Bloomberg analyst explains why cryptocurrency enthusiasts shouldn’t get excited about Bitcoin’s rise just yet

Bloomberg senior analyst Mike McGlone believes that Bitcoin is forming a new bottom in a similar scenario to the one that already took place in 2018. However, there is one significant difference in this process: While in that bearish cycle the US Federal Reserve systematically lowered its benchmark lending rate, it is now doing the opposite. At the same time, “every central bank” in the world is pursuing a similar policy. We give details of the analyst’s point of view.

We note that not everyone in the blockchain industry follows digital asset prices. For example, Trezor CEO Matej Jacques made it clear the day before that the value of Bitcoin and other coins is a secondary factor. Above all, it is important for users to understand the freedom that cryptocurrencies offer to their owners.

Cryptocurrency user

One should also keep in mind decentralization, a fixed maximum supply and a predetermined inflation rate that cannot be changed. After that, paying attention to crypto prices probably won’t happen very often.

When should I buy Bitcoin?

McGlone shared his thoughts on the current situation in the crypto market during another Crypto Trading Secrets podcast with host Scott Melker. Here’s his quote on the subject.

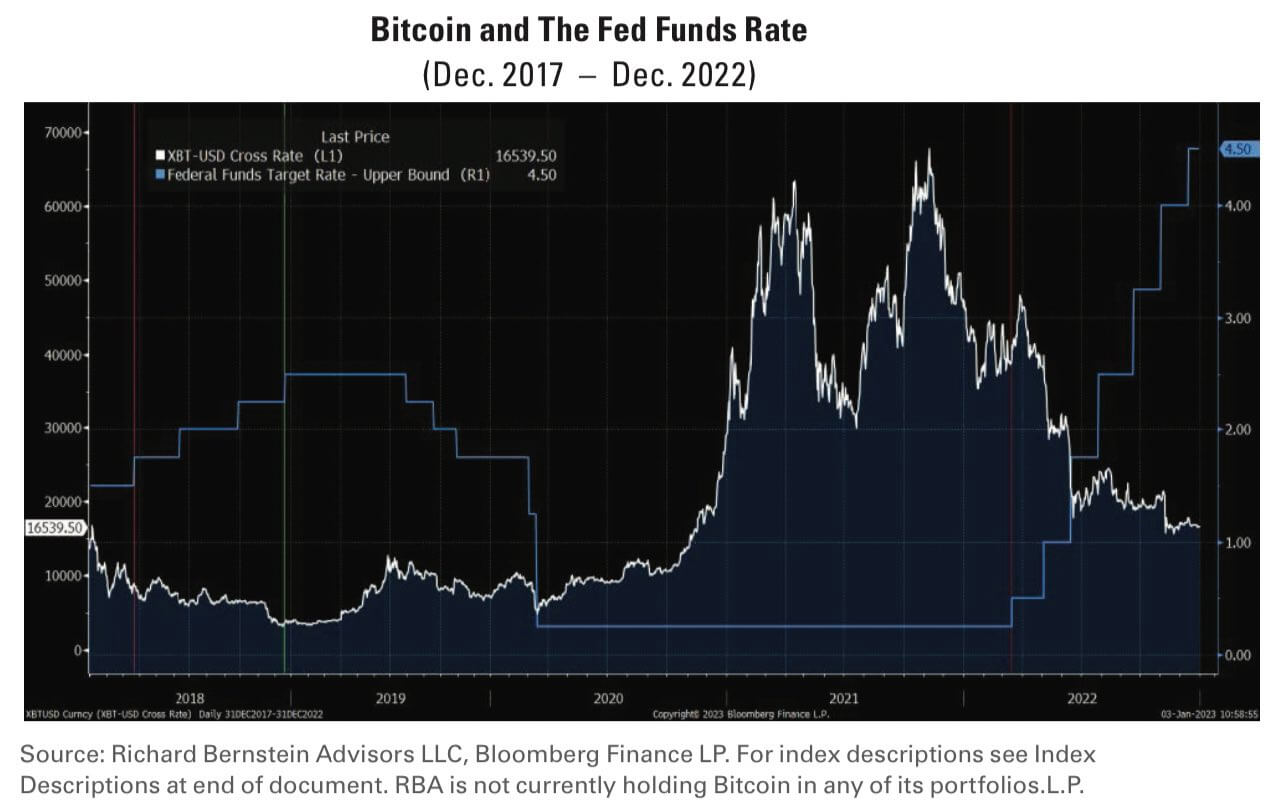

Then in 2018 the Fed had already started easing monetary policy, we held the bottom and pulled higher before more problems came in 2019. They are now aggressively raising rates, so don’t count on a bull run right now in any markets. Give them some time. By and large in the long run, a bullish scenario is still fair for Bitcoin.

Recall that the Fed officials are now actually raising the key rate, which translates into more expensive loans for commercial banks from the central bank. And this, in turn, is forcing businesses to save costs and cut expenses, which also affects their employees, the latter's earnings and their expenses, which are the profits of other businesses. This results in a vicious circle, causing the economy as a whole to sag.

The Fed has raised its key rate by 75 basis points since the summer of 2022, one of the highest rates on record. In December the rate was already raised by 50 basis points. Although experts are betting on a 25-point increase at the next meeting, the effect of previous rises will still be felt further in the economy, which means that it is really too early to relax. However, the prospect of a 0.25% increase is more encouraging than the 0.75% increase anyway.

Bitcoin exchange rate and U.S. Federal Reserve rate dynamics

So the analyst urges traders not to rush to open long positions in response to the recent local rise in Bitcoin. Still, the complicated macroeconomic situation does not yet allow us to say with certainty that in the medium term, the BTC price could head for conquering new peaks.

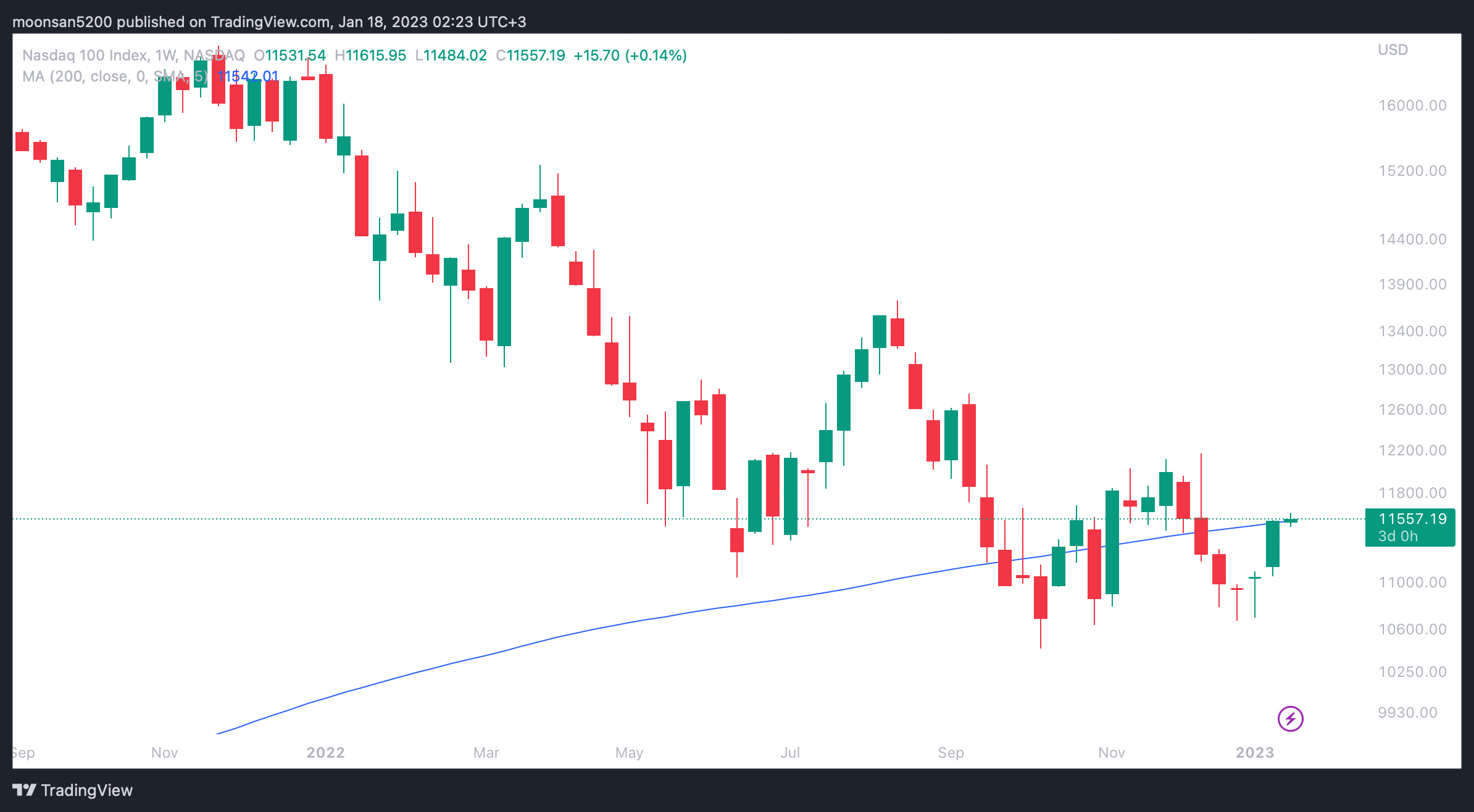

According to Cointelegraph sources, McGlone also expects the Nasdaq index to collapse below its 200-week moving average line – another argument in favor of the bears. Here’s his quote.

Liquidity is still a drag. And if the Nasdaq falls, all other markets will fall after it – Bitcoin will be no exception.

Nasdaq exchange rate.

Overall, the analyst notes that the economy is now in an unprecedented situation. The world is facing first a pandemic and then the largest military conflict in Europe since the end of World War II. Such events occur once in a century, and they will be a serious test for the sustainability of the crypto market. Once the “turbulence” passes, though, BTC will have a good chance to prove itself, the expert believes.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.ZEN!

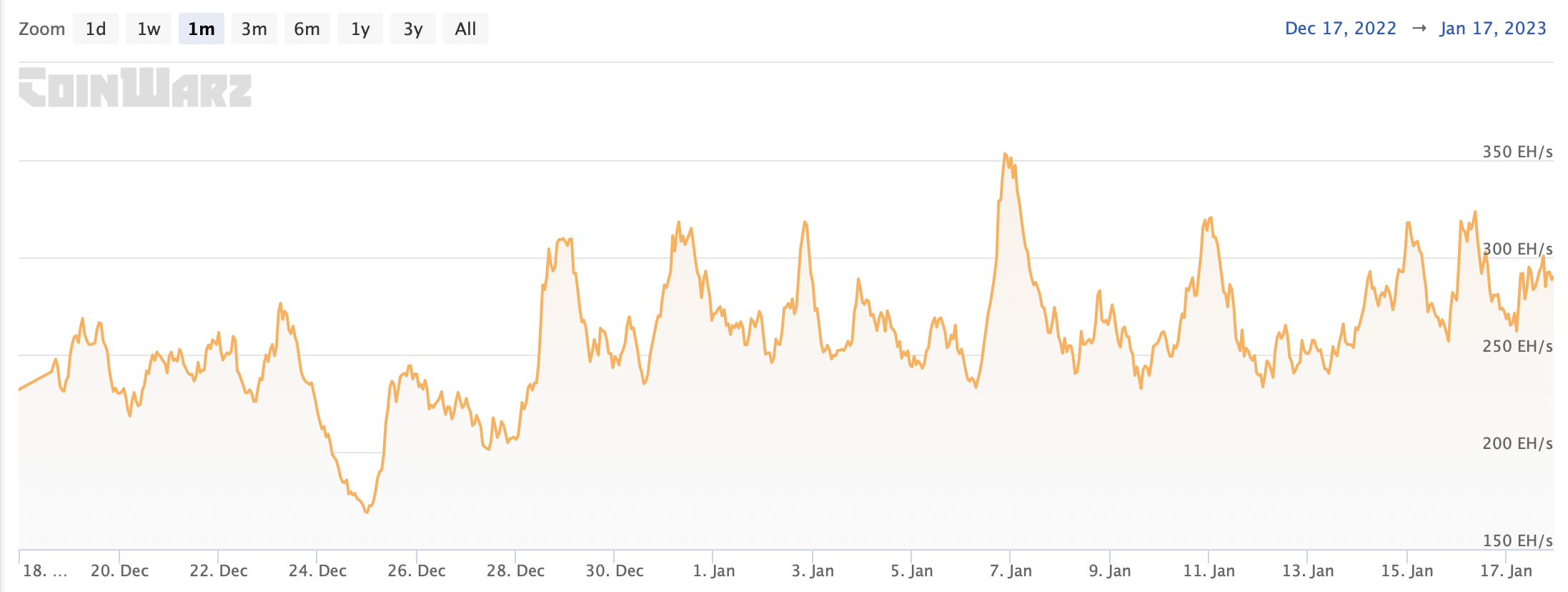

According to a recent report by analysts Glassnode, one of the first to feel the recent rise in Bitcoin’s price was felt by the cryptocurrency’s miners. The local uptrend has boosted the profitability of their business, Decrypt reports. At the very least, some mining companies have moved away from the line beyond which mining BTC would not be profitable at all.

Glassnode estimates that Bitcoin’s realised price – that is, the average value that investors have paid for BTC – is around $19,700. The average price at which bitcoins have traded over the past 155 days is $18,000. The cost of mining 1 BTC equals $18,800 at the same average – which is noticeably lower than the current market price of the cryptocurrency.

The increased activity of miners is reflected in the growth of Bitcoin’s hash rate, which is now hovering near its maximum.

Bitcoin network hashrate

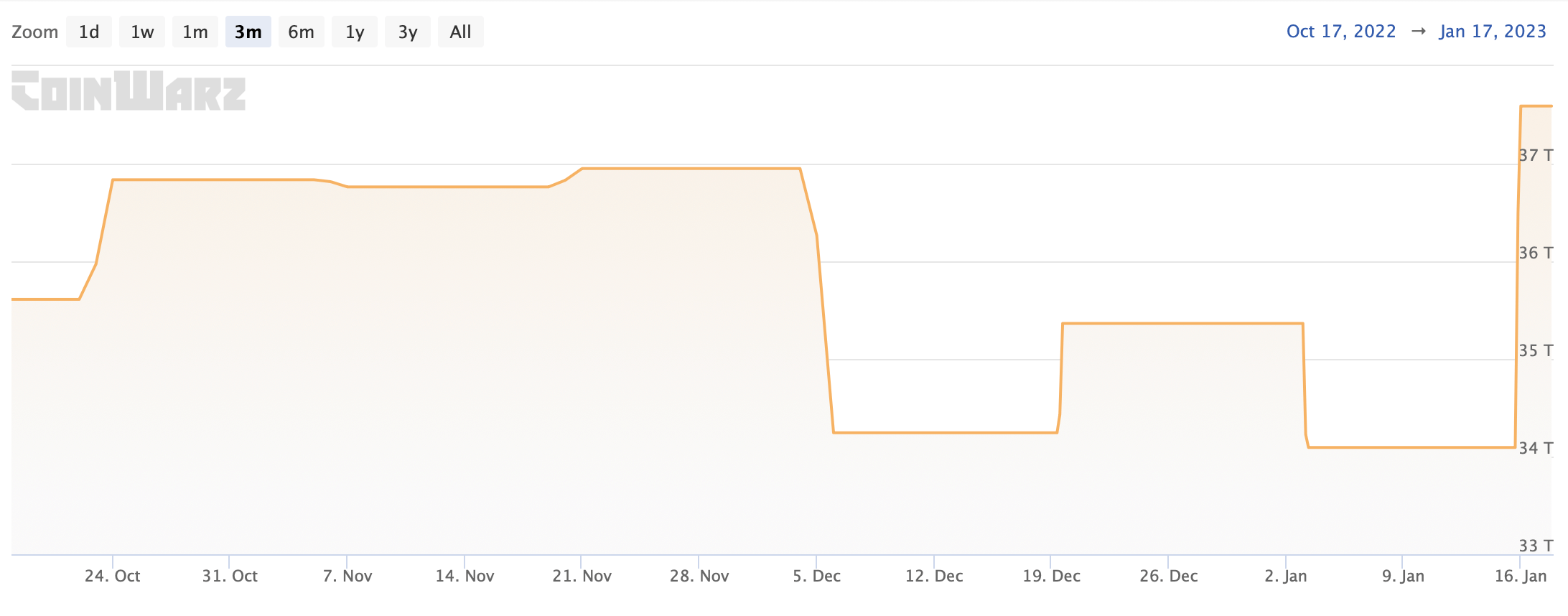

A new record was also set by the cryptocurrency’s network complexity. As a reminder, this figure depends on the hash rate and automatically changes about every fortnight.

Bitcoin mining complexity

As miners will now be less likely to sell BTC from their reserves, the major cryptocurrency is missing another negative factor holding back its value. The better miners do, the faster their reserves grow and there is less pressure on the asset from sellers.

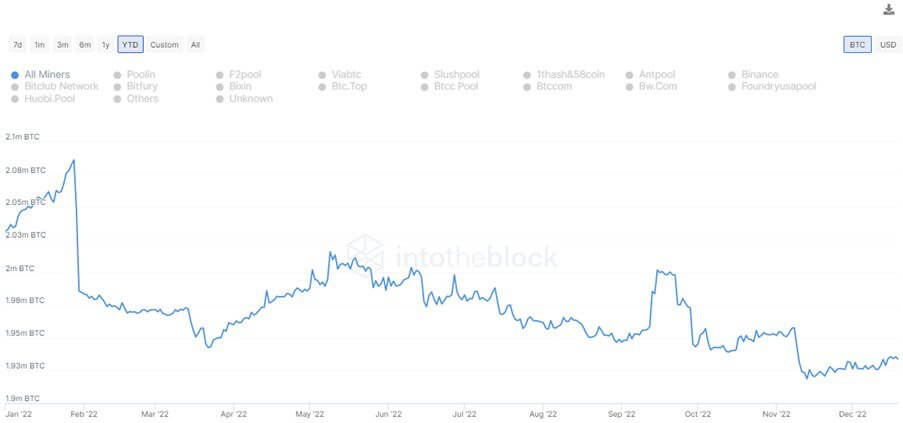

By the way, here’s a chart of Bitcoin miners’ reserves in 2022 from IntoTheBlock analysts. As you can see, the figure has dropped noticeably. Apparently, cryptocurrency holders have been getting rid of coins to pay for electricity, equipment and locations. And as the figure has declined, it means that BTC reserves have been used as well.

Graph of Bitcoin miners’ reserves in 2022

As a result, at the end of December 2022 the amount of BTC at miners’ disposal was at the level of 2010.

We think Mike McGlone's argument is quite compelling. And while cryptocurrencies do have a knack for giving out substantial growth at the most unexpected moments, investors' behaviour is somehow dependent on the world situation. Therefore, it would be more logical for them to wait for the Fed's policy reversal before actively messing with risky assets. However, time will tell how things will actually play out.