Vitalik Buterin talks about the biggest challenge facing the Etherium network

Vitalik Buterin, the creator of Etherium, shared on Twitter a possible solution that would significantly increase the privacy of the blockchain. According to Vitalik, the issue of transaction information security remains “one of the biggest challenges” for developers. With that in mind, the creator of the Eth network proposes to implement the concept of “stealth addresses” – a special solution that, in theory, would make transfers of ETH and NFT tokens anonymous, as well as the registration of new names on the Ethereum Name Service (ENS) platform. Here’s a closer look at the views of one of the blockchain industry’s most prominent figures.

It should be noted that there are more than enough updates coming for the Ethereum network. One of the most important among them will be so-called sharding, which involves splitting the blockchain into separate chains. Transactions in each of them will be validated and conducted separately, so this solution will increase the capacity of this blockchain.

In the first phase, 64 shards are planned to be implemented - and this will increase the bandwidth of Etherium by a corresponding 64 times. That is, if the network now handles approximately 13-15 transactions per second, the figure will rise to 830-1024 transfers once the sharding is launched. Read more about the technical component of sharding in a separate article.

Etherium and other cryptocurrencies

From a closer perspective, a blockchain update called Shanghai awaits. It will primarily provide validators with the ability to withdraw funds from stacking, i.e. the deposit smart contract. Staking itself, along with the Beacon Chain, went live in December 2020, so some will surely want access to their coins.

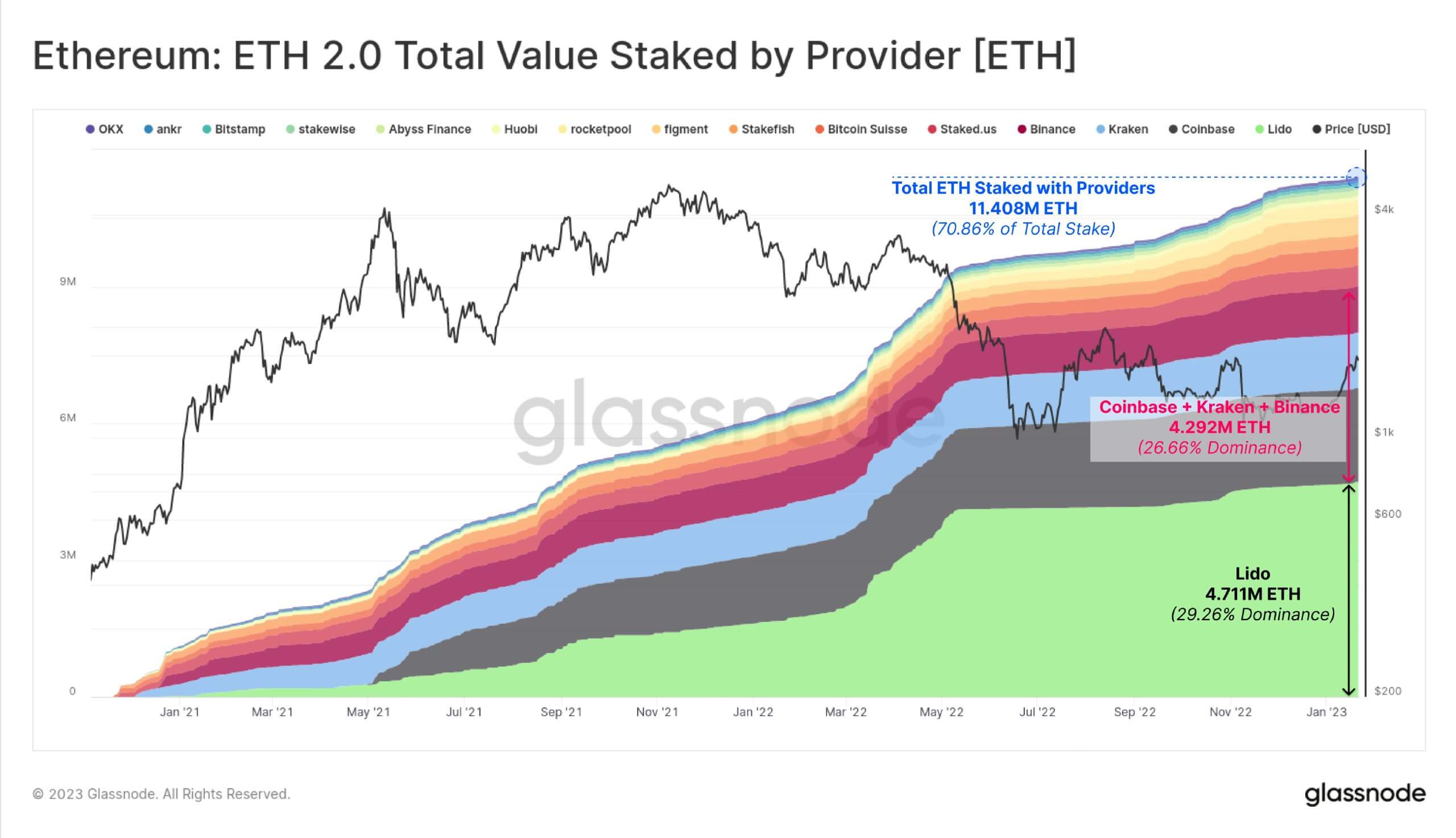

As of today, there are 16.1 million ETH in the staking, which is equivalent to 13.4 per cent of all coins in circulation. Of these, 11.4 million ethers are being staked through dedicated platforms, i.e. not by running a full-fledged validator node. At the same time, Lido is the leader among the largest steaming platforms, accounting for 29.3 percent of the eshs cashed in. Next in the ranking are Coinbase, Kraken and Binance, with shares of 12.8, 7.6 and 6.3 percent, respectively.

Shares of centralised platforms in Ethereum stacking

What updates are in store for Etherium?

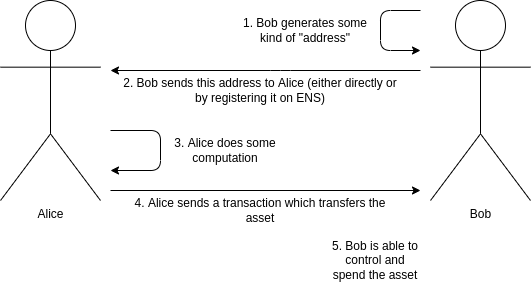

Buterin shared a link to an article on his blog that explains the principle of anonymous transactions on the blockchain. To begin with, whoever accepts the transfer must generate a “spending key”. The latter is needed to create a hidden meta-address.

This address – including one suitable for ENS registration – is passed to the sender of the transaction, who can perform a cryptographic calculation of the meta-address to find the hidden address belonging to the recipient. The sender is then able to transfer assets to the hidden address of the recipient and also publish a temporary key to verify that the correct address belongs to the recipient. A more visual representation of the entire process is shown in the image below.

Scheme of an anonymous transaction proposed by Vitalik Buterin

Buterin noted that in order to hide the connection between the stealth address and the user’s meta-address, a so-called “Diffie-Hellman key exchange” must be implemented, as well as a “key hiding mechanism”. The ZK-SNARKs crypto tool could be used to transfer funds as payment for commissions.

Etherium exchange rate over the past 30 days

However, Vitalik also stressed that his proposed scheme could lead to new problems. For example, there is the relatively high cost of “hidden” transactions, which would probably be caused by more complex features in a smart contract, Cointelegraph notes. This, in turn, will lead to the need to release new upgrades for Etherium with a focus on improving privacy mechanisms.

Top private coins by capitalisation

But should the Ethereum Foundation pay much attention to this issue at all? Transaction privacy will definitely be a nice bonus for Ethereum users, but for now, developers have yet to address the cryptocurrency’s bandwidth and lower fees, which can sometimes increase to exorbitant levels. In the meantime, the cryptocurrency industry has its own examples for private transactions, similar to Monero and Zcash. They support so-called shielded non-public transfers, which are unrealistically traceable.

😈 YOU CAN FIND MORE INTERESTING STUFF ON US AT YANDEX.ZEN!

According to Decrypt’s sources, Ethereum Foundation programmers’ work on their main assignment in the form of the next major upgrade called “Shanghai” could benefit not only individual users, but also centralised platforms. In particular, we’re talking about Coinbase, which provides the ability to send a small amount of ethers to the stack. Such exchange services will gain more popularity after “Shanghai”, JP Morgan analysts believe.

As a reminder, the next update to the Etherium network, called “Shanghai”, is scheduled for March and will allow access to funds in the cryptocurrency’s deposit smart contract. This gives you the opportunity to get a validation role in the blockchain and earn a certain yield in ETH.

Ethereum stacking on Coinbase

Clarity on the prospects of withdrawals from steaking will “breathe new life” into this service on the exchange, experts believe. Here’s their relevant quote.

Stacking in Ethereum forces holders to lock up their ETH indefinitely, which we see as a big disincentive to such a process. Obviously, “Shanghai” could usher in a new era of steaking for Coinbase.

Analysts at the bank estimate that 95 per cent of retail investors at Coinbase will be able to participate in Ethereum stacking after the release of “Shanghai”, which could generate between $225 million and $545 million in revenue per year for the exchange. “Shanghai” could also give another boost to the development of similar staking services on separate platforms for those without 32 ETH to get a validator role. Most importantly, the popularity of ether-stacking among any category of cryptocurrency market participants will have a positive impact on blockchain security in one way or another.

We believe that transaction privacy is an important component that the Etherium network lacks. However, as Vitalik Buterin has parsed the concept, sooner or later it will come to fruition. So it remains to be seen how the community reacts to Vitalik's publication and how active the developers are at the same time.