Why cryptozyme may not end in 2023: response from former Meta spokesperson

Former Meta board member David Marcus sees little prospect for the crypto market in 2023. The day before, he said it would also be a tough year for the digital asset industry. It will supposedly take quite a while until 2025 to finally get rid of the impact of many crypto firms’ bankruptcies – including the collapse of cryptocurrency exchange FTX. Here’s a closer look at the expert’s point of view.

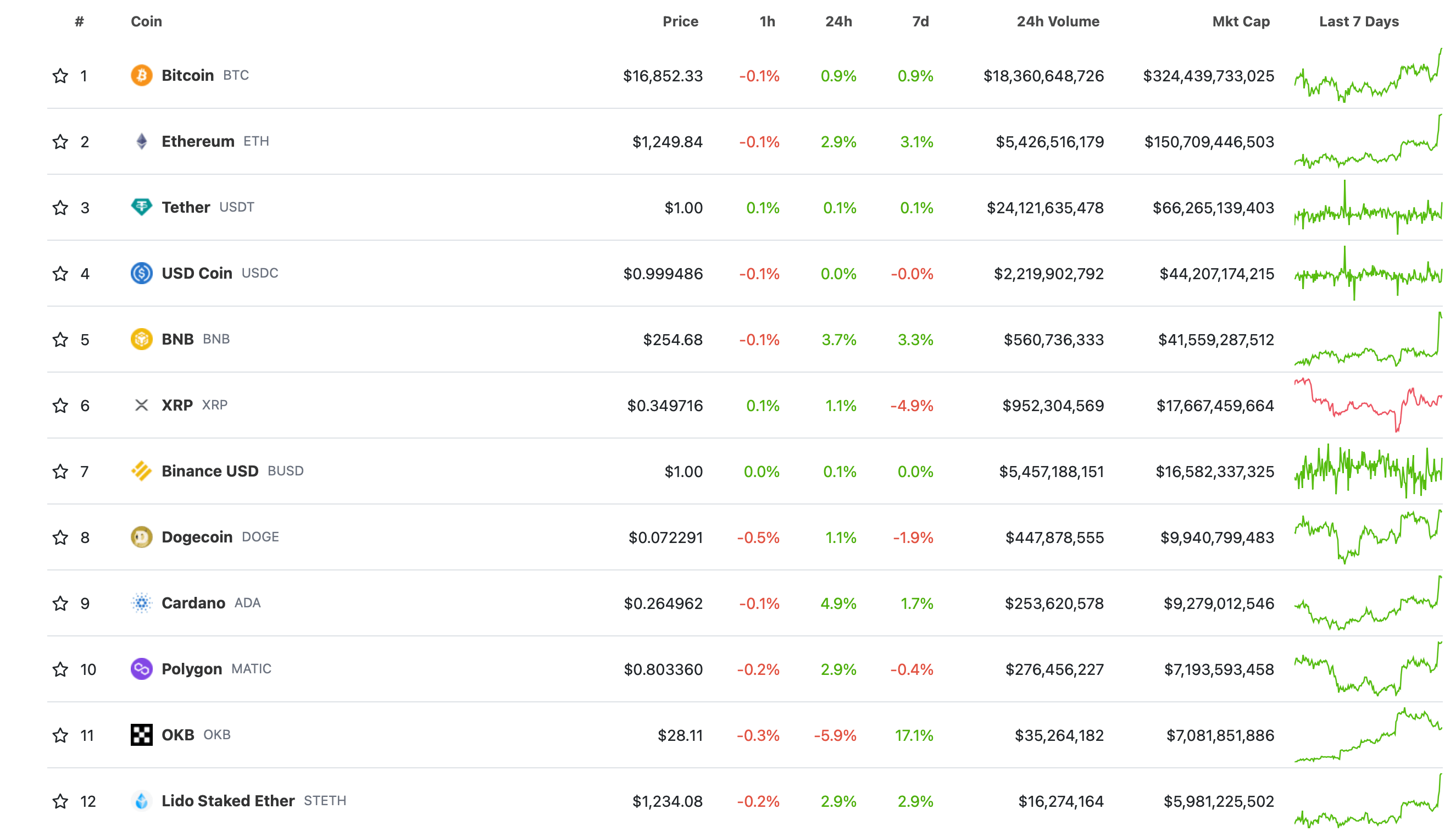

We note that 2023 started relatively quietly for the cryptocurrency market. For the most part, the largest projects in terms of market capitalization remained quite stable, well, on a weekly scale, their growth is mostly in the range of a few percent. Here is the corresponding situation in the niche today.

Ranking cryptocurrencies by market capitalization

The funniest story is with the Solana network’s native token called SOL. The cryptocurrency was one of the main investments of FTX and Alameda, due to which after their problems in early November, the rate of SOL severely sagged. On December 29, the value of the coin reached a local low of $8.

However, the rate has already reached $14.22 today. And that’s the equivalent of a 77 percent increase from the aforementioned bottom.

Eight-hour chart of Solana SOL exchange rate

Obviously, the cryptocurrency was seriously oversold on the back of all the recent news. Therefore, its rebound was quite sharp and tangible.

When will cryptocurrencies start rising?

In his post at what was then Facebook, Marcus was the head of the crypto project Libra. Even though the company’s venture was squeezed by regulators, David still had experience and an understanding of key aspects of the crypto industry. With that in mind, he now believes that many are overly optimistic about the prospects for Bitcoin and altcoins this year.

Former Facebook Libra executive David Marcus

“Unscrupulous market players” in the form of both FTX and other executives have done almost the most serious damage to the industry in its fourteen-year history. Here’s what Marcus writes in his blog about it.

We won’t get out of this “crypto-zima” in 2023, and probably not even in 2024. It will take several years for the market to recover from the actions of unscrupulous market players, and for responsible regulation to emerge. Restoring investor confidence will also take a few years, but ultimately I believe it will prove to be a useful reset for all other cryptocurrency enthusiasts in the long run.

Note that this prediction means nothing for certain and does not have to come true. As events in the cryptocurrency world have shown in the past, this market is capable of surprising and showing unexpected results even in the toughest of conditions. Therefore, participants in the digital asset industry should only take Marcus' words as a possible scenario.

However, if Marcus’ prediction comes to fruition, it will disrupt the current trend of crypto market cycles. According to Cointelegraph’s sources, Bitcoin’s global rise and fall periods are somehow guided by its halving procedure – reducing miners’ reward per block by exactly half, which occurs every 210,000 blocks or once every roughly four years. The previous halving took place in 2020. In its second half BTC showed a noticeable growth, and the whole year 2021 can already be called the year of the new bullwhip.

Halving on the Bitcoin chart

The next halving will take place in 2024, when the reward per block on the first cryptocurrency’s network will drop from 6.25 to 3.125 BTC. By the same logic, BTC could very well start rising in about a year from now. Let’s hope that David Marcus’ prediction will not come true, and the next bullish trend will start much earlier than expected.

😈 MORE INTERESTING STUFF CAN BE FOUND ON OUR YANDEX.ZEN!

At the same time, new details have emerged in the bankruptcy case of the aforementioned FTX: it is about the very “long-term consequences” of the collapse of the exchange. Bankruptcy lawyer Mark Pfeiffer has said that the court could order repayment from many of the companies that had been dealing with FTX Group in the months before it collapsed.

That is, these are firms that did receive money from FTX, but will now have to return it, because there was a special circumstance – bankruptcy. Transactions made in the 90 days prior to FTX’s insolvency are subject to refunds. And if the transfers were made to an insider, this period extends to one year.

FTX founder Sam Bankman-Fried

As a result, creditors can claim back funds transferred by FTX to other companies. This also includes the $2.1 billion paid to the Binance exchange after it pulled out of its Series A investment in FTX. Binance CEO Changpen Zhao said in a recent interview that the prospect of a refund from his side is not yet clear – this is being handled by his company’s lawyers.

Overall, the court has yet to approve any new amendments regarding the issue. Pfeiffer says that if the clawback does go ahead, it introduces another point of contention: How exactly is the value of the capital to be returned determined? That is, will it be valued at the time of the original transaction or at the time of the bankruptcy of the exchange itself?

We think David Marcus' arguments are quite valid, and the cryptocurrency industry has indeed lost the confidence of some investors in the wake of the FTX collapse. However, that does not mean that the current coin prices of promising projects will not attract the attention of other capital holders. Therefore, no one will predict the exact timing of the end of the bearish trend by tradition - we will know it only in practice.

In any case, the forthcoming court sessions should give more answers to these questions. Stay tuned to our millionaire cryptochat. There we will talk about other important topics that affect the world of blockchain and decentralisation.