A preliminary investigation has been launched against a major cryptocurrency company. What is the reason?

The US Department of Justice and the Securities and Exchange Commission (SEC) have tentatively launched a joint investigation into Digital Currency Group, a venture capital firm that is one of the most important players in the crypto market. The investigation has focused on money transfers between DCG and its financially troubled subsidiaries. In general, the names of the latter have not yet been disclosed, as the investigation has not yet been made public. Officials from the Department of Justice and the US Securities and Exchange Commission also want to establish whether DGC investors were informed of the aforementioned transactions. If so, it could cause serious problems for the cryptocurrency industry.

Note that Digital Currency Group and its subsidiary Genesis have been in the news in recent months, and in a negative context. In particular, because of Genesis’ financial problems, withdrawals were forced to suspend Gemini Earn, a platform that lent money to Genesis users.

In addition, at the end of December 2022, Forbes estimated the fortune of Barry Silbert, the head of Digital Currency Group, at $0. According to their data, the amount of DCG’s debt is markedly higher than the assets at the company’s disposal. And since Silbert owns a substantial stake in the giant, it also directly affects the amount of funds of the entrepreneur.

DCG CEO Barry Silbert

Which cryptocurrency company could go bankrupt

According to CryptoSlate sources, so far no charges have been filed against Digital Currency Group and its head Barry Silbert. The DGC speaker left the following quote in his interview.

DCG follows a culture of integrity and has always conducted its business legally. We do not know and have no reason to believe that DCG is under investigation in the Eastern District of New York.

Note that such a response is fairly typical when forced to interact with regulators. That said, as Decrypt notes, a Genesis representative when asked for comment stated that they "do not comment on certain legal or regulatory cases," so no specifics could be obtained in this case either.

DCG head Barry Silbert

That said, the aforementioned Genesis’ bandwidth platform was also implicated in the investigation as one of DCG’s subsidiaries. Its representatives also added the following rejoinder to what is going on.

Genesis maintains a regular dialogue and cooperates with the relevant regulators and authorities when enquiries are received.

A large part of DCG’s problems came after the financial insolvency of Genesis. Genesis was also hit hard by the collapse of the Three Arrows Capital (3AC) fund, which went bankrupt after the collapse of the Terra crypto project last year. The collapse of FTX a few months later only made things worse for Genesis.

Shortly after the exchange went bankrupt, the platform suspended withdrawals. Then, as early as January 5, the company laid off 30 per cent of its staff and signalled that it too might file for bankruptcy.

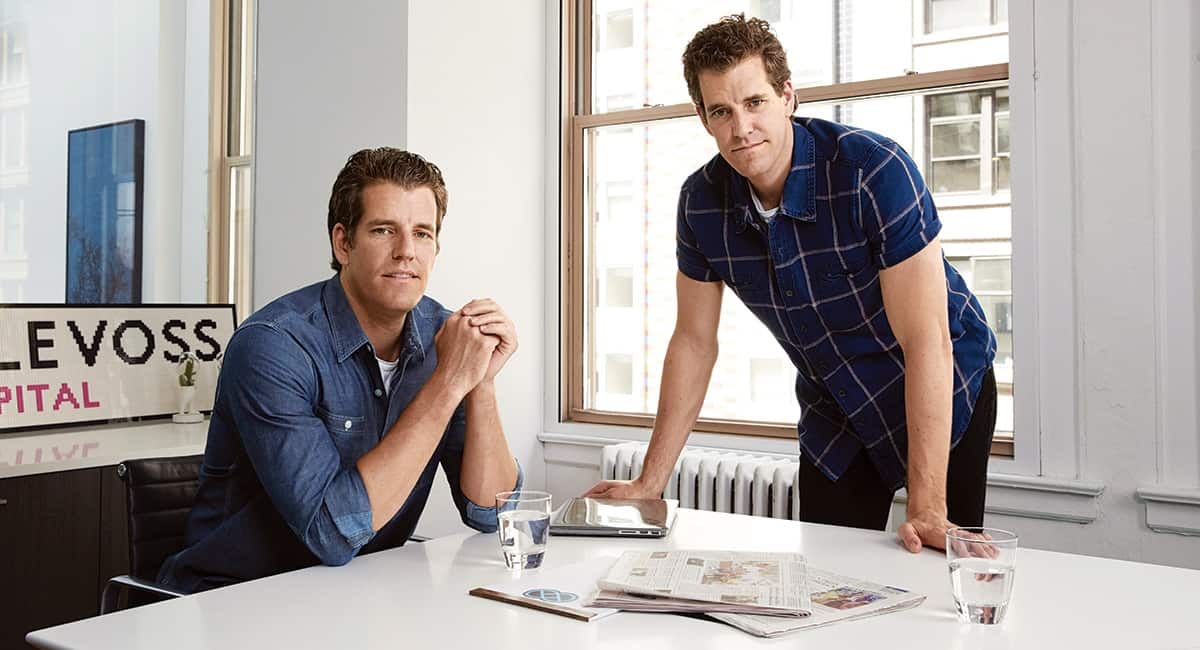

Gemini founders Winklevoss brothers

Genesis also had many ties to cryptocurrency exchange Gemini. Gemini's founders, the billionaire Winklevoss twins, claimed that Silbert owed Genesis $1.675 billion, with part of the amount allegedly belonging to users of the Earn program on the Genesis site. Barry's attempts to somehow resolve the situation were unsuccessful, with the Winklevoss brothers still blaming him for the holes in their own platform's balance sheet.

It should be noted that Genesis was the only platform to which Gemini Earn user funds were sent. Accordingly, Gemini attracted users with a certain percentage of returns in exchange for providing their own assets and then sent the coins to Genesis, which also received a return on the total amount of funds. Genesis ended up charging its own commission, after which it returned the money to the Gemini Earn platform. The latter also took its own percentage and then returned the crypto to users at a certain premium over the original amount. Since Genesis went out of business, Gemini users' money was also stuck.

Gemini crypto exchange executives Winklevoss brothers

We believe that possible legal problems for Digital Currency Group could be a serious blow to the cryptocurrency industry. That said, it is important to keep in mind that the problems of Genesis and DCG have been evident to the blockchain community before, so the collapse of the giant is unlikely to come as a major shock. In any case, investors should prepare for the worst-case scenario as well. Well, users of other bandwidth platforms should probably check the latter for possible links with the Digital Currency Group. Obviously, if anything, they too will be at risk.

What do you think about this? Share your opinion in our Millionaire Cryptochat. There we discuss other curious news that relates to digital decentralised asset rates.