The head of cryptocurrency exchange Coinbase suggested that Bitcoin should be accepted in Argentina and Brazil. Why was the idea criticised?

On Sunday, Brazilian and Argentine government officials issued a joint statement on preparations for the creation of a common currency that could come into circulation in parallel with the Argentine peso and the Brazilian real. Such an innovation would potentially strengthen economic relations between the two countries. Meanwhile, Coinbase CEO Brian Armstrong reacted to the news with an interesting suggestion – he said that Brazil and Argentina should pay attention to adopting Bitcoin as a common currency. At the same time, not everyone appreciated the idea of the well-known representatives of the blockchain industry.

To recall, back in September 2022 BTC became legal tender in El Salvador, a small state in Central America. The cryptocurrency is also part of the country's public reserve, although the prolonged drop in its price last year has so far only brought losses from constant rounds of investment at the expense of public funds.

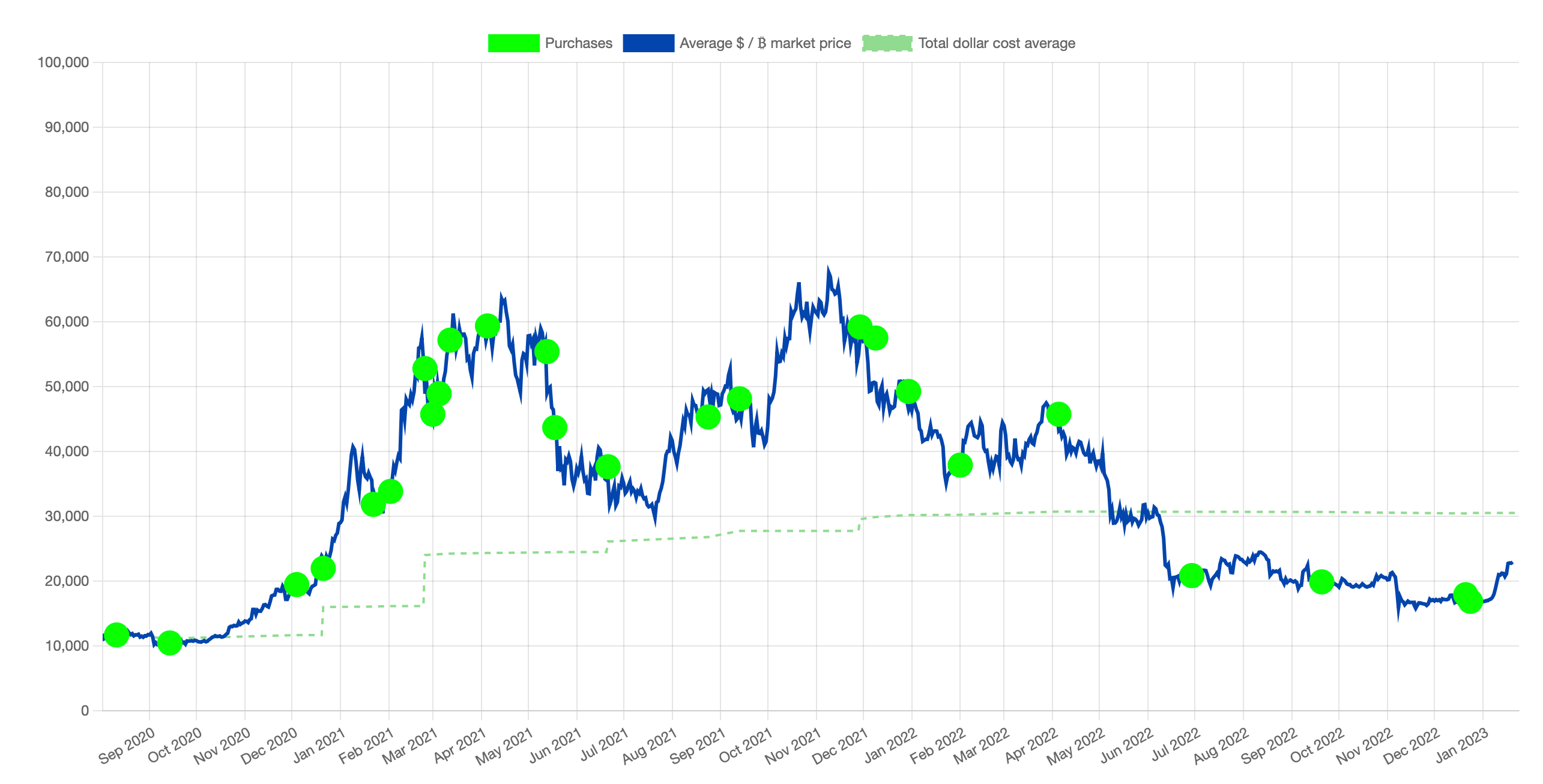

Bitcoin is also owned by some of the world’s largest companies, some of which are publicly traded. The leader among them is traditionally MicroStrategy, which now has 132,500 bitcoins worth $3.03 billion. At the same time, the minus on this position is 999 million, or almost 25 per cent.

Chart of bitcoin purchases by MicroStrategy

Which countries accept Bitcoin?

Armstrong posted his statement on Twitter. He said a move to Bitcoin would be a good long-term bet for the economies of Argentina and Brazil.

Coinbase chief executive Brian Armstrong

It's easy enough to understand the reasons for such a move - especially given current events in world economies. After all, Bitcoin not only has a limited maximum supply of 21 million coins, but also a fixed issuance rate, which in addition is halved every 210,000 blocks, or roughly four years.

However, it is difficult to believe in a full-fledged transition to a cryptocurrency whose issuance is not controlled by the authorities. At best, BTC could prove to be an additional national currency, as is the case in El Salvador.

According to Cointelegraph’s sources, not everyone has taken Brian’s idea with great enthusiasm. For example, Global Macro Investor founder and CEO Raul Paul opposed Armstrong’s proposal with the following argument.

Currently, no one can have a national currency with 100 per cent volatility, whose price drops by 65 per cent during a market cycle downturn and rises tenfold during a bull run. It would be difficult for business to plan or hedge risk in such an environment.

This is indeed the case. However, businesses that interact with digital assets are more likely to convert them into fiat as soon as transactions occur. This simplifies taxation and makes it possible to operate legally in many countries.

Global Macro Investor CEO Raul Paul

A user nicknamed Milky supported Paul’s argument. According to him, Bitcoin has a much better use case within a whole-of-government economy. Here’s the relevant rejoinder.

Anyone who thinks Bitcoin could ever replace traditional currency doesn’t understand the essence of BTC. The only real use of Bitcoin is to store value to support a currency, well, gold used to play that role. And this guy is also the CEO of Coinbase.

Note that a fixed Bitcoin offering would also create problems for business development. Still, releasing more fiat into circulation would, among other things, provoke an increase in economic activity for people who take out financial loans.

Bitcoin price changes too fast at different timeframes

The low transaction speed of Bitcoin – especially compared to traditional payment systems – must also be considered. The counterargument here is the existence of the Lightning Network, but it is not yet mature enough to meet the needs of an entire country. In addition, it is not in high demand even among loyal Bitcoin supporters.

As a reminder, Bitcoin has not become the only currency in El Salvador. It exists as an additional option for businesses and citizens to use the digital asset. The dollar circulates in the country, and it is now impossible to abandon it. That said, given the volatility, Bitcoin could not be an attractive option for the common economic bloc of Argentina and Brazil, so Armstrong’s proposal is unlikely to be taken seriously.

😈 YOU CAN FIND MORE INTERESTING THINGS ON OUR YANDEX.ZEN!

The high risks associated with crypto have also become a topic of discussion in South Africa, Decrypt reports. On Monday, the South African Advertising Regulatory Board released new regulations requiring cryptocurrency advertising to “clearly and explicitly state that investing in crypto-assets can result in loss of capital, as their value is volatile and can both rise and fall.”

The published guidelines note that promotional material should be balanced and simply worded, avoiding the presentation of past performance, so as to “create a favourable impression of the product or service being advertised”. Local opinion leaders “may only share factual information” and “may not give advice on trading or investing in crypto-assets” or “promise benefits or returns”.

New rules on crypto advertising in South Africa

Obviously, these are the right regulations: many crypto platforms advertise their services with unrealistically exaggerated potential benefits for customers. When they lose money, they become disillusioned with crypto, which only hurts the image of the industry. An example of this would be the Gemini Earn trading platform, which allowed users to earn interest in exchange for their deposits. It went out of business in November due to Genesis’ financial problems, which in turn were allegedly caused by the latter’s relationship with crypto fund Three Arrows Capital. It went bankrupt a few months ago.

We think Brian Armstrong's idea can hardly be called a success. Although Bitcoin is indeed reliable digital money, it is rather inconvenient and expensive to use this cryptocurrency for daily transactions. In addition, as the experience of investing in BTC from El Salvador shows, not every connection with a digital asset can be considered successful. And given the volatility of the coins and the current deep bearish trend, such prospects are even harder to believe.