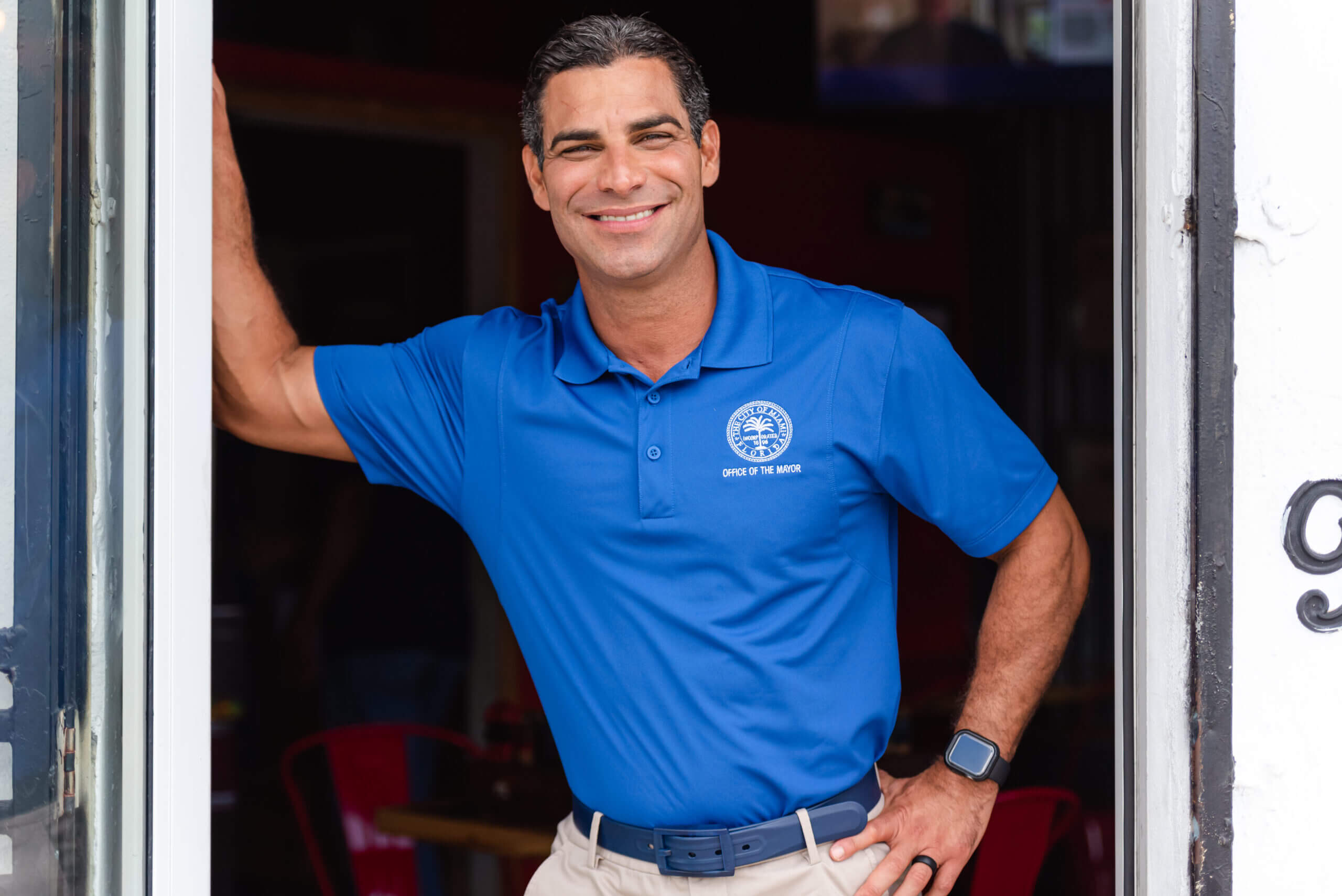

The mayor of Miami was not disappointed in Bitcoin even after the FTX crash. What does he expect from the cryptocurrency?

Miami Mayor Francis Suarez is a strong supporter of crypto-related innovation. He has publicly supported the industry on numerous occasions in the past, promoting useful initiatives and has even stated a desire to receive his pension in Bitcoin. The day before, Suarez was a guest on CNBC, during which he spoke about his positive vision for the future of crypto. As expected, Francis hasn’t changed his principles on the matter. We share the details of what’s happening in more detail.

Note that ideas for promoting the world of digital assets in Miami are indeed overtaking most cities. For example, in July 2022, the city government announced the launch of Miami’s official NFT collection. In addition, it was implemented in partnership with TIME and Mastercard.

Miami’s NFT collection

As you can understand in retrospect, the timing of the launch of the collection was not the best. One way or another, however, the idea reflects the sentiment among officials towards crypto – and that comes at a price.

What’s next for Bitcoin

During the broadcast, the topic of discussion touched on the collapse of crypto exchange FTX last November. Prior to that, many luminaries in the cryptocurrency industry claimed that the site’s bankruptcy was the result of insufficiently sane actions by financial regulators. Suarez, however, holds a different opinion. Here’s his quote.

When people lose money and things don’t go the way they expect, everyone wants to blame someone. We live in a capitalist country where investors risk capital. Sometimes it’s good for them, sometimes it’s not.

Miami Mayor Francis Suarez

In other words, every client who loses money on FTX is also responsible for what happens. From the moment an investor transfers crypto to an exchange, they must bear in mind that those coins could be gone forever. That is, one should not keep most of one’s funds on centralised exchanges, because in theory this could end up losing them.

Note that users should indeed be responsible for storing their own assets with non-custodial wallets. However, in this case it is unethical to blame FTX users at least in part for the collapse of the exchange. Still, the main reason for the bankruptcy of the trading platform were the actions of the head of Sam Bankman-Fried and his colleagues from the trading company Alameda Research. According to the prosecution, Sam transferred users' funds to the Alameda account without their consent, after which they were used for trading, charity and purchasing real estate.

Of course, Bankman-Fried should not have acted this way, which means that FTX users have become victims of fraud. In addition, users of other exchanges like Binance and WOO X have not been affected in any way during the last year, so it's hard to agree with Suarez's comment.

According to CryptoPotato sources, Bitcoin has a chance to replace the dollar, but Suarez’s interviewer expressed doubts about the reality of such a prediction. The mayor of Miami himself did not deny the potential for such a radical change – he noted that BTC does have some compelling advantages. For example, a fixed supply of 21 million BTC, which protects the cryptocurrency from inflation.

However, this immediately brings to mind the limited capacity of the Bitcoin network, which can only cope with a few transactions per second. Naturally, this is not enough to use the cryptocurrency globally on a daily basis.

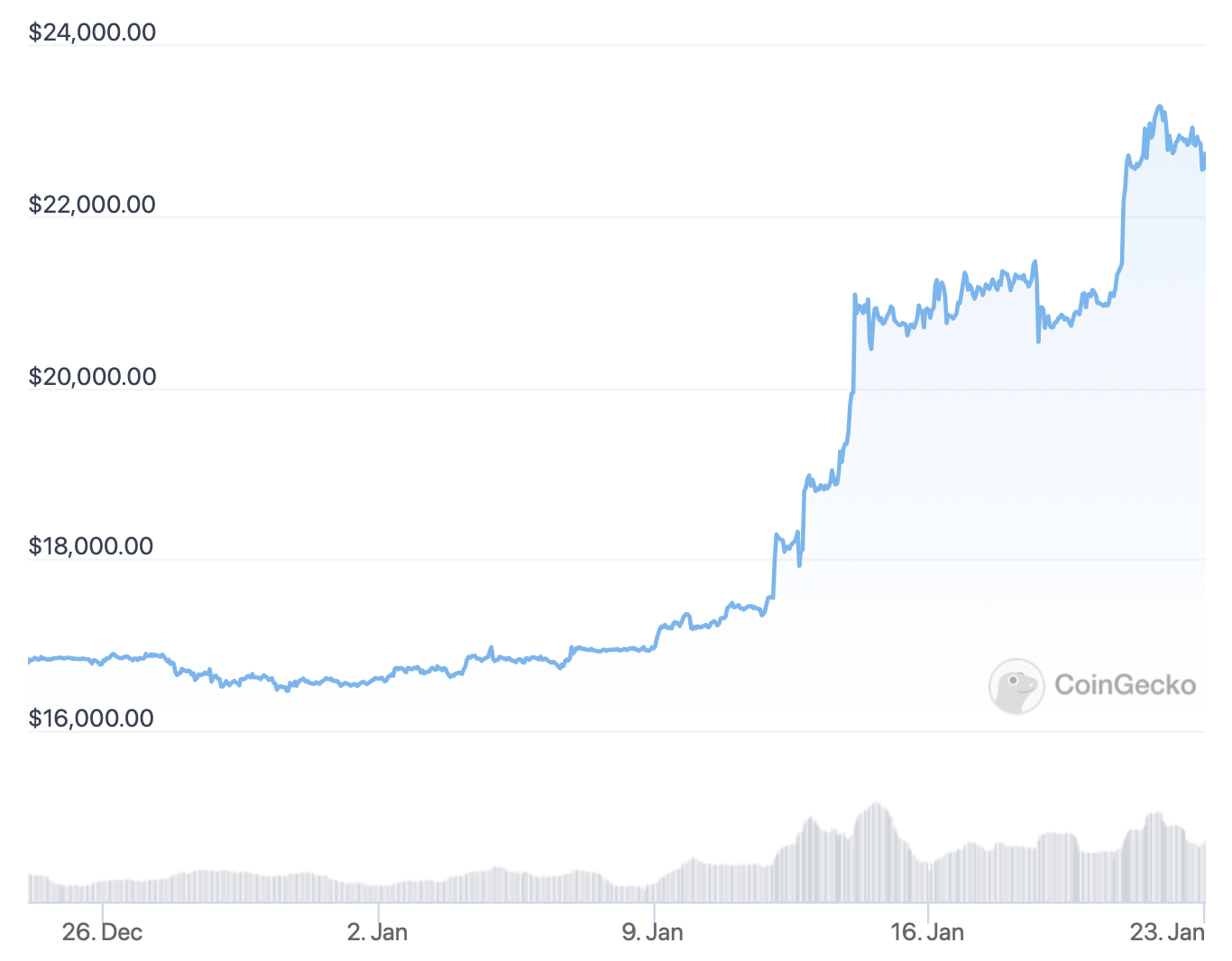

Bitcoin exchange rate over the past 30 days

In the interview, Suarez also urged not to fall for the hype that has been heavily hyped by the media lately when it comes to the FTX collapse last year. The event in itself, although negative, is much smaller in reality than what journalists are portraying, Suarez believes.

😈 YOU CAN FIND MORE INTERESTING THINGS ON OUR YANDEX.ZEN!

Crypto is not just becoming popular at the state level in individual US cities: digital assets will play an important role in the United Arab Emirates’ global trade transactions in the future. This was stated by UAE Foreign Trade Minister Tani Al Zeyoudi during his interview at the World Economic Forum in Davos.

As the UAE works on its own cryptocurrency regulatory regime, the focus will be on making the country one of the world’s hubs where legal protection as well as cryptobusiness-related services will be available to Bitcoin and altcoin investors. Here’s how the minister comments.

We have started bringing some companies into the country to establish good governance and the necessary legal system.

UAE Minister of Foreign Trade Tani Al Zeyoudi

Just a week ago, the UAE cabinet introduced a new law that implies that cryptocurrency-related companies must be licensed and approved by the Virtual Asset Regulatory Authority (VARA). Failure to do so could result in a fine of up to $2.7 million.

Overall, this is positive news for new start-ups. If the UAE does become one of the hubs of the crypto world, it will provide a better operating environment for cryptocompanies. Right now, a huge number of startups are based in the US, which means if the US government imposes stricter regulations on crypto, it will have a negative impact on the market as a whole.

By the way, steps towards regulatory compliance are being actively taken by market leaders. For example, last week crypto exchange Binance reported full compliance with Polish regulatory standards for virtual asset service providers. Thus, the platform will be able to provide crypto-asset exchange and storage services absolutely legally in that state. Well, regulators will not create problems in the operation of the exchange.

Binance chief executive Changpen Zhao

We don't think it's really necessary to be disappointed in Bitcoin and other popular cryptocurrencies because of the collapse of FTX, because the bankruptcy of the centralized company was caused by the actions of its management. So Suarez's approach is generally understandable and commendable. The only downside here is perhaps the Mayor's reduced support for cryptocurrencies during a bearish trend. Obviously, such a trend leads to newcomers opening positions too late in the middle of a bull run and possible losing money.