ConsenSys founder names major achievement of Etherium (ETH) at this stage of cryptocurrency market collapse

ConsenSys founder Joe Lubin is confident in Etherium’s high long-term growth potential – he says the cryptocurrency has survived the “crypto-zima” well. Lubin shared his thoughts in an interview during the Building Blocks 23 event in Tel Aviv. Generally Joe compared previous year to dot-com bubble in the beginning of year 2000 – then stock market collapse caused a lot of new tech companies to disappear, but in the end it ended up with rapid growth of giants like Google, Apple and Microsoft. Let’s take a closer look at the expert’s point of view.

Note that the current bearish trend in the cryptocurrency market is seriously different for Etherium. Still now the cryptocurrency network works on Proof-of-Stake algorithm, under which the issue of new ETH has decreased significantly. The blockchain is also actively burning ethers paid for as commissions.

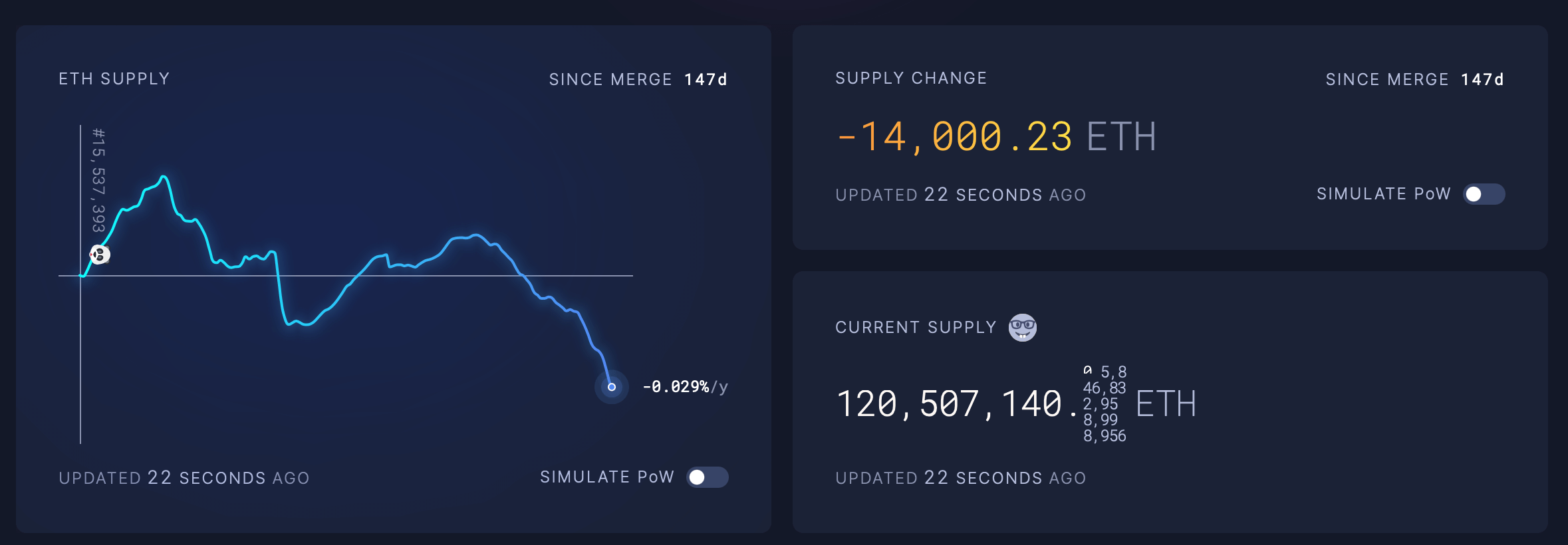

Etherium’s transition to PoS took place in mid-September 2022, or 147 days ago. Not only has the number of ETH in circulation not increased since then, but it has decreased by 14,000 coins. Thanks to this, on a year-on-year basis, the supply of ethers has fallen by 0.029 per cent, which means that the cryptocurrency is indeed deflationary.

A decline in the supply of ethers after the blockchain’s transition to PoS

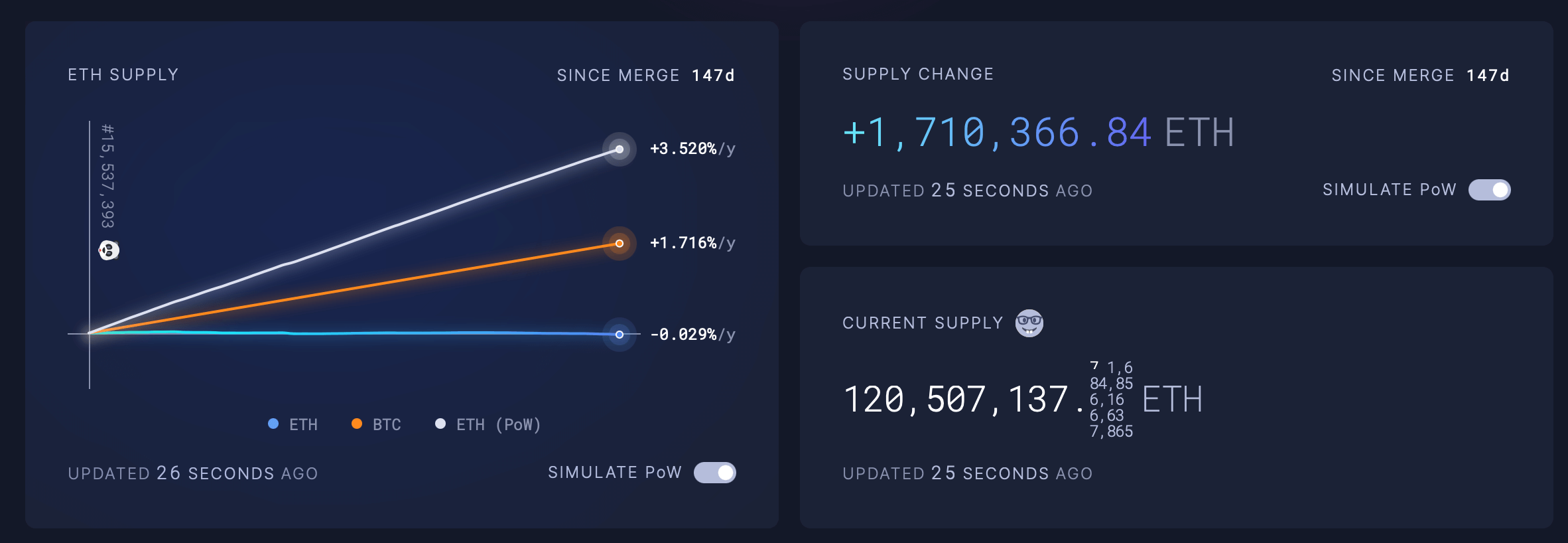

To illustrate, it’s worth showing how the cryptocurrency’s supply would have changed if it had continued to operate on Proof-of-Work. According to the Ultrasoundmoney platform, there would have been 1.7 million more coins in circulation in 147 days.

Hypothetical change in the supply of ethers over 147 days if the blockchain continues to operate on the PoW algorithm

Consequently, there are not as many coins in circulation now. Well, the gradual reduction in their number could be good for the future of ETH when the demand for digital assets starts to rise again with the onset of the bull run.

What’s going to happen to Etherium

There have been many negative events in the cryptocurrency industry in the past year, including the collapse of the Terra project ecosystem last spring and the collapse of cryptocurrency exchange FTX in November. They all played a part in what Lubin called “the result of a bull market peak” for the cryptosphere. As a reminder, the 2021 bull run has traditionally led to over-optimism and inflated expectations from cryptocurrencies. As a result, many of them were unprepared for a prolonged fall in Bitcoin and other coins, forcing them to shut down.

The closures of cryptocurrency services continue until today. In particular, LocalBitcoins, a cryptocurrency exchanger, announced its closure today. It is no longer possible to create an account on the platform, and users have to withdraw cryptocurrency from the wallet. The reason for the decision is the difficulties encountered during the current crypto-zima.

LocalBitcoins platform shutdown announcement

The problems of the crypto market have so far discouraged big investors from investing in digital assets, but in the long term Joe sees great potential in attracting investment. Here’s a relevant rejoinder from the entrepreneur, cited by Cointelegraph.

I think we’re at a stage where we’ve created a fairly favourable infrastructure. We have created scalability and usability, which means we can now create more useful use cases for crypto projects.

Indeed, the current state of the cryptocurrency industry is much better than it was during the previous bearish trend in 2018-2019. Back then, cryptocurrency enthusiasts hardly ever used staplecoins, the field of decentralised finance was in its infancy, and NFTs were mostly known only for the CryptoKitties project. Now, the trading volumes of NFT tokens alone are in the tens of millions of dollars - and that's the result in a day.

ConsenSys founder Joe Lubin

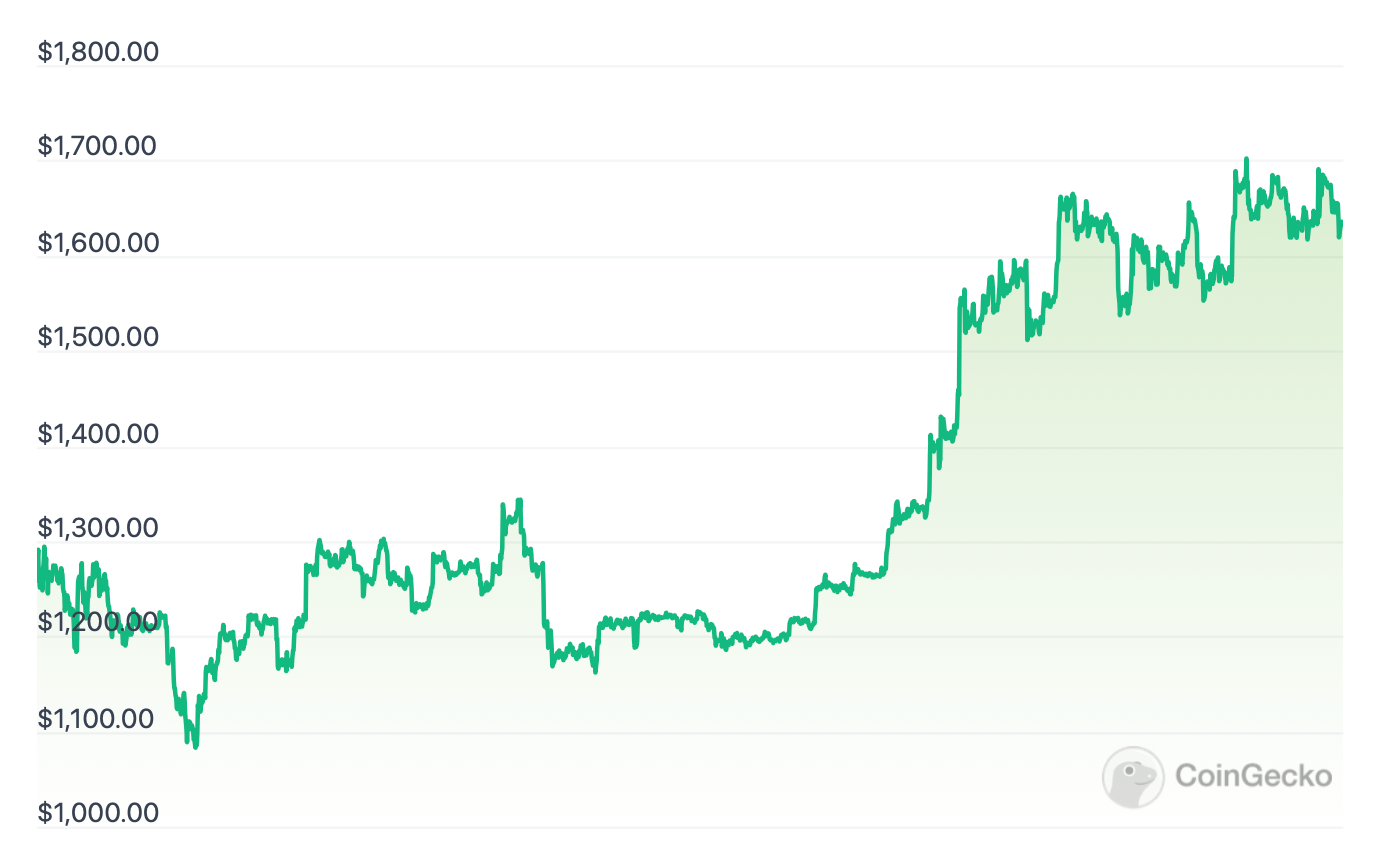

Despite a tough year, Lubin points to the positives in the resilience of the ETH ecosystem. It’s still a platform for a huge number of startups, which only adds to the value of Etherium. The ConsenSys founder also added that ETH’s ability to hold its value at $1,200 for an extended period of time is a good fit for a positive outlook for the future. Here’s his quote.

It feels like there just weren’t any people selling the token at a lower price. And that’s a good thing. I’m bullish on it.

Ether’s move to the Proof-of-Stake algorithm also played an important role – it made ETH become a deflationary asset for the first time in November 2022. Joseph Lubin comments.

There is money you spend to buy coffee. There is money you invest. There is money you can lend and borrow. You want your money with high economic potential in the type of Ether to grow in value all the time.

Etherium exchange rate over the last 90 days

The next big thing for the project ecosystem is the release of the Shanghai update. It will allow validators to withdraw their ETH from the cryptocurrency’s deposit smart contract, making staking a more attractive option for investors. Still, they would then know that withdrawing the 32 ETH node launch amount would be possible in a short period of time, so the activity would cease to be so unpredictable.

We think that Etherium has performed really well in this bearish trend. If you close your eyes to the ETH exchange rate situation, the cryptocurrency's fundamental strengths have increased markedly. It can now be considered deflationary, in addition the blockchain requires far less electricity compared to the Proof-of-Work consensus algorithm, which is good for its reputation. And as the Eth continues to be the main home for protocols from decentralised finance, the blockchain's potential remains huge indeed.