The New York prosecutor’s office is investigating a link between the founder of cryptocurrency exchange FTX and the collapse of the Terra ecosystem. What is known about it?

Was the former CEO of the bankrupt FTX exchange Sam Bankman-Fried involved in the collapse of the cryptocurrency LUNA and the related TerraUSD staple this spring? US federal prosecutors have launched a special investigation to find the answer to this question. They will try to figure out how closely FTX was linked to the Terra ecosystem and whether Sam may have manipulated the price of the aforementioned tokens. Earlier preliminary information emerged that FTX bankruptcy became a likely scenario months ago, which means all this time exchange management has been trying to postpone the inevitable. We recount the events in more detail.

The actions of Sam Bankman-Fried led to the loss of billions of dollars to investors. This raises a logical question for the cryptocurrency community as to why the FTX founder has not yet been placed under arrest.

In short, Bankman-Friede’s guilt has yet to be proven. And since there are several cases pending against Sam at the same time, this could take some time. Read more about the details of what’s going on today in a separate piece.

FTX founder Sam Bunkman-Fried

What Sam Bankman-Fried is accused of

The TerraUSD token from Terraform Labs, now called TerraClassicUSD, is an algorithmic Stablecoin. That is, its parity with the US dollar was regulated by automatic arbitrage depending on LUNA transactions, so that ecosystem users could earn on possible deviations of the UST exchange rate and thus maintain its dollar value. Alas, the mechanism proved flawed, and TerraUSD lost its parity to the dollar in May due to developments in the market.

The rise and fall of the LUNA token

The loss of parity of the stablcoin against the US dollar also caused LUNA’s value to plummet: the development team then set about printing the token in an attempt to equalise the UST to one dollar, causing the project ecosystem token to fall to almost zero in a matter of days. A little later, the Terraform Labs team tried to find a way out by launching new versions of the tokens. In fact, that’s why they now have the prefix “Classic”.

However, even that did not save the company's co-founder Do Kwon from universal censure. The ecosystem collapsed and caused serious physical damage to other giants and investors who held their own savings in these products.

Terraform Labs co-founder Do Kwon

According to Decrypt’s sources, “behind the scenes” of what was happening, FTX was dumping large volumes of TerraUSD, putting additional strain on the shaky stabilitycoin parity system. At the same time, the exchange opened a short position in LUNA with the expectation of generating large profits, but in the end the pressure on the cryptocurrency led to the collapse of the entire project ecosystem.

Whether Bankman-Fried was counting on Terra’s complete collapse or simply saw a lucrative transaction opportunity remains to be seen. So far, it is at an early stage, and Sam himself has not yet been charged with any specific offence.

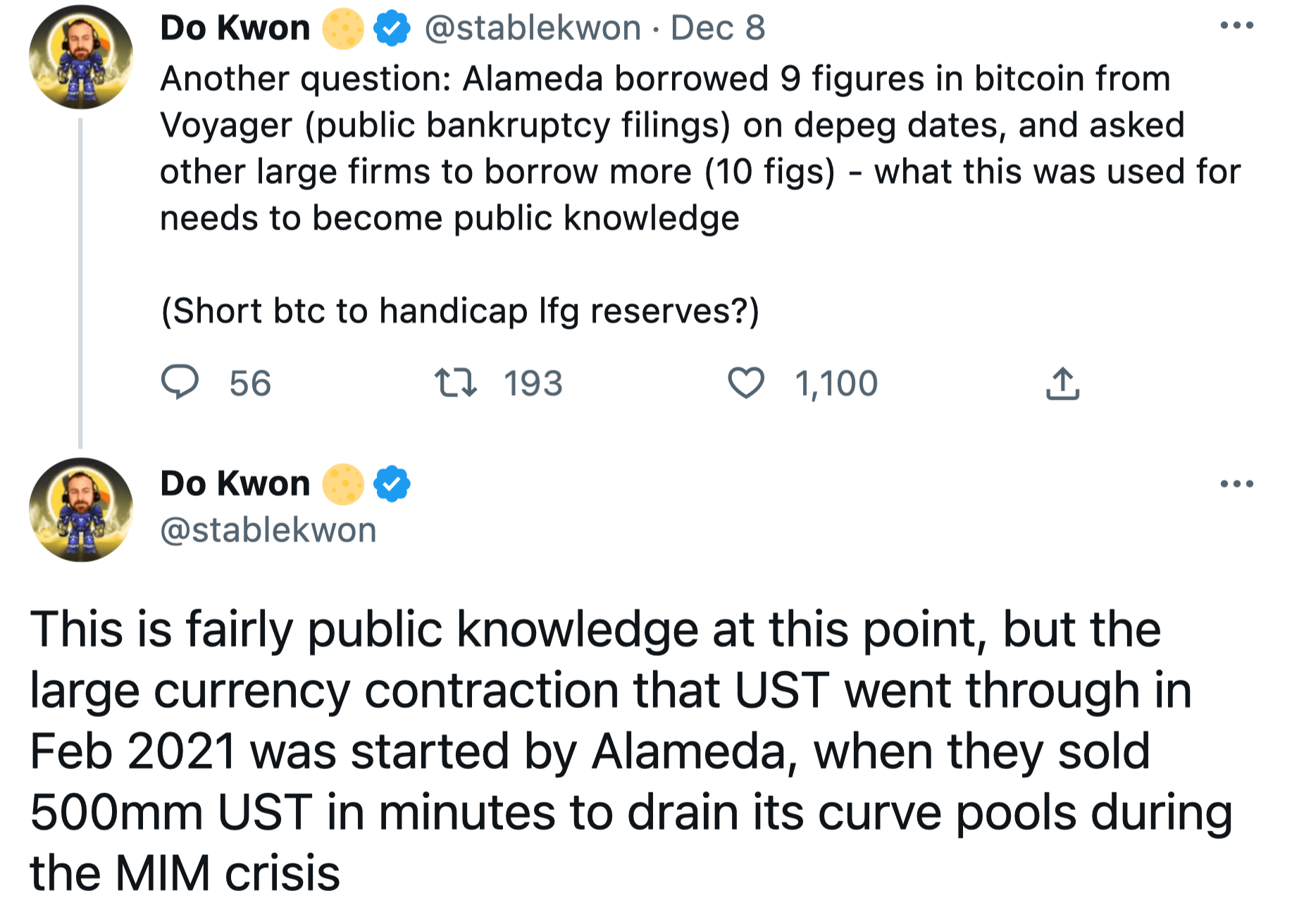

By the way, Terra ecosystem creator Do Kwon has responded to the situation. Through his fresh tweets, he has made it clear that he believes FTX and Alameda management are to blame for Terra’s collapse. Specifically, he stated that Alameda borrowed a large amount of BTC from Voyager during a time when UST was detached from the dollar – and it could have been used to pressure the Bitcoin exchange rate and create problems for Luna Foundation Guard reserves.

He also recalled UST’s problems in February 2021. Alameda’s representatives, who got rid of a huge amount in this stackablecoin in a very short period of time, could also have had something to do with them.

Tweets from Terra founder Do Kwon about FTX and Alameda’s role in the collapse of his project

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

Meanwhile, Bankman-Fried would like to be seen reporting on FTX’s problems to the US Congress – a point made twice by House Financial Services Committee member Maxine Waters on Twitter. Her first address to Sam drew a lot of criticism. At the time, commentators didn’t like Waters’ excessive “softness” in addressing the apparent fraud that Bachmann-Frieda is considered by most in the blockchain community.

As we told you earlier, the congresswoman addressed Sam a second time, in a harsher manner. But until now, these have only been tweets, which means at the level of law, they don’t oblige Bankman-Frieda to participate in congressional hearings. Now Waters, however, is ready to go for more drastic measures – here’s her latest tweet.

CNBC is spreading false information that I don’t want to issue Sam Bachmann-Fried a subpoena. He has been asked to testify at a US congressional hearing on 13 December. A subpoena can definitely be served. Stay tuned for an update on the situation.

Former FTX CEO Sam Bankman-Fried

Earlier, CNBC reporters said during a TV broadcast that Congresswoman Waters had allegedly told her colleagues that she had no plans to force Sam to make an official visit to Washington. According to anonymous sources, Waters said she would have preferred to persuade Bankman-Fried to testify of her own volition rather than a subpoena. Recall that Sam is now in the Bahamas and that country has an extradition mechanism to the US if absolutely necessary.

Sam has recently been trying to create an image around himself as a victim of circumstance: he has repeatedly claimed that he was allegedly unaware of all financial transactions within FTX and the closely associated trading firm Alameda Research. Evidence to the contrary is already in place, so Bankman-Fried could indeed be held responsible for his actions.

We believe that the prosecutors now have a lot of work to do. Obviously, the scope of FTX and Alameda, given the amount of funds at their disposal was enormous, which means that law enforcement will have to study many examples of activity of these companies. And there is bound to be something unethical among them.

Stay tuned to our millionaires’ cryptochat. There we will discuss other important developments in the blockchain and decentralised asset industry.