Cryptocurrency analysts have found a period of “guaranteed Bitcoin growth”. What is it?

Sunday 22 January saw the start of Chinese New Year celebrations, a 15-day celebration that is the longest in China. This day of the calendar also attracts the attention of crypto investors: as it turns out, Bitcoin’s price rises by almost 10 percent on average in a fairly short period of time after that. Where are the origins of this trend, and how was it even identified? The answer to this question was given in their latest report by the analysts at Matrixport platform. We present the results of their study in more detail.

Traditionally, we should note that such expert conclusions are based on the data from the past, which, in turn, has no impact on the future. Accordingly, even if a certain event has happened over the past few years, it may not happen this time. Such discoveries by researchers should therefore only be regarded as funny trends which may well lose their relevance as soon as this year.

However, some events do affect the asset market in a certain way on a regular basis. An example of this is the so-called tax loss harvest, which is relevant to residents of the USA and some other countries. It is the sale of assets into deficit before the end of the accounting period, which allows for certain tax deductions.

US IRS building

This period in the US falls at the end of the year, so some investors do dispose of crypto-assets in the negative to offset tax liabilities against capital gains. Analysts therefore regularly attribute the collapses in the same coin market in December to taxpayer activity.

By the way, they can buy the same coins as soon as the relevant documents for the tax authority have been drawn up. You can't do the same with stocks, because if you buy them again in less than 30 days, you won't receive any capital gain compensation.

When to buy Bitcoin?

Marcus Thielen, head of research at Matrixport, commented on statistics related to the Chinese New Year. Here is his rejoinder, in which the expert shares the results of his work.

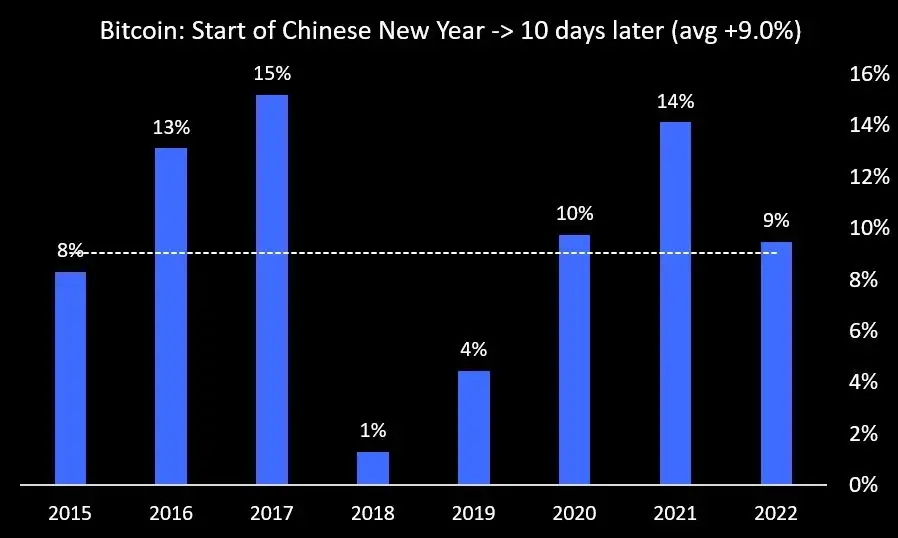

Buying Bitcoin at the end of the first day of the Chinese New Year and selling it ten trading days later would yield an average 9 percent return, with all of the last eight years – from 2015 to 2022 – showing positive returns.

That is, if a person bought Bitcoin at the end of last week and is preparing to sell it on February 1, in theory such a transaction could yield about a 9 percent profit. That’s a pretty good result for holding a long position in BTC for just over a week.

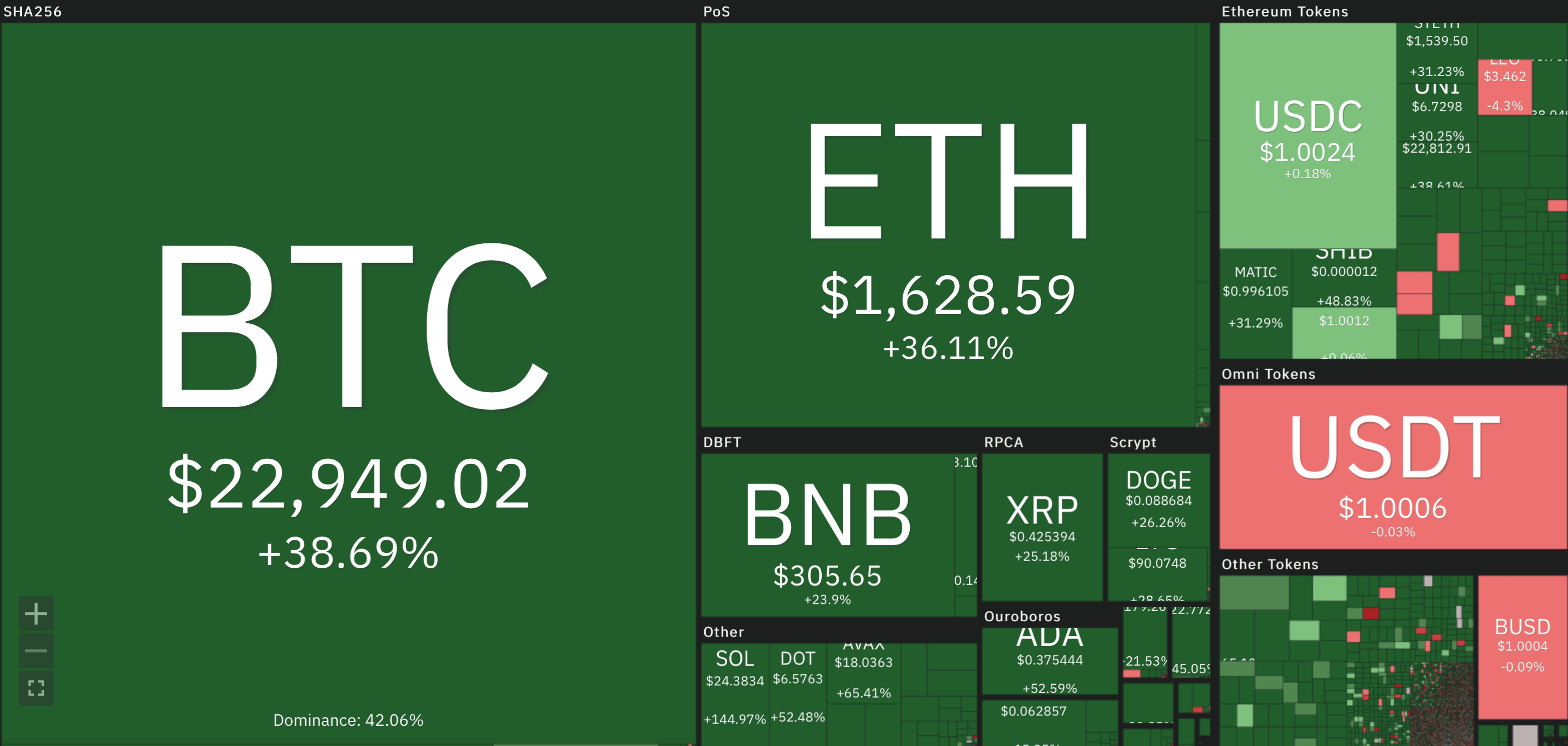

It should be noted that cryptocurrencies are indeed able to show good price results - and even during a bear market. To illustrate, let's look at the price movements of the top digital assets from January 1, 2023.

In this timeframe, Bitcoin is up nearly 40 percent, with Solana SOL leading the growth among the major projects with 145 percent. It is worth noting that these results take into account the market downturn seen over the last 24 hours. Which means that before that the growth was even more tangible.

Cryptocurrency rates change from the first of January 2023

In an interview with Decrypt, Thielen also noted the importance of China as a country that has a significant impact on the crypto industry. He continues.

China has been a big influence on Bitcoin for years. When people get together, they talk.

In other words, people in China will be visiting family and friends during the New Year celebrations. Perhaps a significant portion of them will be talking about crypto, especially against the backdrop of the already mentioned rise in Bitcoin since the beginning of this year.

By the same token, however, the same logic for Bitcoin's rise should be matched by Christmas on December 25, when residents of many countries also gather for a family dinner together. In addition, the interaction with BTC is not particularly welcomed in China, as the cryptocurrency has already been "banned" many times in the country. All in all, the argument does not seem particularly convincing.

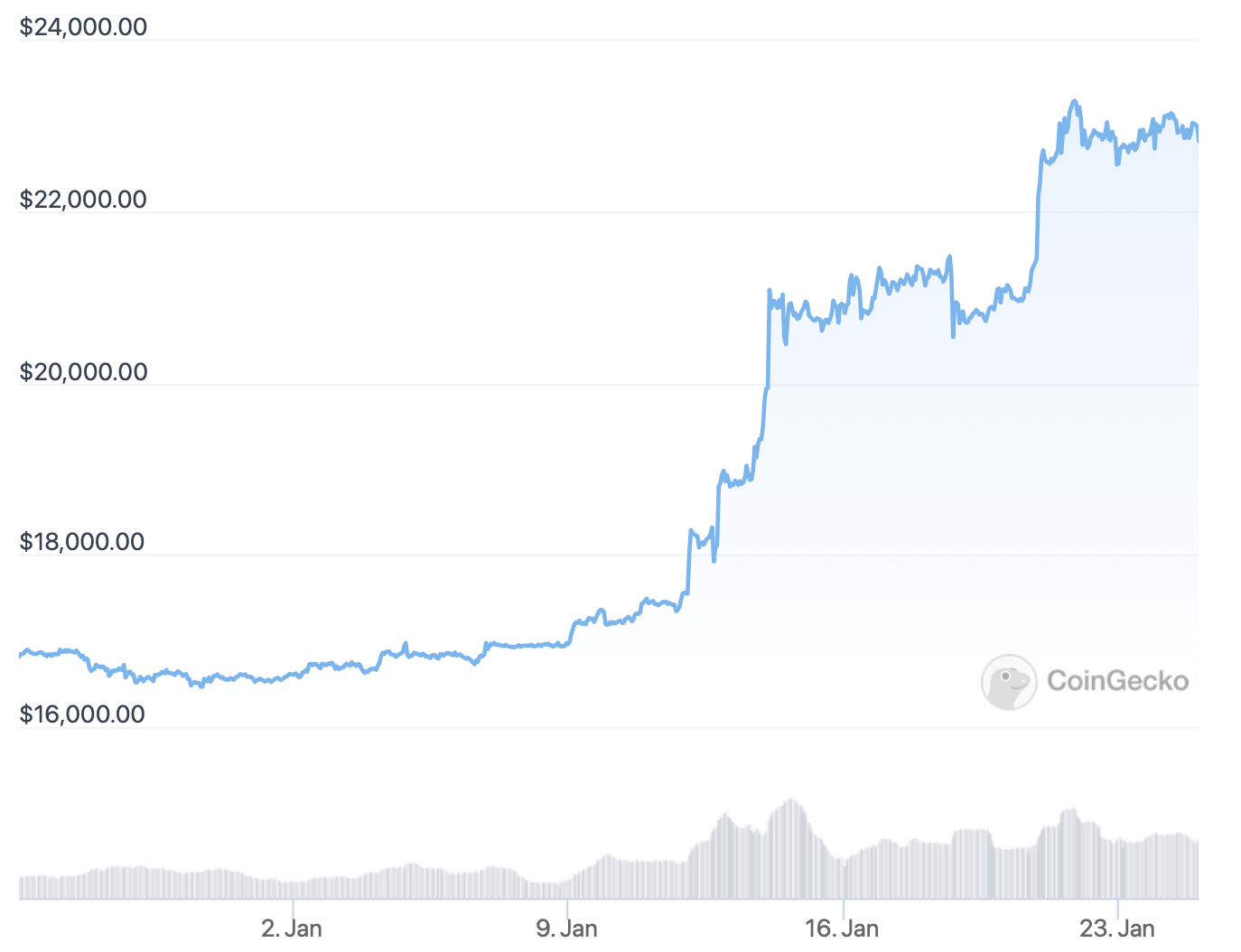

Bitcoin growth since the beginning of the year

For more statistics on Bitcoin investment returns after the Chinese New Year, see the screenshot below. Over the past eight years, 2017 was the most successful year in this regard – then, during the Chinese New Year holidays, the BTC price rose by 15 percent. This was apparently helped by the bull run, which then ended in a record $20,000 for Bitcoin on December 17, 2017.

Bitcoin growth statistics after the Chinese New Year

From the data, an average result can be calculated, Thielen noted. Here’s his thought.

The best average Bitcoin returns are achieved when the timing is ideal – around 15-19 days after the start of the holiday. If these conditions were met, an average return of 12 per cent per bitcoin purchase could well be achieved.

If Matrixport analysts’ forecast is close enough to reality, Bitcoin’s value could reach the $25,000 bar by February 1. This will be a strong argument in favor of the bulls – so high the cryptocurrency traded only in the middle of last year.

Well, from $25,000 a jump to the new milestone of $30,000 does not look so unrealistic, which means that investors can count on a local bull run of notable proportions, the analyst believes. However, the transition to growth is unlikely to be instantaneous, so one should probably not count on a rapid change in the situation.

Bull market for Bitcoin and cryptocurrencies in general

But there is one “but” here – the current difficult situation in the macroeconomy. The crypto market has so far reacted noticeably to the US inflation situation and the Federal Reserve’s steady rise in the base lending rate. The Fed has previously indicated that a rate cut is unlikely in 2023. In other words, the crypto market, like many other niches, still has a growth ceiling.

We believe that the analysts' survey result is not a guarantee of growth for the first cryptocurrency and the coin market as a whole. Experience shows that predicting the future - including for the digital asset industry - is impossible, which means that all such trends only determine the slightly higher probability of the chosen event. So investors should continue to do their own research on an asset or area before getting involved with it. One holiday alone will definitely not be enough to open a position.

We recommend that you focus not only on the dates on the calendar, but also on the underlying economic indicators in general. You can find more information about them and about cryptocurrencies in our Millionaire Cryptochat.

SUBSCRIBE TO OUR CHANNEL ON TELEGRAM. MORE INTERESTING NEWS HERE.