The head of Trezor gave the main reason for buying Bitcoin. And it’s not the prospect of a rise in its exchange rate

Bitcoin rose to a peak of $21,258 tonight. Compared to the magnitude of the cryptocurrency’s decline since reaching an all-time high, this is not much, but even this local rise has caused euphoria among investors. However, their profits are not the cryptocurrency’s main advantage, according to Trezor CEO Matej Jacques. In a recent interview, he said that people should value more the financial independence that comes with investing in BTC. We tell you more about the expert’s point of view.

It should be noted that Bitcoin and other cryptocurrencies are often criticized for their alleged lack of intrinsic value. In fact, this is not the case. At a basic level, BTC is valuable because it is accepted as payment by people who agree to the cryptocurrency’s features and engage with it. In fact, that explains the value of fiat money issued by the government. In their case, the state accepts taxes in the fiat it issues, which means it has value at least because of this feature.

Cryptocurrency investors

Well, further to the advantages of Bitcoin we can add independence from central authorities, immutability of the blockchain, limited maximum supply and limited inflation rate.

Why Bitcoin is needed

Bitcoin and crypto in general are still associated by many people with complicated technical terms. Jacques noted that his company will continue to fight this trend – it is in the interest of its management to make the experience of using BTC as pleasant and understandable as possible. Here’s his rejoinder, cited by Cointelegraph.

Our mission is to make self-storage of cryptocurrency even more accessible to ordinary users.

Note that right now, hardware wallets are the most reliable and convenient way to store digital assets fully non-custodially. They store the user's private keys outside the internet, which keeps their coins safe. Of course, confirming every transaction with such a device is not as convenient, but it is the price for keeping digital assets safe. In addition, the interface for interacting with cold storage has become increasingly intuitive over time - including for newcomers.

Trezor CEO Matej Jacques

Contrary to popular belief, Bitcoin is not a complex tool, but rather “a simple technology with huge potential”, says Trezor’s CEO. This is the main advantage of the cryptocurrency, as it could soon compete in demand with traditional financial instruments. The expert continues.

If one understands Bitcoin in a broader context, such as a financial sovereignty opportunity, the coin’s price becomes secondary.

A 15-minute chart of the Bitcoin exchange rate

That is, much more important is the fact that Bitcoin allows its owner to transfer value to almost anywhere in the world, bypassing any restrictions. Or almost anywhere – for example, you’re unlikely to be free to use some cryptomixers after the sanctions against Tornado Cash. For now though, it’s about US citizens and the Etherium blockchain in this case.

😈 YOU CAN FIND MORE INTERESTING STUFF ON OUR YANDEX.ZEN!

Despite its fundamental independence, Bitcoin still needs the favour of financial regulators to gain more traction and popularity among large investors. In particular, a big boost to the adoption of the major cryptocurrency could be permission to launch the first US ETF based on the BTC spot market, i.e. its regular price.

Recall that several US ETFs were adopted by the US Securities and Exchange Commission (SEC) in 2021, but all are based on Bitcoin futures. Accordingly, the value of such instruments is not linked to the regular BTC price.

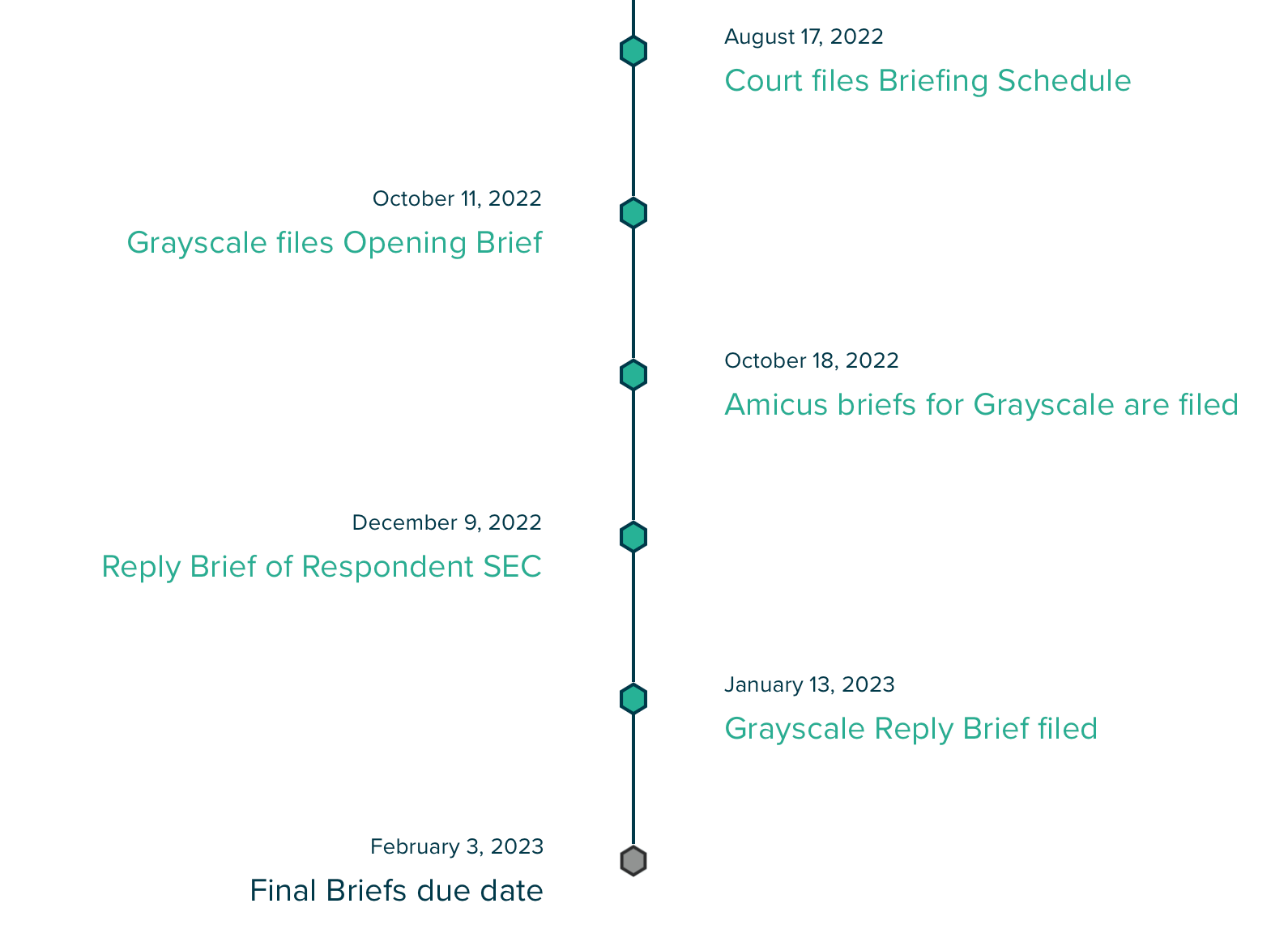

Last June, Grayscale sued the SEC over the rejection of another attempt to create a spot ETF. The lawsuit is still ongoing: the day before, regulators said that the ETF application does not do enough to protect investors from “fraudulent and manipulative activities and practices.” This argument has appeared in almost all of the regulator’s denials.

Grayscale lawyers have already responded to this statement with the following quote.

The Commission’s main argument that the exchange’s joint surveillance agreement with CME provides adequate protection against fraud and manipulation in the Bitcoin futures market, but not in the spot market, is illogical.

Grayscale’s timeline of proceedings with the SEC

The Joint Surveillance Agreement is an agreement between the platform and the Chicago Mercantile Exchange (CME) under which CME monitors any market manipulation that could artificially affect the price of an asset. Grayscale’s response claims that any fraud occurring in the spot market will “necessarily affect the price of Bitcoin futures”. Here is the relevant rejoinder.

Thus, there is no reasonable basis for concluding that CME oversight adequately protects holders of one type of investment instrument but not another. Nevertheless, the SEC’s statement is based on that very conclusion.”

The SEC will make another statement regarding the prospects of ETFs on Feb. 3. However, given SEC Chairman Gary Gensler’s skepticism of the crypto market and the prolonged crypto winter, the regulator is likely to again find a reason to prevent approval of the ETF.

Approval of ETF launch

We believe that Matej Jacques is indeed right. First and foremost, Bitcoin has been revolutionised by the creation of a new value system that can be verified to work without the involvement of centralised intermediaries. Also of particular importance in the current environment is the limited inflation of the cryptocurrency, as the pace of issuance is scheduled until the year 2140. Therefore, the question of the need to link to BTC is not even a question, because it is obvious. However, it requires a lot of research and awareness of the importance of the role of full-fledged cryptocurrencies today.