The FTX crypto exchange accidentally lost tens of thousands of dollars in debt restructuring. How did this happen?

The liquidation team in charge of restructuring the debt of cryptocurrency exchange FTX and trading company Alameda, which went bankrupt last November, lost around $72,000 due to a trivial mistake. According to a recent report from platform Arkham Intelligence, experts attempted to transfer funds to an Alameda-owned multi-sig wallet to accumulate funds, but in the process lost 4 WBTC, which is the equivalent of Bitcoin in another blockchain. We tell you what it was like.

Recall that after their collapse, FTX and Alameda were left owing billions of dollars to thousands of lenders. Their exact number, as well as the exact amount owed, is still being tried during the investigation into the bankruptcy court case.

However, the news of the accidental loss of notable sums of money in the blockchain business shows that it takes people with a lot of experience in the crypto-industry. Otherwise, the prospects for recovering funds will not be so rosy.

What’s going on with the FTX crypto exchange

Arkham Intelligence spokesperson Zachary Lerangis commented on the incident in an interview with Decrypt as follows.

Liquidators would benefit from bringing in a DeFi expert to advise them on the mechanics of closing Alameda’s decentralised finance positions and making as much money as possible.

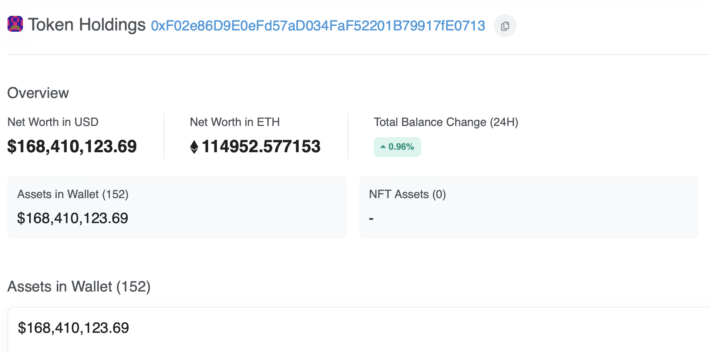

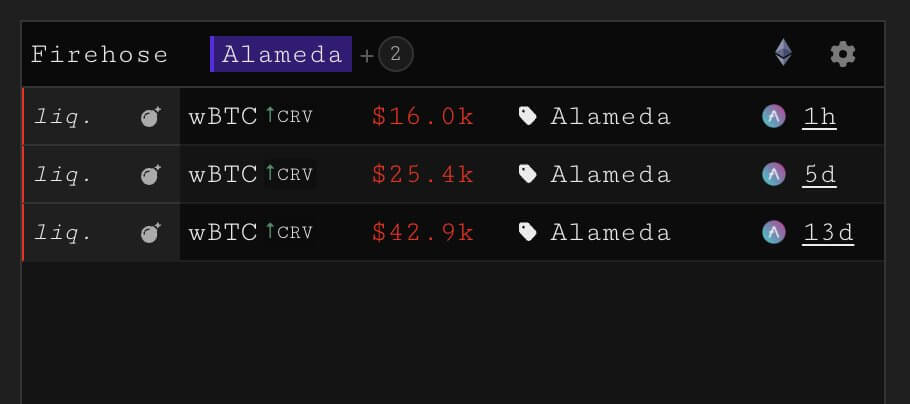

Alameda multi-sig wallet balance

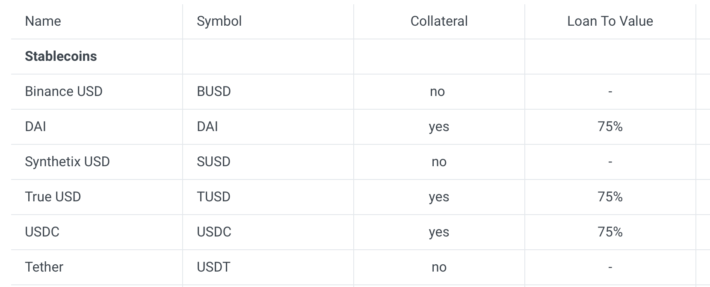

As a reminder, centralised protocols allow users to trade, borrow and lend cryptocurrency without intermediaries, among other things. To work with them, you do need to have some knowledge about the basics of the crypto industry. For example, the way loans work on the Aave platform.

Here, borrowers post certain collateral and take out a loan against it according to pre-known terms and conditions. Loans must be over-collateralised, i.e. the ratio of collateral to borrowed funds must be above a certain threshold, otherwise there is a risk of liquidation, i.e. closing the position. Once the loan has been repaid, the borrower can unlock his collateral. However, the liquidators do not seem to have been privy to the details of this process.

Why take out a cryptocurrency loan against more collateral? For example, it helps simplify the taxation process for such transactions. Still, in this case, the underlying asset remains at the user's disposal, which means it will be easier for the user to calculate everything when the reporting period arrives.

Aave risk parameters for stabelcoins

So, instead of paying out the collateral, the liquidators removed the collateral for the position altogether, which significantly increased the risk of liquidation. In the end, the platform liquidated the position, resulting in a loss of approximately $72,000 in crypto.

Had the liquidators posted the right amount of collateral, they would have gained access to the position itself. However, they were likely unfamiliar with the blockchain loan mechanism. Therefore, it turned out that the liquidators were liquidated.

Arkham analysts also state that this is not the only force majeure for the Alameda liquidator team. They had previously attempted nine times to transfer Lido tokens (LDOs) that were in vesting – that is, a gradual time-bound distribution. At the time of writing, one of the wallets from which the tokens need to be transferred still has $3 million worth of LDOs remaining.

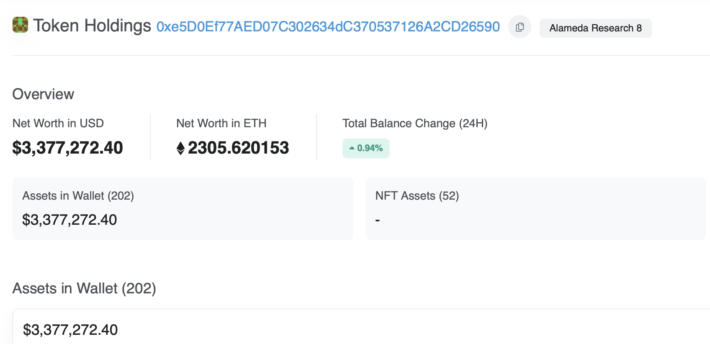

Wallet balance with LDOs

Westing is a special mechanism that prevents an investor from moving their tokens for a certain amount of time after purchase. Westing is primarily used for large investors so that when they first list a token on an exchange, they do not sell all of it at once, devaluing the asset. Typically, the listing in the case of normal assets lasts for several years.

The wallets identified by Arkham Intelligence contain at least $25 million worth of Alameda funds. For example, $6 million in USDC is being used to secure a $2 million loan to NEAR in the Bastion protocol. There are also funds stuck in other blockchains. Another of Alameda’s wallets has a balance of just $300 on Etherscan, but the Aurora protocol still has ETH worth $4.4 million.

By the way, last night blockchain analysts noticed another batch of liquidations that came to the Alameda wallets. In this case the liquidation amounted to 84 thousand dollars, which means that the total amount of losses due to the same error exceeds 150 thousand dollars.

New batch of liquidations on Aave from Alameda wallets

The FTX restructuring team claims that they have managed to find assets worth $5 billion. However, the process of recovering and liquidating them will be extremely difficult, as the situation also depends on the state of the entire crypto market. In addition, suspicious transactions have previously been made from FTX and Alameda wallets after the official bankruptcy declaration.

FTX Arena building no longer so named

We think that such an incident clearly shows how far ordinary people are from what is happening in the blockchain world. Obviously, the involvement of the user of decentralised protocols, at least conventionally, would have avoided the problems mentioned. However, there is no way to access the lost funds now. So one would like to believe that next time liquidators will be more responsible with other people's money.