Sam Bankman-Fried has named three factors that led to the collapse of the FTX crypto-exchange. What were they?

The former CEO of cryptocurrency exchange FTX, Sam Bankman-Fried, is now under house arrest and is involved in his company’s bankruptcy case, which may have led to fraud among other things. He has now set up an account on the publishing platform Substack and in his first post, he details the details of the FTX collapse from his perspective. In a nutshell, Sam continues to blame the CEO of cryptocurrency exchange Binance, Changpen Zhao, for everything. In addition, he does not consider himself guilty and claims that he did not steal FTX customers’ money in any way. We recount the situation in more detail.

It should be noted that such persistent defence by the FTX founder is a predictable phenomenon. He was essentially left with the option of either pleading guilty and going to prison on an expedited basis or denying his role in what happened and trying to knock down future prison sentences.

So now Sam is just preparing his own line of defence, which makes it worth taking his words with scepticism. As a reminder, the trial in the case will begin in October 2023.

Arrested FTX crypto exchange founder Sam Bankman-Fried

Who is to blame for the collapse of the FTX crypto-exchange?

In his publication, Bankman-Fried claimed that Zhao had allegedly waged a long PR campaign against FTX and closely related firm Alameda Research. A total of three factors led to the collapse of the crypto-exchange, which Sam mentioned in his post. The first is as follows.

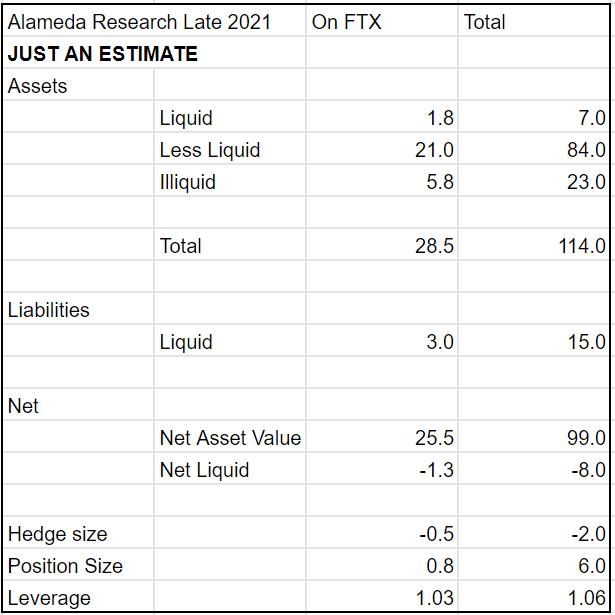

During 2021, Alameda’s balance sheet grew to around $100 billion of net worth, $8 billion of net leveraged borrowing and $7 billion of liquidity on hand.

In the end, Sam Bankman-Fried also started on his own merits. According to Decrypt, he did not admit guilt and in addition did not confirm the theft of user funds. As a reminder, one of the main claims against Bankman-Fried by the prosecutor's office is the misuse of users' money. The funds were used to buy real estate, donate to politicians and parties, as well as the trading activities of Alameda representatives, among other things.

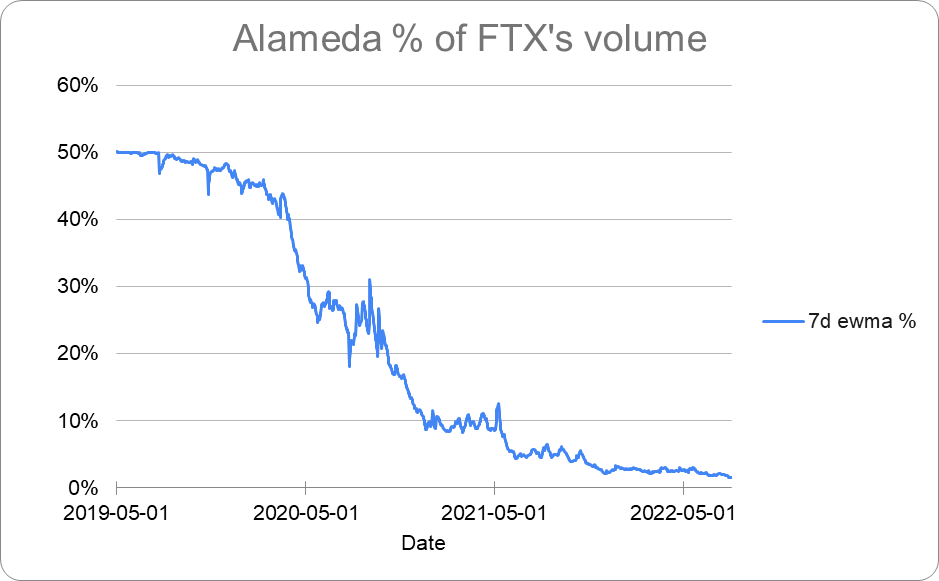

Against the backdrop of the 2021 bull run, FTX was indeed a successful project. In addition, Sam claims that by 2022 Alameda’s share of FTX’s liquidity had already fallen to around 2 per cent. In the early days FTX was dependent on Alameda for its finances, with Bankman-Fried, citing the chart below, not denying this.

FTX’s dependence on Alameda

However, amid the staggering success of the exchange, there was a second factor that contributed to its bankruptcy. Here is the following quote from Sam.

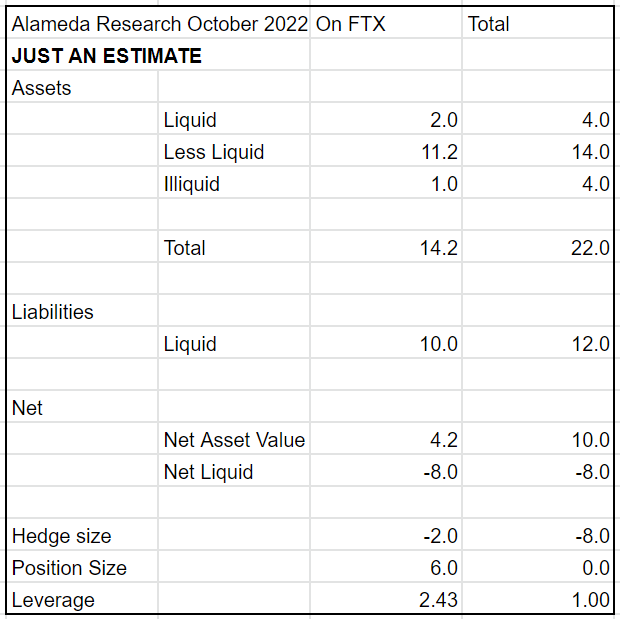

Alameda failed to sufficiently hedge its market risks. Over the course of 2022, there was a series of major market crashes – both stock and cryptocurrency. This led to a drop in the market value of the company’s assets of about 80 per cent.

As a reminder, the prosecution alleges that a special hole in the FTX system allowed Alameda Research representatives to take money from exchange users without paying interest on it. As a result, Alameda ended up with several billion dollars of unknowing users in its account. And in the end this led to a shortage of coins, which users tried to withdraw from FTX at the beginning of November.

Alameda’s financial situation at the end of 2021

Bankman-Fried admits that the company he founded was unprepared for the new crypto-zima. Sam believes it would take a 94 per cent drop in asset value to make Alameda bankrupt. But there is no logic in terms of risk management here either: it is too extreme a situation in which the company should not find itself at all. In retrospect, it may appear that Alameda had a chance to “pull through” and FTX could have stayed afloat, but that does not exclude the stock exchange management’s terrible attitude to risk.

Alameda’s financial situation in October 2022

And here, according to Sam, the situation was taken advantage of by Binance chief Changpen Zhao, which was the third factor in FTX’s collapse. He continues.

In November 2022, an extreme, rapid, purposeful collapse instigated by Binance’s CEO made Alameda insolvent.

To recap, Binance CEO Changpen Zhao announced in November that his trading platform would get rid of a large volume of native FTX tokens under the ticker FTT. Zhao made the decision based on information about the financial problems of the Bankman-Fried crypto empire due to the leaked Alameda balance sheet report.

Binance did not end up selling a large batch of FTT tokens, though. As Changpen Zhao pointed out, after Sam’s call to save the company, Binance staff suspended the FTT drain. This ended up being a big minus for the exchange on the position.

Binance CEO Changpen Zhao

In the same balance sheet there was information about both the close ties with FTX and the heavy reliance of both companies on the value of FTT – it was the token that constituted a significant share of assets and was also actively used for borrowing and investing. Even after FTX’s bankruptcy Zhao has repeatedly stated that he had every right to make such an announcement, which one can indeed agree with. Finally, the final blow to FTX was Changpen’s refusal to buy the exchange – Bankman-Fried was willing to go for the deal in a hopeless situation.

As for the rumours that Alameda had access to FTX users’ funds without their knowledge or consent – which is the main part of the criminal charges against Sam – Bankman-Fried denies any involvement.

I did not steal funds and I certainly did not hide billions. Almost all of my assets have been and continue to be used to support FTX customers.

According to Cointelegraph sources, Bankman-Fried has pleaded not guilty to eight criminal charges, including alleged violations of campaign finance laws and wire fraud.

Ex-CEO of Alameda Research Caroline Allison

Meanwhile, former Alameda Research executive Caroline Ellison and FTX co-founder Gary Wang have already pleaded guilty to the relevant charges and made a deal with the investigation. Consequently, the chances of Bankman-Fried not being in trouble are now much less.

We don't think Sam Bankman-Fried's words should be given much credence. After all, the collapse of his platform led to billions of dollars in lost user funds, which included the wallets of the trading company Alameda Research. Moreover, Sam never admitted his guilt and continues to blame everything on Binance's CEO. Although as common sense would suggest, one tweet shouldn't have brought down an entire company if it was doing well.