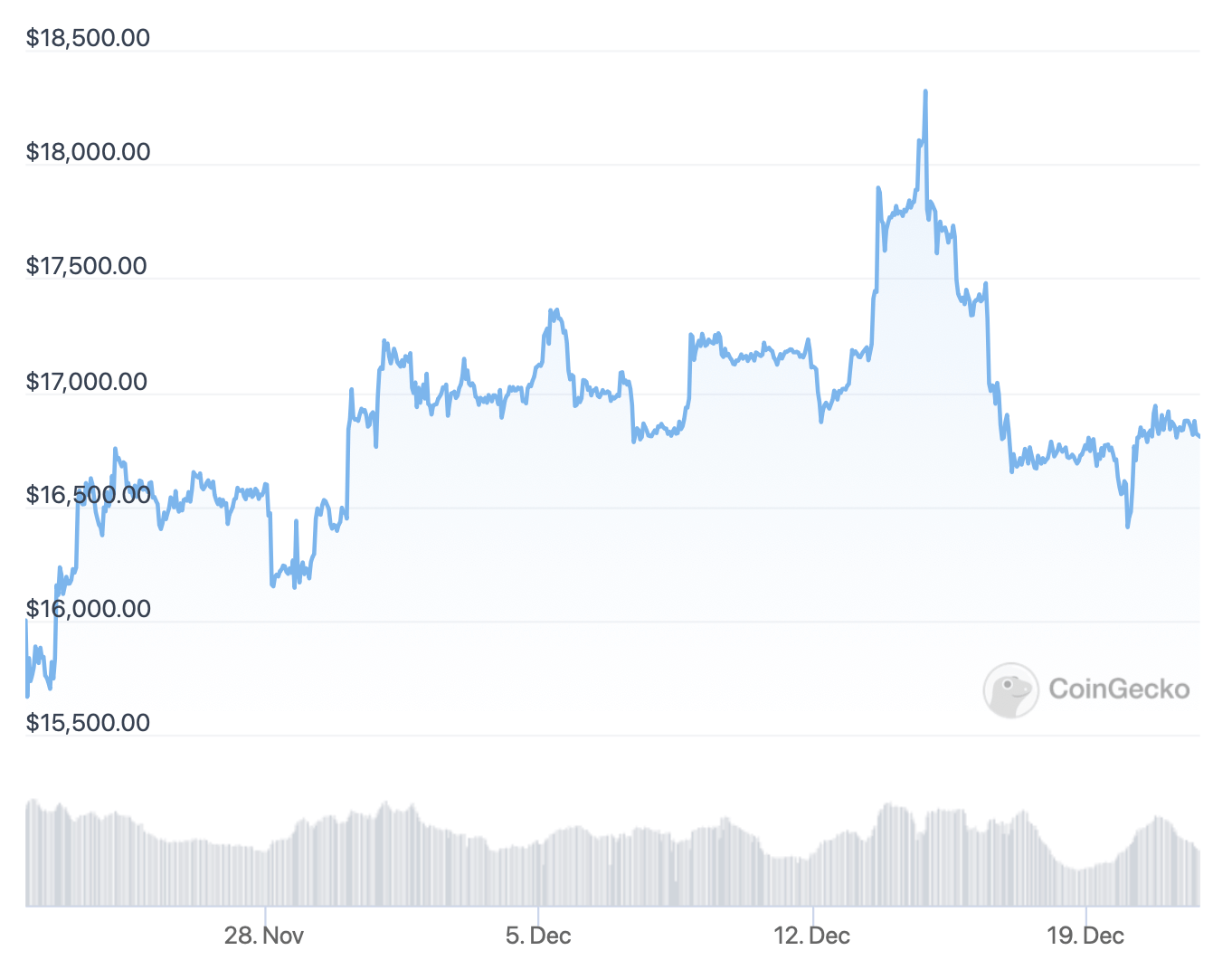

Bitcoin exchange rate over the past 30 days

IntoTheBlock analysts also have similar information. According to their calculations, the share of bitcoin supply in cryptocurrencies worth up to 10 BTC is 17.3 percent of the total volume. In comparison, the figure was only 12 percent at the beginning of 2020, but it began to grow rapidly in 2022.

Volume of BTC supply in the hands of individual investors according to IntoTheBlock

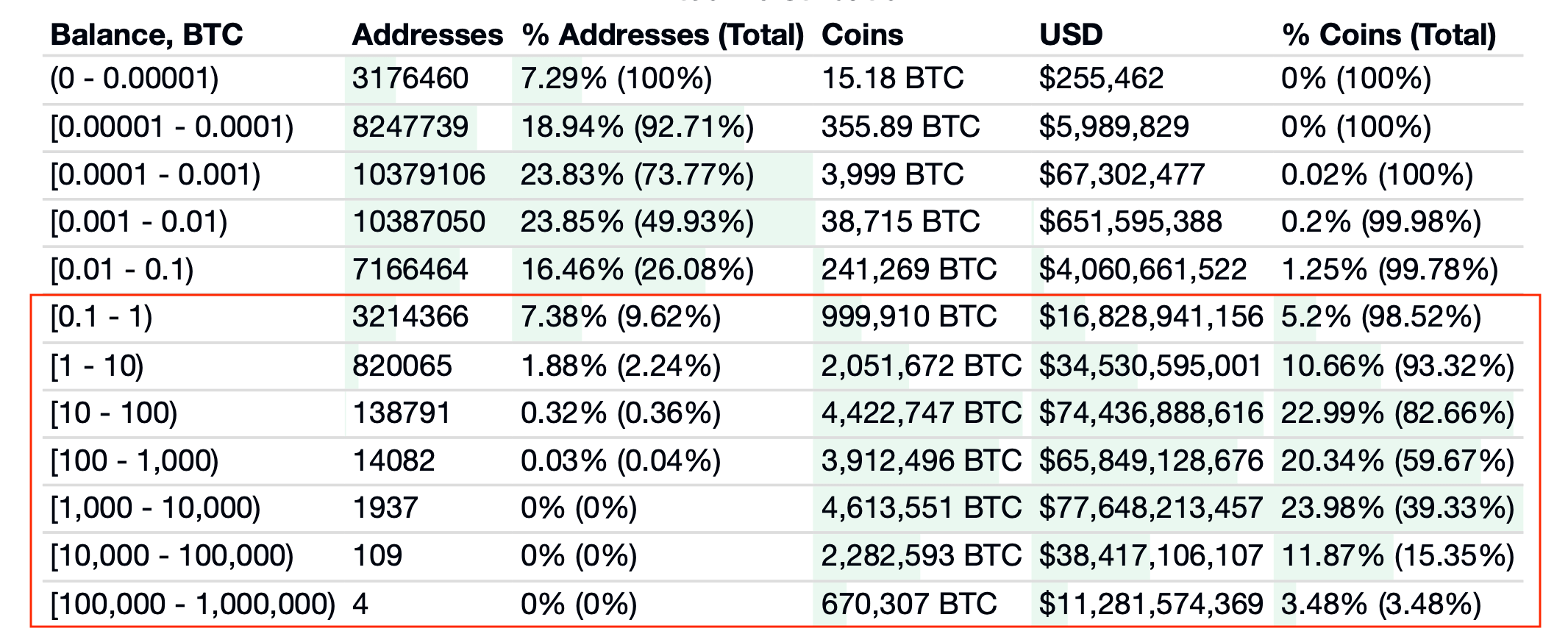

The new record for the amount of bitcoins in the hands of individual investors suggests a fairer distribution of the cryptocurrency among different categories of market players. However, the vast majority of BTC coins are still in the hands of a limited group of individuals and organisations. Among the latter, centralised crypto exchanges should be singled out – they remain a popular place to store crypto, even despite all the risks.

We’ve clarified the latest data: today there is more than one bitcoin at 2.23 per cent of all addresses. The funny thing is that this small proportion of owners of the first cryptocurrency account for 93.32 per cent of all BTC in circulation. Accordingly, the distribution here is also far from fair.

Bitcoin distribution between different addresses of different sizes

The Pantera Capital representative's attitude towards the digital asset industry does not seem to have changed in any way amid the collapse of the FTX exchange. That sounds logical, though. Still, it's important to remember that the main reason for the events of November and the current arrests of FTX and Alameda Research executives were the actions of certain people who broke the law. At the same time, the blockchain remains transparent, and what goes on in it is still visible to everyone.