Why the cryptocurrency market will no longer tangibly collapse: a billionaire’s answer

There is no good reason for the increased panic surrounding the problems of major cryptocurrency company Digital Currency Group (DCG). That’s what Galaxy Digital Holdings CEO Mike Novogratz said in a recent interview. What is happening cannot be called “good news,” but the events are unlikely to cause a tangible drop in the market. That said, the effects will still be felt this quarter, the billionaire believes. We will tell you more about his point of view.

Note that Michael Novogratz has already got a win on this bearish trend. In late December 2022, his company Galaxy Digital essentially rescued a major public miner called Argo Blockchain. The day before, representatives of the platform had requested that trading in the company’s shares on major NASDAQ-type exchanges be suspended due to an important announcement.

It turned out that the giant was able to negotiate a $100 million deal with Galaxy Digital’s management. 65 million went towards the sale of the Helios mining platform in Texas, while the remaining 35 million was given as a loan. Consequently, in this case, Novogratz received a valuable asset at a preliminarily low price.

Bull and bear markets in cryptocurrencies

And this is yet another reminder that having spare cash at the stage of a market crash can lead to great opportunities. And that includes reputational ones.

What will happen to the cryptocurrency market

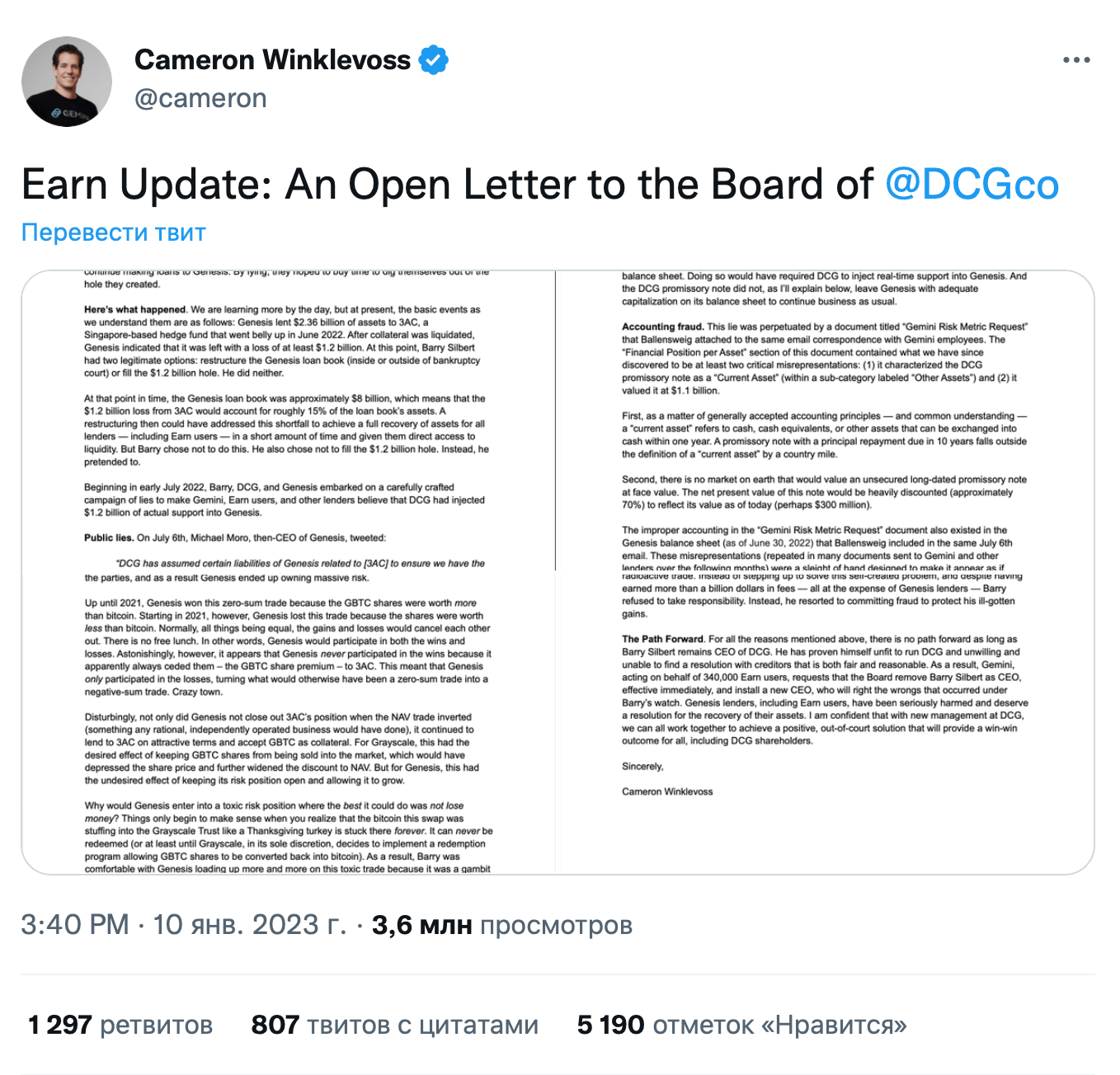

As a reminder, earlier, Gemini cryptocurrency co-founder Cameron Winklevoss said that DCG chief Barry Silbert should step down because he allegedly misled his creditors for a long time and also refused to address the $1.2 billion balance sheet hole.

Cameron also insists that a DCG subsidiary called Genesis Trading owed Gemini over $900 million after the collapse of hedge fund Three Arrows Capital last year. In addition, Genesis’ activity led to the suspension of user withdrawals from Gemini’s Earn trading platform, as well as the subsequent closure of the programme, which came to light this week.

Here is Novogratz’s response to a question from a CNBC interviewer about the current market situation. The renowned cryptocurrency market player’s remarks are cited by Cointelegraph.

There are still some issues between DCG, Genesis and Gemini that will show up in the first quarter. This is not a good thing. However, I don’t think that what is happening will lead to a massive sale of crypto. It’s just more negative news.

Billionaire Mike Novogratz

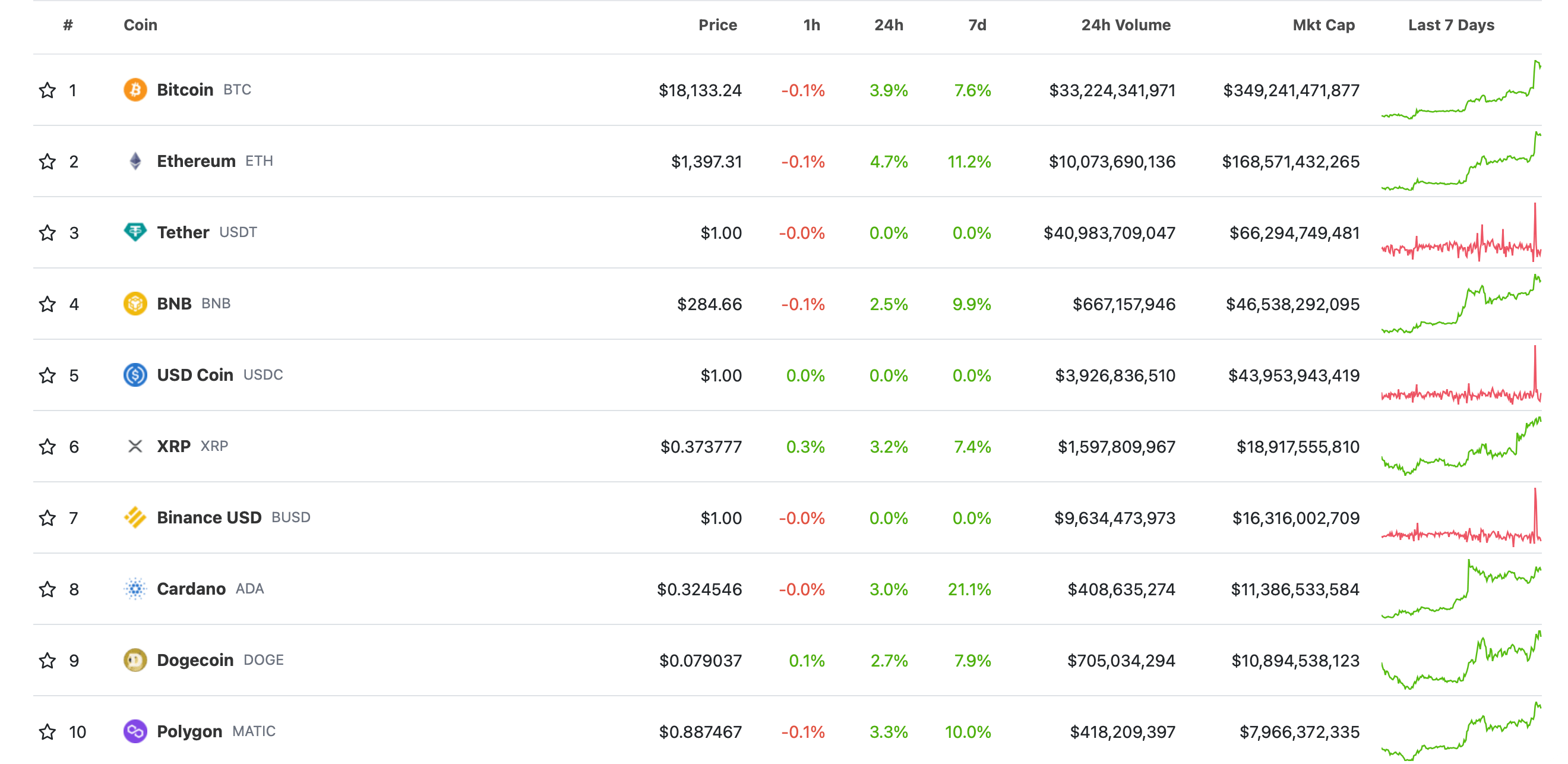

Partial confirmation of Novogratz’s words turned out to be today’s market situation. First of all, it is marked by the growth of Bitcoin above $18,000, which has not been seen since mid-December. The overall situation in the coin market this morning is as follows.

Ranking of major cryptocurrencies by market capitalization today

Novogratz’s opinion is in complete contrast to a recent report from analytics platform Arcane Research, in which experts warned investors to pay attention to the “ongoing financial crisis” in DCG, as its outcome “could seriously affect the crypto market.”

Gemini co-founder Cameron Winklevoss’ public address to DCG head Barry Silbert

If DCG declares bankruptcy, the company could be forced to liquidate assets and sell significant positions in its Grayscale Bitcoin Trust (GBTC) structure and other trusts, which could in theory affect the coin market. However, the situation with the bankrupt crypto exchange shows that the liquidators are in no hurry to sell the platform’s holdings, and they themselves are interested in conducting neat transactions with minimal impact on the industry.

The head of Galaxy Digital, however, believes that the crypto market has “held up pretty well” over the past couple of weeks and has even started to grow. That is, all those who wanted to get rid of crypto have already sold it, which means the impact from DCG’s problems should not be as tangible.

Will Novogratz’s prediction turn into reality? It’s impossible to know for sure, but Mike Novogratz has already gained a reputation for not being the best analyst within the blockchain niche. Recall that he previously actively promoted the Terra LUNA project and even got a tattoo of its emblem. Unfortunately, the Terra ecosystem collapsed last spring, and its investors suffered billions of dollars in losses.

A tattoo of the Terra ecosystem’s Luna token on Novogratz’s forearm

😈 YOU CAN FIND MORE INTERESTING THINGS ON OUR YANDEX.ZEN!

One of the most discussed negative developments in crypto last year was the bankruptcy of crypto exchange FTX. The court case continues to this day, with the investigation recently revealing the names of some of the platform’s prominent creditors. They include American football star Tom Brady, his ex-wife Gisele Bündchen, investment giant Blackrock, cryptocurrency exchange Coinbase, as well as Lightspeed Venture Partners, Pantera Ventures and crypto project Tezos Foundation.

According to court documents released by Decrypt, Brady owned more than a million shares of FTX, while the supermodel, businesswoman and his ex-wife Gisele owned 686,761 securities. The couple at one time acted as FTX ambassadors after receiving their stake in the company in June 2021.

Ex-CEO of FTX Sam Bankman-Fried

It is difficult to estimate the value of the shares in dollars as FTX did not make it to the stock exchange before its bankruptcy. FTX’s ambassadors, sponsors, investors and other lenders may well have received their consideration in currency or crypto, but due to the collapse of the trading platform suffered significant losses due to lost profits.

We believe that it is impossible to be so sure that there is no market collapse. However, it is important to keep in mind that the cryptocurrency industry went through a lot of headwinds in 2022, which means investor sentiment could traditionally be more negative than it should be. Consequently, digital assets themselves could, in theory, have fallen into what is known as an oversold zone, where their value is unfairly low. This hints at the possibility that the worst for the coin market could indeed be over. But it will take time to find out for sure.