A lawsuit has been filed against the former head of crypto platform Celsius. What is he accused of?

New York Attorney General Leticia James has begun legal proceedings against Alex Maszynski, the founder and former CEO of crypto-platform Celsius. James said Maszynski had made numerous “false and misleading statements” that caused investors to lose billions of dollars after his company went bankrupt. Meanwhile, the Celsius strip platform itself filed for bankruptcy last July. We tell you more about what’s going on.

As is customary, we begin by explaining the situation. The collapse of Celsius was one of the most high-profile events of 2022. In a nutshell, the company fell victim to a liquidity crisis amid the decoupling of stETH exchange rate from conventional ETH ethers. As a result, withdrawal of user funds implied high costs and the need to lay down the company’s own funds. It ended up with the suspension of user withdrawals, which were never resumed. A few weeks later the company went bankrupt.

The logo of the Celsius website platform

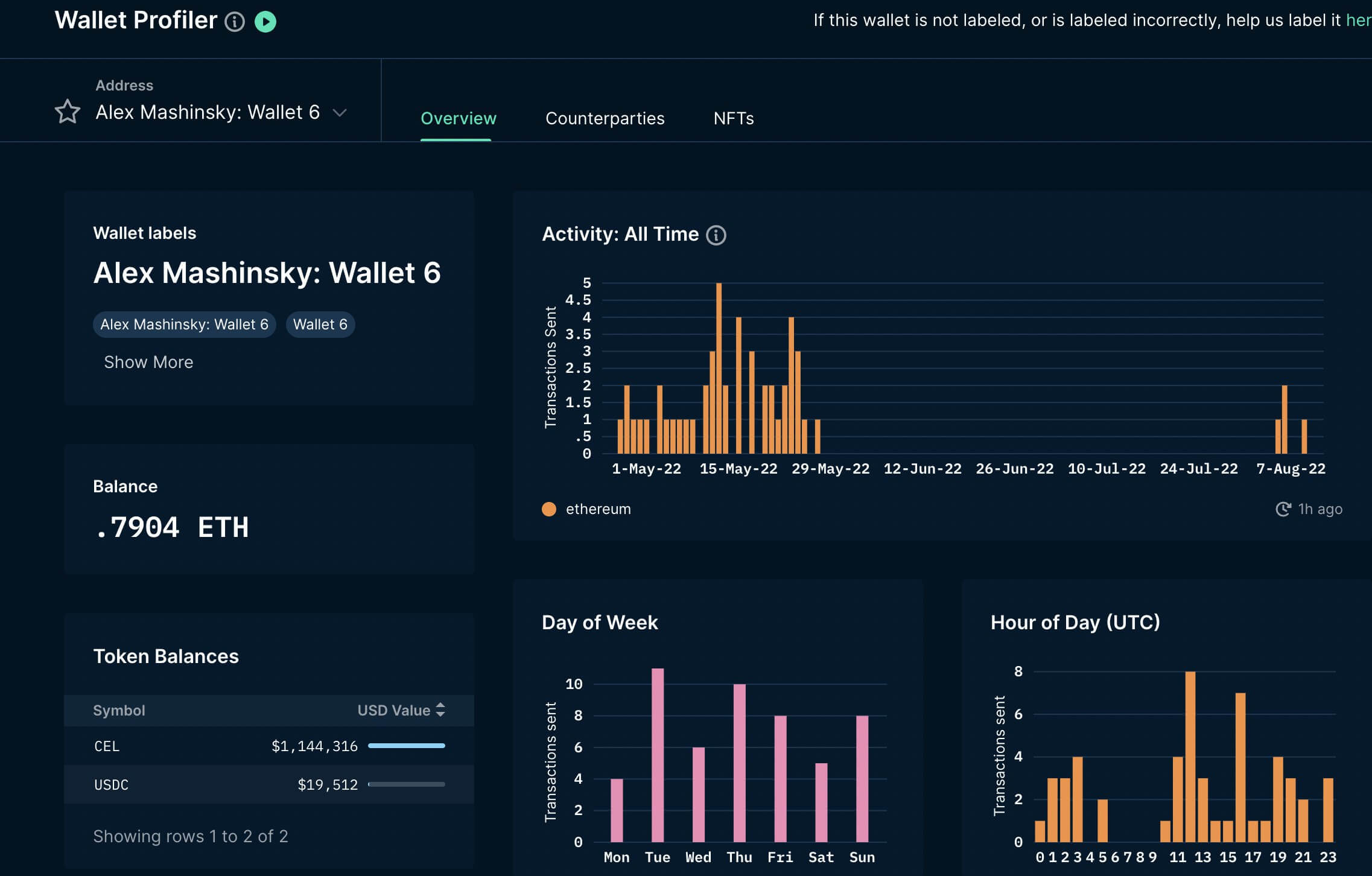

Note that the attitude towards Maszynski in the blockchain community is not the best. He worsened his reputation in August 2022 when he got rid of thousands of CELs, the native token of the Celsius platform. This was done on the decentralised exchange Uniswap, with transactions amounting to $28,000.

Activity with the wallet of Alex Maszynski, who sold a large number of CEL tokens

At the same time, withdrawals for Celsius users at that time had already been blocked for several weeks. Such actions were therefore quite predictably seen as unfair and unethical.

What will happen to the Celsius platform

In a statement, the New York Attorney General’s Office announced a lawsuit alleging that more than 26,000 residents of the US state had lost billions of dollars worth of cryptocurrencies as a result of the fraud. According to James, Maszynski’s actions led to Celsius being declared bankrupt and in addition contributed to investor losses as he misrepresented the financial health of the platform. Here is the relevant rejoinder, which highlights the topic of Maszynski’s activism.

As the former CEO of Celsius, Alex Mashinsky promised to lead investors to financial freedom, but led them down a path of financial ruin. The law is clear that making false unsubstantiated promises and misleading investors is prohibited. Today, we are taking action on behalf of the thousands of New Yorkers who have been defrauded by Mr. Maszynski to recover their losses.

As James noted in the tweet, Maszynski has also not registered to do business in New York. Obviously, this will add to the former entrepreneur's problems.

Ex-CEO of Celsius Network Alex Mashinsky

According to Cointelegraph sources, the aim of the lawsuit is to bar Maszynski from “doing business in New York” in the future, as well as to compensate affected Celsius investors.

😈 YOU CAN FIND MORE INTERESTING THINGS FROM US AT YANDEX.ZEN!

Some more interesting details have emerged in the legal proceedings regarding the bankruptcy of Celsius Network. According to a ruling handed down this week by Judge Martin Glenn, the funds deposited into the Earn platform programme belong to it, not to its individual users. The court also ruled that the liquidators of Celsius could sell a total of $18 million worth of Stablecoins. These coins were placed in Earn to fund administrative costs.

In other words, if users sent their crypto-assets to the Earn platform for additional earnings, those coins essentially no longer belonged to them. Obviously, had the company not gone bankrupt, users would have been able to get to their own funds. However, this could now in principle not be counted on.

Members of the cryptocurrency community reacted to the ruling. According to some of them, this situation is further proof of the need to keep their coins in non-custodial Ledger-type wallets. In that case, there will be no need to worry about having access to crypto assets, which is certainly not the case with centralised platforms.

Earlier, users who were customers of the bankrupt company were told that they could earn interest on the cryptocurrencies deposited on the platform. They lost access to their funds in June when Celsius halted withdrawals on its platform, citing “extreme market conditions”.

Celsius Network

The fresh decision is likely to prevent users of the service from getting the full amount they have invested in Celsius. Ordinary customers are now considered unsecured creditors and “may receive only a small percentage of their legitimate claims as a result”. This was expected and, unfortunately, crypto investors have nothing to provide: the crypto business is inherently considered risky, and such losses are regularly warned about by users of centralised platforms.

We believe that 2022 has indeed turned out to be one big lesson for cryptocurrency users, who should definitely not entrust all their coins to centralised platforms. Even if FTX exchange users could, in theory, get some sort of refund that could take years, there's certainly no hope for former users of Celsius' Earn platform here. Which means that the phrase "not your keys, not your coins" is once again more relevant than ever in 2023.