A JP Morgan bank executive has criticised Bitcoin for failing to understand the basics of cryptocurrency. What are we talking about?

JP Morgan CEO Jamie Dimon remains sceptical about everything about Bitcoin – including the fundamental property of the major cryptocurrency. Dimon doubts that Bitcoin will be limited to a maximum of 21 million coins, and also considers cryptocurrencies a “decentralised Ponzi scheme”. His recent statement in an interview on CNBC looks particularly absurd, as the Bitcoin code is open for anyone to study, in addition there is not a single person in the world who can change the basic properties of the cryptocurrency alone. We tell you more about what’s going on.

Note that Bitcoin is feeling pretty good today. The cryptocurrency is back above the $21,000 level. As a result, over the last week, the BTC exchange rate rose by 12 percent, which is quite tangible.

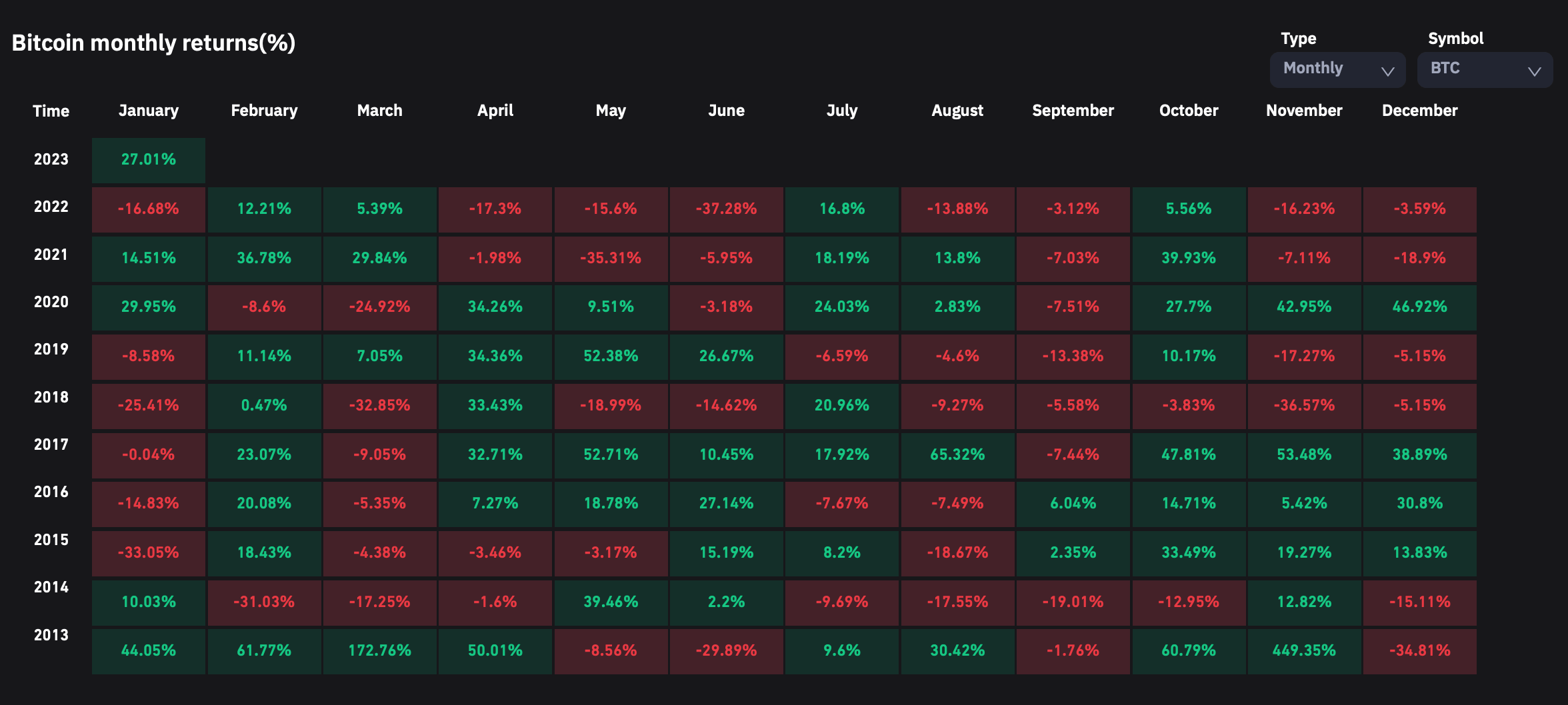

Overall, the value of the first cryptocurrency has jumped 27 percent since the beginning of 2023.

Bitcoin exchange rate changes by month

At the same time, IntoTheBlock analysts admit that the Bitcoin exchange rate has reached the bottom. According to their data, the number of bitcoins held by long-term hoarders of the cryptocurrency, who hold it for at least one year, increased by 50 per cent in 2022. The figure rose from 10 million to 15 million, in addition this category of investors is not prone to sharp sales. With that in mind, experts suggest that sellers’ pressure on the BTC exchange rate will be noticeably less in the future.

The balance of bitcoins at the disposal of long-term hodlers

In addition, the previous bearish cycle followed a similar pattern.

What is Bitcoin being criticised for?

Here’s one of Dimon’s quotes published by the news outlet Decrypt.

How do you know it will end up at 21 million coins? Maybe the last bitcoin will be mined and there will be a picture of Satoshi laughing at all of you?

An argument like this is a vivid illustration of how distant some people can be from what's happening in the cryptocurrency world. Apparently, James Dimon is also unfamiliar with programming, so he can't assume that all the rules of BTC network are published in his code.

In addition, the last bitcoin will be mined around the year 2140, and Satoshi Nakamoto will definitely not be alive until then. Apparently, the banking giant's representative does not know about halving and pace of new BTC issuance either.

JP Morgan CEO Jamie Dimon

As a reminder, the maximum amount of BTC that can be mined is prescribed in the Bitcoin protocol by its creator Satoshi Nakamoto. By now more than 90 percent of that amount is already mined, but the last BTC will be mined only in 2140. This is all because of the already mentioned halving procedure, which is about halving the reward for each block every 210,000 blocks, or roughly every four years.

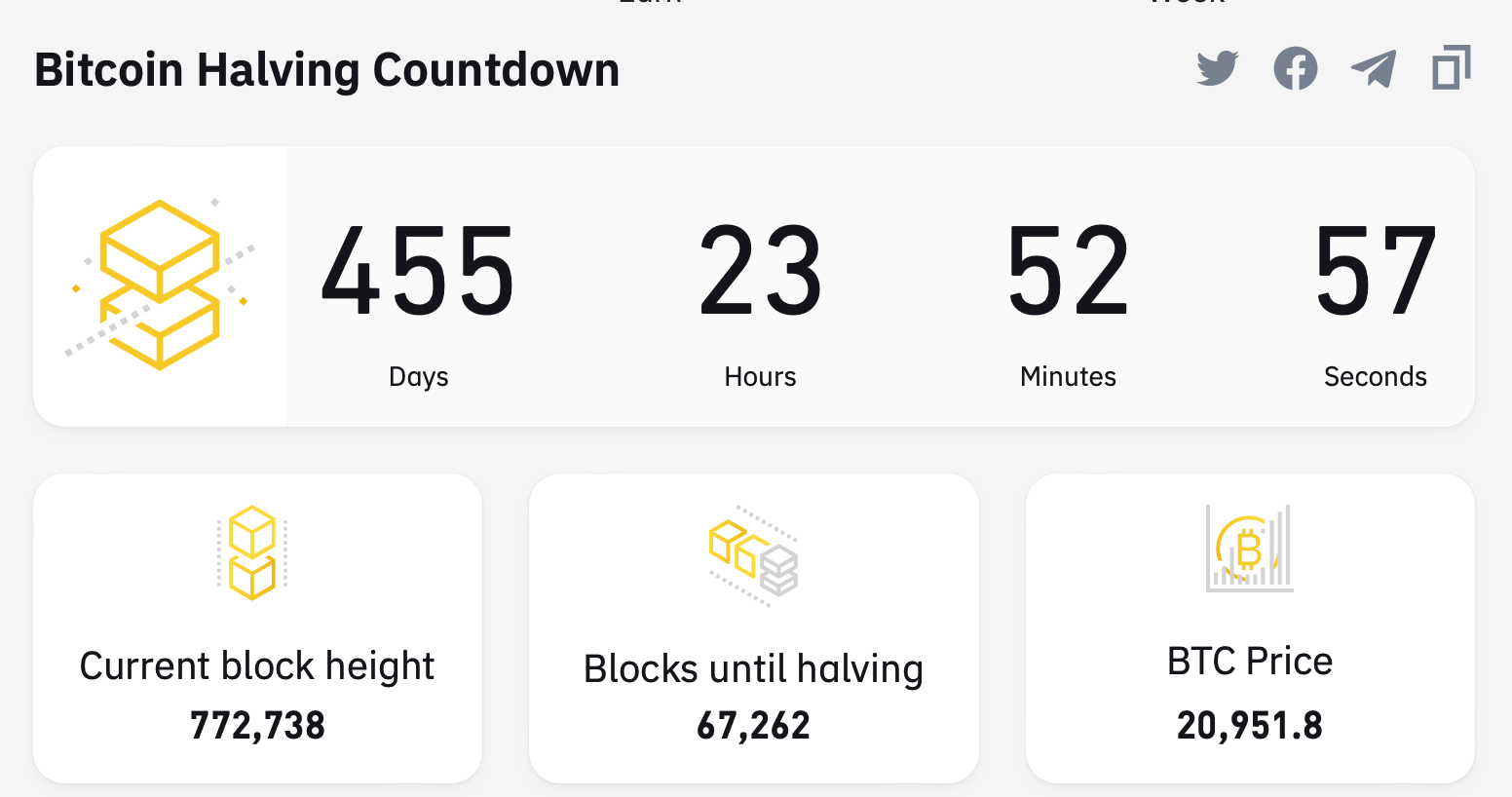

If in 2009 there were 50 new BTC for every block, now miners are getting only 6.25 BTC. The next halving will approximately take place in March-April 2024: the amount of the issue will then decrease to 3.125 BTC.

Countdown to the next halving

This is not the first time Dimon has expressed doubts about the key properties of crypto. Here’s what he said at an Institute of International Finance event last October.

Do you all study algorithms? Do you all believe in it? I don’t know, I’ve always been sceptical about this sort of thing.

That is, Dimon believes that only experienced programmers can be confident in the key features of cryptocurrencies and learn its code. However, this is not really the case.

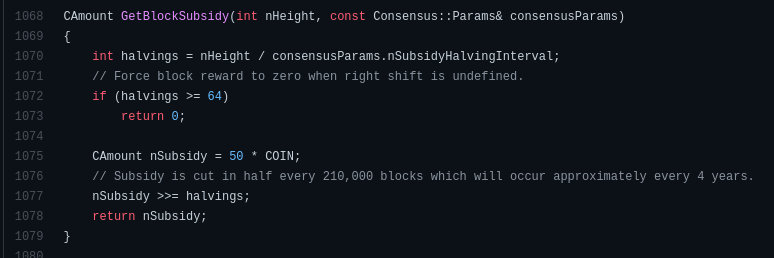

Algorithms are easy enough to “learn”. As popular crypto-enthusiast Jameson Lopp noted on his Twitter page, Bitcoin’s maximum offering is limited to just a few lines of code. Here’s what they look like.

The code that limits Bitcoin’s maximum supply

Naturally, the features of the Bitcoin blockchain can be changed if developers make certain innovations, and most of the nodes in the first cryptocurrency's network support them. However, as recent years have shown, the BTC community appreciates the ideas of anonymous creator Satoshi Nakamoto and does not want to depart from them, so the cryptocurrency continues to be used despite its slowness and technical imperfection. That said, Bitcoin somehow fulfils the role of storing and transferring value, which is more than satisfying for BTC fans.

With that in mind, it's safe to assume that most digital asset lovers won't want to deviate from Satoshi Nakamoto's original precepts. Well, the cryptocurrency network will continue to work as intended.

Bitcoin logo

We believe that James Dimon has once again confirmed his lack of understanding of cryptocurrencies and how they work together with his unwillingness to understand the subject. In this regard, Dimon seems to believe not only in the mystical emergence of Satoshi Nakamoto, but also the alleged lack of an upper supply limit for the first cryptocurrency. And this leads to the conclusion that the JP Morgan representative is clearly not the best interlocutor on the subject of decentralised assets, and his criticism on top of that means nothing.