What to learn from this year and what to expect from cryptocurrencies in 2023: Interview with a WOO Network representative

The year 2022 has been a serious test for all cryptocurrency enthusiasts. Over the past twelve months, the top coins have seen serious losses and have even proved a less attractive investment compared to gold and stocks. At the same time, the industry’s top entrepreneurs have lost tens of billions of dollars, and many popular blockchain platforms have gone bankrupt and ceased to exist. We talked to Julia Bulakh of the WOO Network about the results of the past year and expectations for the next.

WOO Network is the company developing centralised cryptocurrency exchange WOO X and decentralised platform WOOFi, which will support perpetual futures next year.

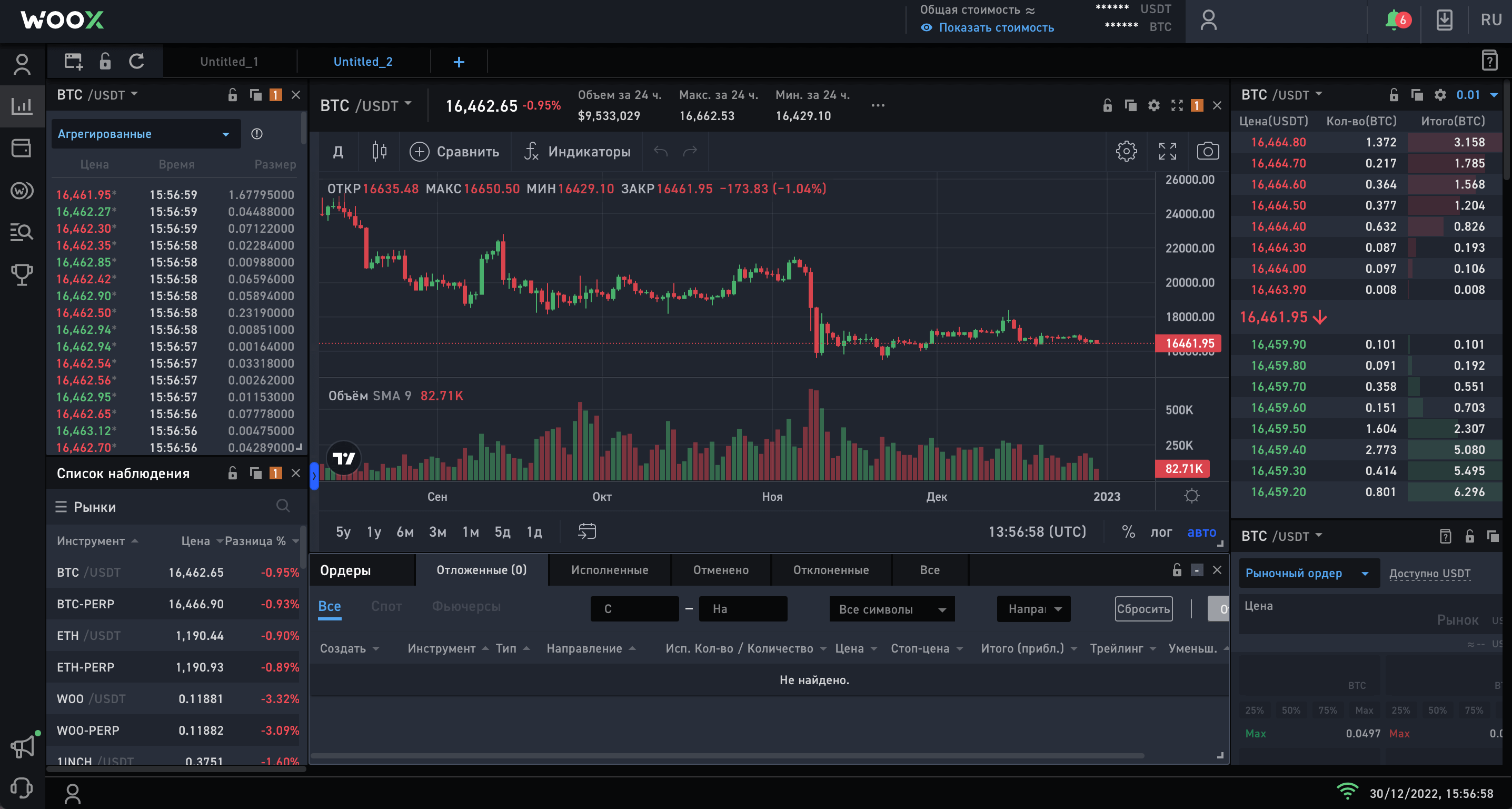

We are already familiar with the WOO X exchange. Its main feature is trading with zero commissions, which is accessed by stackers of a small volume of the platform's native token called WOO.

Unlike other exchanges, WOO X does not provide zero commissions at the expense of a wide spread, that is, the difference between the desired and actual price execution of a trade, or simply at a loss to itself. Zero commissions are embedded in the platform’s business model, and all the magic lies in the absence of third-party market makers to ensure that capital is available on the platform and trades are executed.

WOO X cryptocurrency exchange interface

In the case of WOO X, the provision of liquidity on the exchange is handled by its parent company Kronos Research, with trading volumes ranging between $5 billion and $10 billion per day. Because there are no third-party market makers and no fees for their services, this allows the exchange to provide zero fees to its users while providing excellent liquidity.

What will happen to cryptocurrency in 2023

The year 2023 has already led to the collapse of many exchanges and even the large centralized exchange FTX, so we wanted to discuss the results of the year and prospects for the next one with a representative of trading platforms. Our interviewee is Julia Bulach from WOO Network’s marketing department, who works in the company’s office in Warsaw.

Julia Bulach from WOO Network

The interview is in a Q&A format.

1. Today Bitcoin and Etherium are about 76 percent behind their peak rates, while Solana is down 96 percent. Are you surprised at the scale of the collapse this year? What kind of bear market is this for you?

I would describe 2022 as a deep cryptozyma, which has been a prolonged one, and on top of that has surpassed previous bearish trends. Am I surprised at the magnitude of the collapse? No. The thing is, I entered the cryptocurrency market at the end of 2018 when Bitcoin collapsed to $3,000 to $4,000. It sounds pretty funny, but it was the market crash that prompted me to get involved with the coin industry, as I had the opportunity to buy BTC back then. In addition, at the time of buying the cryptocurrency I was clearly aware of its past price high – and that motivated me.

The fall of Bitcoin and other cryptocurrencies

So all in all, yes, I know what a bear market is, and in addition I consider it a perfectly normal development for crypto. To answer the question: for me it’s a second bear market. The same goes for WOO Network, by the way, which was set up during the collapse. Accordingly, we knew from its launch that the market would not always be in “up and only up” mode. So we prepared ourselves for that, of course.

2. What was the most memorable event or events during the year? If there are positives, you can pick them as well.

I represent a cryptocurrency exchange, so quite predictably I would call the FTX crash the main event of the year. Yes, FTX, not LUNA or anything else.

In my opinion, this is a very positive event for the market, despite the latter’s further collapse. Still, thanks to the bankruptcy of FTX and other companies with huge loans and questionable collateral, the industry is being cleared of bad bad players.

Cryptocurrency collapse

We discussed this situation internally and came to the conclusion that you can’t break a good company with one tweet. If FTX wasn’t in trouble, no statement from Binance CEO Changpen Zhao would have ruined anything. No haip of negativity can ruin what has been built over several years – and that is a fact.

From this we can conclude that the problems in FTX have existed for a long time, and they arose because of wrong decisions and the chosen business model. Be that as it may, the market will be cleaner after something like this. By the way, the same applies to algorithmic stablcoins, the weakness of which was demonstrated by the failure of UST from the Terra ecosystem.

As a conclusion, we can say that 2022 has exposed serious problems within the industry – and now representatives will try to solve them.

3. Do you believe in the end of the bearish trend, a market reversal and further recovery? If so, why?

Of course I believe in the end of cryptozyma, it cannot be otherwise. The only question is how long this decline will last. My experience combined with intuition tells me that we will be in a down-trend for some time yet – at least due to the bad state of the world economy. However, sooner or later things will pick up.

I think the cryptocurrency industry is now left to create new products and improve existing ones, as well as keep an eye on market developments. Still, the main challenge in a bearish trend is to be ready for the industry to turn around and go into growth. As previous years show, many investor-traders remain waiting for lower coin prices and fail to take profitable positions, which in fact is also due to greed. So traders and companies have to actively study the market, find their place in it, and prepare for the industry’s turnaround.

4. What would you recommend to crypto investors who are facing the collapse of crypto for the first time?

The collapse phase of cryptocurrencies is the best time to diversify, i.e. redeploy assets. It’s not just about investments, but also about how you manage your money in general. For example, you need to be aware of where your steady income comes from, where your investment returns come from.

Buying cryptocurrencies

That being said, I believe that above all the state of your investment portfolio should not affect your life. It’s also important not to invest money that you can’t afford to lose – it’s an old and partly golden rule for anyone who works with finance. In addition, it now allows you to keep your psychological state in check, rather than tearing your hair out after every market drawdown.

By the way, I think buying good projects in a collapse is a useful thing to do. In fact, I do it in my spare time.

5. What kind of coins do you have most in your portfolio? How long do you invest for?

I’d like to point out that I do not give financial advice, but only share my own experience. The main positions in my portfolio are Etherium (ETH) and WOO, the native token of our exchange.

Let me tell you right away about a major mistake I made. I was lucky to sell a lot of BTC near its high in 2021, but I never re-bought Bitcoin after the collapse. Why? Because I, like many others, see great upside potential for altcoins, which I set out to buy. However, the trick is that they have equally great potential for both growth and decline.

As a result, I now have a rather noticeable minus in my portfolio, as a certain portion of my profits was spent on buying altcoins. Obviously, it was a mistake, and in the future, under such conditions, I will give preference to buying Bitcoin specifically.

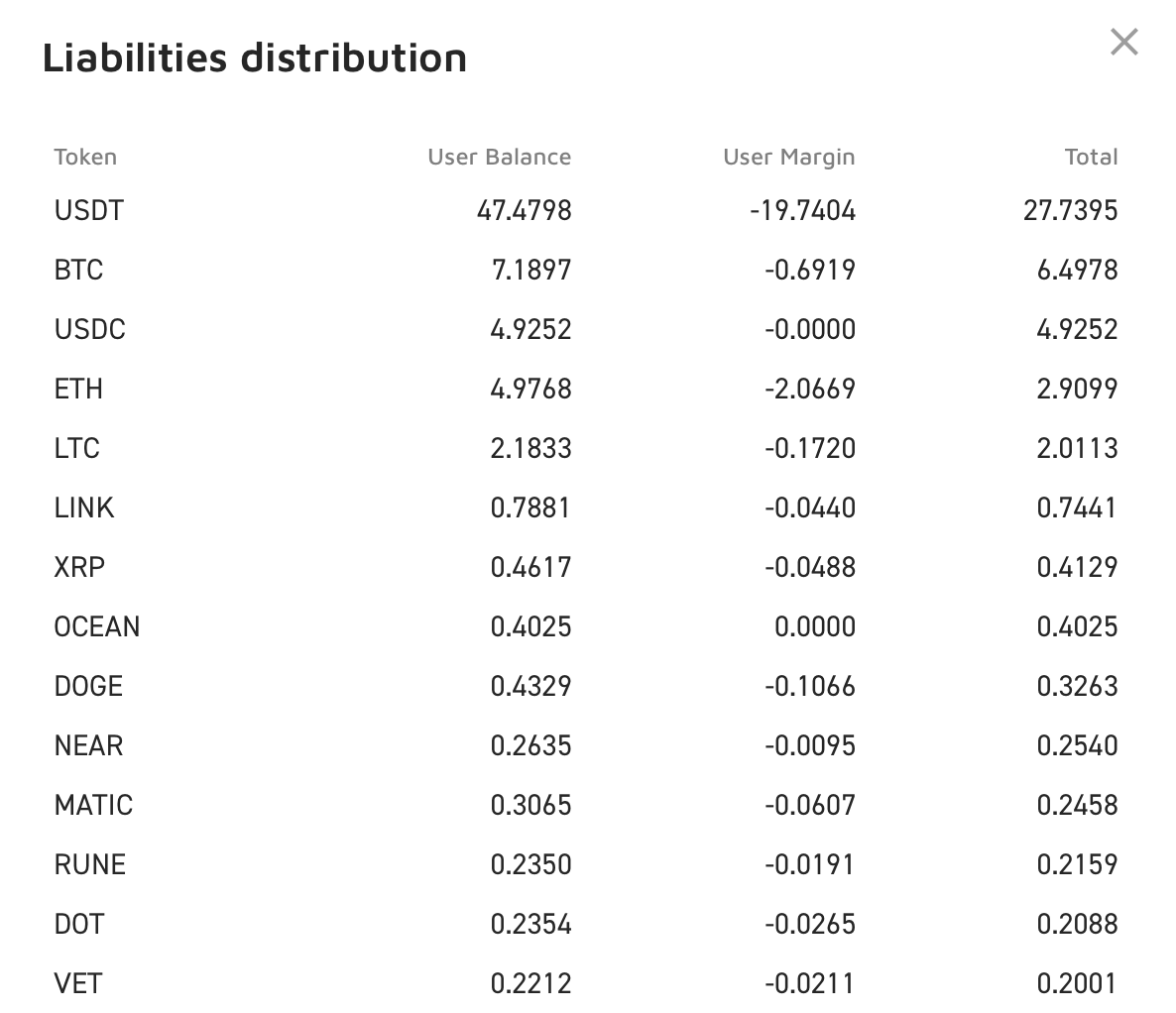

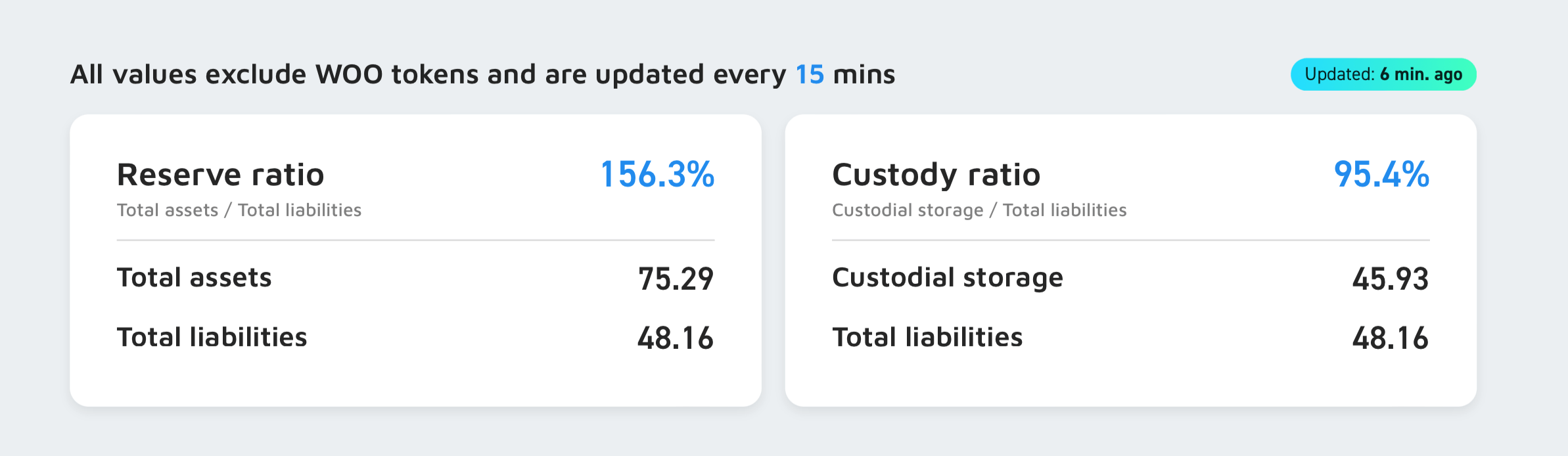

Investors can take inspiration for positions from venture capital funds, which share their investments, and also study the company’s reserve statistics – and see what coins WOO Network holds, for example.

Distribution of assets and liabilities at cryptocurrency exchange WOO X in millions of dollars

Perhaps in a bear market, it’s also worth remembering to diversify, i.e. don’t hold everything in one coin. This usually ends badly. Imagine an investor held all his money in a native token of an FTX exchange called FTT, which was essentially backed by nothing. Or, for example, owning other coins with large holdings held by Alameda Research.

As we know, these companies were actively flipping other people’s money between them, which ended tragically, which is why investors need to go into diversification. Experienced crypto funds in general always build portfolios around two or three major coins at the core of a portfolio. Most often these are Bitcoin, Etherium and other cryptocurrencies.

6. The collapse of FTX – what caused it? What will happen to the industry next – will regulators strangle us?

FTX collapse was caused by misuse of user funds. So when many people withdrew their cryptocurrencies, there wasn’t enough of them in their wallets. And that was enough for bankruptcy.

Regulators – I don’t think they are trying to strangle the cryptocurrency industry, and I am not an opponent of regulators myself. Of course, we are talking about normal legislative bodies, not total control like China, where not only certain information can be blocked, but even people looking for cryptocurrency tickers on social media can be tracked. Normally, regulators promote the state and the lack of sticks in the wheels of the cryptocurrency industry.

Cryptocurrency investors on the bullpen

Here we can mention the achievements of Ukraine, which legalised the cryptocurrency sector in March 2022. Thanks to this, cryptocurrency exchanges can legally operate in the country and open bank accounts, while ordinary users have received judicial protection for their rights to digital assets.

Overall, I don’t see regulators actively interfering with the promotion of cryptocurrencies. Moreover, their active involvement in the industry will make it easier to further develop the niche and in addition clean up the market from scams.

7. What conclusions should crypto enthusiasts draw from this situation? Do you support storing coins on hardware wallets when there are exchanges?

After 2022, cryptocurrency enthusiasts need to think hard about why they need crypto assets. For example, it can be held long term, traded every day or invested regularly. And just depending on the task at hand, one needs to figure out where and how best to accomplish it.

For example, if one is planning to trade, then one needs a stock exchange. If it is a one-time purchase of crypto – you can do without an exchange and use just a hardware wallet. But if he is going to buy it regularly, the combination of exchange and regular withdrawals to Ledger is suitable.

Cryptocurrency trader

Separately, I want to emphasize that you should not see exchanger as a place to store your cryptocurrencies. The purpose of an exchange is to provide a place to buy and sell coins quickly and at a good price, so you should only keep cryptocurrencies that you will use for trading. In essence, it’s about diversifying where coins are stored, which will benefit their security.

The biggest takeaway is to learn and try to understand why you need cryptocurrency.

8. After the FTX bankruptcy, many crypto exchanges took to publishing their own reserves. However, this idea has been criticised, as reserves should ideally be displayed along with liabilities. Is there any point in confirming exchanges’ reserves without liabilities?

No, there really is no point in reserves without liabilities. It is important for users to know how their money on deposit is being used. Perhaps the exchange uses them for risky margin trading or sends them to management funds?

I think so far, most trading platforms have failed so far. Still, without commitment, users cannot be sure that their crypto-assets can be withdrawn at any time.

9. Is demonstration of crypto-exchange reserves a guarantee against an FTX-type crash? How has WOO X approached this issue?

Incidentally, FTX also occasionally showed its own reserves, but that didn’t lead to anything good. We at WOO Network have taken the path of maximum transparency.

We have a special page with exchange reserves and liabilities, which we update every fifteen minutes. Some of the information can be cross-checked on blockchains, and we also show the sources of liquidity.

For example, today the reserves figure is 156 per cent. That means that there are one and a half times more cryptocurrencies on the exchange than users have put in there. We purposely hold assets in surplus, so as to protect against possible problems in case of mass withdrawals of coins.

WOO X cryptocurrency exchange reserves and liabilities

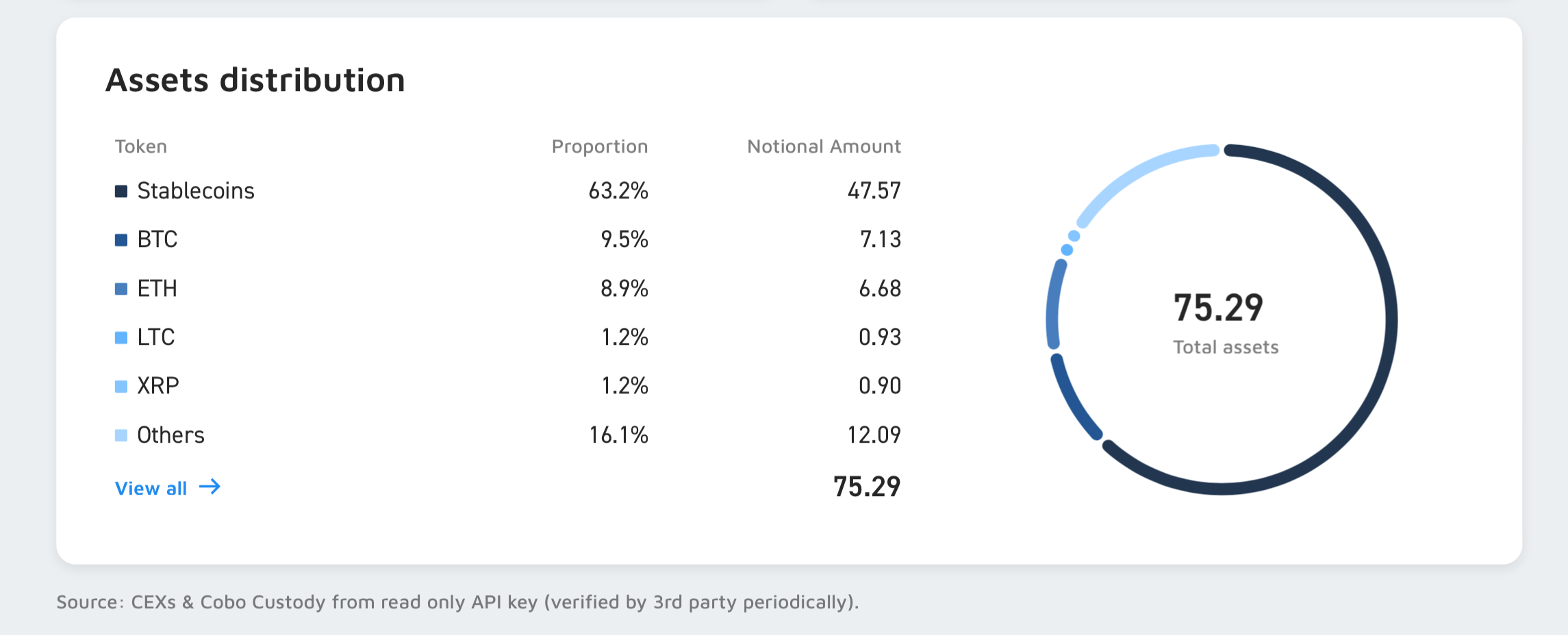

You can also see on the page that 63.2 per cent of the assets on the exchange are Stablecoins. Apparently, users are counting on a further rollercoaster ride in the market and want to hedge against excessive volatility.

Asset allocation on the WOO X cryptocurrency exchange

Our data is updated every fifteen minutes, and it’s kind of an industry record.

10. What are the main achievements of your company in 2022 and what are the plans for 2023?

This is going to sound ridiculous, but the main achievement this year is the continued operation of WOO X. But seriously, the important outcome of the year can be considered the right management and decisions, which allowed us to survive a difficult period in the market and continue to generate income.

We know what to do next. We have created a solid base, hired many new developers, created a sound roadmap and managed to save money in the process. What’s more, we still have the assets raised in the A+ round in January this year, which was led by Binance.

Cryptocurrency trader

However, the result of the efforts made today will be visible once the market turns around and returns to normal. Then we will be able to reap the benefits, but in the meantime it is worth remembering that nothing is built in a day. But the WOO Network already sees opportunities for correcting the market and becoming a market leader.

Look for more interesting topics in our Millionaire Crypto Chat. There we will talk about other topics that affect the blockchain world.